We are attempting to file a lien on a job that was done in DC. My lien was rejected becuase my business licence and certificate of good standing are from MD. We are a MD business, is it even possible for me to get these docuements from DC?

Search Results for: washington dc

How to Get Paid on Washington State Public Projects

The federal government is allocating over a trillion dollars in funding for public infrastructure construction projects over the course of the next decade — and a whole lot of that funding is going to go directly to individual states. Washington State is often at the forefront of infrastructure work with its commitment to improving public transit and affordable housing.

With this much focus on public works construction, contractors nationwide should be ready to take advantage of the opportunity to work on big government projects at both the federal and state level — as well as be completely prepared to protect their payment rights while doing so.

Public works projects are a major source of benefit for contractors, but the popular thinking that these projects run into fewer payment problems than private ones do is a misconception. Protecting your payment rights on public works projects is crucial, as contractors deal with payment issues on these projects just as much as on private ones.

Payment protection on Washington public projects

Even when payment challenges are similar, payment protection is very different between private and public work. Contractors on public projects aren’t allowed to file mechanics liens when payment problems arise, as both the federal and state governments explicitly prohibit private entities from claiming an interest in public property. Due to this, general contractors on public construction projects have to secure a payment bond prior to the start of work. In the event of a payment dispute, contractors file claims against the payment bond instead of against the property itself.

The Miller Act provides directly for this payment protection at the federal level, and most states have their own version of it with laws usually called “Little Miller Acts.” Washington State indeed has its own Little Miller Act, which has wide-ranging protections for contractors — as long as they act early on in order to protect their right to file a bond claim.

Washington State bond claim laws

Washington’s public payment bond claim laws cover all public works projects commissioned by a state or local government entity that have a contract value of at least $150,000 — and it’s additionally possible to make a lien claim against unpaid retainage funds on certain public projects.

The protection under these laws goes far — subcontractors, sub-subcontractors, material suppliers, equipment lessors, and laborers of any tier are allowed to make a claim against a public payment bond; material suppliers to suppliers are excluded from this coverage (as are, of course, general contractors, who can’t make a claim against their own bond).

However, contractors have to follow certain steps in order to keep their payment rights secure on public works projects. Making a successful bond claim includes several requirements, such as submitting preliminary notice prior to making the bond claim itself (or the claim enforcement, if necessary); additionally, there are steps that are not required but are still recommended, such as sending a Notice of Intent to Make a Bond Claim.

In order to secure the right to make a bond claim, a contractor needs to send a preliminary notice (known in Washington State as a Notice to Contractor). This is a crucial part of the process, as failure to send this notice is fatal to bond claim rights.

A Notice to Contractor should be sent by registered or certified mail to the prime contractor no later than 10 days after the claimant’s first furnishing of labor and materials to the project, and should include a description of labor and materials to be provided, the hiring party’s contact information, and statement declaring that the payment bond will be liable for any payment problems. There is also a preliminary notice required for securing the right to file a lien on retainage, but this is usually included in the Notice to Contractor.

Download a Washington State Notice to Contractor form.

Though it isn’t directly part of Washington notice requirements, contractors can send a Notice of Intent to Make a Bond Claim as another effective way to incentivize payment as a “final warning” of sorts.

If payment isn’t received, the next step is the bond claim itself. This must be delivered to and filed with the project’s public entity within 30 days from the completion of the contract and acceptance of the project as a whole. For material suppliers and equipment lessors, the best practice is to send a bond claim within 30 days after the delivery of material has been completed.

Similarly, for a Lien on Retainage Funds claim, notice must be given to the contracting public agency no later than 45 days after completion of the work. Generally, the best practice is to consolidate both the bond claim and Lien on Retainage Funda claim into one filing, and observing one deadline.

A Washington payment bond claim only needs to be sent to the contracting public entity — but with that said, it can still be useful to send a copy of the claim to other parties up the contracting chain. The claim itself should include:

- Public entity’s name & address

- Claim amount

- Description of labor and/or materials provided

- If the claim includes unpaid retainage, a statement that the claim is additionally being made against the retainage funds

The deadline to enforce a claim on the payment bond in Washington leaves a lot of room for contractors, as the enforcement action only needs to be commenced within six years of making the bond claim. However, the terms of the payment bond may specify a shorter period of time for the action to be filed, making it imperative to keep an eye on the details of the bond itself.

Enforcing a claim on retainage funds isn’t as open, unfortunately. If needed, a suit to enforce the lien on funds for retainage has to be initiated within 4 months of the filing of the claim — which reinforces the best practice of filing both a bond claim and lien on retainage funds at the same time.

Washington State retainage laws

Retainage is an amount of money that’s held back from a contractor during a construction project, meant to give an extra incentive for the contractor to complete the project and provide the project owner with a level of protection against issues on the project. Washington’s retainage laws only apply to public works projects.

Learn more: The Ultimate Guide to Retainage in the Construction Industry

The maximum amount of retainage allowed to be withheld on a public project is 5% of the contract amount. This standard applies to contracts between the public entity and the prime contractor and any other subcontract under the same project. In these cases, the public entity needs to release the retainage funds within 60 days of project completion.

There’s an important exception to this that can change multiple details of a project. If the contract is for $150,000 or less, the retainage rate that is withheld can be higher; the public entity and contractor can agree to forgo the project’s bond requirements and instead substitute a 10% maximum retainage rate. If the project works under these requirements, then retainage funds should be released within 30 days of completion.

Washington State prompt payment laws

Washington’s prompt payment statutes include specific timeframes for when general contractors, subcontractors, and suppliers contracting with a public construction project need to get paid. The state’s prompt payment laws apply to all state and municipal public works projects, with the only exceptions being certain contracts that fall under the purview of the Washington State Public Stadium Authority.

- Payments from the project’s public entity to the general contractor need to be made either according to the payment schedule provided in the contract or within 30 days after receipt of an invoice/ receipt of the contract’s goods or services (whichever is later).

- If the project is funded through a grant or federal money, then the public entity needs to make payment either within 30 days of receiving a payment request or 30 days from when the public entity receives the grant or federal money (whichever is later).

- Payments from the project’s general contractor to other contractors down the payment chain are governed slightly differently. After initial payment has been received from a higher-tiered party, payments to any subcontractors or suppliers have to be made within 10 days.

Of course, this doesn’t guarantee that payment is going to arrive inside these deadlines. Washington allows payment to be withheld longer than the required prompt payment deadlines in the event of a dispute over the amount owed, unsatisfactory performance, or payment requests that aren’t in compliance with the contract’s requirements.

If a payment request is incomplete or payment is being withheld, the project’s public entity should send a written notice of noncompliance within 8 working days of receiving the payment request. This notice should specifically state the reasons that payment is being withheld and what needs to be remedied to receive payment. Once the issues with the payment request or disputed work have been resolved, payment must be made within 30 days.

However, late payment has its consequences for those who are withholding improperly. For late payments from the public entity to the prime contractor, interest accrues at a rate of either 1% per month or $1 per month (whichever is greater). For payments to subcontractors, interest accrues at a rate set monthly by the state treasurer, which is posted on the website of the Washington Code Reviser. Any legal action where funds are found to be wrongfully withheld can be costly, as the prevailing party is responsible for attorney’s fees and other court costs on top of interest payments.

Learn more: Washington Prompt Pay Act – Payment Help for WA Contractors

Washington State prevailing wage laws

Prevailing wage laws set a standard for how workers should be paid on public construction projects, setting a level that the majority of a project’s workers should be paid no less than the local prevailing wage.

Washington’s prevailing wage laws require local government contractors and subcontractors to pay prevailing wages to workers on all public works contracts regardless of the project’s contract value. These requirements impact not only standard public construction projects, but also building service maintenance, repairs, and off-site fabrication of items for a project.

Companies can face legitimate penalties for failing to follow these rules. Being found in violation of state prevailing wage laws can result in a $5,000 fine or an amount equal to 50% of the total wage violation in the contract (whichever is greater). Companies can also be assessed interest at 1% per month for each occurrence — all of which happens in addition to having to pay the already-owed wages.

Protect your payment rights on every public project

Though there are a number of guidelines that absolutely need to be followed in order to secure payment rights on public projects in Washington, going the extra mile to protect your payment rights can make sure that you’ll receive the right payment for your work in any situation.

Even though preliminary notices are required on public projects in Washington, it’s important to file them as early as possible in order to ensure that bond rights are maintained. Even beyond maintaining these rights, sending a preliminary notice maintains a line of communication throughout the chain on a construction project, giving all contractors involved the opportunity to make sure that payment disputes are taken care of earlier on in the process rather than later.

Washington’s bond claim laws allow contractors to take care of disputes efficiently, as well. Even though the deadline to enforce a bond claim in the state is six years, you don’t have to wait that long — in fact, if filing a lien on funds in addition to a bond claim, you can even file them together within the lien on funds’ four-month deadline.

When a company is dealing with documentation like what is needed for preliminary notices and bond claims, proper document retention and management is an absolute necessity when it comes to protecting your payment rights. Especially when sending notices and maintaining the proper documents needed for claims, it can be enormously beneficial for you to have an organized policy for document retention.

Washington State Contractor Licensing Guide

Contractors looking to perform construction work in Washington need to be registered with the state. In addition, many Washington cities require business licenses for companies working within their limits. Knowing where to go to get the proper licenses is key to getting a business set up to work in a new location. Luckily, we’ve got the information you need about Washington contractor licensing.

If you need assistance getting licensed in other states, check out our guide to licensing in all 50 states.

Who needs a contractor’s license in Washington?

Washington makes it easy: All contractors working in the state must register with the Department of Labor and Industry (L & I) and must be bonded and insured.

There are two types of registration categories for contractors: one for general contractors and one for specialty contractors.

Important note: if your company hires subcontractors, no matter what kind of work you do, you must register as a general contractor. Specialty contractors in Washington are not allowed to subcontract work.

As was mentioned above, general contractors can hire subcontractors, and they can perform work of any type. Specialty contractors are limited in the type of work they can perform, and they cannot hire subcontractors. There are no less than 63 specialties to choose from.

Do you need a license to file a lien in Washington?

Washington state law says that contractors have to be registered in order to file a mechanics lien. The only exception is for design companies and material suppliers.

It’s important to note that in Washington, construction managers and suppliers to suppliers have no lien rights. These companies will have to use other tools to protect their payments, like having a good collection policy or strict requirements for extending credit to potential customers.

General contractor licensing and registration requirements

General contractors, and other contractors who want to hire subcontractors, need to register with the Department of Labor and Industry. The process involves completing an application and submitting it, along with a surety bond, general liability insurance, and an application fee. Washington has state-provided workers comp insurance, so contractors with employees will need to register for that as well.

General contractors are required to submit a surety bond for $12,000, and general liability coverage of $200,000 public liability and $50,000 property damage, or $250,000 combined single limit coverage. The application fee for registration is $117.90.

Once a contractor’s application has been received and processed, the contractor can then begin advertising and start work.

Washington trade and subcontractor licensing

There are certain trades that require an individual to be licensed before a company can register as a contractor. Those trades are plumbing, electrical, elevator mechanic, boiler and pressure vessel inspectors, manufactured home installer, asbestos removal, and construction cranes.

Individuals must apply for these licenses by completing an application and passing an exam, if required. Once the individual license has been issued, then the company can register with L & I.

Electrical contractors have a special process for applying to be licensed. There are 15 specialties that an electrical contractor can apply for. Once the application is complete, it is submitted with a $4,000 surety bond and an application fee of $319.20. Note that if an electrical contractor wants to provide services that aren’t covered under the electrical specialty, they may also have to register as a general or specialty contractor.

Other specialties and trades register as specialty contractors through L & I. The process and application fees are the same as for general contractors, as are the insurance requirements. Specialty contractors are required to submit a $6,000 bond.

Learn the rules in nearby states

City and municipal licenses

In Seattle, only gas pipe installers and refrigeration technicians are required to get a contractor’s license. There is no business license requirement in Seattle.

Nearby Vancouver requires all businesses in the city or conducting business in the city to get a business license. This includes contractors working on projects within the city limits. The application can be completed online or mailed in. The cost for the license is based on the number of employees working in the Vancouver city limits. The base fee is $200, and each employee is an additional $90.

In Olympia, the state capital, all businesses in the city or conducting business in the city need to apply for a business license. This includes contractors working on projects within the city limits. Olympia partners with the Washington State Department of Revenue’s Business Licensing Service (BLS) to register companies to do business in the city.

Spokane also uses the Washington BLS to process city business license applications for businesses conducting business in the city.

Kennewick uses the Washington BLS to process city business license applications. Contractors need to be registered with a business license for the city. The fee for a Kennewick business license is $55, plus $5 for each employee working in the city.

No matter where you live, it’s always a good idea to check in advance to see if the municipality you’re working in has any specific license requirements.

Working in a city in Oregon? Make sure you check out Oregon Contractor Licensing: Applications, Rules, and Requirements.

Penalties for not being registered

According to Washington law, working as an unregistered contractor is a misdemeanor offense. Unregistered contractors don’t necessarily have the insurance and bonds to protect their customers if something goes wrong on a project. They often are able to undercut the prices of properly registered contractors because they don’t carry these additional costs. If you see unregistered contractors on a job site, you can report them at the state’s contractor fraud site.

The law also requires contractors to provide customers with certification of their license status on projects over $1,000. The disclosure form must be given to each customer at the start of the project, and the customer must sign it to acknowledge receipt.

Protecting construction payments in Washington

Registered contractors working in Washington can protect their payments by filing a preliminary notice before starting work on a project. This notice is required for subcontractors and direct suppliers to protect their mechanics lien rights. Continue to protect your rights by sending a letter of intent to file a lien if you haven’t received payment within your terms. Liens must be filed within 90 days of completing work.

Note that construction management firms and suppliers to suppliers do not have mechanics lien rights in Washington. These companies need to establish additional policies to help them collect their payments.

Washington Prevailing Wage Rules, Requirements & Penalties

Working on a public construction project in Washington requires compliance with the state’s prevailing wage and certified payroll laws. Here’s what construction businesses and laborers need to know about Washington prevailing wage jobs, the rules they must follow, and how to avoid penalties.

Types of projects in Washington

As a GC or subcontractor in Washington state, you can bid and work on three distinctly different types of construction projects:

- Residential

- Commercial

- Public

The first two options are the most common type of construction projects. As the contractor on these jobs, you determine the hourly wages paid to your workers and installers.

But on public projects, also referred to as prevailing wage projects, there is an entirely different set of rules, reporting requirements, and forms for contractors to use.

If you comply with all the elements of the prevailing wage project, then collecting your construction payment is a pretty straightforward process.

However, even minor mistakes can derail your ability to get paid.

Your construction invoice will not get paid until the errors get corrected and then re-submitted to the GC or owner. You have just pushed off collecting your public works construction payment for an additional thirty days.

You might incur late fees on your supply house account for the project because of a typo or misplaced decimal point.

Learn more: How to Get Paid on Washington State Public Projects

What makes a prevailing wage project?

A project is a public work or prevailing wage job if the project owner or lender is a city, county, Washington State, or the federal government, or agency thereof.

These are some examples of common prevailing wage projects:

- Schools

- Hospitals

- Libraries

- City hall

- Roads

- Airports

If you are working on one of these, there is a good chance that it is a prevailing wage or public works project.

But not always. That list of project types above isn’t always a public project. If not, they’re not bound by prevailing wage requirements.

Here’s what I mean:

- School: If owned by a church or other private group, it is a commercial project, funded by the owner.

- Hospital: If owned by a private medical group or company, it is a commercial project funded by the owner.

- Library: If owned by a church or another company, it is an owner-funded commercial project.

- Meeting hall: If for a private community or office building, it is an owner-funded commercial project.

- Private roads: Those found in business complexes, housing communities, and golf courses are not public works projects.

- Airport project: If privately owned and funded, it would not be a public works project.

The bid forms will list who the owner and funder are for the project if you are currently bidding the job.

If you are working on the project, and wondering if it is a prevailing wage or public works project, you can contact Labor and Industries directly to find out for sure.

Washington Prevailing Wage Rules

Chapter 39.12 RCW requires local government contractors and subcontractors to pay prevailing wages to workers on all public works and maintenance contracts – on public buildings and projects – regardless of the dollar value of the contract.

This requirement includes the following sections of the RCW (Revised Code of Washington) or the WAC (Washington Administrative Code):

- Public works projects (RCW 39.04.010)

- Building service maintenance – defined as janitors, waxers, shampooers, and window washers (RCW 39.12.020 and WAC 296-127-023)

- Construction, reconstruction, building maintenance, or repair (RCW 39.12.030)

- Turn-key leases, rentals, or purchases (RCW 39.04.260)

- Off-site fabrication of non-standard items for a public works project (WAC 296-127-010(5)(b))

If the above links don’t completely answer your question, you can contact Washington State Department of Labor and Industries for further clarification.

If you are an owner/worker, you generally don’t have to pay yourself the current prevailing wage for work you do on the project.

All other employees MUST be paid at the current prevailing wage rate.

Current Prevailing Wage Rates for Washington

Typically, the prevailing rate is very close or identical to the current union scale for the same work scope.

The Department of Labor and Industries (L&I) governs compliance with prevailing wage requirements in Washington, and sets the rates.

View the current prevailing wage rates in Washington State.

The L&I website includes a link to descriptions of different trades and classifications.

Statements of Intent

Washington law requires every contractor and subcontractor on a public works project to file a Statement of Intent to Pay Prevailing Wages. Click here for the Step-by-Step Instructions to the WA Prevailing Wage Intent & Affidavit System.

These forms get filed with L&I immediately after the contract is awarded and before work begins, if the construction schedule allows for it.

The L&I Industrial Statistician approves the statement of intent, and the agency administering the contract may review the form.

The completed form must be on file with L & I before the GC or subcontractor can receive their first construction payment.

Weekly Certified Payroll Reports

Effective January 1, 2020, contractors must file weekly certified payroll reports for all prevailing wage jobs (regardless of project amount) and submit them directly to L&I through the online Prevailing Wage Intent and Affidavit (PWIA) system.

The local government agency in charge of your project is not responsible for reviewing or checking the reports.

Instead, Labor and Industries ensure that everyone gets paid correctly by overseeing all of the project’s certified payroll report forms.

If a paperwork issue arises, your construction payments will cease until your paperwork gets accepted as “true and correct.”

L&I can enforce some severe penalties against the contractor for non-compliance.

Penalties for non-compliance

The civil penalty for the non-payment of prevailing wage is a minimum of $5,000 or an amount equal to 50 percent of the total wage violation found on the contract, whichever is greater.

They can also assess interest at 1 percent per month, for each occurrence or employee.

These penalties are in addition to any amounts you failed to pay to the employee for his work.

A penalty can result from payroll calculation errors for straight time work, overtime work, and even paid holidays.

Whether you are a contractor or employee, it makes sense to double-check with Labor and Industries to see if the job is a public works project or not.

Is a Prevailing Wage Project in Your Future?

Choosing to work in the public works sector can be financially rewarding for your company.

All things being equal, the typically higher wage rates should increase your profit margins on the project. The higher wages can be a boon for your employees, especially for a large project or an extensive timeline.

However, the rules and regulations are substantially more complicated and rigid than typical residential or commercial projects.

- Timelines for billing and payment have no gray area, and enforcement is rigorous.

- Paperwork errors will delay your construction payments until corrected.

- Contractors cannot file mechanic liens for non-payment on a public work project.

- A minor error, or complete disregard for the prevailing wage rules, will land you in hot water with the folks at Labor and Industries.

If you’re considering a prevailing wage or public work project in Washington, be sure that you understand the requirements, laws, and exemptions entirely for the project.

It will be time well spent and save you some time, money, and frustration down the road.

Best of 2020: Top Construction Lawyers in Seattle, Washington

Construction is a complex, high-dollar industry. When you have a complicated contract with a lot of money on the line, it helps to have an experienced and knowledgeable construction attorney on your side when you face a legal dispute. Below is our list of the top construction lawyers in Seattle, Washington and around.

Construction lawyers can help with disputes & claims

Construction law industry experts believe that about 10-30% of every construction project results in a legal claim attached to it. That alone should tell contractors just how valuable a construction attorney could be for their business.

Construction lawyers assist contractors during every phase of a project, from drafting or reviewing construction contracts to enforcing a mechanics lien claim when a contractor doesn’t get paid.

Top Construction Lawyers in Seattle

These attorneys on this list were selected based on the following criteria:

- Focus their practice on the construction industry

- Members of the Construction Law Section of the Washington State Bar Association

- Work on cases in northern Washington

- Are thought leaders in construction law

- Actively seek to help answer contractor questions about getting paid in Washington

Mark Clausen

Mark Clausen

Mark Clausen is the principal of Clausen Law Firm, PLLC. With 34 years of experience representing contractors, he has been involved with several multimillion dollar cases. Mark has also been a seminar speaker and lecturer for the Washington State Bar Association, Washington State Trial Lawyers’ Association, Associated General Contractors, Associated Builders and Contractors, and other trade associations.

On top of that, Mark is a Trustee for the board of the Construction Law Section of the Washington State Bar Association. He is also a part of several professional associations, including:

- Washington Association for Justice

- Commercial Brokers Association

- Brain Injury Association of Washington

Mark also actively helps to answer questions from Seattle contractors, including:

- Do I need to be licensed to file a Washington mechanics lien?

- How do I end my contract with a subcontractor?

Seth Millstein

Seth Millstein

Seth Millstein handles litigation matters specifically in construction and real estate law. Based in Seattle, Seth is the founder and partner at Pillar Law. With his construction law practice, Seth specializes in construction contracts, mechanics liens, and public/private bonds. His service to contractors has earned him an Avvo.com Top Attorney award with a 10.0 rating. Seth has also been recognized by Super Lawyers as a top-rated Seattle construction attorney.

He received his B.A. from Tufts University and his J.D. from the University of Oregon School of Law in 2002. Seth holds several bar admissions, including the Washington State Bar Association, Oregon State Bar Association, and with the United States Tax Court.

Using his 17 years of experience, Seth actively answers questions from contractors about the issues they face on a daily basis, like “When should you deliver a model disclosure statement?”

Allen Estes

Allen Estes

Allen Estes is a partner at Gordon & Rees, where he serves the Greater Seattle area. Allen’s practice focuses on construction, commercial litigation, consumer protection litigation, and green technology. He serves as the Co-Chair of the Construction Practice Group at Gordon & Rees, and he’s also a Steering Committee Member of the ABA Forum on the Construction.

While assisting all parties of the construction industry, Allen handles bidding issues, contract drafting/negotiation, project performance, project disputes, project closeout, and warranty issues on transportation. He’s also been a member of ABA Forum on the Construction Industry Diversity Committee since 2012.

Aside from Washington, Allen also holds bar admissions in California, the U.S. District Court, Western District of Washington, and the U.S. District Court, Northern, Central, Southern and Eastern Districts of California.

Dave von Beck

Dave von Beck

Dave von Beck has several areas of expertise, including construction defects, property insurance claims, general litigation, and real estate law. He has been admitted to practice in Washington since 1996 and in Oregon since 2003. Dave is a shareholder at Levy von Beck Comstock P.S. His firm has been recognized as “Best Construction Defect Litigation – Pacific Northwest” by U.S. Business News as part of that publication’s 2019 Legal Elite Awards.

His practice focuses on construction defect litigation, and he’s represented homeowners, condominium associations, and commercial building owners. Dave also has a number of legal recognitions, including:

- Avvo.com Top Attorney with a 10.0 rating

- Super Lawyers

- Avvo.com Client’s Choice Award winner in 2018

- 2019 Top 3 Real Estate Lawyer in Seattle

With 24 years of construction law experience, Dave can help contractors handle almost any construction law matter.

Eric Spiess

Eric Spiess

Eric Spiess is a staff counsel at DCI Engineers. He’s been a construction attorney for DCI Engineers since 2016. Eric has been practicing construction law for 10 years and has bar admissions in both Washington and California.

Eric received his B.S. from UCLA in 2001 and his J.D. from Loyola Law School in Los Angeles in 2010. Before joining DCI Engineers in Seattle, Eric worked with Gibbs Giden Locher Turner Senet & Wittbrodt LLP in Los Angeles as a contract attorney.

Geoff Palachuk

Geoff Palachuk

Geoff Palachuk was named to the 2019 Washington Super Lawyers list for his work in construction law and commercial litigation. He is an associate at LanePowell, where he’s become an experienced construction dispute resolution strategist. Geoff has counselled owners, GCs, lenders, and architects throughout his career.

Some of Geoff’s latest honors include being named a Diversity Scholar from the American Bar Association Forum on Construction Law in 2020, along being rated AV Preeminent in Martindale-HubbellPeer Review Ratings. Geoff earned his B.S. from the University of Oregon and his J.D. from Notre Dame Law School.

Geoff is a member of several community organizations, including the King County Bar Association Judiciary & Litigation Committee, Forum on Construction Law scholar with the American Bar Association, and a Fellow with the Microsoft & Hispanic National Bar Association IP Law Society.

John Leary

John Leary

John Leary is a senior counsel at Gordon Rees Scully Mansukhani. His practice is focused on construction law, emphasizing on claim preparation, litigation and dispute resolution for construction industry clients on public and private projects. John has represented owners, GCs, subs, and suppliers over the course of his career during mediation, arbitration, and litigation.

John’s construction law expertise includes:

- Contract drafting and negotiation

- Project performance disputes

- Delay and impact claims

- Mechanics lien claims

- Bond claims

- Stop notices

- Prompt Payment law

A graduate of UCLA, John later earned his J.D. from the University of Oregon School of Law in 1987. He has several bar admissions aside from Washington in California, Nevada, Utah, Idaho.

Kainui Smith

Kainui Smith

Kainui Smith is an associate attorney at Schwabe, Williamson & Wyatt. His focused industries are construction and real estate. Kainui has served as co-lead counsel in construction litigation and arbitration. He’s also negotiated a settlement agreement with an independent claims administrator related to a defective roofing product. Kainui’s practice specializes in litigation and resolution. He also writes articles on new legal updates in the construction industry.

Kainui holds bar admissions in both Washington and Hawaii. He earned his bachelor’s and juris doctorate degrees from the University of Hawai’i at Manoa.

Richard O. Prentke

Richard O. Prentke

Richard O. Prentke is a partner at Perkins Coie in Seattle. He has more than 30 years of experience serving the construction industry. Richard has been named “Lawyer of the Year,” for Construction Litigation by Best Lawyers in 2020 and 2018. He’s also been listed in Chambers and Partners “America’s Leading Lawyers” in 2019.

Over the years, Richard has worked with contractors by handling construction transactions, counseling and disputes. Richard has worked preconstruction, construction-management, design-build construction transactions, and more.

He’s also provided advice on litigation of construction and has worked on public and private construction projects and programs across the nation. Richard is a mediator at the U.S. District Court, Western District of Washington and an arbitrator at the King County Superior Court.

Andrew L. Greene

Andrew L. Greene

Andrew L. Greene is also a partner at Perkins Coie. He serves as the Firmwide Chair of Perkins Coie’s Construction Practice. The firm’s construction practice is ranked Tier 1 nationally for Construction Law in U.S. News “Best Lawyers and Law Firms” and Band 1 in Washington by Chambers and Partners.

Andrew was recognized as the 2020 “Construction Law Lawyer of the Year” for Washington by Best Lawyers. His practice has several focus areas, including litigation, construction law, government contracts, arbitration, and more. Andrew is also a member of the King County Bar Association and the Washington State School Construction Alliance.

Traeger Machetanz

Traeger Machetanz

Traeger Machetanz is another award-winning construction lawyer in Seattle with his firm at DavisWrightTremaine LLP. He has been listed in Best Lawyers in America since 2006, and he’s also been selected to “Washington Super Lawyers.”

Traeger’s practice deals with construction and government contracts counseling and litigation in both Seattle and Alaska. He’s also assisted GCs, subs, and owners with bidding, contract negotiation and formation, government compliance, and dispute resolution.

Traeger is a member of several legal organizations, including the Anchorage Bar Association, King County Bar Association, Alaska State Bar Association, and the Washington State Bar Association. He also writes construction law articles for the DavisWrightTremaine blog.

Get construction legal help in Seattle and beyond

As you can see, there is a tremendous amount of highly-qualified and capable construction lawyers around Seattle. Check out our Attorney Network to find even more lawyers in Seattle and other places around the country. You can also visit our Payment Help Center to ask a question for free and have it answered by a construction lawyer in your area. We hope this list has helped you orient yourself with the legal talent that’s available in the Seattle, Washington area.

How To File A Washington Mechanics Lien | Step-By-Step Guide to Get You Paid

If you haven’t been paid for labor, services, or materials furnished on a construction project in Washington, you may be able to collect the money you are owed by filing a mechanics lien (also referred to as a Claim of Lien). Let’s look at exactly how to file a Washington mechanics lien.

Before you file: Determine if you are qualified to file a lien

Washington’s mechanics lien laws don’t give everyone the right to file a claim. The services, materials, or labor you furnish to a construction project must qualify for protection the law.

Liens are authorized by RCW 60.04.021 for any person furnishing labor, professional services, materials, or equipment for the improvement of real property.

The trick is determining whether your construction project is a qualifying improvement::

“Improvement” means: (a) Constructing, altering, repairing, remodeling, demolishing, clearing, grading, or filling in, of, to, or upon any real property or street or road in front of or adjoining the same; (b) planting of trees, vines, shrubs, plants, hedges, or lawns, or providing other landscaping materials on any real property; and (c) providing professional services upon real property or in preparation for or in conjunction with the intended activities in (a) or (b) of this subsection.

RCW 60.04.11(5)

Suppliers to suppliers are not protected.

Get paid now

File a lien through Levelset in minutes to speed up payment collection.

Did you preserve your mechanics lien rights?

Even if the Washington’s mechanics lien laws In Washington, most construction participants must deliver some type of notice to preserve their lien rights — in other words, their right to file a valid lien.

Those who did not contract with the property owner must deliver a “Notice to Owner” within 60 days of first furnishing labor or materials to the project. If you did not send a preliminary notice on time, but have furnished labor or materials within 60 days, there are some protections for those who sent late notices as to labor and materials furnished within a 60 day period from when the notice is sent.

Most notice requirements are for those who did not contact with the property owner. However, on smaller residential and commercial projects, those who did contract with the owner must provide a “Model Disclosure Statement,” also known as “Notice to Customer” under RCW 18.27.114, before commencing work to preserve their lien rights.

Failing to deliver a Model Disclosure Statement can have serious consequences. You can end up getting infracted by the Department of Labor and Industries and being counter sued for a Consumer Protection Act violation if you try to lien a job where such notice was required.

Step 1: Prepare the mechanics lien form

Washington has strict requirements about what your mechanics lien must contain, and you can find those requirements at RCW 60.04.091. The statute itself proscribes a form to use to file a Washington mechanic’s lien.

Free Washington Claim of Lien form

Download a free Washington mechanics lien form, prepared by construction attorneys to meet all statutory requirements.

Claimant information

If you’re filing a mechanics lien, it’s important to include your name, phone number, and address. Keep in mind, this is the name of the party making the lien claim. So, if you’re filing a lien on behalf of your business, you must include the business name, number, and address must be present, here.

Any information that’s incorrect could ultimately lead to an invalid claim, so attention to detail is critical.

Furnishing dates

The lien claim also needs to include the dates when you started and finished work, known as “furnishing dates.” The statute technically calls for the “first and last date on which the labor, professional services, materials, or equipment was furnished or employee benefit contributions were due.” Naturally, it’s important to keep track of these dates.

The first and last furnishing dates are generally the first and last dates when you performed work that is covered by Washington’s lien laws:

- First furnishing: The first day you began work or delivered materials

- Last furnishing: The last day you provided labor or materials

If you provided non-covered work, like pulling permits or punch list items, don’t include these when calculating your furnishing dates.

Name of your customer

A Washington mechanics lien must include “The name of the person indebted to the claimant.” This will usually be your customer — but, if someone else was supposed to pay you for your work, you should include that person here. When in doubt, it might be worthwhile to put both, just to be sure.

Keep in mind that it’s common for businesses to operate under one name (like a D/B/A or a nickname), but for their actual business to be called something else. Lien claimants should be as accurate as possible when filing a lien, so it may be worthwhile to double-check their legally registered business name.

Description of the property

It’s common to think that a legal property description is required for all lien claims. However, the Washington mechanics lien statute calls for “The street address, legal description, or other description reasonably calculated to identify, for a person familiar with the area, the location of the real property to be charged with the lien.“

Still, a legal property description is the most official way to describe the property, and failing to properly describe the land in some other way could result in the loss of lien rights. So, when possible, it’s a good idea to find the legal property description.

Name of the property owner

You also need to identify the property owner or “reputed owner.” This is simple on its face, but if you don’t have a contract with the owner, finding their information can be a challenge. Learn how to find the property owner on any project.

Note that there’s some wiggle room here with “reputed owner.” A reputed owner is someone who’s reasonably believed or held out as the property owner. That way, if appearances aren’t what they seem, a lien claimant won’t lose the ability to file a mechanics lien simply because they got the owner’s information wrong (as long as there was good reason for believing the “reputed” owner was actually the owner).

Note, though, that Washington is a rare state where the owner’s information isn’t always required. If the owner or reputed owner isn’t actually known, the lien claimant can state that the owner isn’t known right there on the lien. Still, it’s a good idea to include the owner’s information in Washington mechanics lien claims.

Lien amount

This part’s easy — it’s the amount of money for which the lien is being claimed. Keep the rules described at the beginning of this article in mind – some debts might not be lienable. But, generally, construction work performed but not paid for will give rise to lien rights.

Don’t take too many liberties with the lien amount. Interest, attorney fees, and filing fees can’t be included in a lien claim, and neither can other extraneous amounts.

Rather, the lien amount should reflect what is owed but unpaid for work performed. Note that exaggerating a lien claim can lead to the loss of lien rights and even liability.

Assignee (if the lien has been assigned)

This probably isn’t something most lien claimants have to worry about. But, if the lien claim has been assigned to someone else at the time the lien is filed, the assignee (person receiving the right to payment) must be featured on the lien form.

If you’re not familiar with assigning a mechanics lien, don’t sweat it – we’ve got you covered! Things to Think About When Assigning a Mechanics Lien.

Signature and acknowledgement

Before filing the lien, it must be signed and acknowledged. That means the document must be notarized. Again, it’s important that the document is as accurate as possible, because you’re swearing to its accuracy at this point. So, if you know something on the document is inaccurate, it would be wise to fix the issue before signing and acknowledging it. Otherwise, some liability might arise later on.

Step 2: File the lien

After you fill out the mechanics lien form, the next step is to file your claim. This is also known as recording or perfecting a lien. Mechanics lien claims must be filed in the county recorder’s office in the county where the property is located. If a project is situated in two counties, it must be recorded with both recorder offices.

View all Washington county recorder offices

Deadline to file

Washington requires all parties to record their mechanics lien within 90 days after last furnishing services, labor or materials to the project. There are no excuses for a late filing — once the deadline has passed, it’s gone forever. If you record a mechanics lien late in Washington, it will be void.

What to bring

Generally, filing a Washington mechanics lien is simple compared to some other states. Lien claimants will generally only need to bring their lien claim and their checkbook. Filing a mechanics lien isn’t free, but each county has its own fee schedule for recording documents, and those fees are subject to change. So, claimants are usually better off waiting to write their check until they’re sure what the filing fees will be.

Recording options

There are a few different ways to file a lien. Let’s discuss the 3 most common methods: filing in person, filing by mail, and filing electronically.

In person

If you are filing a Washington mechanics lien on your own, delivering it in person is the safest way to file a lien — a claimant can immediately be sure that the fees are correct. It’s also the easiest way to know whether the lien was filed or rejected.

Filing in person isn’t always practical, though. For claimants who aren’t able to go to the county recorder’s office and file the lien themselves, mailing or electronically recording (“e-filing”) the lien are great options.

By mail

Filing a mechanics lien by mail, when done right, can alleviate the stress and time associated with having to file a mechanics lien in person. But, as mentioned above, it’s important to verify filing fees.

Since a check will be mailed along with the lien document, it’s crucial to verify the filing fees before actually filing the lien. Mechanics liens are regularly rejected for including incorrect fees (whether the fees have been overpaid or underpaid).

Electronic

Most counties in Washington allow for mechanics liens to be electronically recorded. This combines the relative ease of filing by mail with the certainty which comes with filing a lien in person.

When a document is electronically recorded, that recording is placed remotely, but the county auditor’s office must still review the filing. Typically, they’ll reply pretty quickly indicating whether the document has been accepted or rejected.

However, in order to electronically record documents in Washington, a claimant will likely need to have an account with an electronic recording service provider, like Simplifile. Here’s a list of Washington counties Simplifile currently operates in: Simplifile E-recording in Washington.

Step 3: Serve a copy of the lien

Washington requires all mechanics lien claimants to serve a copy of the mechanics lien on the property owner within 14 days of recording. Failure to serve the lien might not invalidate it, but it will disqualify you from recovering your attorney fees in any action to enforce the lien (Washington law typically allows lien claimants to recover their attorney fees).

So, not having the lien served can be an expensive oversight. The mechanics lien must be served on the property owner by certified or registered mail, or by personal service.

Besides all of the requirements, though, this is just a basic, important part of the payment recovery process (at least when a lien is involved).

Step 4: Get paid — or enforce the lien

Filing a mechanics lien doesn’t automatically result in payment. Rather, the lien claimant uses the filing itself as leverage to get paid.

Once the owner is aware of the lien claim, it’s time to talk payment. Generally, owners and general contractors don’t like dealing with lien claims, and owners are naturally wary of anything that could harm their title to the property. So, even if they’ve been unwilling to make payment, once a lien has been filed, they may come around.

The vast majority of mechanics lien claims are resolved without the need for legal action. Still, an owner or contractor may need a little extra push after a lien has been filed.

If a lien has been filed but payment hasn’t been made, sending a document like a Notice of Intent to Foreclose can help. By sending a Notice of Intent to Foreclose, a claimant can show the owner or contractor that they’re not afraid to do what it takes to get paid on the lien — even if that means taking their lien claim to court.

Enforcing the lien

Nobody likes mechanics liens. But you know what they hate even more? A lawsuit. Still, if push comes to shove and payment still isn’t made, filing a lien enforcement suit may become necessary. By enforcing a mechanics lien, a lien claimant is filing a lawsuit to collect the payment on the lien. And, if worse comes to worst for a property owner, their land may even be foreclosed.

Of course, lawsuits are expensive. So, before proceeding with a lien enforcement suit, it’s worth weighing whether filing suit is worthwhile. But, as alluded to above, Washington mechanics lien claimants who successfully enforce their claims are entitled to recover attorney fees and other costs. So, when a claim is rock-solid, there might not be all that much risk involved.

Note that there’s a time limit, though — mechanics liens don’t last forever. In Washington, a mechanic lien must be enforced within 8 months from the date the lien was recorded.

Releasing the lien

Once payment has been made one way or another, it’s time to release or cancel the lien claim. Washington law requires that the lien claimant “immediately prepare and execute a release of all lien rights” once full payment is made. Even if payment isn’t made, it might be a good idea to release an expired lien to avoid potential liability down the line.

Releasing a filed lien is done similarly to filing the lien, itself. A lien release must generally be in a recordable format, must identify the previously filed mechanics lien claim, and must generally request that the lien be released.

Other Washington Mechanics Lien Resources

2022 Guide to US Building Commercial Construction Cost per Square Foot

Commercial construction can be a lucrative business, but it’s not for the faint of heart. Companies working in the commercial industry need to have plenty of cash in reserve or easy access to a healthy credit line. Between commercial construction being so cash-hungry and notoriously slow payments, contractors need to have a laser focus on their construction cost per square foot.

By controlling these costs with effective forecasting and keeping their eye on the budget, contractors can replenish their cash reserves with a healthy profit when the project wraps up.

The cost per square foot on a commercial project can vary quite a bit from one project to another. This is especially true when you compare the costs of commercial projects in different areas of the country, as well as the types of commercial buildings.

Let’s take a look at the average price per square foot in commercial construction, and learn about how much it can differ depending on your project and its location.

Learn more – Residential and Commercial Construction: 7 Crucial Differences

Types of commercial construction

Commercial construction includes a wide range of building types. Essentially, commercial construction boils down to almost any project that isn’t purely residential in nature.

Common examples of commercial projects could include office buildings, malls, schools and universities, sports stadiums, hotels, entertainment venues, and parking structures.

Even apartment buildings, full of residential spaces, are considered commercial projects. Most states consider residential projects as single or multi-family structures under three or four units. States generally consider structures outside of that scope as commercial construction projects.

Read the full guide: How Much Does it Cost to Build an Apartment Complex?

Factors that affect commercial construction costs

Many factors come into play when pricing out a commercial project. You have to understand the difference in locations, materials, and labor can have a huge impact on the cost per square foot. The types of buildings and finishes included will also undoubtedly reflect in the total building cost.

Location

Some areas of the country are just generally more expensive to build in. For instance, a highly desirable area in a crowded city will be more expensive to build in than a less populated area. A project in NYC can cost more than twice as much as the same project in a small midwestern town. While some of this is due to the cost of labor, much of it just has to do with the climate and precedents set by other buildings erected in the area.

Building type

The type of building you’re constructing definitely impacts the cost per square foot. For example, a basic single-story warehouse will cost much less per square foot than a high-rise office building. The high-rise will have much higher engineering and planning costs, site prep, permits and inspections, and logistical costs, all of which contribute to the cost per square foot.

It will also have different structural needs, which we’ll get to next.

Materials

The materials specified by the designer have a lot to do with a building’s cost to build. A steel-structured building that requires extensive fabrication won’t be cheap to build. Also, custom-built windows and doors can quickly drive up the price per square foot.

Building Material Price Tracker: View cost trends for common construction materials

Finishes

If you haven’t considered the cost of the finishes, you’re missing a huge piece of the puzzle. The perfect example is the consistent $200-plus per square foot jump in price between three-star and five-star hotels. High-end finishes will drive the cost per square foot up tremendously over builder-basic or mid-grade options.

Labor

One of the most significant factors in the cost of building per square foot is labor. In areas where unions are popular, the price per square footage will be significantly higher than it would be in non-union regions.

In areas experiencing booms, workers will expect to be paid quite well — or they’ll jump ship to the next contractor that will pay their price.

Commercial construction costs per square foot: Breakdown by region

If you’re wondering how the costs per square foot stack up against each other in the different regions, this next section is for you.

We’ll break down the average cost for a commercial project per square foot in the East, West, Midwest, and South in the United States.

In order to bring you these averages, we used Cumming’s U.S. Construction Per Square Foot Data.

Commercial cost per square foot in the Eastern US

Using figures from New York City, Boston, Washington DC, Philadelphia, and the Raleigh-Durham area, we’ve come up with the average cost per square foot for commercial projects in the East.

On average, the cost to build a single-story commercial office building on the high end is $361 per square foot. On the low end, the average cost is $301 per square foot. For a mid-rise building, the numbers jump to $719 and $599, respectively. High rise buildings jump a bit more, with a high average of $827 and a low average of $688 per square foot.

A standard neighborhood strip mall’s cost per square foot averages at $371 per square foot on the high end and $309 on the low end. A regional mall’s top-end average is $554 per square foot and $461 for a bottom average.

For a three-star hotel, your high and low average costs per square foot are $604 and $489, respectively. Bump that up to a five-star hotel, and you’re looking at $871 per square foot on the high side and $677 on the lower end.

When it comes to elementary, middle, and high school construction, the average cost per square foot on the high end is $381, while the low end comes in at $317.

Commercial costs per square foot in the Western US

The average cost per square foot in the West is the result of samples from San Francisco, Los Angeles, San Diego, Sacramento, Las Vegas, Seattle, Portland, and Honolulu.*

Single-story commercial office buildings in the West average $378 per square foot on the high end, and $313 for the low end. Mid-rise commercial buildings average $607 for a high, and $481 for a low. High-rise buildings cost an average of $730 on the high end, and $557 per square foot on the low end.

A neighborhood strip mall in the west will cost $413 for an average high and $261 for an average low. Regional mall highs and lows are $575 and $442 per square foot, respectively.

If you’re building a three-star hotel in the west, average costs will be $545 at the top of the range and $402 for the low average per square foot. Make that a five-star hotel, and your high average will be $849 while the low comes in at $577.

For education K-12 school buildings, the average cost per square foot in the west is $417 on the high end and $341 on the low side.

* Note: The cost of construction in Honolulu can drive the average cost per square foot up significantly. The difference is $10 per square foot more in the case of the average price to build a hospitality building.

Commercial costs per square foot in the US Midwest

The building climates in the Midwest vary quite a bit, but these averages are from samples in Denver, Chicago, and Nashville.

If you’re in the commercial office building business, constructing a single-story commercial building will average $298 per square foot on the high end and $237 for the low average. Building a mid-rise building will average $556 per square foot for a high in the Midwest and $454 on the low. High-rise buildings jump a bit more, with a high and low average of $689 and $554 per square foot to build, respectively.

A basic neighborhood strip mall has a high average cost per square foot of $340 and a low of $284. Those numbers jump to $507 and $423 for building a regional mall.

When it comes to hospitality buildings, a three-star hotel’s cost per square foot will average $400–$533. You’ll see a respective jump to $537–$762 for building a five-star hotel.

When it comes to a school building, K-12 buildings average $290 per square foot on the high side and $242 on the lower end of things.

Commercial costs per square foot in the Southern US

Examples for the average cost per square foot in the South came from samples of the commercial building climates in Dallas, Atlanta, Orlando, and Miami.

Building a single-story commercial office building will cost an average of $238–$286 per square foot. A mid-rise building costs $569 on the high end and $474 on the low end to construct. Building a high-rise will cost a high between $545–$654 per square foot on the low end.

If you’re looking to build a strip mall, high costs average $245–$294 per square foot. Building a regional mall averages $439 on the top end and $366 at the average bottom price per square foot.

Building a three-star hotel will between$478–$341 per square foot. A five-star hotel costs an average of $683 per square foot on the high end and $462 on the low end to build.

Constructing K-12 school buildings in the South will cost an average of $260 per square foot on the high side and $217 for a low average.

Commercial building cost per square foot: Breakdown by building type

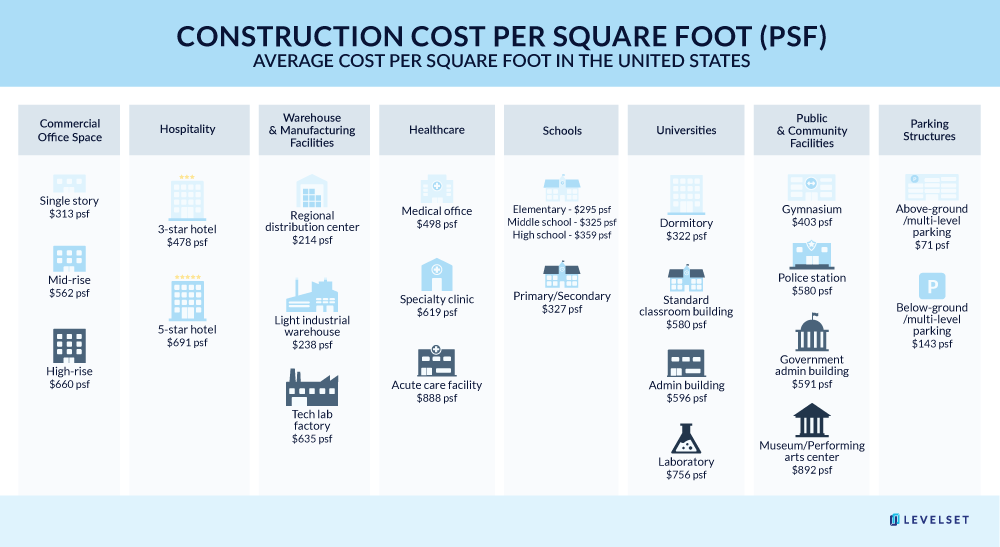

The cost per square foot varies wildly between the types of commercial projects you’re working on. We’ve examined the regional variants, but here’s a breakdown of the average cost per building type across the US as a whole.

Commercial office space

If you’re building a single-story office space in the US, your average cost per square foot will be around $313. Constructing a mid-rise office building will cost an average of $562 per square foot. High-rise buildings cost an average of $660 per square foot to build.

Hospitality

As you can imagine, the finishes in hotels can vary throughout the nation, driving a significant range of cost per square foot. However, building a three-star hotel in the US costs an average of $478 per square foot. A five-star hotel costs an average of $691 per square foot to build.

Warehouses and manufacturing facilities

Prices per square foot to build warehouses and manufacturing facilities often vary based on what the facility will be storing or making.

However, building a regional distribution center will cost an average of $214 per square foot. A light industrial warehouse will cost an average of $238 to build. Tech laboratory facilities are much more expensive to build, with an average cost per square foot of $635.

Healthcare

Healthcare is always big business, and new facilities seem to pop up all the time. Acute care facilities are expensive to build, costing an average of $888 per square foot. Medical office buildings cost an average of $498 per square foot to build in the US. A specialty clinic costs an average of $619 per square foot to build.

Schools and universities

If you’re looking into building a primary or secondary school building, it will cost an overall average of $327 per square foot. This brings into consideration the elementary, middle school, and high school averages of $295, $325, and $359 per square foot, respectively.

Building higher education facilities is much more expensive than constructing grade schools. Standard classroom buildings cost a square-foot average of $580. Laboratory buildings cost $756 per square foot on average to construct. Your average American university admin building costs $596 per square foot to build. Dormitories are the least expensive of the university structures, costing an average of $322 per square foot to build.

Read the full guide: How Much Does it Cost To Build a School?

Public and community facilities

Public and community buildings can be some of the most costly to construct per square foot.

Gymnasiums and rec centers cost $403 per square foot to build. Police stations cost an average of $580 per square foot to build.

Government administration buildings cost an average of $591 per square foot.

The most expensive of all structure types on our list of commercial structures are museums and performing arts centers, costing an average of $892 per square foot to build.

Parking structures

Compared to the other commercial building types, parking structures are the least expensive to build. A below-grade, multi-level parking structure costs an average of $143 per square foot to build, while an above-ground multi-level structure costs $71 per square foot.

The cash flow challenges of commercial construction

The construction industry puts a significant amount of pressure on the cash flow of its contractors. Fronting cash for projects is the norm, and it can really take its toll on a company. The issue gets even worse when it comes to commercial projects.

While most projects, regardless of size, require a bit of cash upfront from the contractor, some situations are easier to deal with than others. Residential contractors tend to have far less cash out before they start to get paid for their work. Conversely, commercial contractors might have to front millions of dollars to get a project off the ground. Couple that cash with the fact that commercial construction payments are painfully slow, and one missed payment can wreck a company.

Bechtel for Subcontractors: Payment Guide & Resources

Bechtel tops the list of the largest contractors in the country. They are a powerhouse for engineering, construction management, and development in the United States. Subcontractors working with a GC like Bechtel are likely involved in an important and potentially lucrative project.

However, before jumping the gun and signing the contract, subcontractors should do all the research they can. Construction projects are unpredictable, and the industry is riddled with cash flow issues and other hang ups. Furthermore, working on a massive project with countless other subs means transparency on the job is limited—and your pay app could get buried underneath everyone else’s.

Since it’s vitally important for subcontractors to learn everything they can about their general contractor, this guide will introduce subcontractors to Bechtel’s payment process, helping you make informed decisions and greatly improving your chances of getting paid in-full and on-time.

About Bechtel

Like many other great construction firms, Bechtel had humble beginnings. Founded in 1898 by Warren A. Bechtel, the firm has been in business for more than 120 years. In 2019, Bechtel pulled in around $21.8 billion.

Bechtel is headquartered in Virginia, and has eight other offices around the US, including:

- Arizona

- Houston

- Los Angeles

- New York

- Tennessee

- Washington

- Washington DC

- Texas

Bechtel also has offices in nearly every continent across the globe.

Bechtel specializes in defense and nuclear, environmental cleanup and management, energy, infrastructure, mining and metals, petrochemicals, and water. Bechtel fulfills a wide variety of roles on their projects, including general construction, engineering, development, investment and financial, master planning, and much more.

Before Working With Bechtel

Always prequalify a general contractor before signing a contract with Bechtel or any other company. The pre-qualification process is relatively straightforward, and it can be completed in five simple steps:

- Review the GC’s payment history

- Check their credit history

- Find out what other subcontractors have said after working with the GC

- Call the general contractor and ask about their payment process directly

- Ask the GC for a copy of a subcontract for you or your attorney to read over

If the general contractor meets your criteria based on these five parameters, then you can feel a little bit more confident when it’s time to sign the contract and get to work.

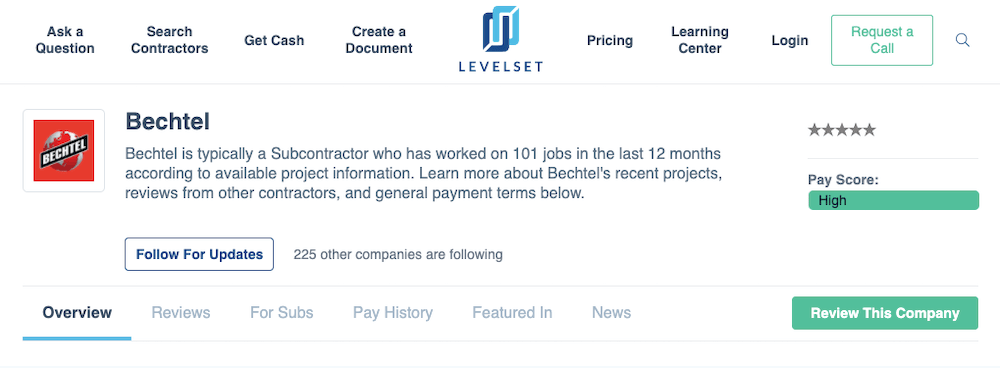

Review Bechtel’s Payment Profile

A great place to begin your pre-qualification is on Bechtel’s payment profile, where you can view their payment history, read subcontractor reviews, and see their overall payment score.

Despite their speedy rating, there are two incidences of slow payment on record and two liens threatened on projects in California three months ago. That means 96% of Bechtel projects in the last 12 months have had no reported payment issues from other contractors.

Bechtel’s Payment Process

Bechtel’s payment process isn’t unlike other comparably-sized general contractors, although a couple of their company standards may be slightly different.

Bechtel’s subcontractor & supplier page contains information and resources. Their Supplier Guide is for subcontractors, too. It contains information about their global supply chain and performance standards, selection process, and guidelines for working with the company.

On Bechtel’s Supplier Resources page, you can register for Oracle EBS, the software that Bechtel uses for communications and negotiations with the contractors they work with. Contractors and suppliers can begin the pre-qualification process here.

Getting Prequalified

Before working with Bechtel, you need to get prequalified. After registering your company, you will need to submit a Pre-qualification Questionnaire through the iSupplier portal.

Note: Subs and suppliers will need to get a DUNS number before registering their company on the iSupplier portal.

Prospective subcontractors receive the questionnaire if a Bechtel buyer is interested in learning more about their company and the products they offer.

You will find all the forms, documents, and other information you need to provide within the iSupplier portal.

After you answer the questionnaire and submit it, it will be reviewed by a Bechtel buyer, who will reach out if they wish to move forward with your company.

You can find more information about the pre-qualification process for Bechtel on the resources page.

Before the Job Begins

After you’re pre-qualified, you need to provide the necessary paperwork for insurance and payment purposes. Usually, this includes:

- A W-9 form

- The contract

- Any bonds related to the project

- Proof of insurance

Applying for First Payment

The first step in getting paid on time is to make sure all the information in your payment application is as accurate and thorough as possible. Bechtel uses standard AIA billing forms. These forms include the G702 Application for Payment and the G703 Continuation Sheet.

Pay apps, negotiation documents, and other invoice-related paperwork can be submitted through the iSupplier portal.

Applying for Progress Payments

To apply for progress payments, provide a detailed pay application as well as a thorough schedule of values.

Applying for Final Payment

As the project reaches its end, it’s time to apply for final payment. Upon sending your final pay application, complete and submit any requested closeout documents. These should be sent to you by the project administrator for you to submit along with the pay app.

Bechtel may also require you to submit lien waivers, written consent from the sureties, or any other related paperwork.

3 Tips to Get Paid With Bechtel

Whether or not you expect payment issues while working with Bechtel, it’s always a good idea to employ the best practices for construction payment in case anything go wrong on the project. The general contractor isn’t always in control. Project funding could fall through, the property owner could delay payment to the GC, or an architect could reject your pay application.

Subcontractors have payment rights that are backed up by law. Here are three easy ways to leverage your right to get paid on a construction project with Bechtel.

1. Always provide preliminary notice

A preliminary notice informs the people in charge of the project that you’re on the job, and what kind of work you’re doing. This simple step will do wonders for any company’s accounts receivables.

Construction projects with companies like Bechtel can be gigantic, and sometimes subs and suppliers can get lost under all the other parties and paperwork. Sending a preliminary notice is a requirement to protect your lien rights in many states, and failure to send one could leave you with little to no recovery options down the line.

2. Review lien waivers

General contractors will often ask subcontractors to sign lien waivers in exchange for payment. If you’re presented with one, always have a construction attorney look it over before you sign it.

If the terms aren’t agreeable, signing the waiver could leave you without options. Construction attorneys specialize in reading documents like these, and having one on your team greatly increases your chances of a complete and timely payment.

3. Secure your lien rights

Make sure your lien rights are secure so you can file a claim in case you go unpaid for the labor or materials you supplied. Since Bechtel operates in 10 states, you want to make sure you’re up-to-date on the mechanics lien laws in your state.

Mailing Construction Notices: Is notice served when mailed or received?

Given the impact of COVID-19 on construction, many businesses have been forced to close their doors, whether it be temporarily or permanently. This means that securing your lien rights during this time is more important than ever. However, this inevitably raises questions in contractors’ minds. When is a construction notice served – upon mailing, or upon delivery? What if my notice was never delivered? What if it was returned undelivered? What happens to my mechanics lien rights? This article will break down the service requirements and when they’ve been met in each state.

Continue reading “Mailing Construction Notices: Is notice served when mailed or received?”Lien Release Deadlines & Penalties in All 50 States

If you’ve filed a mechanics lien, and eventually get paid before the enforcement deadline, congratulations! Now that you’ve got your money in hand, you’re ready to move on to the next project. But not so fast! You may still be required to release your lien claim. Just because a lien has expired doesn’t mean it has been removed from the books. In many states, once the claim has been satisfied you may be required to release the lien. A contractor or supplier who fails to release a lien by the deadline may be liable for fines and other penalties.

Learn more: Read the Guide to Lien Releases in Construction

Continue reading “Lien Release Deadlines & Penalties in All 50 States”