Texas Lien Waiver Rules

- Rules At A Glance

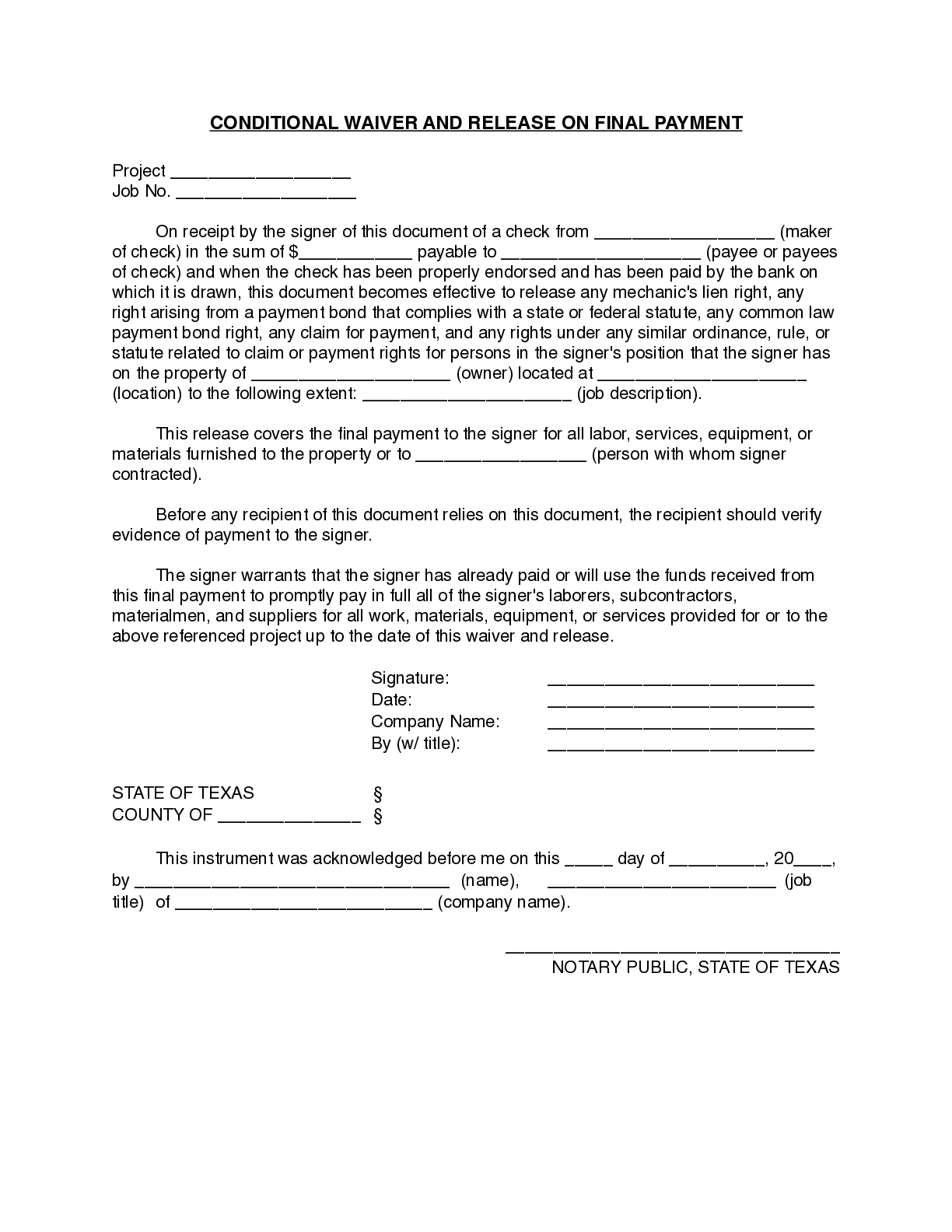

Specific Forms Are Required

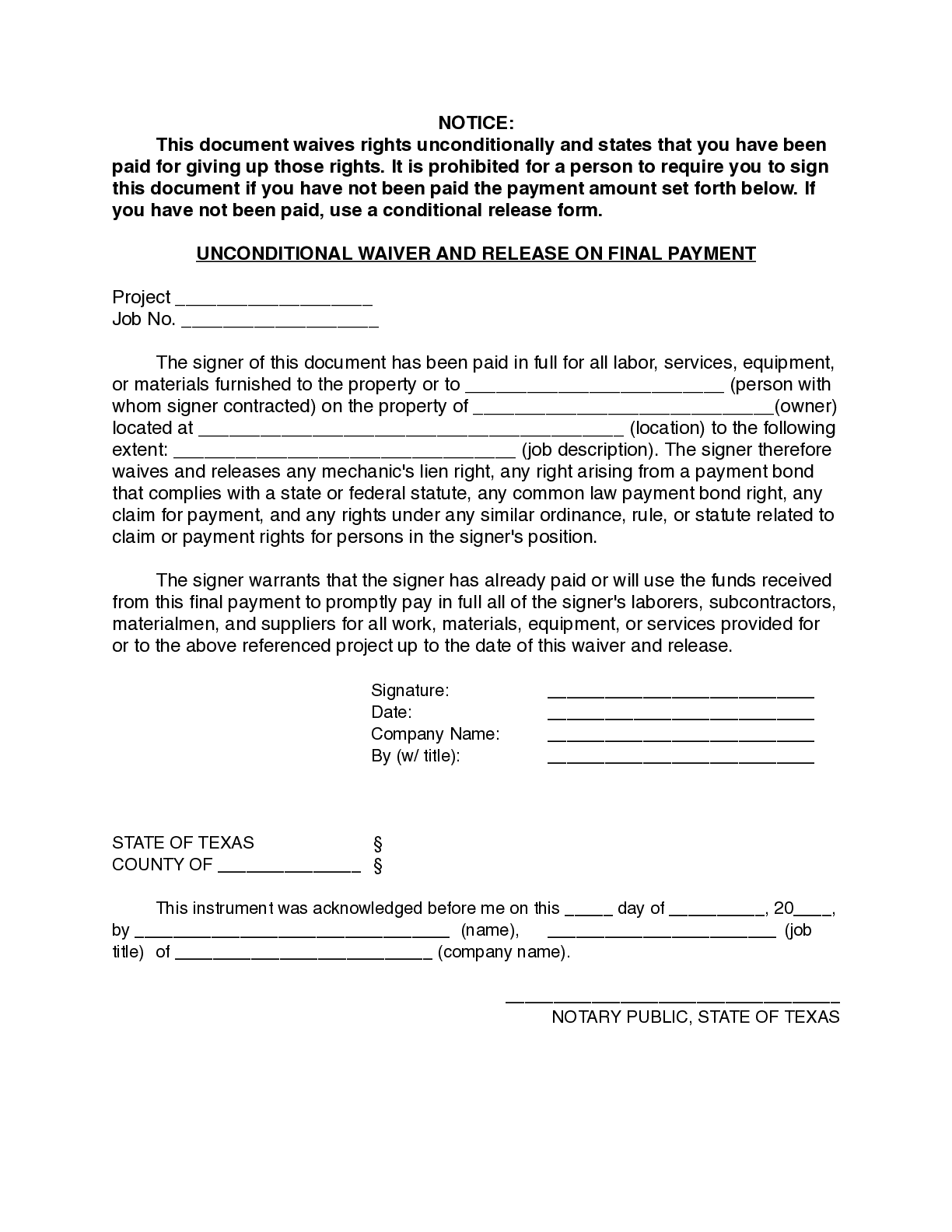

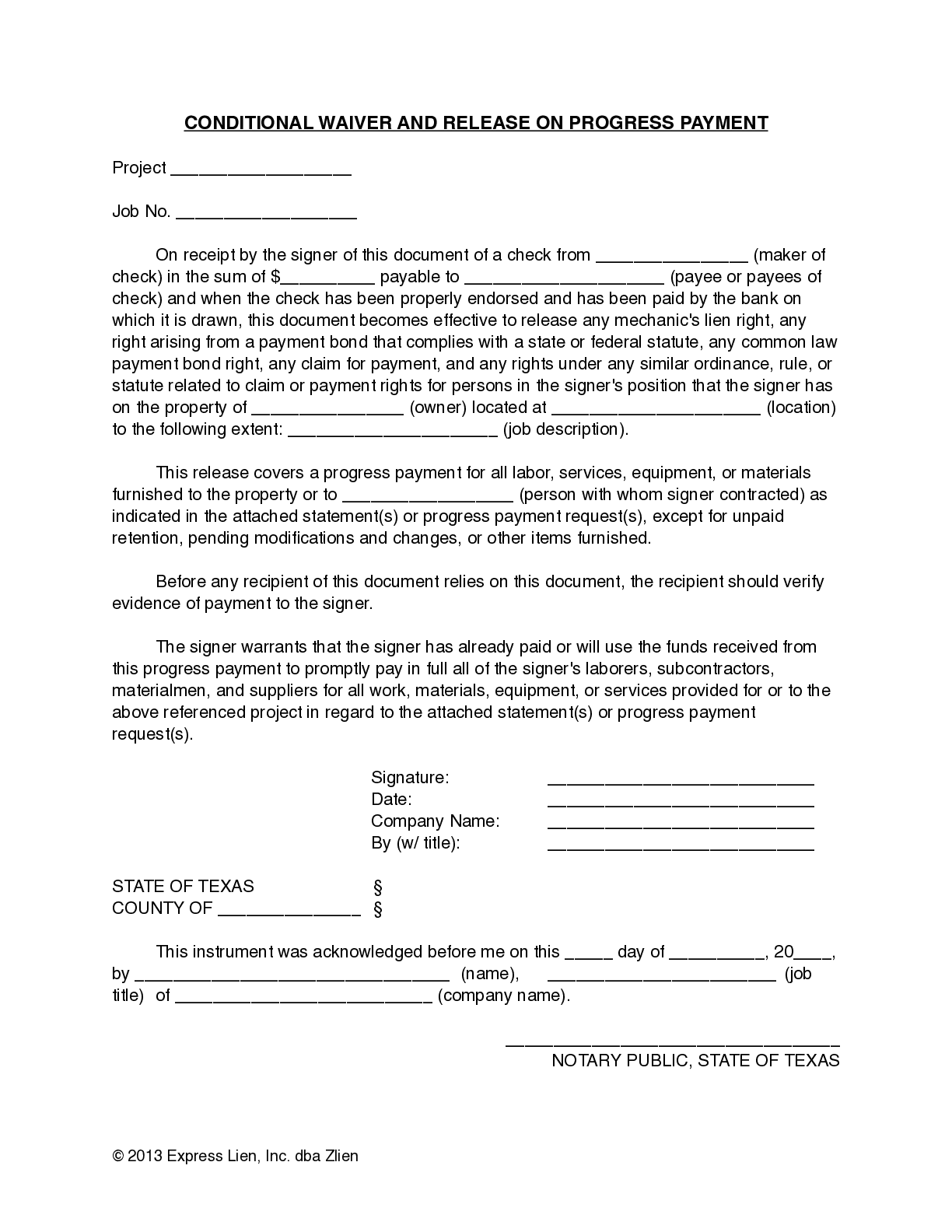

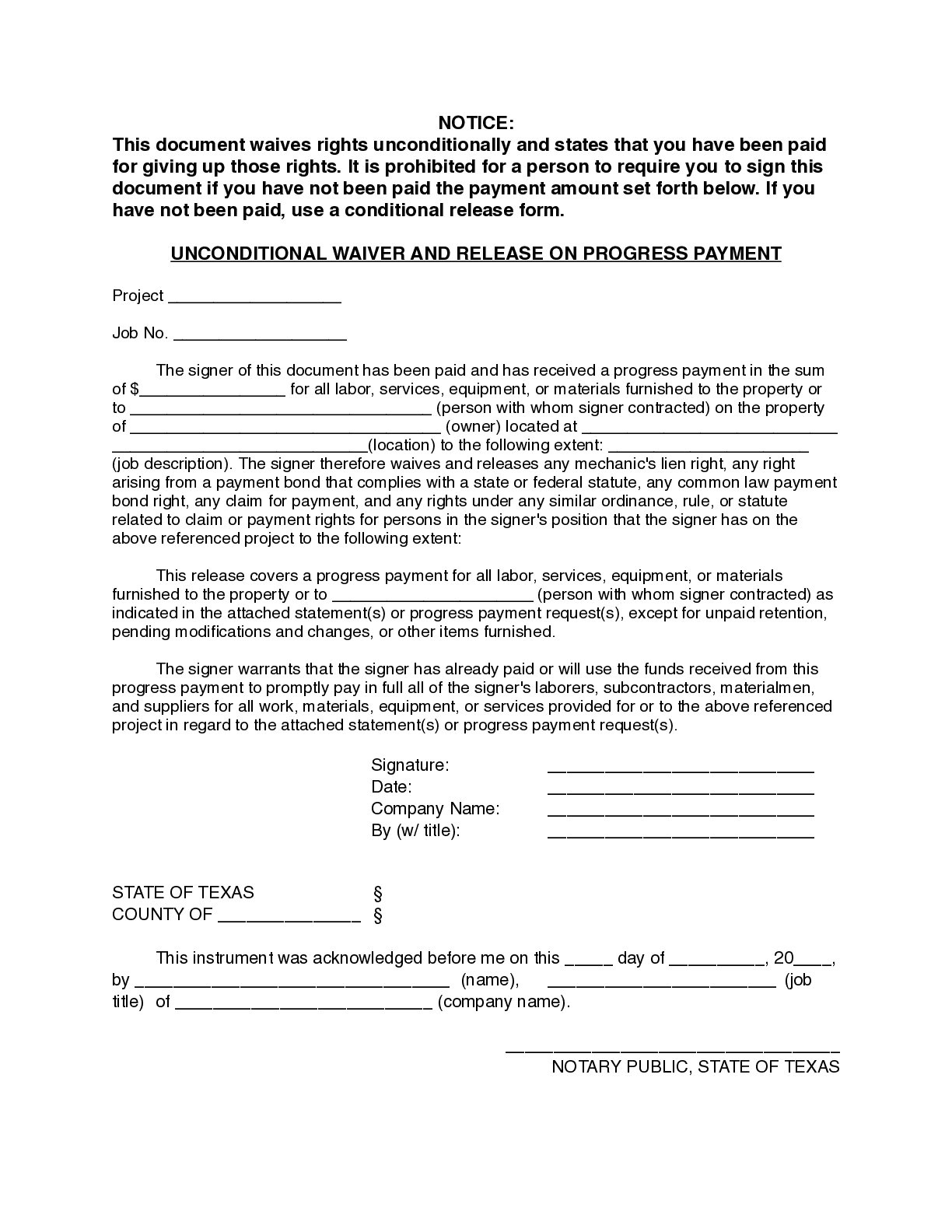

Texas sets out required lien waiver forms by statute. In order to be valid, a Texas lien waiver must follow those forms.

Notarization Required

Texas lien waivers are required to be notarized in order to be valid.

NOTE: Effective on all original contracts entered into on or after 1/1/22, Texas lien waivers will no longer need to be notarized.

Cannot Waive Rights in Contract

While not explicitly clear, it appears that, because of the requirement for “evidence of payment to the claimant exits” for a conditional waiver, and actual receipt for an unconditional release, advance lien waivers are unenforceable.

Cannot Waive Rights Before Payment

In Texas, lien rights may not be waived unless the claimant actually received payment in good and sufficient funds in full for the lien claim.

Lien waivers are documents commonly exchanged on construction projects that release the signer’s lien rights for the amount listed in the waiver. Texas has strict lien waiver rules — it’s important to follow them closely, and use the right forms. Here, we explain everything you need to know about the legal requirements for exchanging lien waivers in Texas, with free form downloads, frequently asked questions, and links to other helpful resources.

Lien waivers act as a receipt for funds for the receiving party. They specify that the party waives their right to file a mechanics lien. As a result, they protect the property owner from lien claims on their property. Typically, the GC or property owner will require their subcontractors and suppliers to sign a lien waiver in exchange for payment.

Texas rules are strict

Texas has strict and specific requirements related to lien waivers, which are regulated under Texas mechanics lien law. Texas requires contractors to use specific waiver forms, with few exceptions. Failure to use the proper forms, using the wrong form, or attempts to modify the waiver language will result in the lien waiver being invalid and unenforceable.

Read the full guide to Texas lien waivers.

Types of waiver forms

There are four types of lien waivers regulated in Texas statutes. Each one is used in a specific situation and has a specific meaning. Conditional means that it is only effective after payment is made. Unconditional means it is effective as soon as it is signed and delivered. There are conditional and unconditional waivers for both progress payments (while the project is ongoing) and final payment (after the project is finished).

Care should be taken when signing any waiver, but it is most critical with an unconditional final waiver. Signing this document effectively states that you have already received payment in full for the work and materials you provided on the project.

Here are guides to each form in Texas, and how to use them:

- Conditional Progress Lien Waivers

- Unconditional Progress Lien Waivers

- Conditional Final Lien Waivers

- Unconditional Final Lien Waivers

Notarizing

Texas requires lien waivers to be notarized — it is one of just three states that do so. Note, however, that a Texas lien waiver can be notarized outside of Texas, by a notary in a different state. This makes it easier for parties performing work in Texas, but not based out of that state, to comply with the specific requirements of Texas lien waiver law.

But mistakes are still common, which is why it’s so important to understand all of the requirements.