Retainage, also called “retention,” is an amount of money “held back” from a contractor or subcontractor during the term of a construction project. This is a very unique practice specific to the construction industry, but within the industry, it’s extremely popular. Most construction contracts mandate that a certain percentage of the contract price (frequently 5% or 10%) is withheld from the contractor until the entire project is substantially completed. This creates cash flow challenges in an already cash-poor industry, the practice is too frequently abused, and of course, it’s subject to complicated regulations that make it tricky to execute.

In this guide, you’ll learn everything you need to know about this practice, including why it exists, how it works on different types of projects and in different states, links to a state-by-state overview of rules and requirements, tips on how to negotiate the best terms for you in your contract, and some alternatives that could make everyone happy.

Video Overview of Retainage in Construction

The History of Retainage & Why It Exists

Retainage was first invented in Britain back in the 1840s to ensure that construction projects were completed fully, and to manage the risk of poor workmanship, which was very common at that time (and, many would argue, still common). The argument in favor of the retention practice contends that withholding money from a contractor accomplishes two things:

- It creates a financial incentive for the contractor to finish the project successfully; and

- It provides protection to other stakeholders in the event of any problems, such that the retained money can be used as an insulation for that risk.

Since its first use almost two hundred years ago, the practice of withholding money from contractors during the course of a construction job continues, and it continues in largely the same form that existed back in the 1840s.

Today, the practice is common and is part of the industry’s culture. The practice is also baked right into laws all across the world that regulate the types of contractual provisions that contractors can agree to. Most of these laws were created to regulate and create limitations on the practice, mostly to promote its fair use and to prevent its abuse.

However, many businesses in the construction industry — especially subcontractors and other project participants that are on the lower end of the payment chain — are adversely affected by the way that this process functions in the industry today. Plus, the process of managing and tracking withheld money is a real pain in the neck for everyone involved. Internationally, there is a huge cry to abolish retention practices in construction.

There are many different questions and issues that arise when dealing with retained money on construction jobs. One issue, for example, is whether any money should be withheld from the contractors at all! Nevertheless, when retention is withheld, the 2 biggest sticking points are these:

- How much should/will be withheld?

- How long should/will the money be withheld?

As you can probably imagine, the rules and answers here can be complicated.

Now that we’ve explored where this practice comes from and why it exists, let’s dig into some of the rules of the game, and how it may impact your project and your pocketbook.

What are the Retainage Rules For Your Job?

If you’re a property developer, owner, or general contractor, you may be thinking about how to use retainage to protect yourself against problems on your next job. If you’re a contractor, you may be thinking about how to avoid having money withheld at all on the job, or otherwise, to get as little withheld as possible, for as short as possible. What can you expect? What are the rules that will help or hurt you?

Retainage Amounts & Timetables Are Mostly Set By The Parties Agreement

In either case, the place for everyone to start is with the construction contract.

While different laws exist regulating retainage practices, unlike more prescriptive laws like lien rights, retention laws typically operate as “limitations.” The laws, in other words, put a limit on what parties can agree upon. As a result, whenever thinking about retainage or retention, it’s important to first consult the underlying agreement: what have or what will the parties agree(d) to?

If retainage is not specifically addressed in the construction contract…then it does not exist. A general contractor cannot just withhold money from a subcontractor. The subcontractor and the general contractor have to specifically agree to such a withholding, in writing. Accordingly, if no such agreement exists, there’s not retainage on the job!

It’s pretty common for the parties to include some retention agreement within their construction contract. In fact, most of the popular form contractors (such as the AIA documents or ConsensusDOCS) contain retainage agreement provisions.

According to 2004 research on retainage by construction educator Dennis Bausman, PhD, at Clemson University, it’s very common for retainage to be held from contractors on a job. If it’s a private job, there’s an 85% chance that at least 5% will be withheld. And this burden is disproportionally felt by subcontractors. Two out of every three subcontractors have 10% withheld from them, but only one out of three general contractors, architects, and construction managers have the same burden.

And how much is typically withheld? According to that same study:

- On private jobs, the average is 7.59%;

- On state jobs, the average is 5.56%

- On federal jobs, the average is 3.26%

And here comes the worst part. It takes a long time for contractors to collect these withheld funds.

Again based on Bausman’s research, general contractors wait an average of 99 days to get their retainage, and subcontractors wait an average of 167 days. And, according to a study in the U.K., over 25% of retained money was never paid!!

So, going back to the 2 biggest sticking points.

1. How much should/will be withheld?

This depends on the parties’ agreement. Generally speaking, the parties can agree to anything they want, so long as they don’t run into a legal limitation (we’ll discuss those below). The average amount of retainage withheld on private jobs is 7.59%, on state jobs is 5.56%, and on federal jobs is 3.26%, with higher percentages withheld from subcontractors than from general contractors.

2. How long should/will the money be withheld?

This again depends on the parties’ agreement. Retained money is usually withheld from all parties until the very, very end of the project. On average, that means that general contractors wait about 99 days to get withheld money, and subcontractors (who likely finish before the general contractor) wait an average of 167 days. For a variety of reasons, it’s common for retained money to never actually get paid…so be very careful.

Legal Limitations On Federal Public Works Projects

Holding back money from a contractor is an invention of contract, meaning it started with parties agreeing to the practice. Over time, however, governments began to recognize that one party (i.e. an owner) could take advantage of another party (i.e. the contractor) with retention practices, and further, that retention withholdings caused problematic cash flow issues.

And so, beginning with the Office of Federal Procurement Policy’s urging in 1983, federal and state governments started passing laws governing and limiting retainage. The federal government was one of the firsts to address this, and has a number of limitations on how much money can be withheld from contractors on federal jobs.

Prime Contractors Can Withhold Retainage from a Subcontractor, but cannot Bill the Government for it

Under the Federal Acquisition Regulation (FAR), a prime contractor may withhold payments from their sub pursuant to the contract between the parties. So, if the contract between them provides for retainage, they are allowed to do so under the terms set forth, even if the government is not withholding retainage from the prime.

There’s a very important note to make here: If the prime is withholding retainage, they cannot bill the government for the retainage. This basically results in the government holding the retainage on those particular federal projects.

The Government Agency Responsible for the Project Can Withhold Money from the Prime Contractor only if there is “Cause”

The federal government’s policy on retainage states that funds shall not be retained “without cause,” and should be determined on a “case-by-case” basis. The legal translation of that is, the Contracting Officer has complete discretion to decide whether or not to withhold retainage based on their assessment of past performance and likelihood of continuing performance.

According to the FAR, if “satisfactory progress has not been made, the Contracting Officer may retain a maximum of 10% of the amount of the payment until satisfactory progress is achieved.” However, in practice, it is usually between 5-10% with a gradual reduction once certain milestones are reached.

And finally, for more information on how to actually collect the retained money due to you on a federal job, check out this Question and Answer on our Expert Center: How can we get our retainage from General Contractor on Government funded HUD project.

Legal Limitations on State/County or Municipal Public Works Projects

Just like with federal projects, retainage can be withheld on state, municipal, and county projects. In fact, there are very few instances when the laws are in agreement in every state, but this is one of those instances. Every single one of the 50 states allows retention to be withheld on a public works project. However, each state has different rules and limitations that govern the practice.

In fact, in some states, retainage isn’t a choice — that is, withholding money on state/county public works projects is sometimes actually required.

In a number of states, the retainage withheld is a percentage of the total contract price, not a percentage of each progress payment. (For example, if you’re working on a project with 10 progress payments and 5% retainage, and the 5% is maxed out with the 6th payment, that means that no more money can be withheld for the final 4 payments, 7-10.)

In other states, the normal practice is that no more can be withheld after 50% of the project has been completed. Consult the law in the state where your projects are located and confirm that the retainage in place on your project is allowable according to the law. You can view the laws and rules for your state by reviewing our 50-State Retainage Law Guide & FAQ Pages.

Legal Limitations on Private / Commercial Construction Projects

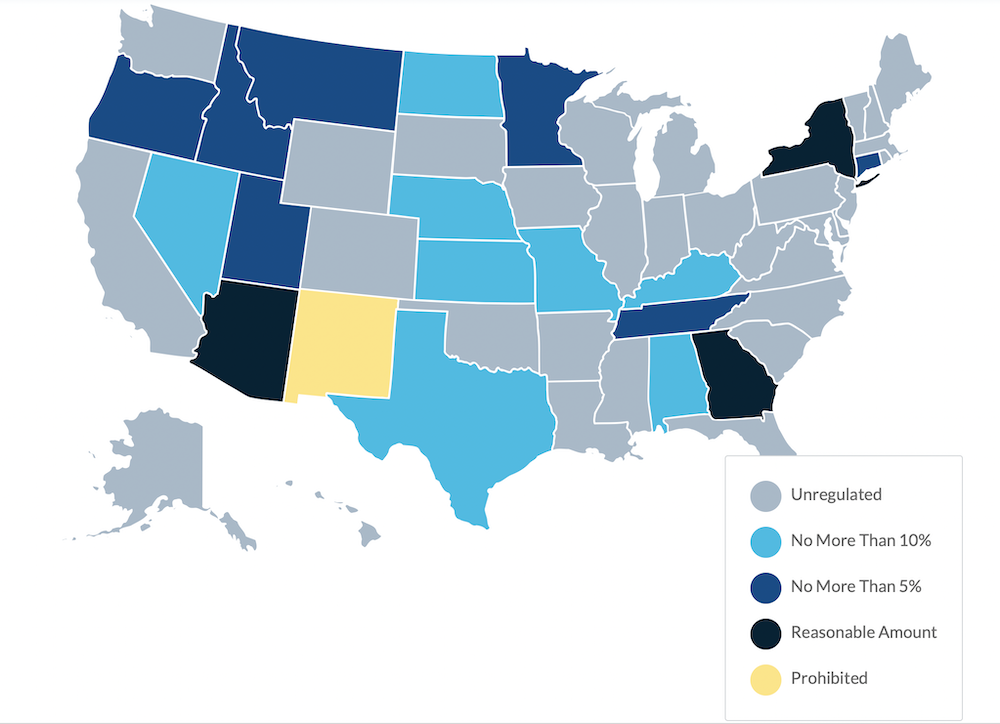

No surprise here — with one notable exception (the state of New Mexico forbids retainage) — money can be withheld from contractors on all private construction projects. Each state, however, does have different regulations about the amounts that can be withheld, the length of withholding, and the process for recovery. When abuses happen or someone engages in retention practices that run afoul of the limitations, the state laws will usually provide punishments (in the form of interest penalties).

While there are many laws, limitations, regulations, and details, on private/commercial construction projects, the single biggest factor in determining how retainage will work is what’s allowed by the project contract. Click here to see Retainage rules, info, and FAQs for all 50 states, and you can also take a look at the map below to see an overview of the requirements in your state.

Retainage Is a Huge Financial Challenge, Especially for Subcontractors

Subcontractors and other down-the-chain participants have gripes about retainage – with good reason. Retainage practices are problematic because they cause practical issues and business relationship issues within the already-complicated accounting and payment systems of the construction world.

According to a 2004 report published by the American Subcontractors Association, the majority of subcontractors believe that “[prime] contractor abuse of their retainage” is a widespread problem.

Some of the data shared in the report are troubling:

- Subcontractors say that they end up receiving less than the full amount of retainage withheld on more than 10% of their projects.

- On normal projects with no major disputes, subs had to wait anywhere from 30 to 900 days after completion to collect the final retainage due to them, with an average wait time was 167 days.

- Asked about the single longest retainage wait they had encountered during their careers, subs reported that the worst cases ranged from a low of 60 days all the way up to 2500 days (that’s almost 7 years!), with an average wait time of 567 days for each sub’s worst-case scenario story.

But that’s not all. Here are a few common sentiments that we’ve heard from talking to subcontractors and others in the industry:

- There is a widespread belief among subs that prime contractors often withhold a greater amount of retainage on them compared to what is withheld by the project owner on the prime contractor.

- Many in the industry believe that retainage is used not so much to ensure subcontractor performance, but rather as leverage, forcing the project subs into a weaker financial position (by withholding money from them).

- Many in the industry also believe that GCs and owners use their withheld retainage as a free financing mechanism, shifting the borrowing costs of project finance onto the smaller players further down the payment chain while they have an interest-free pile of money they can use to fund their own operations and business cash needs.

Yet, even with all of these potential problems, retention clauses in construction contracts are rarely questioned or even thought about very much, at all.

Money Withheld on a Job Cripples a Contractor’s Cash Flow

At the end of the day, there’s really just one reason why a business — any business — fails. The reason? A business fails when it runs out of cash.

Unfortunately, it’s clear that cash flow is an issue in the construction industry, and that’s even before retainage enters into the picture. Construction businesses fail faster and more often than any other industry, as highlighted in the industry’s failure rates.

There are many reasons for this — perhaps chief among these is the incredibly long time it takes to get paid in the construction business. Many construction businesses are expected to float all of the costs and expenses associated with their jobs and projects up front, all while hoping that payment comes eventually, if at all.

On top of that, the margins in the construction industry are notoriously slim. And that’s where the problem lies because it’s not uncommon for the amount of retainage withheld on a project (as a percentage of the total contract value) to be greater than a construction company’s profit margin on that same project.

For example, let’s assume that ‘ACME Plumbing’ is a subcontractor on a project where retainage of 10% will be withheld from their payments. However, ACME Plumbing’s profit margin on this project is only 7%. In this scenario, ACME is going to be in the red on this project to the tune of -3% until they finally receive their retainage withheld.

This also means that ACME is going to have to have enough cash on hand (or the ability to secure financing) to fund that loss for as long as it takes for them to finally receive the retainage withheld. The longer that takes, the more money ACME will need to keep their business going.

Thus, it’s easy to see how retainage only makes a bad problem worse for many contractors.

Retainage, Lien Rights, & Payments Rights Conflict to Give Contractors Difficult Choices

It appears that the laws on retainage and the laws on mechanic’s lien rights were written in 2 different universes and 2 different eras. Simply put, these 2 sets of laws could not be any more contradictory.

On the one hand, owners and others are allowed to withhold money from a contractor until the very end of the project. On some projects, that time period could stretch from weeks, to months, and even to years for the largest projects.

On the other hand, contractors, subcontractors and others that want to leverage their mechanic’s lien rights in order to resolve a payment issue on a project typically only have a small window of time allowed to file their mechanic’s lien claim. For projects with extended timelines, it’s quite possible that the mechanic’s lien deadline may expire long before the retainage is actually due.

So, what should a contractor or supplier do in that situation? Is filing a mechanics lien before the retainage is due even allowed? And if a mechanics lien before the retainage is due is allowed, is it a smart move to do so?

Mechanics Lien Process doesn’t Wait for Retainage Payments

Unfortunately, most states’ laws are silent on this issue. One notable exception is the State of New York which amended their lien laws to make sure that those forced to file a mechanics lien would not lose out on their rights to the portion of the payments withheld as retainage.

In a few other states including California, Utah, Illinois, Massachusetts, and Louisiana, the lien filing deadline is calculated from the completion of the project as a whole instead of an individual company’s last furnishing date. While this does not address the retainage problem head-on, it does minimize the problem significantly since the completion of the project will also trigger the retainage payment.

Should You Include Legally Withheld Money in a Mechanics Lien Claim?

The previous section addressed whether a mechanics lien filing could include retainage (and in many states, the answer is unfortunately unclear). The next question is whether the withheld retainage should be included in a lien filing.

Here’s one thing to consider before taking this step: many general contractors, owners, and lenders would consider filing a lien for retainage before the retainage is due to be a pretty adversarial step. While retainage withheld can amount to a considerable amount of money, filing a preemptive lien before the retainage is actually due might be too much (especially if the project is otherwise free of payment issues).

Nevertheless, the bottom line here is that Retainage can almost always be included in a lien claim…long before the withheld funds are ever actually due.

If a mechanics lien claim is being filed, most states empower the party making the claim to file for the full amount of what they’re owed against the project. The lien claim, in other words, is equal to the total value of the work, labor, and materials that the filing party furnished to the job (less any payments received). The fact that some of this money may be held as retainage is usually irrelevant — basically, if you earned the money fair and square, and if your lien rights are intact, then you’re allowed to file a mechanics lien.

How to Leverage Your Lien Rights When Dealing with Retainage

1. Always Send Preliminary Notice to Secure Your Lien Rights

Preliminary notices are a common requirement in the majority of states for a potential lien claimant to remain in a protected position and retain the ability to file a valid and enforceable mechanics lien.

In most cases, sending the required preliminary notice for the project’s state is sufficient to protect the potential claimant with respect to all s/he is owed on the project, including retainage. In other words, if you send the required preliminary notices within the time they need to be sent, then you are protected — and that includes any withheld funds.

However, in rare situations, a different, or additional retainage notice is required, but that is the exception.

[Texas contractors take note: Texas is a state where there is a specific “notice for contractual retainage” that can be provided “instead of or in addition to” the regular monthly notices that Texas requires – but which is limited to protecting the ability to make a claim against the retained amounts. Check out our Texas Retainage FAQs, Guide, & Forms here.]

2. Understand that Mechanics Lien Deadlines Won’t Be Extended Just Because Retainage Is Still Withheld

First off, as we discussed above, ALL construction companies need to know the following:

RETAINAGE DOES NOT EXTEND YOUR LIEN FILING DEADLINE.

See: Retainage & What It Means To Your Mechanics Lien Deadline for more details on this. And the tricky, tricky situations that can arise with lien deadlines and retained money, such as was explored on our Expert Center with this question: General Contractors do not pay retainage until 1 year after completion of project. How do we file a lien on a Retainage amount if liens can only be filed 90 days after last day on job??

However, in most cases, including the retainage withheld in the lien claim is the wise move.

Other Tips to Help Manage the Impact of Retainage

Here is some practical advice to help deal with the potential impact of retainage on a project…

1. Learn How the State and Federal Laws Work and the Contractual Details of the Project You’re Working On

On government projects, the retainage is usually pretty controlled. However, on private projects, the retainage is less controlled. The challenge with the private project laws is that those who need the money the most won’t have the cash to fight for the penalties.

When you’re entering into a contract for a project where there will be money withheld, make sure you examine the terms to find out everything you possibly can about how the retainage will work. Confirm the percentages that will be withheld.

Additionally, you should ask questions such as:

- Will retainage be held in escrow? (A number of states require this, so be sure to check for your state.)

- Will retainage that’s withheld earn interest? And who is entitled to that interest?

- Can a project owner use retained funds to “discharge” a mechanics lien claim?

- Can a project owner (or another project participant – like the GC) use retained funds as compensation for workmanship issues or deficiencies?

2. Ask Your Customers to Negotiate on the Retainage

The old adage “It never hurts to ask” applies here. Has your company been in business for a long time with an equally long track record of success? Does your business have a stellar reputation? Then ask to negotiate the percentage withheld.

Perhaps you can offer a letter of credit or a surety bond to substitute for the retainage requirement. There is even such a thing as a “retainage bond.” This type of negotiation is probably going to be difficult, but it never hurts to ask, and your company’s goodwill has value. Explore alternatives that will make the other parties on the project comfortable with the risks.

3. Plan for the Impact on your Cash Flow

Once you know what you’re getting into, and once you’ve exhausted all of your alternatives, then you can plan for the cash flow reality. You need to KNOW YOUR FINANCIAL NUMBERS. Do the math (i.e., do a project cash flow forecast) and make a plan to have access to the working capital required to “float” the withheld money.

Learn more – Accounting for Retention Receivable & Payable: A Contractor’s Guide

4. Don’t Be Afraid to Leverage Your Lien Rights in Order to Get Paid

We can’t stress this enough. Mechanics liens are the most powerful tools available to construction companies to secure all of their payments, including withheld retainage. If you want to find out more about how mechanics lien rights can help your company, get in touch with us, or just go forward to file your lien online now.