Unpaid on a construction job? The mechanics lien may be just what you need. This article will help you understand how to file a mechanics lien in any state. We’ll guide step-by-step through the general process to file a claim no matter which state your project is in.

Do you have a question about placing a lien on property in your specific state? Scroll down to the end of this article to view Step-by-Step Guides for Filing in Each State.

How Liens Work in Construction

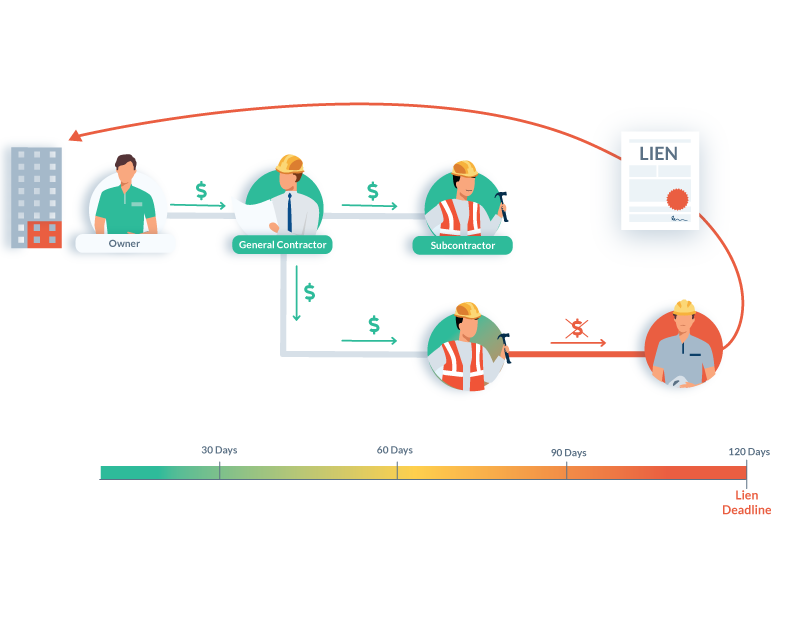

Every state has construction lien laws that give contractors and suppliers the legal right to place a lien on the property if they aren’t paid. A lien is an extremely effective tool to help construction businesses get paid, because it attaches to the property title and creates significant headaches for the owner.

On the surface, filing a lien is not extremely complicated. It’s as simple as filling out a form and delivering it to the recording office in the county where the property is located. After a claim is filed, the claimant has anywhere from 60 days to 2 years (depending on the state) to negotiate payment with the property owner.

However, it’s best to think of a mechanics lien as a process rather than a single document. That’s because, in most cases, a contractor must send certain notices at the beginning or during a project in order to protect their right to file a lien later on. Forgetting a step or missing a deadline could mean you don’t actually have lien rights when you need them.

Even minor lien mistakes can invalidate your non-payment claim. The devil is in the details, and mechanics lien laws in the United States require an extraordinary amount of detail. Plus, the rules are different depending on where the real estate is located and what type of project it is.

In spite of the challenges, a mechanics lien is the strongest payment tool that construction businesses have. It can be even more powerful than trying to enforce a construction contract through legal action (which will ultimately rely on a judgment lien). A construction lien, by contrast, can often get a contractor paid without ever having to hire a lawyer or step foot in court.

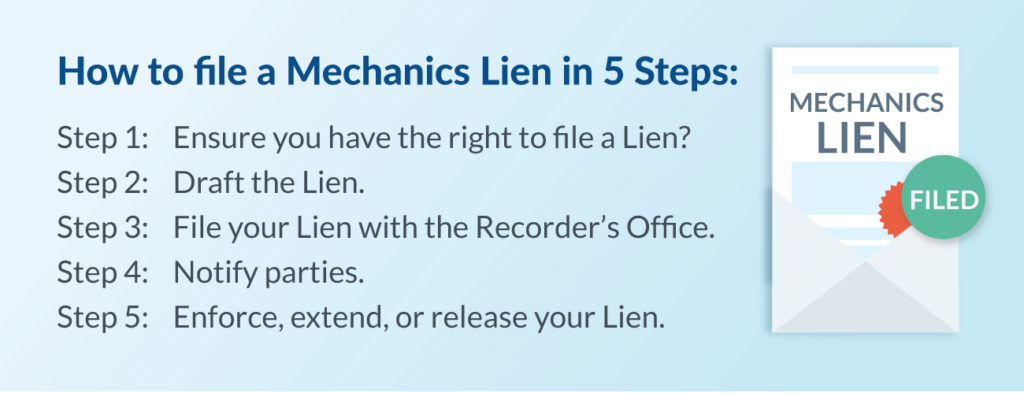

The 5 Steps to File a Mechanics Lien

Watch the Video Walkthrough

Step 1: Ensure You Have the Right to File a Lien

The first step to filing a mechanics lien is to determine whether you have the right to file the lien. Every state has construction laws that govern who has the right to use a mechanics lien if they are unpaid. And even though you may have lien rights at the start of a project, you can lose them if you don’t follow the state’s specific requirements. If you file a lien and didn’t have the right, this could be considered a “frivolous lien” and could create an expensive legal mess. However, since this issue is rarely black and white, there’s a lot of room for error.

To figure out if you have a right to file a lien, ask yourself these 3 questions:

Does your work or materials qualify for lien protection in your state?

There are a ton of professional services, roles, and participants in construction projects, and construction jobs come in all shapes and sizes. Each state allows some types of people to file liens and prohibits others. Here’s a rule of thumb: Anyone who contributes a permanent improvement to real property generally has the right to file a mechanics lien if they don’t get paid. But the answer to this question will always depend on the state law for your project. You can find the answer for your state in our guide to mechanics lien laws & requirements in every state.

The most traditional construction participants – for example, general contractors, subcontractors, and material suppliers – almost always have lien rights. However, things begin to get a little trickier with some of the following examples:

- Design professionals (architects, engineers, etc.)

- Landscapers & lawn care companies

- Suppliers who provide materials to other suppliers

- Solar panel installers

- Equipment rental companies

- Fence rental companies

- Companies who build field hospitals or mobile homes

- …and so on

Does state law require you to send notice? Did you?

Most states have some type of notice requirement. The term “notice” can be just as confusing as the term “lien,” because it goes by so many names and has so many different versions. Construction notices play an important role in helping contractors and suppliers collect payment.

Generally speaking, in thinking about whether you have the right to file a lien or not, you’ll want to pay attention to these 2 main notices:

Preliminary Notice: Many states require contractors, material suppliers, and equipment lessors to deliver a “preliminary notice” to the property owner at the very beginning of work. Depending on your state, it might go by other names: a Notice to Owner, 20-Day Notice, Notice of Furnishing, or something else. If you don’t this notice on time, you likely lose lien rights. If you needed to send a notice and didn’t, you likely don’t have the right to lien the job. And, since states typically require this notice at the very start of your work, you probably don’t have time to send it now.

Notice of Intent to Lien: Only a few states require the “notice of intent to lien,” but it’s usually a lot easier for contractors and suppliers to deal with than the preliminary notice. If your state requires you to send a notice of intent before a lien filing, you simply need to send this notice before filing your lien. The biggest trick here is waiting too long…because your lien deadline won’t wait for you!

It’s important to understand which states require notice – and whether you can file a lien without providing notice.

Are you within your lien deadline?

You don’t have forever to file your mechanics lien claim. Different states have different time limits to file a lien. You have to file your lien within this time frame, or else. These deadlines are strict, and there are very few exceptions.

The lien filing timeline is usually tied to the completion of the project, or the last day you provide labor or materials. It won’t wait for your notice of intent to lien delivery, and it usually won’t even wait for a holiday or weekend! Download a free chart to learn your lien and notice deadlines.

Get Free Legal Advice To Determine If You Have Lien Rights

Figuring out whether you have lien rights can be difficult and confusing. You may still have questions even after reading this post. We have 2 tools available to help you get answers to your questions:

Payment Help Center: First, you can use the Levelset Expert Center to ask any question to a network of construction attorneys and payment experts. Their legal advice is completely free. Just post your question and you’ll get an answer in a few hours.

Deadline Calculator: Second, you can use our free Mechanics Lien Deadline Calculator. Enter a few project details and the calculator will tell you the next steps required to protect your lien rights. You’ll get an answer immediately with specific steps you can take to get paid!

Step 2: Draft the Lien

If you have the right to file a lien, the next step is to produce the lien document. This means drafting the lien form that will be filed. This is known as your lien claim.

Unfortunately, preparing your mechanics lien is more complicated than just downloading your lien form and filling in the blanks. Lien laws are quirky. You must be careful and include every required piece of information. And you must be careful to get the right form.

Get the right lien form for your project and state

The claim of mechanics lien form itself is very important. Most state laws prescribe very specifically what you must include in your mechanics lien filing. Some states go so far as to publish the form itself. You can find free mechanics lien forms in a lot of different places, but be very careful. There are a bunch of “form houses” on the Internet that make a business out of providing forms of all kinds. And they will provide you lien forms as well.

However, it’s too common to see these free form farms just copy and paste forms from other locations. Or they use one state’s form for all states. Even reputable companies like Rocket Lawyer have problems with the complex lien forms.

You can download mechanics lien forms from Levelset for free. These are curated and/or created by construction attorneys and payment experts. Our extreme focus on the mechanics lien and construction payment process, and our quality standard, can help you feel comfortable that you’re getting the right form for your business.

Get a free lien form

Download free mechanics lien forms for each state, prepared by construction attorneys to meet the statutory requirements.

Keep going! Getting the form is only half the battle. Now you have to fill it out.

3 tricky parts when filling out your mechanics lien form

Every state’s mechanics lien form is a little bit different. But, here is a guide to the common items that you’ll need to include on your lien and the major mistakes contractors and suppliers make when filling out the lien claim.

1. The Lien Amount

When you file a mechanics lien claim you are making a claim for payment. Every state requires that you identify the dollar amount that you’re unpaid. This is your “Claim amount” or “Lien amount.” The lien amount seems straight-forward, but can present some tricky questions. First, you have to understand what costs you can include in a lien amount.

Including other fees or costs

Can you include attorney fees, filing fees, or filing costs? Regardless of how you file your mechanics lien, there will be costs. Can you include these costs in the lien claim amount?

This is one of the most common questions contractors ask. The answer really depends on each state’s rules.

Including retainage

Should I include retainage in my lien claim amount? It may be the case that past due amounts are owed to you on the job, but retainage isn’t technically due.

Should you include the retainage amount in the lien claim or not? Again, this depends on each state, but the general answer is that you probably should include the retainage amount in your lien claim.

If work isn’t complete

What if work isn’t complete? Do I include all of the contract price, or only the work completed? You may be in a payment dispute and filing a mechanics lien claim before you actually finish work.

Should you include the full contract price? Or just the amounts due for work done? After all, the other party owes you the entire amount per contract! And what if the GC is claiming back charges? Should those be included in the lien amount, or not?

There is great information on this question in our Expert Center, in answer to the question, “Can I proceed with a lien if a customer is arguing about the owed amount?” The answer to this question is almost always the same: You can lien for the amount due for work actually done or materials actually delivered (even if you can legally recover more by contract).

2. The Claimant’s Name (That’s You)

Getting your own name right seems like the easiest part of the form.

But this is a common pitfall, and maybe even a complicated question. What if you have a tradename? What if you’re a joint venture? Do you need to put the “LLC” in your name or not? And so on and so forth.

There are constantly court cases where property owners win a lien challenge because the person filing it has put their name in slightly wrong. There was a case where a lien claimant got their own name wrong in New York. Or a case in Connecticut where a claimant misidentified themselves.

This is an easy one to get right: use your legal name!

3. Describing The Property

The last tricky part of filing out the lien form is identifying the property. The property is an extremely important part of your mechanics lien. You are, after all, filing a lien against this property. You need to identify it correctly so that the lien gets recorded and indexed correctly, and because liens can easily be invalidated if they fail to identify the property.

“Which property,” you ask?

We’re talking about the property where you actually did the work or provided materials. You need to identify this property in the lien.

So, “how to identify the property,” you ask?

This depends on each state’s rules. And sometimes, the state rules are unclear. The most common requirement and safest practice is to use the property’s “Legal Property Description.” Need help with the legal description or don’t understand what this is? Check out our Legal Property Description Search | A Complete Guide.

Step 3: File your Lien with the County Clerk or Recorder

At this point, we’ve established that you have the right to file a mechanics lien. Even better, you have filled out the right mechanics lien form! This is great progress. You’re ready to file your mechanics lien. We’ll walk you through the process of filing your lien here.

The filing cost will depend on the route you take, and can range from just $5 in some counties to thousands of dollars with a high-priced attorney.

The county recorder rules

All mechanics lien claims need to be filed in the county where the construction job is located. Do not file the lien where you are located, where the general contractor is located, or even where the property owner is located. The lien gets filed in the county where the job site is located.

When you know the county, you’ll need to figure out which county office files mechanics liens. In this post, we refer to these offices as the “County Recorder’s Office,” and it may indeed be what your county calls it. However, in some states, the office goes by another name, like the county clerk’s office or the Tax Records office, or Prothonotary, etc.

Always consult the recording office before filing your lien. Each office has unique requirements and procedures. It’s not uncommon for the county recorder to reject a lien several times before the claimant gets it right. They might reject a lien because:

- The claimant formatted the document improperly

- Payment for the filing fee is insufficient

- Minor typos

- Specific content is missing

- Not having a cover sheet (i.e. some county recorders require you fill out a cover sheet with every filing)

Many counties also have a strict font, margin, and paper size requirements. Failure to follow these standards may cost you additional filing fees, or result in the rejection of your lien. It’s a good idea to consult the county recorder’s office ahead of time to learn any special filing requirements they may have. Here are some Questions to Ask the County Recorder When Filing a Lien.

Mailing your lien, filing in-person, or electronically filing with the county

County record offices are typically not the most technologically advanced or user-friendly. You may find that the experience of recording a lien is a lot like going to the DMV.

Generally speaking, you have 3 options when filing your lien with the county recording offices directly:

- Go in-person: If you’re going to do the lien filing yourself, then this is probably your best option. You can deal with any of the little issues that come up in person, and you may get lucky and land a helpful government employee that walks you through the process. Some recording offices actually require you to file and/or serve the lien in person. Usually, if you are unable to do this yourself (because you are out of state, for example), you can send the lien to a courier who will record the lien for you.

- Mail your lien claim: If you are mailing your lien to a courier or to the recording office, be aware of mailing delays (due to weather and holidays, for example), that might cause you to miss your lien deadline. Also, take note of warnings from counties that liens they receive in the mail can take days or weeks to process!!

- File your lien electronically: Some counties have electronic filing or “eRecording.” However, you must use a third party eRecording service to take advantage of this. Very few counties allow contractors or suppliers to electronically record liens directly. Using a third party eRecording service makes sense for people who have to do a lot of county record recordings (i.e. law firms, mortgage lenders, etc.). For contractors or suppliers who only deal with this infrequently, setting up and paying for an eRecording account doesn’t make sense.

Using a lien filing service or law firm

As you can see, the process required for filing liens can be a little overwhelming, involve a lot of different steps, and can take a lot of time. It’s a good idea to put this process into someone else’s hands, such as a mechanics lien filing service, or a law firm.

They will know how to record your lien claim quickly, and how to jump through all of the county hoops. And they are your best option to electronically file your mechanics lien quickly.

Step 4: Notify Parties

Immediately after filing a claim of lien, and sometimes even simultaneously with filing, you need to deliver a copy of the lien claim to those involved on the job and affected by the lien.

You’ll frequently hear this referred to as “serving” the lien claim.

When & how to serve your mechanics lien

Like everything else when filing a mechanics lien, when you need to serve your lien and how you need to serve your lien will vary from state-to-state.

Generally speaking, you’ll need to serve your mechanics lien at the time of filing, or immediately after filing. In most cases, you’ll want to take care of this in one motion. File the lien, get an official copy, and deliver that copy immediately to the required recipients.

Typically, you’ll be okay to just drop a copy of the lien filing in the mail. Certified mail, of course (see our discussion on this here: Methods of Delivering Notices). There are a few notable exceptions to this, such as in Pennslyvania, where there are complex service requirements that must be carried out by the sheriff’s office! This is a pretty unique requirement, though, and most states require just simple mail notification. Some states deem service complete upon depositing the notice in the mail, while others require that the party actually receives the notice. You can see a full 50 state breakdown in Mailing Construction Notices: Is notice served when mailed or received?

Who needs to be served with your lien claim

So, who needs to receive a copy of your mechanics lien filing?

In most states, the lien claimant must send immediate notice to the property owner. Other states require that you also serve the prime contractor and construction lender (if there is a lender on the project). It’s a good, safe practice to make sure everyone above you in the contracting and payment chain gets a copy of your lien.

Make & keep proof that you met the service requirements

Finally, it’s incredibly important that you keep detailed records of your attempts to serve the lien, and any documentation that the lien service was successful. Some states require you to sign a specific document swearing that you delivered the lien to all the parties. This is called an affidavit of service. In some states — like California — you must file this with the county recorder.

Note that you may wind up running into some challenge service situations, such as when you’re unable to get an owner to accept service, or have a hard time serving one of the parties. Take a look at this question on our Expert Center, for example, about an owner in Oregon who refused to receive the lien filing.

Step 5: Enforce, Extend, or Release Your Lien

This final step is not technically part of the process of recording your lien. So, if you completed Steps 1 – 4, congratulations! Your mechanics lien is already hard at work to help you collect your payment.

However, what happens after you file a mechanics lien is definitely part of the lien process, and making sure you get this part right is an important step to making sure you get your overall mechanics lien filing right. And there are generally 3 things you’ll need to keep in mind.

Don’t let your lien expire

A very, very common mistake is for contractors and suppliers to think that their mechanics lien filings last forever. They absolutely do not! Mechanics lien filings are temporary and will expire within a specific period of time…and in some cases, quite short periods. The period of time differs from state-to-state.

A handful of states allow lien holders to extend this period of time, though sometimes this requires permission from the property owner. However, this is very uncommon and only allowed in a very small number of states. We answered a question like this on our expert center here: “Can the mechanics lien be reactivated and re-enforced?” Even when states allow it, the process is not simple, and only extends the lien for a small amount of time.

If your deadline to enforce your lien is approaching, you’ll want to take measures to extend the deadline, or to file suit to enforce the lien, which usually requires help from an attorney.

Move on to foreclose your lien or make demands and warnings of foreclosure

If you filed your mechanics lien and haven’t been paid, you should start taking steps to enforce your lien. This is the “Mechanics Lien Foreclosure Process,” which involves filing a civil lawsuit.

If you’re not ready for a full-blown foreclosure lawsuit, you may want to consider increasing the pressure by sending out a “Notice of Intent to Foreclose.” States don’t typically require this document. However, it is another step that increases the pressure to pay. Sometimes sending a notice that you intend to foreclose still doesn’t work. In that case, you’ll need to get a formal legal process moving. However, it’s quite rare for liens to get that far along.

Release the mechanics lien if you are paid or if it expired

At some point, you will likely need to release your mechanics lien. Yes, mechanics liens do expire, but that doesn’t necessarily mean it will be removed from public records.

After you collect your payment, you will likely need to release (or cancel) the lien. Not all states require claimants to cancel the lien, but property owners will usually ask for this after paying the lien claimant.

To cancel the lien, file a Lien Release (or Lien Cancellation) with the same office that recorded the lien. In fact, in many states, if you don’t release your claim within a certain time period, you may be liable for penalties and damages.

Plain English Introduction To The Mechanics Lien

Filing a mechanics lien is a powerful tool available to contractors and suppliers to get paid on construction jobs. If you worked on a job or provided materials to a job in the US, then you likely have the right to file a mechanics lien.

What else is a mechanics lien called?

There are plenty of confusing things about this tool. One of the simplest confusions is the document’s name.

Commonly referred to as “mechanic liens,” the document actually goes by a lot of different names. You might know it as a “construction lien,” “contractor’s lien,” “supplier’s lien,” “laborer lien,” “artisan’s lien” (when referring to a lien filed by an architect, engineer, designer, or other “artisan”), or just the plain old “lien.”

The word “mechanic” can throw people off. 200+ years ago, when this legal remedy was invented for contractors; automobiles didn’t exist. People used the term “mechanic” to refer to people who worked with their hands. Today, the term “mechanic” usually refers to someone who works on a car, truck, motorcycle, boat, airplane, or other vehicles. Certainly, these people also have lien rights when they are not paid. However, the construction industry and state laws still use “mechanics lien” widely.

How does a mechanics lien affect the property?

Mechanics liens aren’t filed against a particular person or company. Rather, once filed, the lien is placed against the property itself. It becomes public record and stays with the property; not the owner. So what does that mean for the owner? Well, they will have a tough time refinancing, selling, or otherwise transferring the property if a lien is filed against it.

For example, let’s say you put a lien on a house. When that owner goes to sell the house or try to take out a second mortgage, that buyer or lender will run a title search. If they discover that a lien has been placed against the property, alarms will begin ringing. They will typically require the owner to satisfy the debt and resolve the lien beforehand. If not, that lien will become their problem. This is one of the main reasons why mechanics liens are so powerful.

Mechanics lien or bond claim?

It can be confusing to figure out how making a lien claim is different on private projects v. state, federal, county, or other public jobs. A lien-like remedy is available to contractors and suppliers on both private and public jobs, but they work a little differently.

As mentioned above, on private construction projects, a mechanics lien filing actually attaches to the land itself. This clouds the property title and makes it extremely difficult for the owner to do anything with the property unless the lien is resolved. Read more here: How a mechanics lien works to get you paid.

On state, county, federal, or other public jobs, however, it’s not generally available to file a “lien” against the property itself! The property, after all, is owned by the public, and cannot be transferred to or sold by a contractor or supplier. Contractors & suppliers can still submit a payment claim – called a “bond claim” – which is made against and attaches to a bond. Learn more about bond claims here.

Before filing a lien, consider sending a notice of intent to lien

Filing a mechanics lien is a serious step for everyone involved. A lien filing has the power to disrupt a construction project, and in some cases, bring it to a stop. For this reason, filing a lien should be considered a last resort.

Before filing a mechanics lien, consider sending a Notice of Intent to Lien. A small number of states require contractors and suppliers to deliver a notice of intent to lien before they move forward with a lien. This usually gives the property owner or general contractor a 10-day or 30-day warning that, if unpaid, you’re going to file a lien.

If you’re in one of the states that require a notice of intent you definitely want to send one. It’s more likely you aren’t required to send the notice of intent, but if you have time, you should anyway. For a discussion about this and the effectiveness of NOIs, see this article: What Is A Notice of Intent to Lien and Should I Send One?

A notice of intent to lien is a lot like a demand letter or “dunning letter,” except that it’s a demand letter that really works.

Once you file a mechanics lien all the milk gets completely spilled. The lien gets recorded, served, and has stiff legal consequences. On the other hand, a notice of intent gets everyone’s attention and will likely be enough to resolve the payment dispute, without the more aggressive effects or requirements. It’s simply a letter!

Free Mechanics Lien Form Downloads for All 50 States

Below you’ll find links to download mechanics lien templates for all 50 states. To use these form documents just click on the state and form that you want, and then click “download.” You’ll be able to save this form to your desktop, fill it out on your computer, and then use it as you see fit.

- Alabama Claim of Lien Form

- Alaska Claim of Lien Form

- Arizona Mechanics Lien Form

- Arkansas Mechanics Lien Form

- California Mechanics Lien Form

- Colorado Mechanics Lien Form (for GCs)

- Colorado Mechanics Lien Form (for Subs & Suppliers)

- Connecticut Certificate of Mechanics Lien Form

- Florida Claim of Mechanics Lien Form

- Georgia Mechanics Lien Form

- Hawaii Mechanics Lien Form

- Idaho Mechanics Lien Form

- Illinois Mechanics Lien Form (for GCs)

- Illinois Mechanics Lien Form (for Subs)

- Illinois Mechanics Lien Form (if you contracted with Tenant)

- Indiana Mechanics Lien Form

- Iowa Mechanics Lien Form

- Kansas Mechanics Lien Form

- Kentucky Mechanics Lien Form

- Louisiana Statement of Claim & Privilege (Lien) Form

- Maine Mechanics Lien Form

- Massachusetts Statement of Account (Lien) Form

- Michigan Mechanics Lien Form

- Minnesota Mechanics Lien Form

- Mississippi Mechanics Lien Form

- Missouri Mechanics Lien Form

- Montana Mechanics Lien Form

- Nebraska Mechanics Lien Form

- Nevada Mechanics Lien Form

- N. Hampshire Mechanics Lien & Petition Form

- New Jersey Construction Lien Form

- New Mexico Mechanics Lien Form

- New York Mechanics Lien Form

- N. Carolina Claim of Lien Form (for GCs)

- N. Carolina Claim of Lien Form (for Subs)

- N. Dakota Mechanics Lien Form

- Ohio Mechanics Lien Form

- Oklahoma Mechanics Lien Form

- Oregon Claim of Construction Lien Form

- Pennsylvania Mechanics Lien Form (for GCs)

- Pennsylvania Mechanics Lien Form (for Subs)

- Rhode Island Mechanics Lien Form

- S. Carolina Mechanics Lien Form (for GCs)

- S. Carolina Mechanics Lien Form (for Subs or Suppliers)

- S. Dakota Mechanics Lien Form

- Tennessee Notice of Lien Form

- Texas Affidavit of Lien Form (for GCs)

- Texas Affidavit of Lien Form (for Subs/Suppliers)

- Utah Mechanics Lien Form

- Vermont Mechanics Lien Form

- Virginia Memorandum of Lien Form (for GCs)

- Virginia Memorandum of Lien Form (for Subs)

- Virginia Memorandum of Lien Form (for Sub-Subs)

- US Virgin Islands Mechanics Lien Form

- Washington Mechanics Lien Form

- Wash DC Mechanics Lien Form

- W. Virginia Mechanics Lien Form

- Wisconsin Mechanics Lien Form (for GCs)

- Wisconsin Mechanics Lien Form (for Subs)

- Wyoming Mechanics Lien Form

Step-by-Step Guides for Each State

The above post is a step-by-step guide on how to get a mechanics lien claim prepared and filed generally. However, every state has its own nuances and differences. This includes the need to navigate the filing requirements of your project’s specific county! The following guides walk you through filing the mechanics lien in your particular state.

- How to File Your Alabama Mechanics Lien

- How to File Your Alaska Mechanics Lien

- How to File Your Arizona Mechanics Lien

- How to File Your Arkansas Mechanics Lien

- How to File Your California Mechanics Lien

- How to File Your Colorado Mechanics Lien

- How to File Your Connecticut Mechanics Lien

- How to File Your Deleware Mechanics Lien

- How to File Your Florida Mechanics Lien

- How to File Your Georgia Mechanics Lien

- How to File Your Hawaii Mechanics Lien

- How to File Your Idaho Mechanics Lien

- How to File Your Illinois Mechanics Lien

- How to File Your Indiana Mechanics Lien

- How to File Your Iowa Mechanics Lien

- How to File Your Kansas Mechanics Lien

- How to File Your Kentucky Mechanics Lien

- How to File Your Louisiana Mechanics Lien

- How to File Your Maine Mechanics Lien

- How to File Your Maryland Mechanics Lien

- How to File Your Massachusetts Mechanics Lien

- How to File Your Michigan Mechanics Lien

- How to File Your Minnesota Mechanics Lien

- How to File Your Mississippi Mechanics Lien

- How to File Your Missouri Mechanics Lien

- How to File Your Montana Mechanics Lien

- How to File Your Nevada Mechanics Lien

- How to File Your Nebraska Mechanics Lien

- How to File Your New Jersey Mechanics Lien

- How to File Your New Mexico Mechanics Lien

- How to File Your New York Mechanics Lien

- How to File Your North Carolina Mechanics Lien

- How to File Your North Dakota Mechanics Lien

- How to File Your Ohio Mechanics Lien

- How to File Your Oklahoma Mechanics Lien

- How to File Your Oregon Mechanics Lien

- How to File Your Pennslyvania Mechanics Lien

- How to File Your Rhode Island Mechanics Lien

- How to File Your South Carolina Mechanics Lien

- How to File Your South Dakota Mechanics Lien

- How to File Your Tennessee Mechanics Lien

- How to File Your Texas Mechanics Lien

- How to File Your Utah Mechanics Lien

- How to File Your Vermont Mechanics Lien

- How to File Your Virginia Mechanics Lien

- How to File Your Washington Mechanics Lien

- How to File Your Washington DC Mechanics Lien

- How to File Your West Virginia Mechanics Lien

- How to File Your Wisconsin Mechanics Lien

- How to File Your Wyoming Mechanics Lien

Mechanics Lien Laws & Deadlines in Each State

Use the following links to get specific information about the lien rules in your state and see frequently asked questions that contractors and suppliers have about using the lien laws in their state to get paid.

- Alabama Mechanics Lien Laws, Deadlines, & FAQs

- Alaska Mechanics Lien Laws, Deadlines, & FAQs

- Arizona Mechanics Lien Laws, Deadlines, & FAQs

- Arkansas Mechanics Lien Laws, Deadlines, & FAQs

- California Mechanics Lien Laws, Deadlines, & FAQs

- Colorado Mechanics Lien Laws, Deadlines, & FAQs

- Connecticut Mechanics Lien Laws, Deadlines, & FAQs

- Delaware Mechanics Lien Laws, Deadlines, & FAQs

- Florida Mechanics Lien Laws, Deadlines, & FAQs

- Georgia Mechanics Lien Laws, Deadlines, & FAQs

- Hawaii Mechanics Lien Laws, Deadlines, & FAQs

- Idaho Mechanics Lien Laws, Deadlines, & FAQs

- Illinois Mechanics Lien Laws, Deadlines, & FAQs

- Indiana Mechanics Lien Laws, Deadlines, & FAQs

- Iowa Mechanics Lien Laws, Deadlines, & FAQs

- Kansas Mechanics Lien Laws, Deadlines, & FAQs

- Kentucky Mechanics Lien Laws, Deadlines, & FAQs

- Louisiana Mechanics Lien Laws, Deadlines, & FAQs

- Maine Mechanics Lien Laws, Deadlines, & FAQs

- Maryland Mechanics Lien Laws, Deadlines, & FAQs

- Massachusetts Mechanics Lien Laws, Deadlines, & FAQs

- Michigan Mechanics Lien Laws, Deadlines, & FAQs

- Minnesota Mechanics Lien Laws, Deadlines, & FAQs

- Mississippi Mechanics Lien Laws, Deadlines, & FAQs

- Missouri Mechanics Lien Laws, Deadlines, & FAQs

- Montana Mechanics Lien Laws, Deadlines, & FAQs

- Nevada Mechanics Lien Laws, Deadlines, & FAQs

- Nebraska Mechanics Lien Laws, Deadlines, & FAQs

- N. Hampshire Mechanics Lien Laws, Deadlines, & FAQs

- New Jersey Mechanics Lien Laws, Deadlines, & FAQs

- New Mexico Mechanics Lien Laws, Deadlines, & FAQs

- New York Mechanics Lien Laws, Deadlines, & FAQs

- N. Carolina Mechanics Lien Laws, Deadlines, & FAQs

- N. Dakota Mechanics Lien Laws, Deadlines, & FAQs

- Ohio Mechanics Lien Laws, Deadlines, & FAQs

- Oklahoma Mechanics Lien Laws, Deadlines, & FAQs

- Oregon Mechanics Lien Laws, Deadlines, & FAQs

- Pennsylvania Mechanics Lien Laws, Deadlines, & FAQs

- Rhode Island Mechanics Lien Laws, Deadlines, & FAQs

- S. Carolina Mechanics Lien Laws, Deadlines, & FAQs

- S. Dakota Mechanics Lien Laws, Deadlines, & FAQs

- Tennessee Mechanics Lien Laws, Deadlines, & FAQs

- Texas Mechanics Lien Laws, Deadlines, & FAQs

- Utah Mechanics Lien Laws, Deadlines, & FAQs

- Vermont Mechanics Lien Laws, Deadlines, & FAQs

- Virginia Mechanics Lien Laws, Deadlines, & FAQs

- Washington Mechanics Lien Laws, Deadlines, & FAQs

- Wash DC Mechanics Lien Laws, Deadlines, & FAQs

- W. Virginia Mechanics Lien Laws, Deadlines, & FAQs

- Wisconsin Mechanics Lien Laws, Deadlines, & FAQs

- Wyoming Mechanics Lien Laws, Deadlines, & FAQs

Preliminary Notice: Many states require contractors, material suppliers, and equipment lessors to deliver a “

Preliminary Notice: Many states require contractors, material suppliers, and equipment lessors to deliver a “ Notice of Intent to Lien: Only a few states require the “

Notice of Intent to Lien: Only a few states require the “