California Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

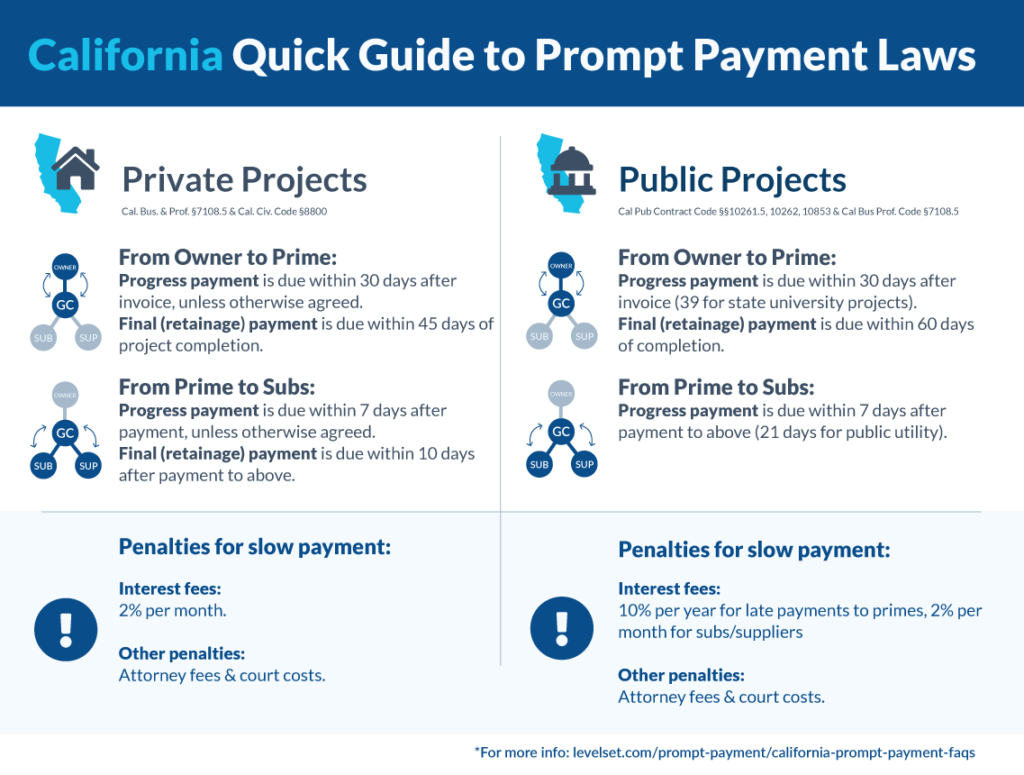

For Prime (General) Contractors, progress payments due within 30 days of request for payment. Final/retainage payment due within 45 days of the project's completion as a whole.

Subcontractors

For Subcontractors, progress payments due within 7 days after payment is received above; unless otherwise agreed. Final/retainage payment due within 10 days after payment is received above.

Suppliers

For Suppliers, progress payments due within 7 days after payment is received above; unless otherwise agreed. Final/retainage payment due within 10 days after payment is received above.

Interest & Fees

Interest awarded at 2% per month; attorney fees awarded to the prevailing party.

Prime Contractors

For Prime (General) Contractors, progress payments due within 30 days of request for payment. (time is extended to 39 days after invoice for state university projects) Final/retainage payment due within 60 days of the project's completion as a whole.

Subcontractors

For Subcontractors, payment due within 7 days after payment is received above. Deadline for payment extended to 21 days after payment received from public utility.

Suppliers

For Suppliers, payment due within 7 days after payment is received above. Deadline for payment extended to 21 days after payment received from public utility.

Interest & Fees

Interest at 10% per year for Prime, with attorneys' fees only available when court determines funds were wrongfully withheld. Interest at 2% per month for sub-tiers, and attorney fees awarded to the prevailing party.

- Prompt Pay: Overview and Limitations

- Free PDF Download: Guide to Prompt Payment Laws in all 50 States

- California Prompt Payment Act: What Contractors Need to Know

- Get Paid Faster: Write A Prompt Payment Demand Letter

- How To Make A Claim Under Prompt Payment Laws

- Know Your States Prompt Payment Act To Speed Up Construction Payments

- What to do when you receive a prompt payment demand letter

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Projects Covered by Prompt Payment in California

The state of California regulates prompt payment on both private and public construction projects.

Private Projects

Private construction projects in California are governed by Cal. Bus. & Prof. §7108.5 and Cal. Civ. Code. §§8800, and 8810-8822.

Payment Deadlines for Private Projects

The payment deadlines on private projects differ depending on whether it is a progress payment or a final payment. Progress payments from the owner to the prime contractor must be made within 30 days of the payment request, unless the contract says otherwise. Once the prime contractor receives a progress payment, they have 7 days from receipt to pay their subcontractors or suppliers.

Final payments from the owner to the prime contractor become due within 45 days after the completion of the entire project. Upon receipt of payment from the owner, the prime contractor needs to make payment to their subs and suppliers within 10 days. The same deadline applies to all other payments down the chain.

Penalties for Late Payment on Private Projects

If there is a dispute regarding a payment request, the paying party may withhold up to 150% of the amount in dispute. This must be based on one of the reasons to withhold payment provided in the statutes. If payment is late or wrongfully withheld, interest will accrue at a rate of 2% per month, until the payment is made. Also, if the dispute ends up in court or arbitration the prevailing party will be awarded costs and attorney fees.

Public Projects

California has separate sets of statutes that regulate public works projects. These statutes are found in Cal. Bus. Prof. Code §7108.5. and Cal. Pub. Contract Code §§10261.5, 10262, and 10853.

Payment Deadlines for Public Projects

Upon receipt of a progress payment request form the prime contractor, the public entity must release payment within 30 days. This deadline is extended to 39 days if the work was contracted by a state university. As for final/retainage payments, the public entity must release payment within 60 days after the completion of the project.

Once a prime contractor has received any payment from the public entity they must pay their subs and suppliers within 7 days. But, if the payment is received from a public utility, then the deadline is extended to 21 days after the prime received payment. As for all other payments, they are due within 7 days of receipt, unless the contract terms say otherwise.

Penalties for Late Payment on Public Projects

If there is a bona fide dispute over the amount due, no more than 150% of the amount in dispute. If not, and payment is late or wrongfully withheld, interest will accrue. The rate of interest depends on whether its a payment from the public entity to the prime, or payment other payments.

For late payments to the prime contractor, interest will accrue at 10% (0.833%/month). In addition, attorney fees will only be available if the court or arbitrator determines the funds were wrongfully withheld. Late payments to any sub-tier participants will accrue interest at 2% per month; along with costs and attorney fees being awarded to the prevailing party.