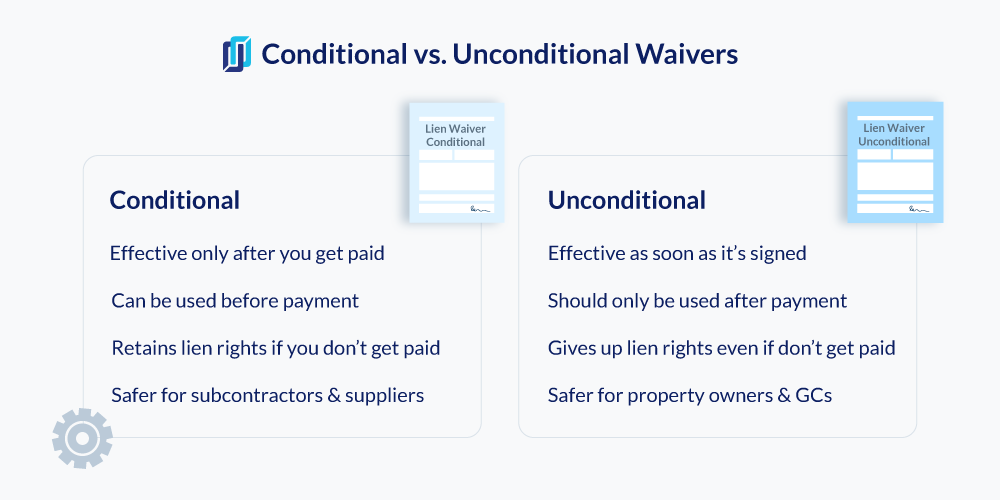

There are two main types of lien waivers used in construction: conditional and unconditional lien waivers. Though both are used as a receipt of payment to waive a contractor’s right to file a mechanics lien, they are actually quite different.

- A conditional lien waiver lists the amount owed during the period, and is effective upon actual receipt of payment.

- An unconditional lien waiver lists the amount already paid through the waiver’s date and is effective immediately upon signing.

It’s critical for contractors to understand the differences between these two types of lien waivers – signing the wrong one could void your right to all future payments!

Essential Reading: The Ultimate Guide to Lien Waivers

What is a conditional lien waiver?

A conditional lien waiver is effective on one condition: The contractor receives payment in the amount listed in the waiver. In other words, getting paid is the condition that makes the waiver valid. The contractor’s lien rights are waived if – and only if – they actually get paid.

Bottom line: When you sign a lien waiver, what the waiver says you received is always more important than what you actually received. Don’t make mistakes like the infamous Zachry Construction lien waiver mistake.

What is an unconditional lien waiver?

An unconditional lien waiver goes into effect as soon as it is signed. It doesn’t matter if you haven’t yet received payment or if something happens and you end up never receiving payment.

If you send in a signed unconditional lien waiver, you are giving up your lien rights no matter if you get paid or not.

For this reason, an unconditional lien waiver can be very dangerous for the signing party. (Just see this court case in Arizona where a contractor signed an unconditional waiver before they were paid and lost their lien rights.)

Signing an unconditional lien waiver means giving up your lien rights no matter if you get paid or not. If there is any reason the payment might fail (e.g. a check that hasn’t cleared), it’s a bad idea to sign an unconditional lien waiver.

In other words, you should only sign an unconditional waiver after receiving payment in hand.

What to review before signing a lien waiver

Regardless of the payment amount or promises made, contractors should approach every lien waiver with a critical eye. If you see language, dates, or amounts that don’t match up with the work you actually performed, you shouldn’t sign the waiver.

The form title

Lien waivers are actually regulated by law in some states – the waiver form must match the form included in the statute. (Even minor changes can invalidate the waiver.) In these states, the title of the form will generally include the word “conditional” or “unconditional,” depending on which type it is.

For example, California lien waivers must say “Conditional Waiver and Release” or “Unconditional Waiver and Release” right at the top of the form.

“Final” vs “progress”

In addition to being conditional or unconditional, a lien waiver can be used for either a progress payment or a final payment on a project. A final unconditional lien waiver is probably the most dangerous document to sign, because it indicates you’ve received every payment you’re owed on the entire project.

“Through date”

The “through date” is the last date of the period for which the payment is being made. A conditional lien waiver, particularly when used for a progress payment, will list the through date for the period(s).

Signing parties should be careful that the dates described in the waiver match the dates for which payment has been received. For example, a payment request might seek payment for work performed through March 30th, but if the unconditional lien waiver states April 30th, the signor cannot file a lien for any work performed in the month of April.

“Upon receipt of payment”

If the waiver says “upon receipt of payment” or something similar, that’s a pretty good indication it’s a conditional waiver. Because a conditional waiver is only effective once payment is received, anything that conditions However, don’t rely on this statement alone – make sure you understand the full document and what the language means.

The consequences

- A contractor in Nevada nearly lost $1 million after signing an unconditional waiver

- A subcontractor in Georgia gave up all legal right to payment by signing a waiver

- In Utah, a court reinstated a contractor’s mechanics lien after they signed the wrong waiver

- In Minnesota, a court dismissed a supplier’s bond claim because of a waiver they signed

The lien waiver catch-22

The lien waiver “catch-22” is quite infamous in the construction industry. Regardless of whether it’s your job to sign lien waivers in exchange for payment, or to collect signed waivers from contractors and suppliers in order to send them a payment, it’s likely you’ve had to negotiate a frustrating disconnect:

- One side wants to sign a waiver only after they’ve received payment.

- The other side wants to get the signed waiver before they make the payment.

From an objective point of view, when executed properly, lien waivers are fair. A subcontractor receives a payment of $5,000 for work performed and that subcontractor gives up the ability to file a lien for that same $5,000. Everybody wins, right?

But when it comes to real life, things can get a little sticky when it comes time to decide who should go first. Does the payee give up their lien rights (by signing the waiver) before receiving payment, taking it on faith they will receive that payment?

Or does the payor make payment first, taking it on faith that the signed lien waiver will indeed come in?

In any case, the first question you should always ask yourself when dealing with lien waivers is: “Is this a conditional or an unconditional waiver?”

The bottom line: Always use conditional waivers

The solution to this catch-22 is to use the “conditional” set of waivers. These lien waivers are only effective when the “condition” — receiving payment — is satisfied. Thus, everyone goes away happy (and paid!) and the catch-22 situation is avoided.

Think of all the ways that receiving a supposed “sure-thing” payment can go wrong:

- the check could bounce

- a credit card charge could be disputed

- an ACH payment could be reversed

Anyone of those things happens and your lien rights will be irreversibly lost if you signed an unconditional lien waiver. For these reasons, contractors should always use conditional lien waivers.

Best practices for exchanging waivers

The lien waiver document was supposed to be simple. It was supposed to be a receipt…a waiver of lien rights exchanged for a payment. Now, however, it’s a hot mess of legal traps and nuances.

If you learn anything from reading about lien waivers, you must learn this: It is impossible to manage lien waivers without some tool. Just like you need a tool to manage mechanics liens, preliminary notices, and bond claim compliance, so too do you need a tool to manage lien waivers. Don’t underestimate this need!

Downloading a lien waiver form is a good quick fix, but it is not a solution to organizing and managing all your waivers. You need, instead, some type of lien waiver software application or tool. Levelset makes it easy for companies that exchange lien waivers regularly to track all their lien waivers in one place. You can explore other tools in our review of the 5 Best Lien Waiver Tools.

With a free Levelset account, you can exchange unlimited lien waivers. Send signed waivers to your customers, or request waivers from your customers and vendors. Collect all the waivers you receive in one place whether they come by mail or email, so you can track waiver status and take next steps. Levelset makes lien waivers easy, fast, and collaborative for everyone ranging from suppliers and contractors to lenders and property owners.