The Texas Prompt Payment Act was enacted to ensure that subs and suppliers are paid in a timely fashion. It’s not only important to know your rights to payment, but also your obligations regarding the release of payment down the chain. These statutes provide certain rights to those seeking payments on construction projects; including interest payments and attorney’s fees.

Prompt payment

Late payment has plagued the construction industry for decades. In response to this problem, many states have enacted their own prompt payment laws to right the ship on construction payments. These acts vary from state to state. However, the main goal of prompt payment is to set certain payment deadlines. If these time limits aren’t met, the statutes grant contractors and subs the right to charge interest and reasonable attorney’s fees.

Knowledge of your state’s prompt payment provisions is basically a requirement for construction companies to operate in the black. The Texas Prompt Payment provisions are split into two sections, covering both public and private contracts

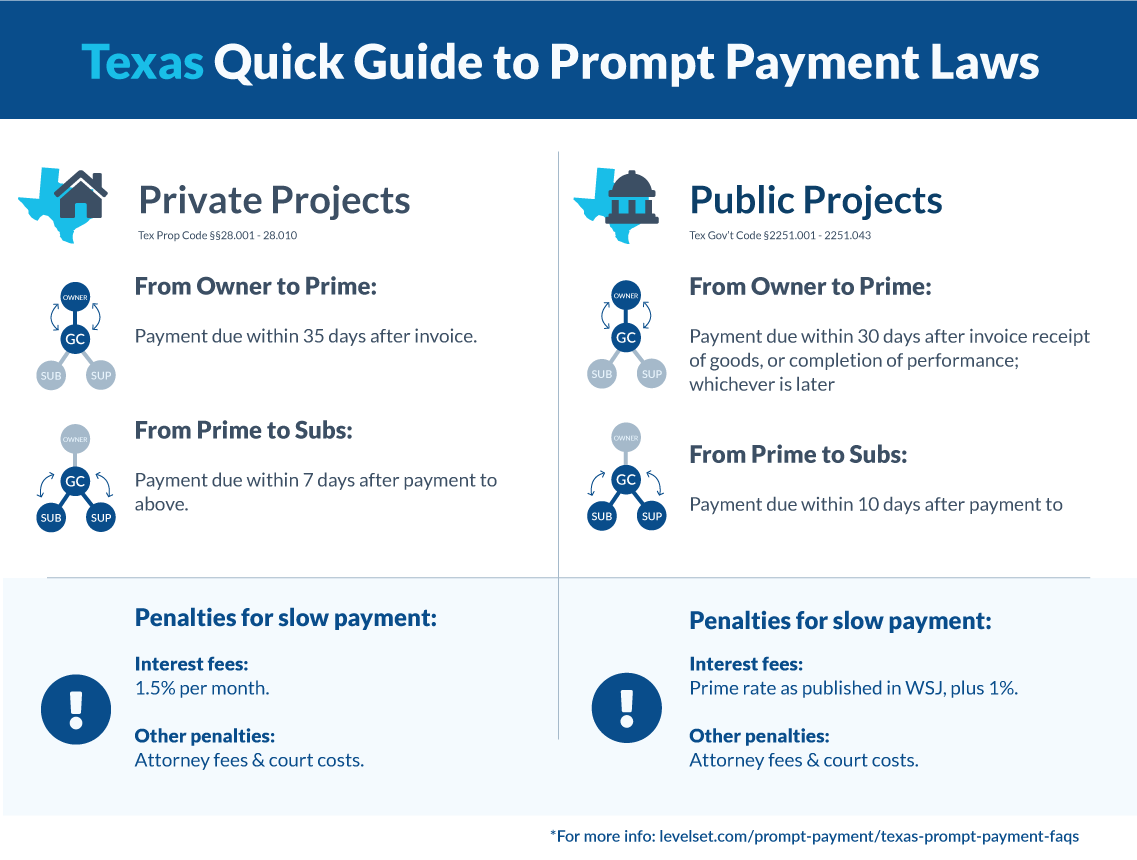

For a quick reference:

Private projects

Ch. 28 of Texas Property Code regulates the timing of payments on almost all private construction projects. Let’s take a look at the specifics.

Prompt payment timeframes

The general rule for private projects is that all owners must release payment within 35 days of receiving a pay application or invoice from the prime contractor. As for payments from the general contractor to their subs and suppliers; they have 7 days from receipt of the owner’s payment to pay. And this applies to every other payment down the chain. And lastly, for retainage, the retention funds must be released within 30 days of substantial completion.

If however, the project is a single-family, residential improvement, the owner may contractually modify this deadline. But this can’t be extended longer than 60 days after receipt of a payment request.

Ways the owner can withhold payments longer

The deadlines for enforcement are pretty strict. But, there are a few circumstances in which the owner can withhold payments for an extended period. In the event, there is a good faith dispute, the owner may withhold an amount no more than the difference between what the contractor thinks is the unpaid amount, and what the owner thinks is due.

There is yet another difference here for residential, single-family projects. If there is a good faith dispute, the owner may withhold the same amount of difference between the amounts, plus an additional 10%.

If the dispute is based on the quality of work performed or materials supplied, then, there are a few extra steps the owner must take here. They must provide a written notice to the contractor detailing the specific reasons for non-payment, and offering a reasonable opportunity to cure the non-conforming work or materials. The sub can then either cure the defective work or offer a reasonable amount of compensation for the listed item to be properly cured.

Another exception is if the owner obtained a loan for the improvements. If the owner made a timely request for disbursement, and the lender who is legally obligated to make payments fails to do so within 35 days after the application. In a situation like this, the owner will not be required to pay until within 5 days after the owner received the loan proceeds.

As far as the ability for GCs or subcontractors to withhold payments, the statutes are silent. Therefore any right to withhold these types of payments will be regulated by the contract terms between the parties.

Right to suspend work for nonpayment

According to §28.009 contractors and subs are provided the right to suspend work for nonpayment. This is a useful tool as delays caused by the suspension of work is sometimes more detrimental to a project than merely releasing funding.

If the owner fails to make timely payments, the contractor or sub may send a notice of their intent to suspend performance to the owner (and lender if applicable). This notice should inform that payment has yet to be received, and if payment isn’t forthcoming, the intention to suspend work in 10 days.

If the contractor or sub actually suspends work they will not be required to resume work until they have been paid the late amount plus and demobilization and remobilization costs. Nor are they responsible for any damages caused by the suspended work unless the owner informs them of the possibility in writing before work is suspended. However, this right is not available for contracts to improve residential projects of four units or less.

Penalties for late payment

Any improperly withheld payments will begin to accrue interest at a rate of 1.5% a month, or 18% a year. That’s a nice return! The interest will stop accruing on the date when one of the following events occur; (1) payment is made, (2) mailing of payment if it is received within 3 days; or (3) judgment is entered for violation of the Act.

If the dispute does end up going to trial and the contractor prevails, the court may award court costs and reasonable attorney fees. It is up to the courts to determine what amount is “equitable and just” under the circumstances.

Public projects

As for public projects, the prompt payment provisions are found in Texas Government Code Ch. 2251. This chapter regulates payment for all goods and services provided under state and local government contracts.

Prompt payment timeframes

For most public works projects in Texas, the governmental entity must pay its prime contractors within 30 days. The clock starts to tick after the later of the following events; (1) the delivery of materials, (2) the completion of the performance, or (3) the date the invoice or pay application is received.

If the contracting agency is a political subdivision that holds regular meetings; then the payments are due 45 days after the last meeting.

In turn, payments from GCs to subcontractors must be made no later than 10 days after receipt of payment from the agency. The same timeframe applies to payments from subs to their subs or suppliers. As for any other payments further down the chain, the deadline is 7 days from receipt of payment.

Right to withhold payments

The Texas Prompt Payment Act does allow the withholding of payments on public works projects in particular circumstances. The entity, vendors (prime contractors), and subs may withhold payments if there is a bona fide dispute about the goods delivered or services performed.

Another scenario where the prompt pay deadlines don’t apply is when the terms in the federal contract, grant, or some regulations or statute that prevents the contracting entity from making timely payment.

If the dispute is over the quality of work performed or the materials delivered, then the government entity should give a reasonable opportunity to cure the defective by sending written notice of the reasons for nonpayment.

Penalties for late payments

Any payments that are yet to be disbursed after the prompt pay deadlines will begin to accrue interest. The interest rate imposed is a little tricky to calculate, but I’ll break this down as simply as possible.

The statute states that the interest rate will be the rate “in effect on September 1 of the fiscal year in which the payment becomes overdue.” The statute then proceeds to set forth how this is calculated, which is 1% plus the prime rate published by the Wall Street Journal on the first day of July of the preceding fiscal year that does not fall on a Saturday or Sunday. Crystal clear right? It’s actually not as complicated as it sounds.

So let’s say for example, that payments become overdue in May of 2019. The prime rate published by the WSJ (a history of which can be found here) in July of 2018 was 5% yearly. So the interest rate that would accrue is 6% yearly or 0.5% monthly. Not nearly as much as on private projects, but that’s to be expected when dealing with the government.

Right to suspend work for nonpayment

Just like private projects, public works projects also allow for the suspension of work as a remedy for nonpayment. Direct contractors and subcontractors may suspend work, as long as they send the same 10-day notice required on private projects.

The contractor or sub will not have to restart work until they’ve been paid both the outstanding amount and any mobilization costs associated with the suspended work. Nor will they be responsible for any damages caused by the suspension of work, unless they are notified of the potential problems before work is suspended.

Dive deeper:

Enforcing rights under the Texas Prompt Pay Act

As mentioned above, the suspension of work is an excellent way to induce payments on both public and private projects. Construction projects are coordinated efforts. When one portion of the work becomes delayed, there is a ripple effect on other trades, and will eventually impact the overall schedule. But, this still may not be enough to induce payment. So what are the other options?

For further reading:

If you’ve retained your lien or bond claim rights, that’s a good start. But if you want that “oh so precious” interest rate, you have two options to enforce your rights under the Texas Prompt Pay Act. One option is to file a lawsuit asserting a right of action under the Act. Obviously, litigation is a time-consuming and costly process. Attorney’s fees are awarded on a reasonable basis and may not cover all costs, and even worse; what if you lose.

The better option is to send a payment demand letter. These letters act as a warning shot that litigation is coming if you don’t get paid. This letter should inform the debtor of your rights under the Act and the penalties that come with it. It should also state that to avoid any additional interest accruing payment should be sent within x amount of days or a lawsuit will be filed.

Bottom line

The Texas Prompt Payment Acts provide valuable protection for those working on construction projects. Not only do contractors need to be aware of their right to payment, but also their obligations to pay within an appropriate time. Interest rates can sneak up quickly, making contractors liable for far more money than the work performed.

Additional resources

- Texas Pay-if-Paid Clauses | Levelset

- Texas Construction Trust Fund Statutes

- Specifics Under the Federal Prompt Payment Act