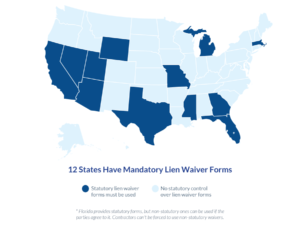

Lien waivers are routinely exchanged by parties on construction projects. Interestingly, however, there are only 12 states that have lien laws that set forth what must be on those lien waiver forms.

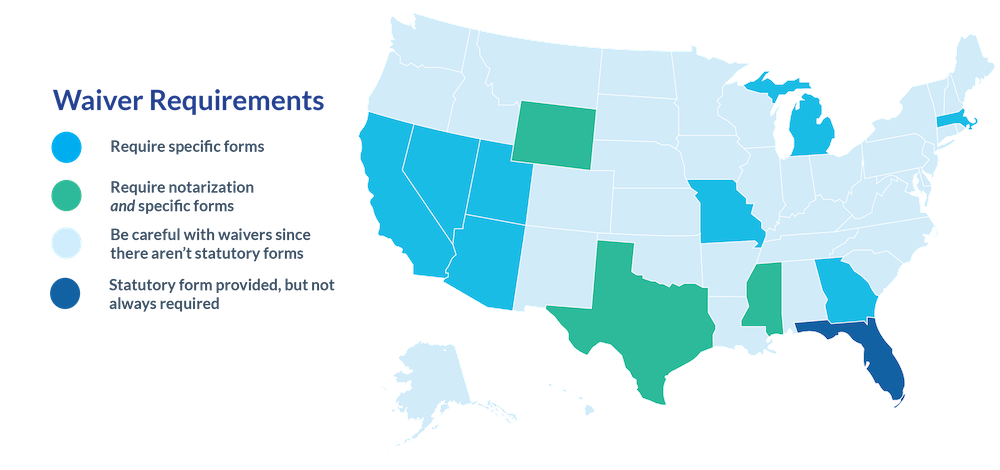

The color-coded map of the United States identifies the states with specific statutory lien waiver form requirements, and this article explains the details about what this means for your company’s legal and financial risk.

Which 12 States Have Required Lien Waiver Forms?

It’s the minority rule in the United States that lien waiver forms are regulated, as only 12 states have mandatory waiver forms. However, for these 12 states (highlighted in blue in the above chart), the law is serious about its mandate.

First, when a state statute requires use of a statutory lien waiver form, the statute almost universally invalidates any document used by the parties that does not “substantially” conform to the law. When reading the term “substantially,” you might as well consider it to be “exactly.” The courts will allow for some stylistic or formatting changes, but the parties will be unable to make any changes to the substance of the document. The penalty of invalidating the waiver document as a whole is a pretty stiff penalty.

Second, many states build it into their laws that a lien waiver will be ineffective as a rule if payment was not exchanged in consideration of the waiver. This is the case in Georgia where O.C.G.A. 44-14-366(b) provides specifically:

Waiver not effective or enforceable unless: (1) It is pursuant to a waiver and release form duly executed by the claimant prescribed [in the statute]; and (2) The claimant has received payment for the claim.

Absent actual payment, therefore, the waiver is not effective, regardless of what the waiver document says. All in all, lien waiver forms regulated by statute promote clarity between the parties. And just for note, the states with regulated lien waiver forms are below.

Download Free Lien Waiver Forms from the 12 States with Required Forms

Click on each state’s link to see the Lien Waiver FAQs for that state. You can also download all of the waiver forms used in each state, all for free.

- Arizona Lien Waiver Forms and Waiver FAQs

- California Lien Waiver Forms and Waiver FAQs

- Florida* Lien Waiver Forms and Waiver FAQs

- Georgia Lien Waiver Forms and Waiver FAQs

- Massachusetts Lien Waiver Forms and Waiver FAQs

- Michigan Lien Waiver Forms and Waiver FAQs

- Mississippi Lien Waiver Forms and Waiver FAQs

- Missouri Lien Waiver Forms and Waiver FAQs

- Nevada Lien Waiver Forms and Waiver FAQs

- Texas Lien Waiver Forms and Waiver FAQs

- Utah Lien Waiver Forms and Waiver FAQs

- Wyoming Lien Waiver Forms and Waiver FAQs

*Florida does not require that parties use the statutory lien waiver, but it offers the waiver as a safe option and seems to prohibit parties from requiring a non-statutory form.

Essential reading for contractors and suppliers: The Ultimate Guide to Lien Waivers

How Do Lien Waivers Work in the States that Don’t Have a Required Waiver Form?

Subcontractors and suppliers have a huge problem when it comes to lien waivers: 38 states don’t have statutory waiver forms. The result of this is a legal wild, wild west, where lien waiver forms vary from a general contractor-to-general contractor or owner-to-owner, and you can bet that each is written to leverage legal rights in favor of the drafter.

Making a mistake or overlooking negative language within a lien waiver can be very expensive.

Take, for instance, a situation in Texas with Zachry Construction who lost over $10 million because of an easy-to-make lien waiver mistake (before Texas switched to statutory lien waiver). A nearly identical thing happened to JH Larson Electrical Company in Minnesota (notice that Minnesota does not have statutory waivers), when a court said this about the lien waiver:

[L]ien waivers are “customarily used on both public and private construction projects to keep the general contractor . . . informed of the payment status of subcontractors and suppliers and to protect the projects from . . . bond claims.” … these documents permit the court’s finding that [the claimant] never indicated amounts owing in the lien waivers it furnished …The evidence in the record, although not overwhelming, is sufficient to support the district court’s findings on the customs of the industry and reasonable reliance.

Very often, subcontractors and suppliers get a lien waiver document sent to them, and they wonder: Should we sign this lien waiver? In the 38 states without statutory forms, this is a complex legal question. The forms are left to the whim of attorneys designing the document to maximize the GC’s or owner’s legal position. And you’re waiting anxiously for a payment…be careful.

Be Smart about Lien Waivers — Legal Integrity of Form Is Important

Generating a fair construction lien waiver is a critical moment for subcontractors and suppliers on a construction project. Unfortunately, all of the tools designed to assist in this process are designed with the general contractor or property owner in mind, and not the subcontractors and suppliers.

Not only is this a legal problem for those sub-tiers and suppliers, but it’s also adverse to the administrative burdens placed on companies by lien waivers. Subs and suppliers, after all, are the ones who generate a high volume of these waiver documents (not the generals).

Lien Waiver Help Is Available

Here are a few resources that can help you make sure you get your lien waivers right:

-

Download free lien waiver forms for any state

-

Unconditional Lien Waivers vs. Conditional Lien Waivers

-

Lien Waiver Notarization