California Lien Waiver Rules

- Rules At A Glance

- Top Links

Specific Forms Are Required

California sets out a required lien waiver forms by statute. In order to be valid, a California lien waiver must follow those forms.

Notarization Not Required

California does not require lien waivers to be notarized. Notarizing a lien waiver form in California could actually invalidate it.

Cannot Waive Rights in Contract

No, California statute specifically prohibits waiving lien rights in the contract.

Can Waive Rights Before Payment

California does not specifically prohibit waiving lien rights prior to payment, provided that the statutory lien waiver form is used.

In California, lien waivers are regulated. This means that everyone connected to a construction project must follow the rules outlined in California’s mechanics lien rules. Among other requirements, California’s lien waiver laws mandate the use of a specific form template. When exchanging lien waivers on a construction job in the state, it’s important to follow the statutory requirements. Using the wrong form could invalidate the waiver.

Lien waivers, sometimes called lien releases, act as a receipt for payment. They are exchanged by people at the time of payment on a construction project. It’s common for subcontractors and suppliers to include lien waiver documents with their pay applications or invoices. When a subcontractor signs and submits a valid lien waiver, it gives up – or waives – their right to file a mechanics lien for the amount listed in the form. General contractors, property developers, and construction lenders often have intricate lien waiver tracking and collection practices.

When it comes to tracking, collecting, sending, and requesting lien waivers in California, everyone must pay attention to the state’s requirements.

California regulates lien waivers pretty tightly. For instance, California is one of the 12 states that provide statutory lien waiver forms. Failure to use these forms or using the wrong form will result in the lien waiver being invalid and unenforceable. As will any attempts to modify or add more provisions to the waiver.

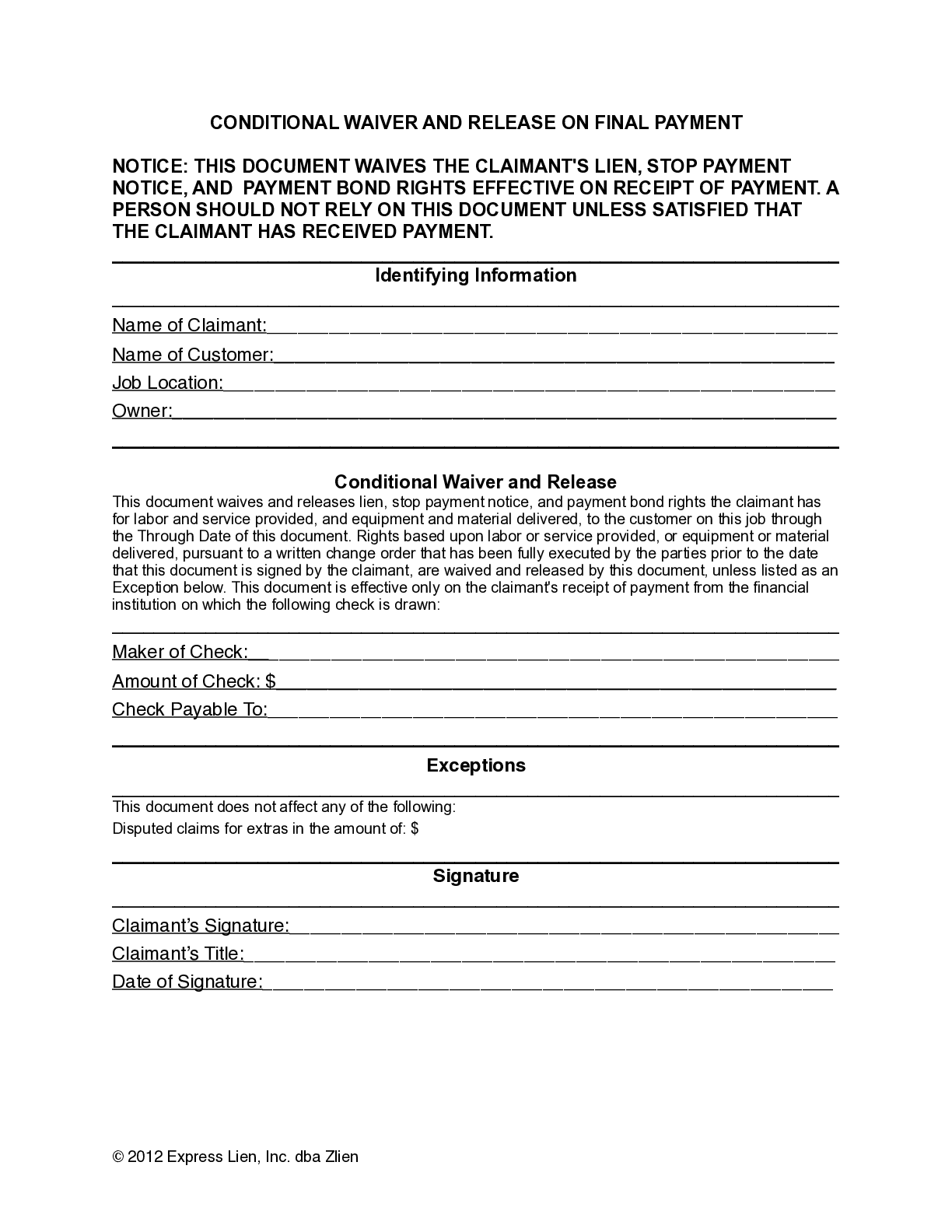

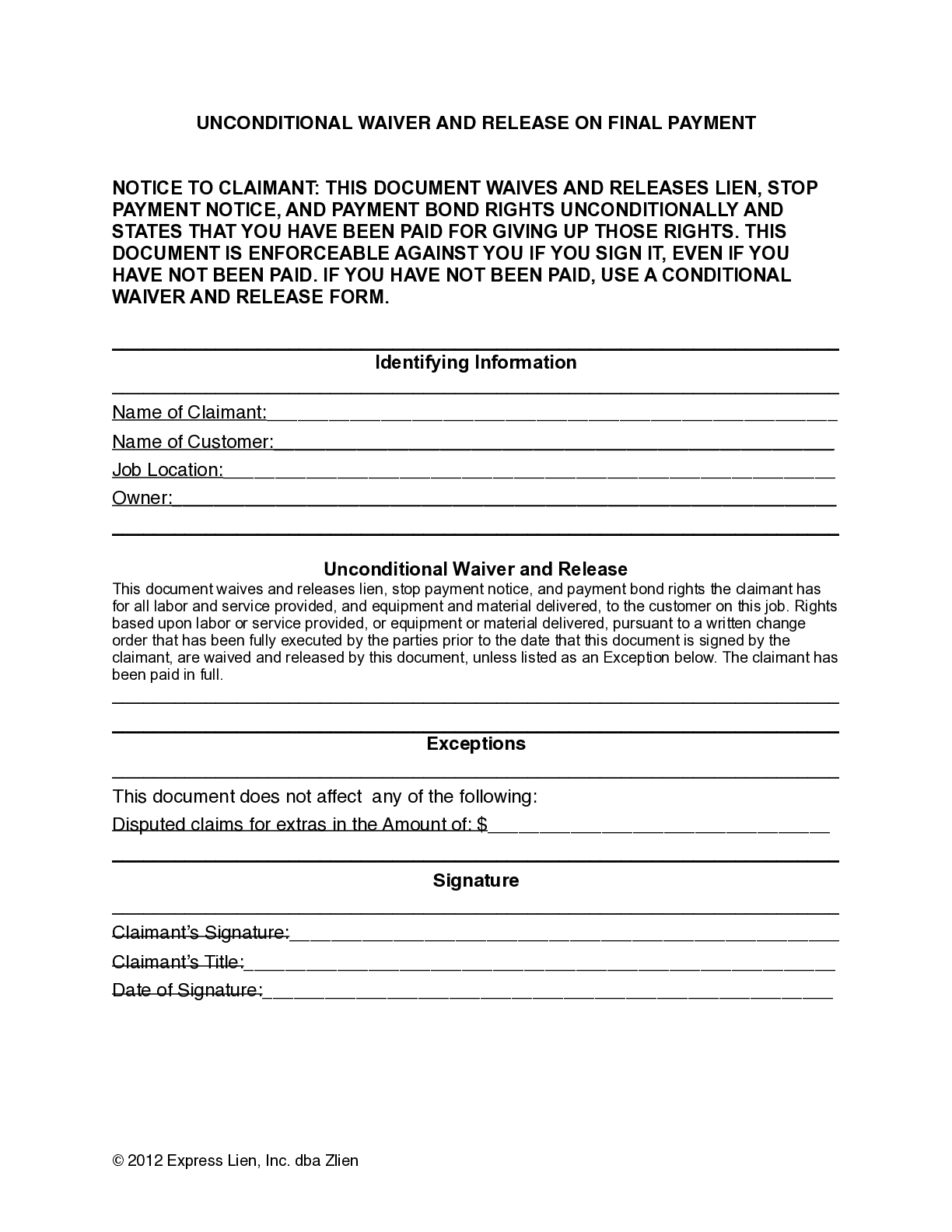

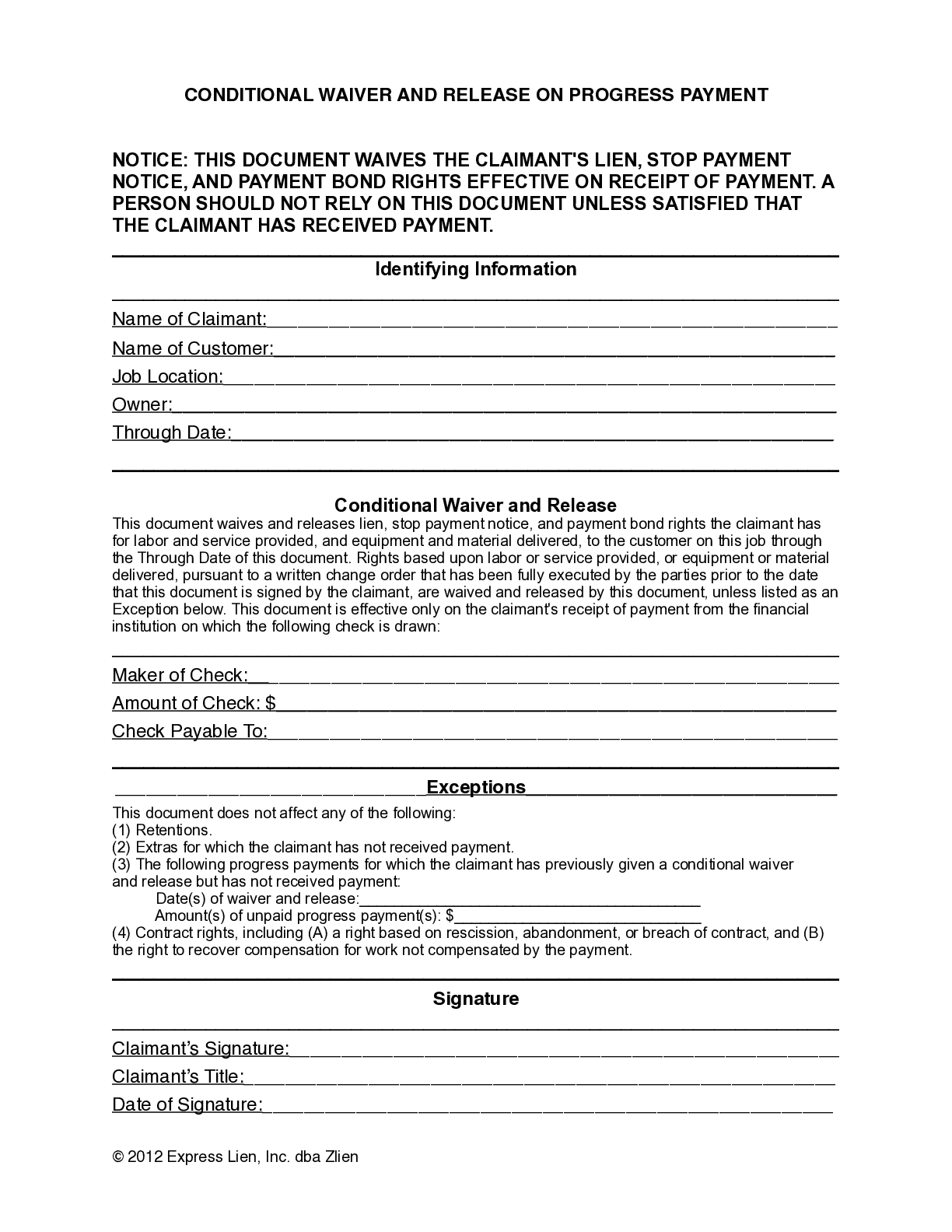

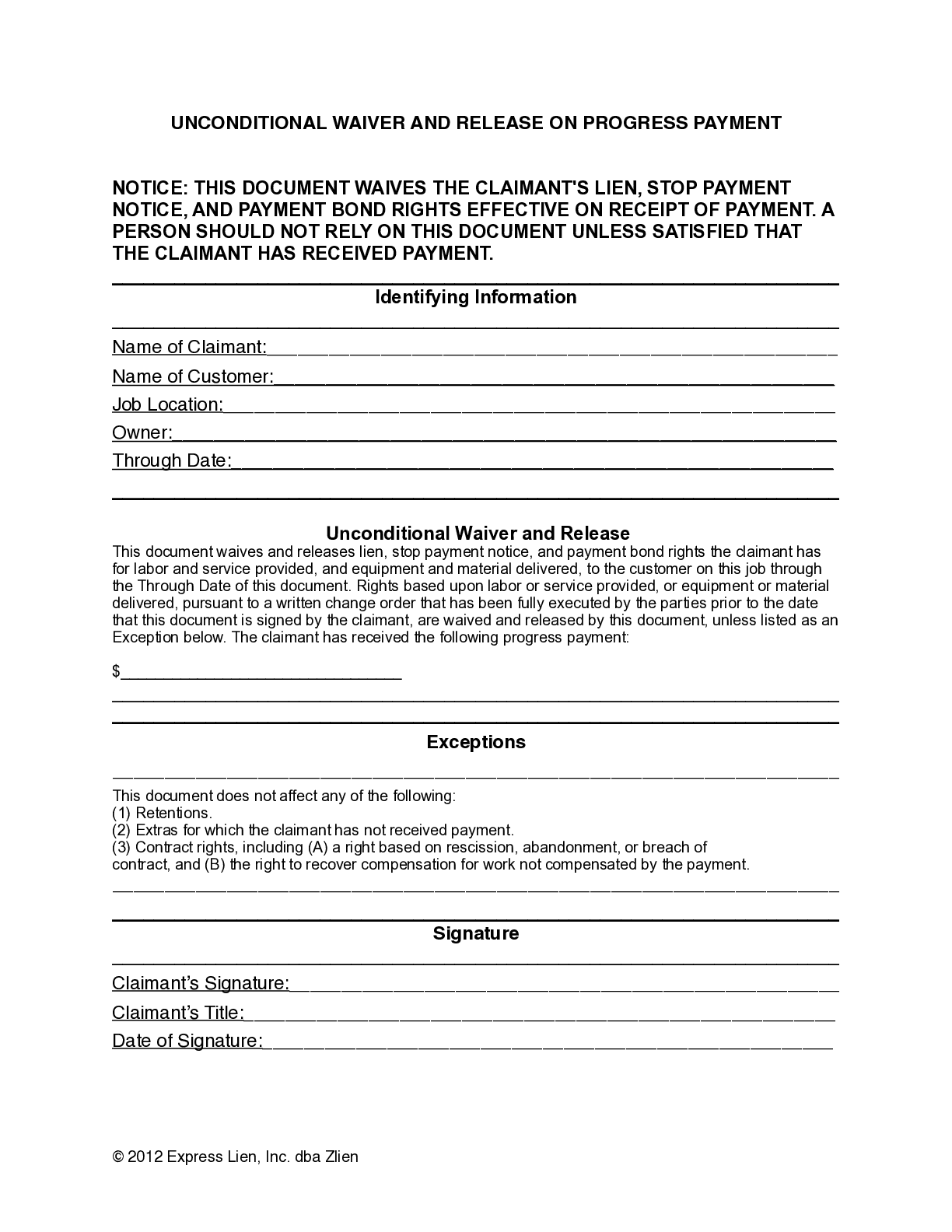

Types of lien waivers in California

It’s easy to make mistakes. Even if you use a mandatory form and fill it out completely right, it’s easy to mistakenly use the wrong form! After all, California has 4 different required lien waiver forms. It’s important to use the right one at the right time. Here are guides on how to fill out the four California statutory lien waivers:

- Conditional Progress Lien Waivers

- Unconditional Progress Lien Waivers

- Conditional Final Lien Waivers

- Unconditional Final Lien Waivers

Otherwise, the information on this page provides frequently asked questions, forms, guides, and other helpful information on California’s Lien Waivers.