What is a Notice of Intent to Lien?

NOI Resources

- At A Glance

Map of Nationwide NOI Requirements

Not sure whether notices of intent are required in your project's state? While there are benefits to sending NOIs wherever you are, here are the states that require them before a lien filing.

Notice of Intent FAQs

Here are some frequently asked questions about NOIs that will help you understand when to use the document, and how to leverage this tool to get paid!

Watch the videos

Browse video lessons about what a notice of intent is, how it works, and when to send it.

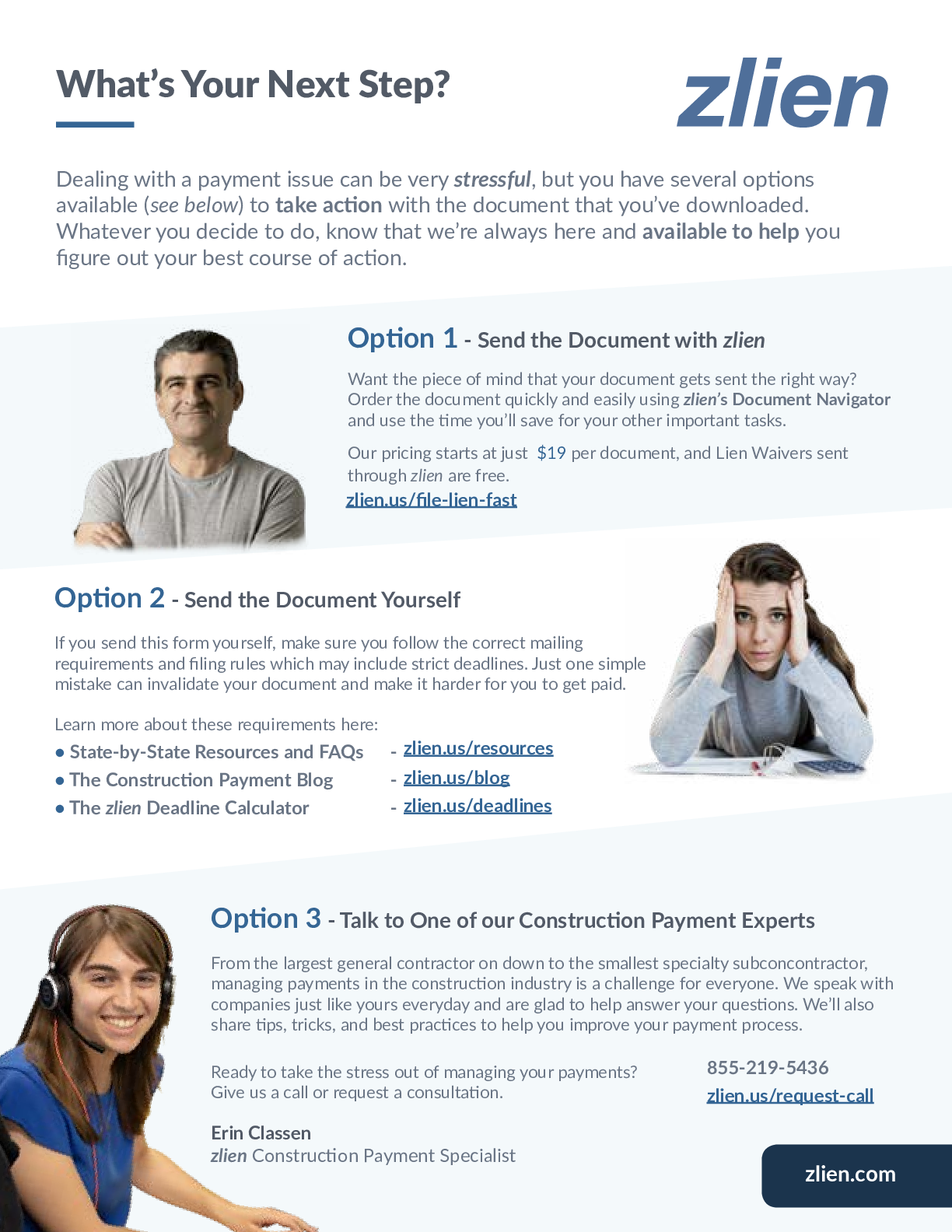

Not Sure What To Do?

Have a payment issue on a job and not sure what to do? Use our Deadline Calculator tool to get advice on your next steps.

Do it with Levelset

Ready to get paid faster? You can fire off a notice of intent to lien with Levelset in just a few minutes, and get your account closer to PAID status.

A notice of intent to lien (NOI) – sometimes called an intent notice or notice of non-payment – warns the property owner, prime contractor and/or other party that a mechanics lien or bond claim will be filed unless payment of overdue amounts is made within a certain period of time (i.e. 10 days). Although only legally required in a few states, there are benefits to sending these notices for projects in any state, as they are inexpensive and very effective at producing payment.

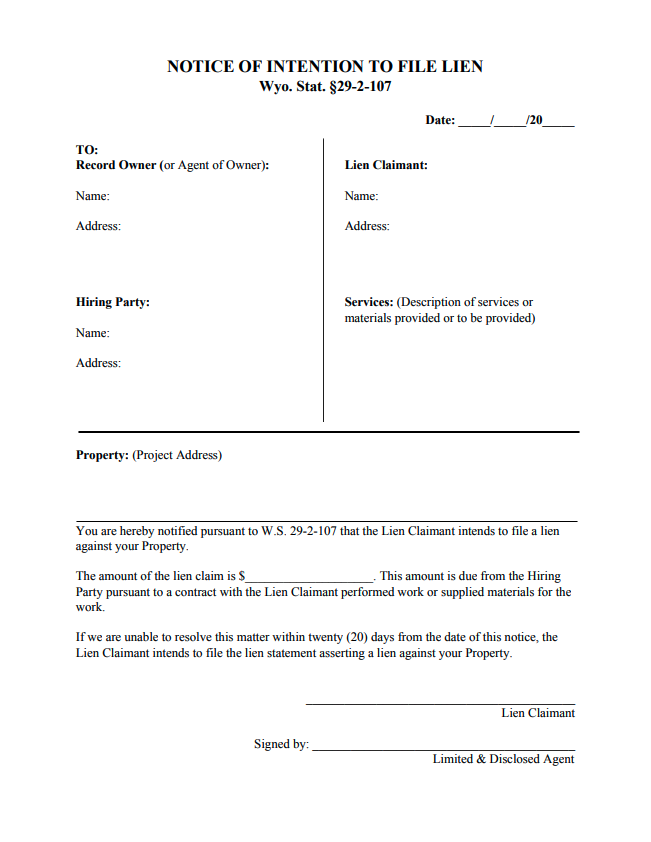

In some states and scenarios on private construction projects, notices of intent must be sent before a party is allowed to file a mechanics lien. There are no notice of intent requirements on state, federal, and other public works. The states requiring these notices are listed here:

- Alabama

- Arkansas

- Colorado

- Connecticut

- Illinois

- Louisiana

- Maryland

- Missouri

- Nevada

- North Dakota

- Pennsylvania

- Wisconsin

- Wyoming

Although notices of intent to lien are formally required in a handful of states, there are proven benefits to sending these notices on other accounts with an unpaid balance. In many ways, a notice of intent to lien can be a replacement for a demand letter or dunning letter, except that NOIs have the extra benefit of being relevant to parties other than the debtor and carry more overall weight. This results in demanding more attention and producing more success.

According to research by Levelset, 47% of NOIs produce payment within just twenty days of delivery – all without any further collection efforts or legal action. Many Levelset users have watched that success number increase to over 90% when examining a longer post-notice period, such as 90 days.

The notice of intent to lien tool is a perfect pressure release valve for the construction industry, which is notorious for payment abuses, delays, and working capital challenges. A survey by Construction Enquirer of more than 900 subcontracting firms found that more than half (50.4%) said they had to recently resort to legal action to get their bills paid. That’s an enormous statistic. And the success of notice of intent to lien claims appears to be a perfect antidote to the industry’s payment woes.

Additionally, notices of intent to lien can salvage important business relationships that are at risk. It’s common that delayed payment or non-payment is related to a communication problem on the project, or something simple.

A properly delivered notice of intent to lien document notifies key project stakeholders of a payment problem they may not otherwise know exists, and gives all parties an opportunity to resolve the problem before a more adversarial lien claim is filed.

Levelset makes sending Notice of Intent to Lien documents easy. We routinely deliver thousands of NOIs on construction projects across the country. Further, Levelset’s NOIs are engineered to succeed at producing payment and encouraging critical communication, which explains why users who implement and execute a NOI policy through Levelset’s platform commonly see payment success on NOIs in a vast majority of deliveries.