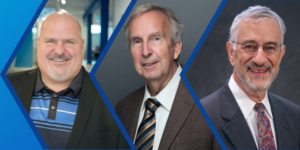

During an exclusive Levelset panel on September 15, construction industry experts Alex Carrick, Chief Economist for ConstructConnect, and Ken Simonson, Chief Economist for the Associated General Contractors of America (AGC), weighed in on what’s affecting construction material finances the most right now — as well as where we may find ourselves in the near future.

Watch the panel moderated by Levelset payment expert Allan Francis.

High material prices have been on everyone’s minds over the past few years, as supply costs have been unstable and heavily weighing on contractors.

Even as some prices stabilize, concerns still remain over the possibility of an economic recession amidst global supply chain problems and geopolitical instability, and the effect that this might have on construction.

What is impacting material prices the most?

When asked what the largest impacts on material prices are, “There’s really quite a number of factors,” said Alex Carrick.

Carrick singled out the COVID-19 pandemic’s effect, the war in Ukraine, and public health shutdowns in China as major factors.

A common theme is expectations and the impact that uncertainty has had on prices and financial speculation. “The pandemic certainly had an influence because heading into the pandemic the expectation, for example, was that housing would really deteriorate…and then housing stayed much stronger than expected, so the price of lumber took off,” Carrick said.

Related coverage: Boom or Bust? The 5 Best Cities for Residential Construction — and the 5 Worst

As for the war in Ukraine, he added, “threatening to cut off supplies of natural gas and oil, and the uncertainty there, caused fossil fuel prices to really increase dramatically, and that had a lot of knock-on effects in terms of agricultural prices.”

The handling of the COVID-19 pandemic by the Chinese government, though effective for public health, has also been also a major factor for construction, said Carrick.

“The government there has shut down parts whenever they come across even a small number of cases, and so the cost of moving goods across the pacific by container ships has increased tenfold.”

Ken Simonson added that small issues that are not necessarily recurring turned out to make surprisingly large impacts: “…it continued with the freeze in Texas that shut off the supply of many construction plastics for a while, blockage of the Suez canal…a lot of one-off events that both disrupted supply chains and drove prices up.

Huge material price spikes have happened year-over-year

Carrick noted that ConstructConnect’s analysis had shown huge materials spikes across the board year-over-year when comparing September 2020 to July 2022.

“We put up graphs for 35 building inputs, and almost all of them have spiked — and it’s things that you wouldn’t normally expect,” he said. “For a while cement was up, and flat glass, and even construction equipment, heating equipment, cooling equipment…it’s been very widely distributed, there’s been spikes in almost all of 35 of these inputs in the construction industry.”

Though material prices have been spiking, both Carrick and Simonson are hopeful that improvements are on the horizon.

“Just in the last few months, things have started to calm down,” Carrick continued. “I don’t usually stick my neck out and predict what a given index will look like the month out…but I do think we’ll continue to see this downward trend.”

“I can’t see how it isn’t going to be a world in which simply living and doing business isn’t going to be a whole lot more expensive than it was in the past.”

– Alex Carrick, Chief Economist, ConstructConnect

How will material prices change over the next 6, 12, & 24 months?

According to Alex Carrick, there’s a good chance that things will be easier for contractors financially in the immediate future. “I think in the short term we’re going to see some easing in the difficulty everyone has been having,” Carrick noted.

“[In] the next 6 and 12 months, the outlook is for moderation in prices,” said Carrick. “There’s a slowdown on the way in the economy…the increases in interest rates, clearly there’s reasons to think that the economy, overall, is slowing down. But a lot of the prices are moderating just as a natural fallback.”

Simonson agrees. “I do think we’ll see moderation in costs,” he said.

He pointed out that the country is already seeing selective increases in supplies, with major fabrication and manufacturing projects — like new steel mills and fabrication plants and new semiconductor factories — already giving a boost to construction work and more hope for the domestic supply chain.

“Generally [there could be] a downward trend in materials costs increases,” Simonson added. “If that index continues to be rising on a year-over-year basis, it’ll be by single digits, not by double digits.”

However, Carrick sees the long-term outlook as being a bit more difficult, saying “Inflation or not, everything is going to become more expensive.”

“What you’ve got to be aware of in terms of your business is that, in the longer term, I can’t see how it isn’t going to be a world in which simply living and doing business isn’t going to be a whole lot more expensive than it was in the past,” he added. “I’m very much inclined to think that there might be a next commodity price supercycle and that that will have quite the impact on prices over the long term.”

For Simonson, a major concern in the next few years will be labor.

“The biggest worry for contractors, and the most persistent one, will be finding enough labor and getting that labor up to an adequate skill level,” he said.

Beyond the lack of available workers currently in the workforce, new government restrictions stemming from the recently-passed federal funding which put major requirements focused on using U.S.-based labor and materials could make it difficult to have enough for projects to even get started quickly.

“Owners can expect projects to take longer,[and] for projects to take longer to launch.”

“I don’t think that we’re in recession…and I think that we’ll escape without a recession.”

– Ken Simonson, Chief Economist, Associated General Contractors

Is there a recession on the horizon — and what would it mean for construction businesses?

For those concerned about a recession, it’s reasonable — but both Carrick and Simonson are, thankfully, optimistic that this may not happen.

“In this setting, I don’t think that we’re in recession…and I think that we’ll escape without a recession,” said Simonson.

Carrick is similarly calm on the economy’s situation, saying “I don’t really think of [recession] as a huge concern.”

He notes that the possibilities included in the recently-passed federal Inflation Reduction Act and CHIPS Acts could lead to new industries and new opportunities as he believes that “the U.S. is now serious about confronting climate change.”

Related coverage: Fluor Misses Q2 Earnings Expectations; CEO Looks to CHIPS Projects for a Boost

A big part of Carrick’s optimism is his declaration that “The U.S. is starting to think strategically.”

With an emphasis on making more industries domestic, such as semiconductor chips and battery production, more construction opportunities will lay on the horizon. “In terms of the whole picture, I’m very optimistic,” he said.

Of course, it isn’t all positive. Just because the economy may not be headed directly for a recession, it doesn’t mean that the economy is about to boom.

Full recession aside, a slowdown is happening

“…there’s no denying we’re heading to a slowdown, or we’re already seeing signs of it,” Simonson said of the construction industry.

“I think any business that relies on immediate income to pay the costs of construction and the financing is vulnerable to this slowdown. I’m thinking of apartments, warehouses, office buildings, multi-tenant office buildings, retail, restaurants, and certainly hotels.”

“But other types of construction are about to come into the limelight,” he adds. “Now we’ve already seen a pickup in many kinds of manufacturing…the power and energy sector will be growing quite strongly.”

Related coverage: 4 Construction Sectors That Could See a Boost from the Inflation Reduction Act

Though, due to the slower flow of the new federal funding and meeting the new regulatory requirements, as well as state and local processes for bids, it may take some time for the effects to be felt.

“It’ll be a 2023 story before we get a pickup in many of the infrastructure categories,” Simonson said.

Impacts of Infrastructure Bill, CHIPS and Science Act, and Inflation Reduction Act

Both Carrick and Simonson see a lot of positivity in recent government funding, but they also see some hurdles that companies are going to have to get past.

“All three of these bills should have positive effects on demand for projects,” said Simonson, though he added that this also adds issues.

The extent of which competing projects will affect worker and materials shortages could be a big roadblock in the future — and one that he’s already seeing in his industry analysis.

According to a recent AGC survey, Simonson noted, “93% of firms said that they were looking for hourly craft workers — of those, 91% said that positions were hard to fill.”

This, he said, is normal — but the issue is that the labor shortage isn’t just related to hourly workers.

“…what’s changed is that 70% of firms said that they had openings for salaried positions, and 89% of those firms said that those positions were hard to fill also,” said Simonson.

Competition from other industries plays a big part in this, said Carrick: “Contractors are going to have to be aware that there’s all kinds of new jobs that are going to be opening up in other areas.”

He added that to stay competitive, contractors will benefit from figuring out how construction can attract a younger workforce.

“Young adults getting their education are going to have opportunities to work in things like artificial intelligence…doing a whole bunch of stuff that was never an option before. So it’s going to take some real [work] to find things that are going to attract young people into the industry.”

Construction Pros Share 3 Key Ways Employers Can Gain & Retain Quality Workers

Stay informed with construction financial resources

Levelset, AGC, and ConstructConnect have multiple resources you can use to stay up-to-date on construction finance and economic news, material prices, infrastructure funding, and more.

- Levelset’s Construction Material Price Tracker tool: See the current price of materials, find the lowest prices among suppliers in your area, and track trends that indicate whether the price is rising or falling.

- AGC Construction Inflation Alerts: Regular inflation updates published by AGC.

- AGC’s Data DIGest: A weekly summary of the latest economic news relevant to the construction industry with commentary and analysis from Ken Simonson. Note: This is a paid subscription.

- Blueprint construction financial newsletter: Get construction financial news you can use delivered directly to your inbox every two weeks.

- AGC’s Infrastructure Investment page: An up-to-date source for news on national infrastructure funding for construction.

- ConsensusDocs Price Escalation Resource Center: Surveys, state and metro data, and fact sheets on prices.

- ConstructConnect’s Economic Resources page: Webinars, blogs, monthly construction starts, quarterly forecasts, and more.

Contact experts Ken Simonson and Alex Carrick

Ken Simonson:

Alex Carrick: