Getting paid on a construction project can be cumbersome. Not only do contractors have to deal with some of the longest payment delays of any industry in the world. They also typically have to apply for payment with a packet of documents and receipts that prove they’ve earned it. So when a general contractor or property owner says you have to notarize a payment document, you would be right to be a bit skeptical.

In this article, we look at notarization on common construction payment documents. When is it required (if ever)? How should you respond when a property owner or GC asks (or demands) that you notarize a particular construction document?

What is notarization for, anyway?

Notarization is way of proving the authenticity of a legally executed document . The notary must be physically present to witness the signatures on the document. They’re there to confirm the identity of the person or people signing, typically by checking their driver’s license. A notarized document will have the signatures of the parties to the document, the signature and verification statement of the notary public, and potentially a notary stamp as well.

The job of a notary public is to ensure that the person signing a document is actually who they claim to be. This serves two primary purposes:

- Notarization prevents forgery. The notary public checks the ID of the person signing to prevent someone else from faking their signature.

- Notarization ensures free, sound decisions. The notary looks for signals that the signer isn’t coerced or intoxicated. That they understand the document has legal consequences, and they’re signing of their own free will.

In the United States, some common legal documents that require notarization are power of attorney, last will & testaments, and real estate transaction documents.

Especially on a large construction project, it’s easy to imagine a scenario where a property owner or general contractor would want the subs to notarize payment documents. If they don’t personally know the subs involved on the project, they may want a notary to confirm the signer’s identity. It’s important that an authorized person is approving the documents, so both parties can avoid disputes later on. However, there are often simpler ways to achieve this same goal that aren’t as tedious (or expensive) for the subcontractor.

So, do you need to notarize that construction document?

Every construction project will require a variety of documents that a contractor needs to provide in order to get paid. It all starts with the contract, which will specify which documents you’ll need to provide throughout the project. So you’re ready to provide them. Now the question becomes: Do you need to use notary services?

Do you need to notarize a construction contract?

Answer: Typically, no.

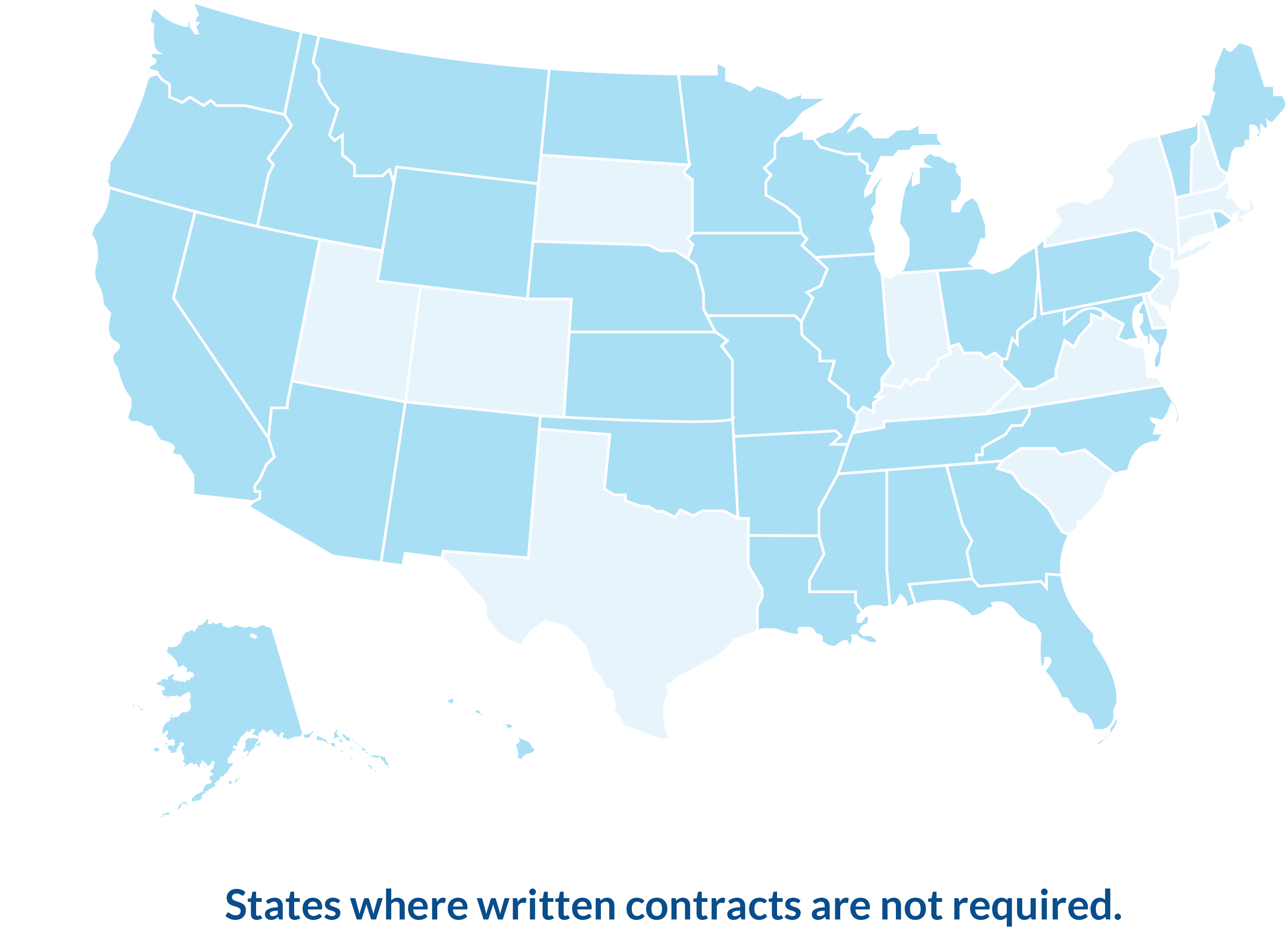

There are no state laws requiring you to notarize a construction contract, since it’s already binding. Even a verbal contract is legally enforceable in most states. Generally on construction projects, the requirement to notarize a document is actually a contract provision.

Even though it’s not a requirement, there may be advantages to having the contract signed in front of a notary public. If the other party later objects to the agreement, notarization is just extra proof that they originally agreed to the terms. If both parties agree to notarize, it only makes the contract that much stronger.

Do you need to notarize a payment application?

Answer: Typically, no.

A payment application generally doesn’t need to be notarized, unless the contract explicitly calls for it. There’s really no logical need for it, though. Check your contract before you sign it. If the contract requires you to notarize any of the payment documents during the project, see if you can get the GC or property owner to remove that requirement.

This gets confusing when you’re using a payment application like the G702 from the American Institute of Architects (AIA). The pay application includes a section for notarization, but that doesn’t mean it has to be notarized. It’s not a binding document, after all – the owner reviews it with the option to accept or reject it.

As we’ve stated, check your contract. If it doesn’t require you to notarize the pay application, then you can leave that section blank on the pay app.

Do you need to notarize a change order?

Answer: Typically, no.

Construction projects rarely ever go as they were planned, which is why it’s common to see additions and deductions to the scope of work. That’s the premise of change orders. An approved change order contains the description of work, change in cost, and signatures of both parties confirming agreement. If everyone wants to have change orders notarized, then go for it. But there’s really no need. An approved change order effectively becomes part of the original contract, and is enforceable without notarization.

Do you need to notarize a lien waiver?

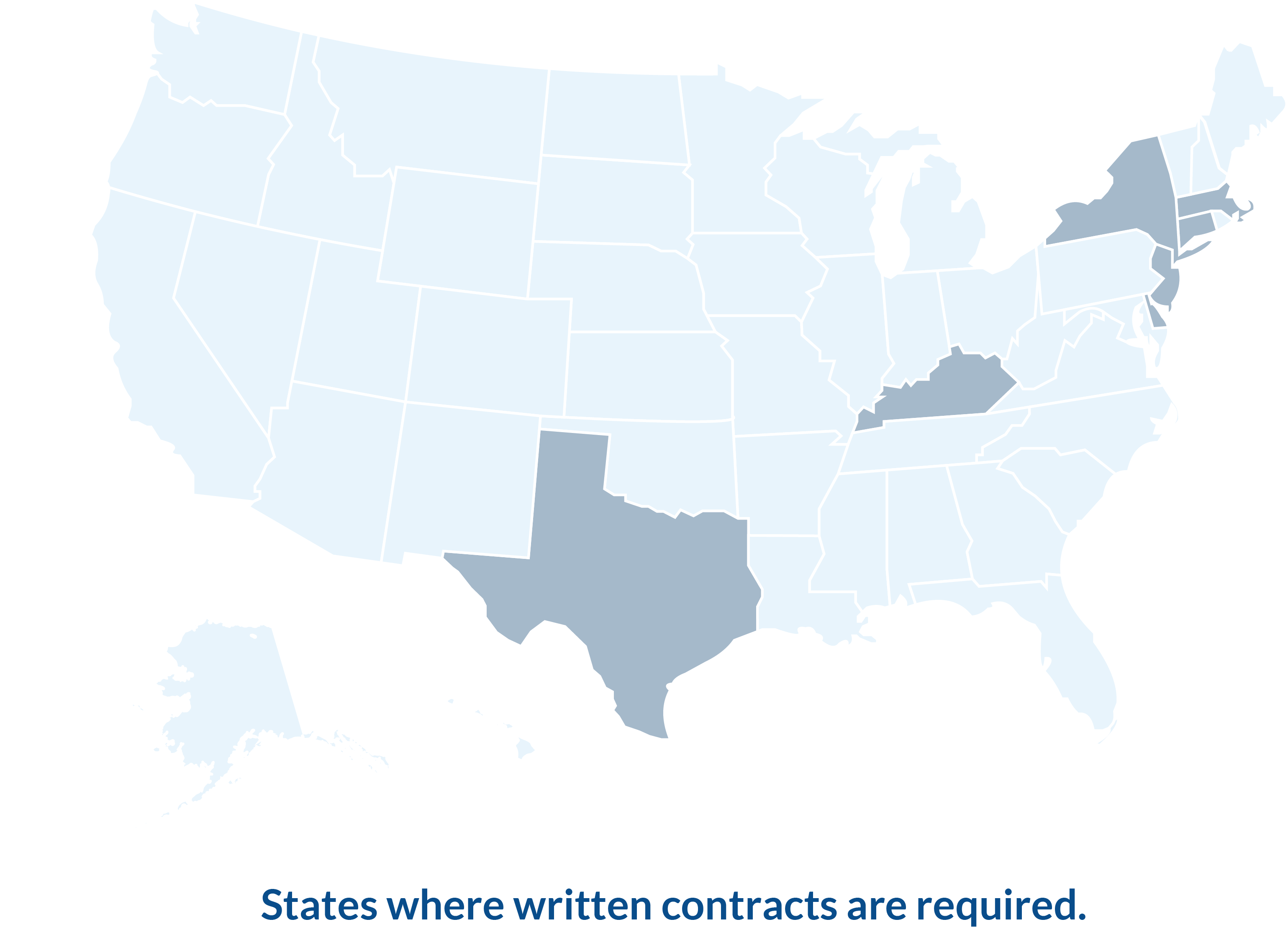

Answer: Only in 3 states.

Lien waivers must be notarized in 3 states: Texas, Wyoming, and Mississippi.

In all other states, don’t notarize lien waivers. In fact, in some cases, notarizing a lien waiver could actually invalidate it. This is because some states have very specific parameters for the lien waiver form, and the statutes state that waivers should be in substantially the same form. So, adding a notary block does technically change the form, and could potentially be a point of contention when things go south.

Do you need to notarize a preliminary notice?

Answer: Typically, no.

States very rarely require you to notarize a preliminary notice. However, if the state in which your project is located requires preliminary notices to be filed rather than just sent, it is a good idea to check if it also needs to be notarized.

In some states, the notice itself might not need to be notarized, but something else does. Take Arizona, for example. They don’t require notarization on a preliminary notice, but they do require “proof that the notice was given.” This can either be given by the signature of the person receiving the notice, or by a notarized affidavit swearing under oath that it was sent.

In states where claimants aren’t required to send preliminary notice in order to protect your lien rights, you never need to notarize these construction documents.

Do you need to notarize a notice of intent to lien (NOI)?

Answer: Not in most states. But…

In these ten states, you must send a notice of intent to lien (NOI) in order to protect your right to file a mechanics lien:

- Arkansas**

- Colorado**

- Connecticut

- Illinois*

- Louisiana

- Missouri*

- North Dakota

- Pennsylvania**

- Wisconsin**

- Wyoming

[Click on any state above to view or download the NOI form. If an affidavit is required with the mechanics lien, it will also be attached.]

*In these states, the NOI requires notarization.

**In these states, the NOI itself doesn’t require notarization. However, you must submit an affidavit when you file the mechanics lien. The affidavit is an official document that affirms that you sent or delivered the document. The affidavit needs notarization.

In the other 40 states, sending an NOI isn’t required to protect your lien rights. As such, the document is optional, and doesn’t require notarization. Even in states that don’t require it, sending an NOI is still a very effective way to speed up payment.

Do you need to notarize a mechanics lien?

This is where it starts to get a little complicated.

Answer A: Yes, in these 30 states…

- Alabama

- Alaska

- Arizona

- Arkansas

- Colorado

- Florida

- Idaho

- Kansas

- Kentucky

- Maine

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Mexico

- New York

- Ohio

- Oregon

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wyoming

- Washington DC

Answer B: Yes, plus…

In these 6 states, you must notarize a mechanics lien, plus additional steps. Each has their own special requirements.

Answer C: Not if you’re in these 12 states…

These states don’t require notarization on mechanics liens:

- California

- Georgia

- Hawaii

- Illinois

- Louisiana

- Mississippi

- Montana

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Wisconsin

Answer D: Not in these 2 states, but…

If you live in Delaware or Massachusetts, notarizing a mechanics lien isn’t required, but it’s still best practice to notarize it anyway. In these states, you do need to show another form of “attestation,” or evidence that you filed the lien. What that evidence entails exactly varies by state.

If filing a lien in these states, its best practice to have the mechanics lien notarized anyway. Recorder’s offices can be fickle beasts, and they each have their own internal processes. An office may end up rejecting a non-notarized document, even if the law doesn’t require notarization. In these states, notarizing the mechanics lien can provide extra assurance that the Recorder’s Office won’t hold up its approval.

Bottom line

In some states, you must notarize specific construction payment documents. In others, there is no law requiring notarization – and in some cases, notarizing a document can actually invalidate it. Here’s are some general steps to follow when deciding whether to notarize a document:

- Does state law require you to notarize it?

If yes, then definitely notarize it. - Does your construction contract require you to notarize it?

If yes, then notarize it. - Does your GC or property owner want you to notarize it?

If neither the law nor the contract require it, they can’t legally deny you payment if you don’t notarize a document. But you might still want to notarize the construction document just to make them happy.

The ultimate problem with requiring construction documents to be notarized, is the time and cost it requires. Consider the volume of documents that fly back and forth on any given project. Requiring notarization on one or more of these documents is a tedious and burdensome obligation. If working in a state where notarization isn’t required by law, it’s best to leave this issue alone. Exchanging construction documents is stressful enough, why not streamline the process?

However, if you do end up working on a long project where many payment documents must be notarized, it might be worthwhile to have a member of your staff certified as a notary public in the project state.