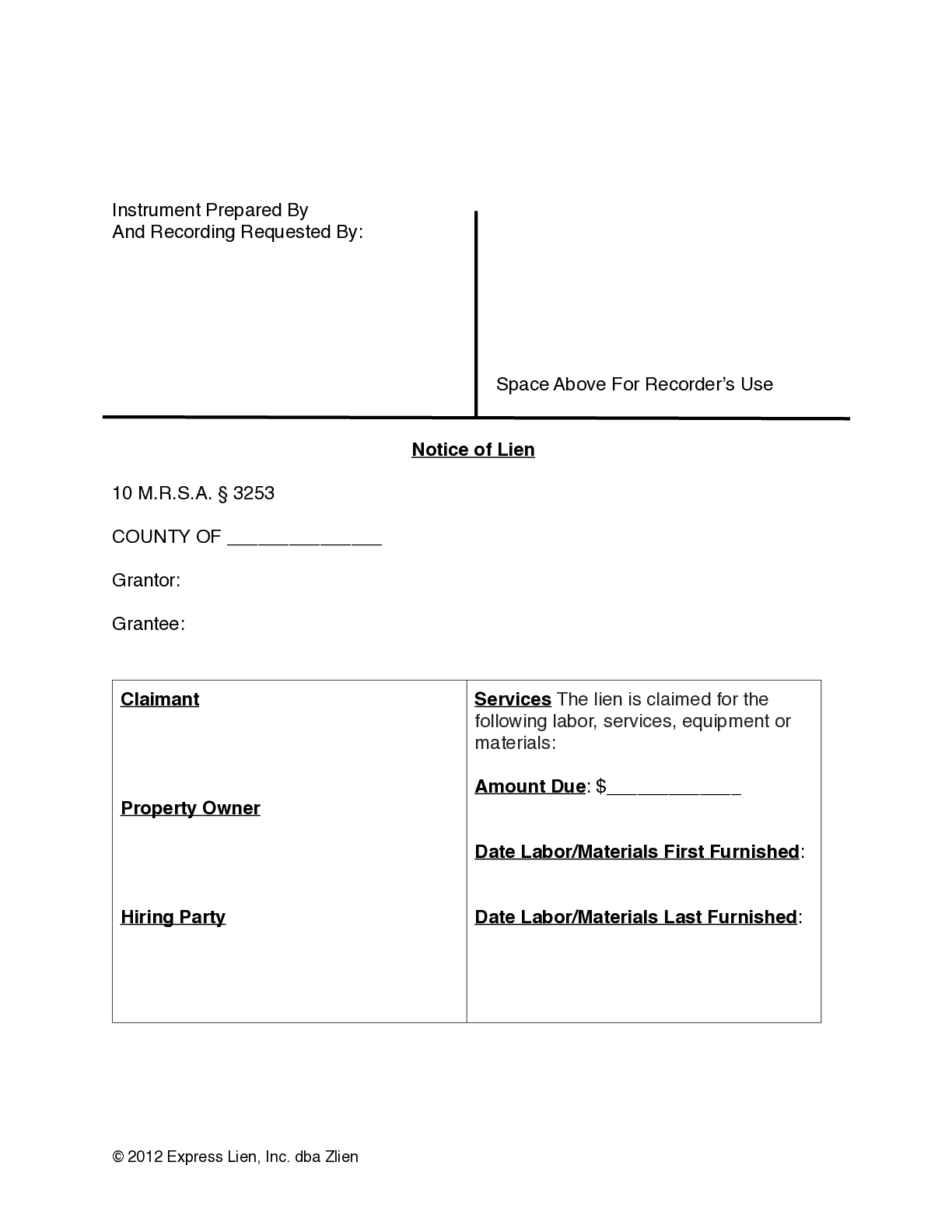

Maine Notice of Lien Form

Download your Notice of Lien Form | Free Downloadable Template

Get help filing your Maine Mechanics Lien

When unpaid on a construction project in Maine, parties who provided labor and/or materials may file a Notice of Lien against the property within 90 days from last furnishing labor and/or materials to the project.

Fill out the form on the right to download your Maine Notice of Lien Form. Use this form to file a lien in Maine.

Rules and regulations for sending a Maine Mechanics Lien

Notice of Lien must be recorded in the registry of deeds within 90 days from the last furnishing of labor and/or materials at the project. This deadline marks the end of this 90 day period on this project.

After completing the Maine Notice of Lien Form, you must deliver it to the appropriate parties required by statute. Notices are typically served on the property owner and, for sub-tier parties, the general contractor. However, depending on the type of notice, it can be helpful to send notices to anyone else who is in charge of your payment, like a lender or surety company on the project.

Others are asking about Maine Mechanics Lien

I am contesting a $12,000 final invoice which the owner is not willing to pay in full. He states he will only pay $500.

The place to start, assuming you have one, is to review your contract with the owner to determine what it provides in the event of a dispute. You will want to follow the contract procedures for the resolution of disputes. That process may involve binding arbitration, nonbinding arbitration, or mediation. If there is no dispute resolution process, and you cannot resolve the issue by negotiating with the owner, then you will likely need to file a lawsuit seeking to collect what you are owed. Of course, as this process moves forward, you will want to make sure you preserve and enforce any available mechanic’s lien rights and claims you have in a timely manner by following the applicable Maine statutes and case law. Acting timely is critical; failure to meet the applicable deadlines, which are strictly enforced, and failing to properly preserve or enforce a mechanic’s lien will mean that lien is lost, and generally that loss will be permanent.

Can a moving company file a lien

As a matter of Maine statutory law, to potentially qualify for a mechanic’s lien the labor you perform must be used in erecting, altering, moving or repairing a house, building or appurtenances. The packing and delivering of a customer’s household goods does not appear to fall within this language. Accordingly, I do not believe you would have the right to pursue a mechanic’s lien in these circumstances. Of course, you can always sue the client based on the written agreement the client signed and you can request an attachment, which if approved would allow you to place a lien on certain property owned by the client.

Attempting a fraudulent lien claim in Maine owners recourse?

No, a valid lien cannot be placed on an owner’s property using fraudulent information in Maine. The applicable Maine statute uses the phrase “a true statement of the amount due the claimant,” so fraudulent information would not qualify. Among other possible claims, it sounds like you would have claims for Declaratory Judgment, Quiet Title, and Slander of Title.

Other forms to use in Maine

Maine County Recorders

Looking to file/record a mechanics lien in Maine? You'll need to get your Maine mechanics lien filed and recorded with the county recorder in the county where the construction project is located. Here is a listing of all county recorders in Maine. Click on any county to find more information about how to get your lien recorded in that county.

Androscoggin

Cumberland

Franklin

140 Main St.,Suite 5

Farmington, Maine, 4938

phone: 207-778-5889

fax:

Hancock

50 State Street, Suite 9

Ellsworth, Maine, 4605

phone: (207) 667-8353

fax:

Lincoln

32 High Street

Wiscasset, Maine, 4578

phone: (207) 882-7431

fax: (207) 882-4061