— 9 min read

Construction Payment Applications: A Guide for Contractors

Last Updated Apr 24, 2024

For general contractors, getting paid requires much more than just an invoice. Before any checks are sent, contractors are asked to prove what has been completed, delivered, and more with a payment application.

A payment application is a collection of documents requesting payment for completed work or materials in place. A pay app serves the same purpose as an invoice, but includes the additional details to handle the complexities of construction deliverables.

This article will discuss when contractors should send pay applications and what information and documents they must include to help them get paid.

Contents

Table of contents

When does a contractor send a pay application?

A contractor should send a pay application according to the draw schedule laid out in the contract. Project teams often agree on monthly billing periods set on a specific monthly date.

General contractors should attempt to align the schedule of payment they've agreed to with the owners to their requirements for subcontractors. For instance, a contractor who submits for owner payment bi-monthly wouldn't want to set a monthly or bi-weekly pay schedule with their subcontractors, or they may struggle to maintain adequate cash flow.

Why are pay applications important in construction?

Unlike invoices, pay applications involve a lot of detail, many documents, and specific forms. Rather than simply billing for a set amount of a single object, pay applications establish proof of completed work.

Risk Management

When subcontractors send pay applications to general contractors, they are fulfilling several risk-management strategies for the GCs and owners on the project. As part of the pay application, the subcontractor will include receipts for payment for laborers, suppliers and equipment suppliers, reducing the risk of liens placed on the property.

Quality Assurance and Schedule Maintenance

The documents in a pay application effectively prove that the contractor has completed the work for that section of the project and installed the proper materials. In effect, it acts as a progress report on the project.

What's included in a pay application?

Requirements for a pay application may be affected by what kind of billing method is in place for the project. For instance, a project owner using a lump-sum billing method may not request as many backup materials as for a project using progress billing.

A contractor will not usually send anything the owner hasn't explicitly asked for in a pay application — no extraneous details or additional proof of work completion — because it could set a precedent for the owner, who may expect that type of proof going forward. Contractors have to find the balance between providing all the information they need to get paid and oversharing.

Payment Application Forms

Payment application forms are the first things to include in a pay application. Which form a contractor will use will depend on the project and the contract requirements. Two of the most common standardized forms are the AIA G702 and ConsensusDocs 710.

Whichever form a contractor uses, the pay application form should include:

- Project name

- Pay application number

- Owner, architect and contractor names and contact information

- Dates included in the application

- Change order details

- Financial information, including contract total, total value of work completed so far, amount currently due and balance remaining

Besides the form, the pay application package should include a number of backup documents.

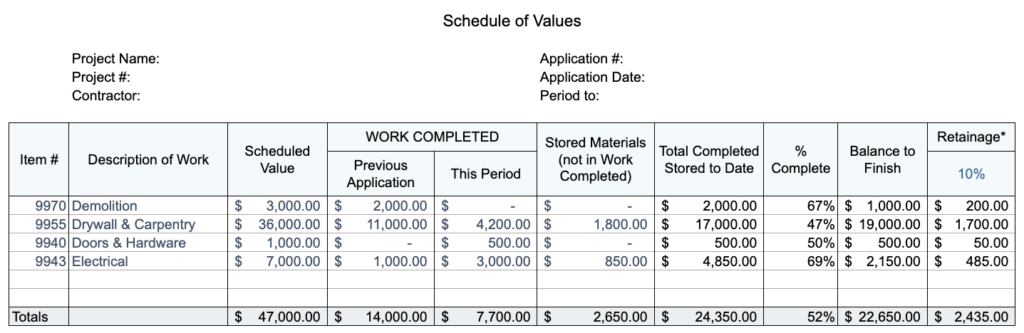

Schedule of Values

As part of the pay application, the contractor will include a schedule of values. The schedule of values (SOV) is a list of each work item that the project requires and its total cost. Contractors and owners will agree on a schedule of values when drawing up the project contract, and agree on the budget breakdown for each category of expenses.

A schedule of values might look like this:

Daily Reports

Daily reports are logs that detail each day's work on site. They are usually written by a site manager or a superintendent. Daily reports include details from the weather on site to which workers were present, and are essential for monitoring project progress.

Supporting Documents

Supporting documents illustrate the facts presented in the pay application. They may include photos, vendor invoices, receipts and payroll and wage reports. Drawings may even be required as backup for pay applications.

Stored Materials

If the contract allows, the contractor can also request payment for materials that have been purchased but not yet installed. Owners who submit payment for stored materials may require photographic proof that the materials are safe from risks of damage or theft, and request proof that the contract has taken out insurance on the materials.

If the contract does not allow for payment on stored materials, the contractor will have to float the associated costs until the time the materials are installed on the project.

Change Orders

A contractor can include any approved and completed change orders in the pay application. The contract will set out exactly what backup materials the contractor should include, such as photos of completed work and receipts for associated material costs.

Lien Waivers

Before issuing payment, owners and general contractors may require signed lien waivers from any lower tier contractors, including conditional lien waivers for the payment expected from the current progress payment and unconditional lien waivers from payments made last billing cycle.

Can contractors negotiate pay application requirements?

Like all other elements of a construction contract, the terms surrounding pay applications are up for negotiation. The contractor may haggle to get the owner to accept fewer backup materials on pay applications, or may have to decide if the admin costs of submitting pay applications are worth the profit that will result from a project.

The GC may bend on pay application requirements if the market for subcontractors is tight. If the project requires concrete, but there are very few concrete suppliers near the project location, the GC may agree to more favorable payment terms for the sub, like more frequent billing.

Before contractors accept altered pay application terms with their subcontractors, they should check which items they're required to send in their own pay apps to the owner. Fewer details on pay applications could put everyone on higher tiers at risk — a materials supplier that didn't receive payment from a subcontractor could put a lien on a project that will impact all stakeholders up to the owner.

Challenges in Submitting Pay Applications

Pay applications are different for every project. Each owner may have unique expectations, and the working relationships between all the involved stakeholders can impact what backup documentation is required. Sometimes contractors can have a payment delayed because of a seemingly minor omission in the pay application, so it's critical to read and understand the contract to get pay apps right the first time.

Requirement Changes

Owners sometimes change their minds after a project begins, and contractors need to adapt. An owner may begin a project with one set of payment rules but decide to ask contractors for more when a pay app arrives. When that happens, it can be difficult for contractors to go back and secure all of the backup materials they need.

Open communication is vital here. Contractors should meet with owners and architects to ensure all stakeholders are on the same page with pay app requirements.

Spot Checks

Owners may have architects tour the jobsite to ensure the work included in the pay application is actually complete. If the billed work is incomplete, the architect may reject payment for that portion of work. A shared understanding of what work completion means to everyone involved can help stave off any delays.

Understanding Expectations

We recently had a project with an architect who was very particular about how things were done. When he inspected the work completed on site, the question wasn't about whether the work was complete but whether it was to the expected standard.

The site staff planned to finish the details during punch, but the architect wouldn't sign off on payment until those elements were up to spec. There was a lot of back and forth that definitely delayed the project because it pushed us from getting paid, and then we had to delay in paying our subs.

We ended up going over budget and over the schedule because of the misalignment between our expectations and the architect's.

The due diligence we could have taken was to better understand what work complete meant for that architect.

Relationship Matters

Owners who have a strong relationship with their contractors may require less proof of the completed work than those who haven't worked with their contractors before. Establishing trustworthiness and open communication can help smooth owner/contractor relationships.

Trickle-Down Effects of Nonpayment

When an owner or architect rejects a portion of a contractor's pay application, the impact may have an impact on the lower-tier contractor as well.

For instance, if a GC agreed to pay a sub for some work that was partially completed but the architect rejected the pay application, the GC may have to hold off on paying the sub until the next payment cycle. In order to keep the project moving, the GC may pay the sub anyway but suffer the cash flow consequences.

Pay Application Success

To succeed with pay applications, contractors need to read and fully understand the requirements spelled out in the contract — that’s a bare minimum. Without that step, it’s too easy to slip up by using the wrong form or omitting documents that were specifically requested. Beyond combing through the contract, it’s essential contractors maintain open communication with all stakeholders involved in approving pay applications — not just owners, but architects, lenders and investors, too. Any one of them could turn down a pay app, which could impact the contractor’s financial health and ability to pay subcontractors.

Categories:

Tags:

Written by

Brittney Abell

9 articles

Brittney Abell joined Procore after 6 years as an accounting manager for a commercial general contractor, overseeing accounts payable and receivable. Before that, she worked as a contract administrator for an architecture & design firm for 6 years. She has worked on a variety of building projects, including travel stops, restaurants, hotels, and retail warehouses raging from $2M to $20M. She lives in Louisville, Kentucky

View profileKristen Frisa

26 articles

Kristen Frisa is a freelance writer specializing in finance and construction technology. She has helped numerous companies to provide value to their readers and establish their expertise in their industries. Kristen holds a degree in philosophy and history and a post-graduate certificate in journalism. She lives in Ontario, Canada.

View profileExplore more helpful resources

Construction Escrow: What Contractors & Suppliers Need to Know

Every construction project starts with funding — and some projects are funded through construction escrow accounts. These accounts are often opened by the lending institution to help with the distribution...

Contractor Payment Schedules: Why They’re Important & Choosing the Best Schedule for Each Project

In construction, a payment schedule is a timeline of the payments to be made throughout the lifetime of a project. On most jobs, contractors don’t receive a single, lump-sum payment...

Guide to Progress Payments on Construction Projects

There are lots of ways to bill for work on a construction project. You can bill at the end of the project, at the beginning, or as you go along....

Subcontractor’s Guide to the AIA G703 Continuation Sheet

If working on a project using the American Institute of Architects (AIA) payment applications, the GC will likely require you to provide a continuation sheet, known as the AIA G703-1992...