What are back charges?

- Learn more about back charges

FAQs about back charges

View answers to frequently asked questions about back charges in construction.

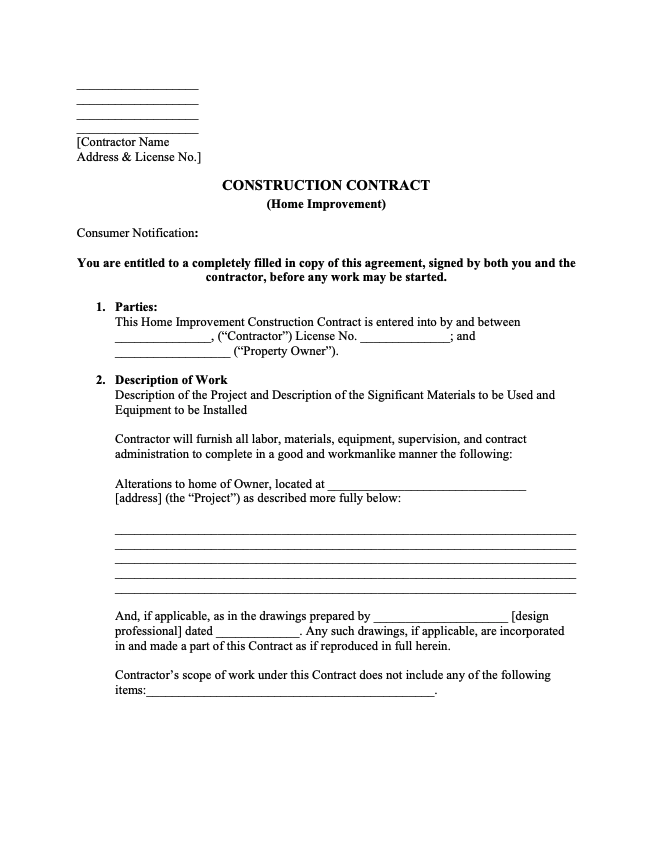

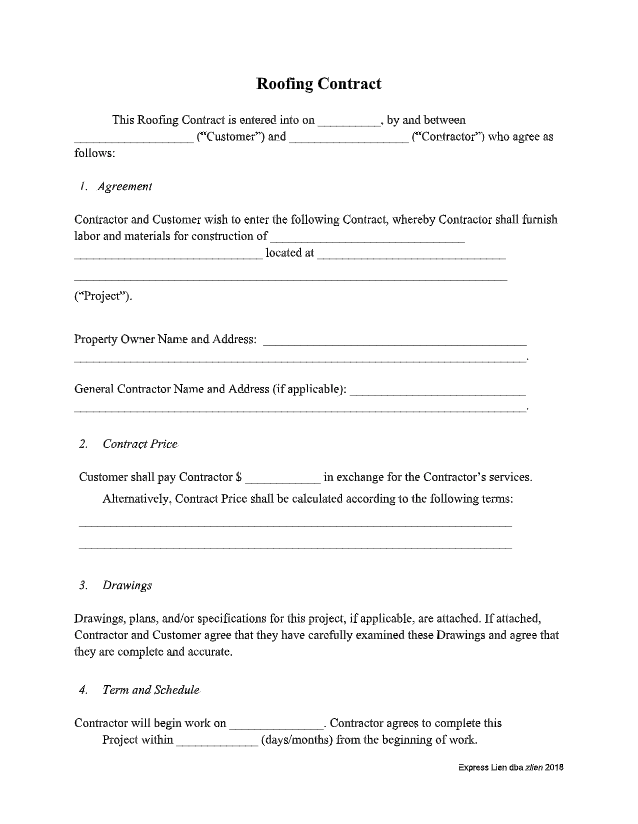

More about contracts in construction

Understanding how construction contracts work, and the type of clauses to watch out for, is the first step to protecting your rights on the job. View more articles, videos, and other resources to learn about contracts on construction projects.

Back charges are billings for expenses incurred in a previous pay cycle. A back charge is also known as a chargeback. While back charges are typically made when costs are incurred on the same project, some states allow a type of chargeback known as a setoff. A setoff occurs when a GC charges a subcontractor on one project for costs incurred under a separate contract.

Why they exist

Construction projects are complicated and complex, and disputes over the quality of work are common. A job is rarely completed without the general contractor running into some kind of issue with subcontractors or a vendor.

If the GC or property owner discovers a defect or problem, they may include a back charge on the current or subsequent billing cycle. The back charge effectively deducts money from the current payment to cover the costs of fixing the problem or issue.

Construction back charges can be incurred for a variety of reasons, including:

- Defective work

- Defective materials

- Job site damages

- Clean up

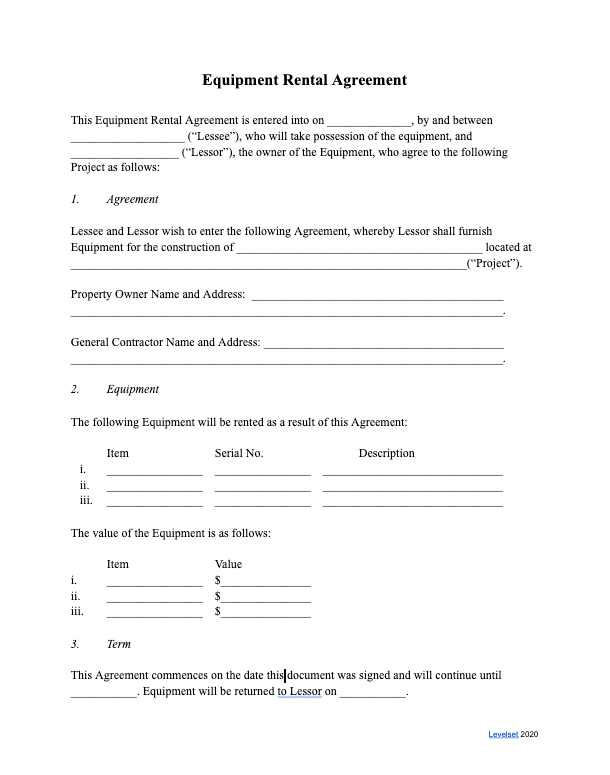

- Equipment use

Back charges are not statutory, or provided by law. Instead, they are generally rights given to the GC or property owner through the construction contract. This means they are governed by the terms set forth in a contract (if they’re even included in the contract in the first place). Many subcontracts allow for some sort of back charges, though many do not.

Example of back charges

As an example, a subcontractor agrees to perform work for a GC at a price of $100,000. At any point – whether it’s during or after work – the GC and the project owner contend that $20,000 of the sub’s work is incorrect or incomplete. This means that the sub won’t receive their full $100,000. Instead, they’d earn $80,000 because the $20,000 back change is subtracted from their payment.

Legal Rights

While the governance of back charges is generally left up to the construction contract, there are some rules about how setoffs can be used (i.e. charging for costs that were incurred on another project).

Federal projects, along with construction projects in Washington, DC, allow for setoffs. The federal government retains this right under the Federal Acquisition Regulations. The District of Columbia doesn’t have any statutes preventing offset charges, which one could argue makes them permissible.

Several states have construction trust fund statutes that governs how funds can (and can’t) be used on a project. As a result, these often limit a contractor’s right to setoff.

On private construction projects, Virginia used to allow contractors to use setoffs. That law changed on July 1, 2020. Now, these types of charges are limited to the same contract.

Negotiating Payment

Most construction disputes could be resolved by the combination of communication and documentation. Back charges work off of disputes, so it’s important for GC’s to react correctly towards subs when they do arise.

First, general contractors can try to avoid non-performing subs by using a pre-qualification phase in their hiring process. GC’s can also create a collaborative project that identifies problems early through daily reports, performance assessments, and by talking person-to-person on the job site. Before there is ever a need to use a back charge, GC and subs should communicate clearly to try to reach an understanding. If none of that works, it’s time to either supplement or terminate a non-performing sub.

If a subcontractor or supplier disagrees with a back charge, they have a few options. If you agree on the basis of the back charge, but not the cost, the first step would be to negotiate directly with the GC.

If the back charge was fraudulent or not provided for in the contract, you may be able to file a mechanics lien claim for the unpaid amount.

- Can I file a mechanics lien for back charges?

- Filing a lien for the full contract amount (including back charges)

Disruption Claims

Disruption is when the contractor or subcontractor has to perform differently or less efficiently than originally planned. These types of claims are usually based on additional costs due to increased labor and equipment and not because of extra time spent at the jobsite. What led to a sub’s back charges could in turn cause a disruption claim.

For instance, if a sub damages equipment or requires the GC to bring in more equipment, these could become costs that go well beyond what was originally planned. In this case, a GC could use a disruption claim to recover damages for the loss of productivity.

- Read more: Getting Paid for Lost Productivity

Back charge abuse

Subs are constantly at risk of facing abuse of back charges from GCs. It’s a common concern for subcontractors, especially because back charges are solely governed by contract terms. Abuse can occur when a top of chain party has arbitrarily allocated anticipated project costs to the subs without regard to their use of a particular service. Even worse, the back charges could be accruing throughout the entire project. GCs may not notify the sub until their work is complete.

In some instances, GCs and owners can use back charges as leverage against subs to force them to perform work that is outside of the scope of work, or to make other change orders or change directives in the work.