Texas Prompt Payment Requirements

- Private Jobs

- Public Jobs

Prime Contractors

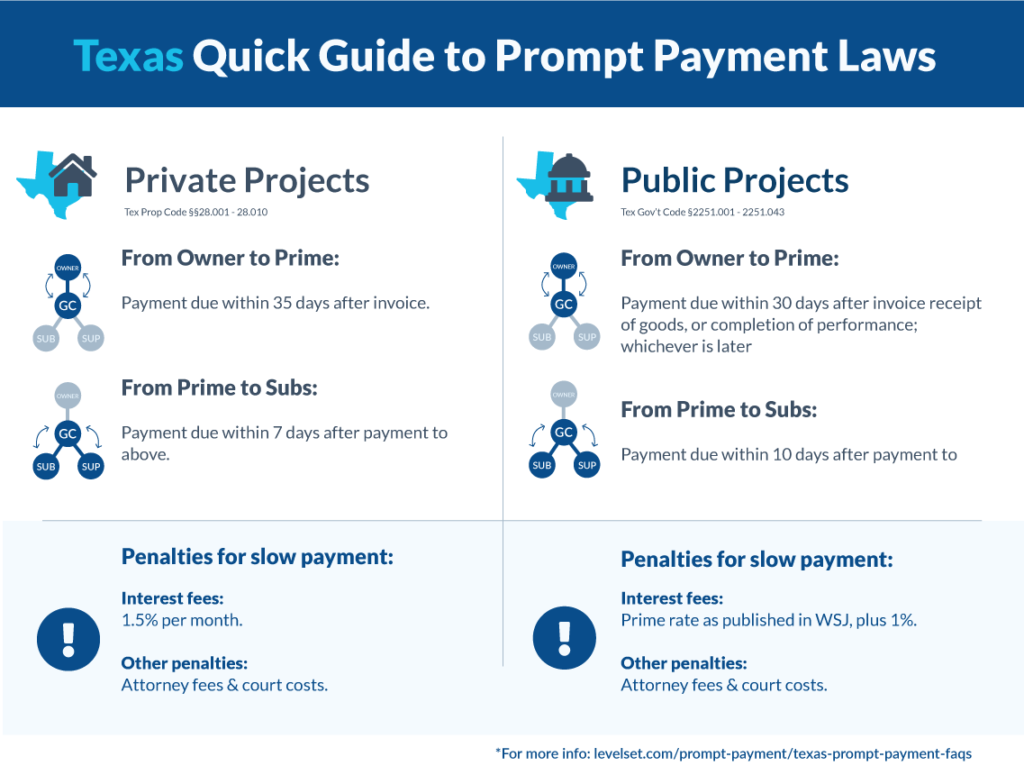

On private construction projects, Texas property owners must make progress payments to prime contractors within 35 days of invoice.

Subcontractors

Prime contractors on private projects in Texas must pay subcontractors within 7 days after receiving payment from the owner. The same 7-day deadline applies to parties down the chain.

Suppliers

Suppliers on private construction projects in Texas are entitled to payment within 7 days after their hiring party receives payment.

Interest & Fees

On private projects, the Texas Prompt Payment Act assesses interest on late payments at 1.5% month. Attorney fees may be awarded by the court in a prompt payment claim.

Prime Contractors

On public projects in Texas, the government agency must pay the prime contractor within 31 days of invoice or receipt of services, whichever is later.

Subcontractors

Subcontractors on public construction projects in Texas are entitled to payment within 10 days of payment receipt by the hiring party.

Suppliers

Suppliers on public construction projects in Texas must receive payment within 10 days after their hiring party receives payment.

Interest & Fees

On public construction projects in Texas, interest for late payments is set at prime plus 1%. Attorney fees are also awarded to the prevailing party in a prompt payment claim.

The Texas Prompt Payment Act is actually a collection of laws that set a deadline for payment on construction projects. These laws ensure timely payments to contractors and suppliers to improve cash flow and working capital. Nearly all states have prompt payment laws that regulate the acceptable amount of time in which payments must be made to contractors and subs.

Projects Covered by the Texas Prompt Payment Act

The State of Texas has prompt payment laws that regulate payment on both private and public construction projects within the state.

Private Projects

Payments on private construction projects in Texas are governed by Property Code Chapter 28: Prompt Payment to Contractors and Subcontractors.

These statutes regulate the time limits and interest penalties on all private construction projects within the state.

Payment Deadlines for Private Projects

On private projects in Texas, the property owner must make payment to the prime contractor within 35 days of invoice receipt.

Once the prime contractor receives payment from the property owner, they must pay their subs and suppliers within 7 days.

This same 7-day turnaround period applies to all payments down the next tier.

Reasons for Withholding Payment

Retainage laws in Texas requires the property owner to retain 10% of the contract amount.

In addition to retainage, prompt payment laws provide specific reasons that a party is allowed to withhold payment. If there is a good faith dispute regarding whether the work was performed in a proper manner, payments may be withheld.

On Texas residential projects or four units or less, the maximum amount that can be withheld is 110% of the difference between what the party claims is owed and what the paying party thinks is owed. For all other private projects, this is reduced to 100% of the difference.

Interest & Penalties on Private Projects

If payment of an undisputed amount is late or wrongfully withheld on a private project in Texas, interest will begin accruing on the overdue payment at an interest rate of 1.5% per month. In addition to that, if the dispute goes to court or arbitration, the court may award costs, a reasonable amount of attorney fees, and any interest due to the prevailing party.

Public Projects

Payments on public construction projects in Texas are governed by Government Code Chapter §2251: Payment for Goods and Services.

Payment Deadlines for Public Projects

Payment from the government entity to the prime contractor is due within 30 days of the later of:

- the date the entity receives goods under the contract

- the date performance is completed

- when the invoice is received

If the payment request is disputed by the public entity, they must notify the contractor within 21 days of receipt.

Once the prime contractor receives payment, they are required to pay any subcontractor or supplier they hired within 10 days. The same 10-day deadline applies to payments from subcontractors down the payment chain.

Penalties for Late Payment on Public Projects

Texas allows retainage to be withheld on public construction projects, though the law does not specify a maximum amount.

In addition, if there is a bona fide dispute concerning the goods or services performed, there are specific reasons allowed for nonpayment. If payment is late or wrongfully withheld, interest will accrue the day after payments become due.

If payment of the undisputed amount is improperly withheld on a public project in Texas, the contractor may suspend performance until they are paid the amount including any demobilization and remobilization costs.

In addition, penalties will begin to incur if payment isn’t made within the specified timeframes. Interest will accrue on the unpaid amount at the prime rate published by the Wall Street Journal plus 1% per year. Interest will stop accruing once the payment is mailed/postmarked. Additionally, if the dispute goes to court or arbitration, the prevailing party will be awarded the interest due, and reasonable attorney’s fees.