Connecticut Lien Waiver Rules

- Rules At A Glance

- Top Links

No Specific Form

Connecticut does not require any specific or statutory lien waiver form. Parties are free to use any form they wish.

Notarization Not Required

Connecticut lien waivers are not required to be notarized, and gain no benefit from notarization.

Cannot Waive Rights in Contract

Connecticut statute does not allow lien waivers in advance of furnishing of materials and/or performance of services. However, lien rights may be subordinated under a mortgage or other security interest by contract.

Can Waive Rights Before Payment

Connecticut statute forbids lien waivers prior to payment. However, lien rights may be subordinated under a mortgage or other security interest by contract.

Lien waivers are pretty complex documents. But they are also unassuming because of how frequently they get exchanged on construction jobs across the country, and in Connecticut. A lien waiver is basically a receipt that payment has been made for work or materials on a job. These documents are exchanged at the time of payment, and commonly attached to subcontractor pay applications or vendor invoices.

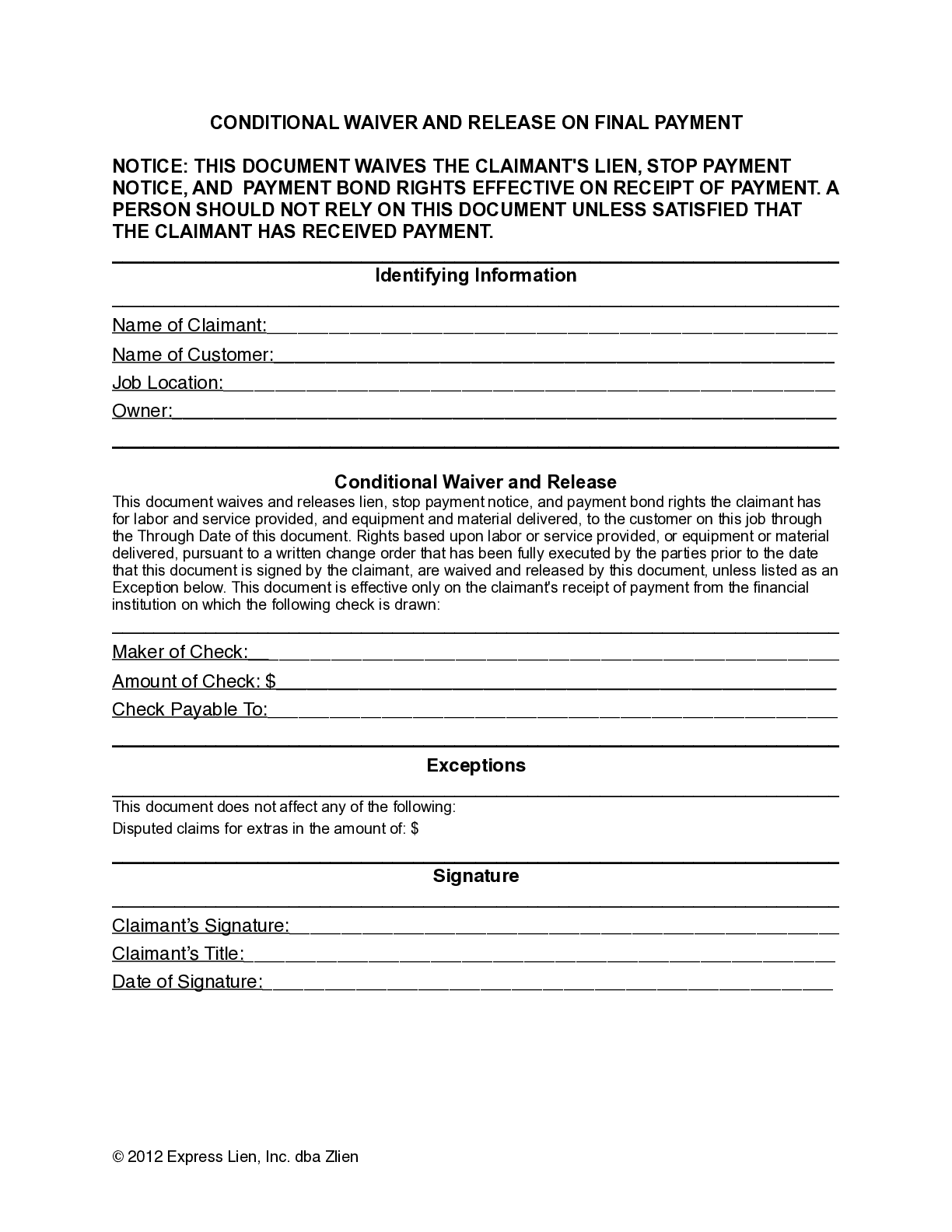

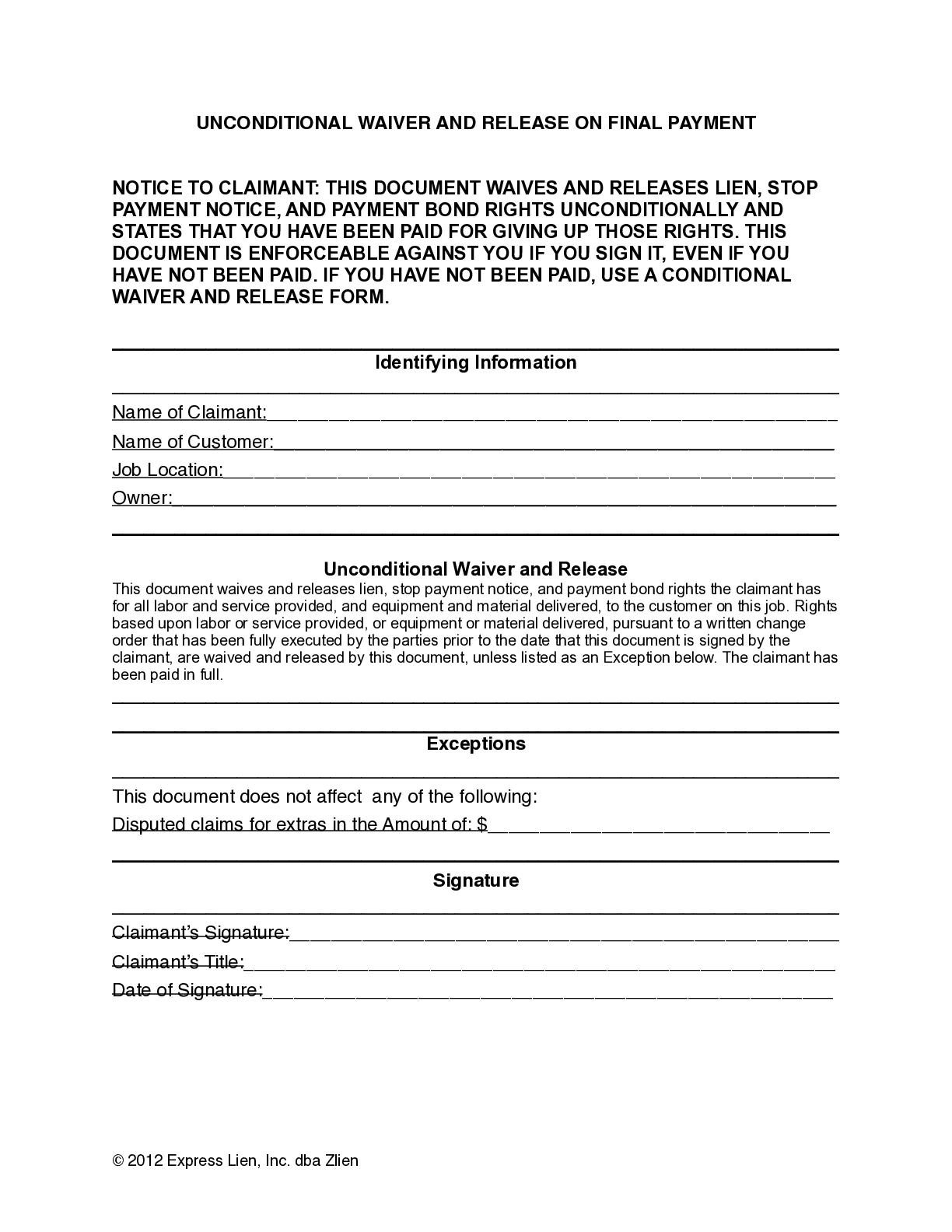

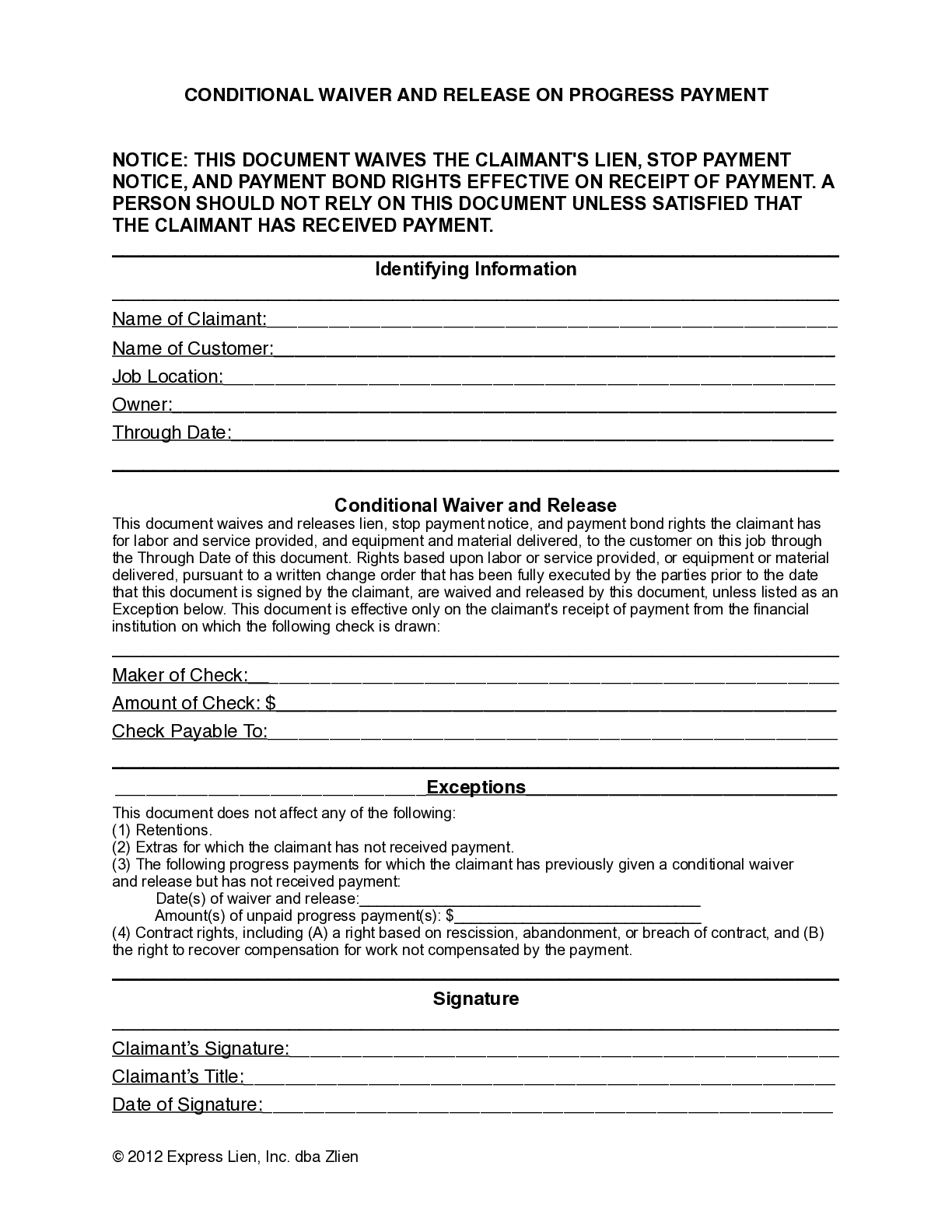

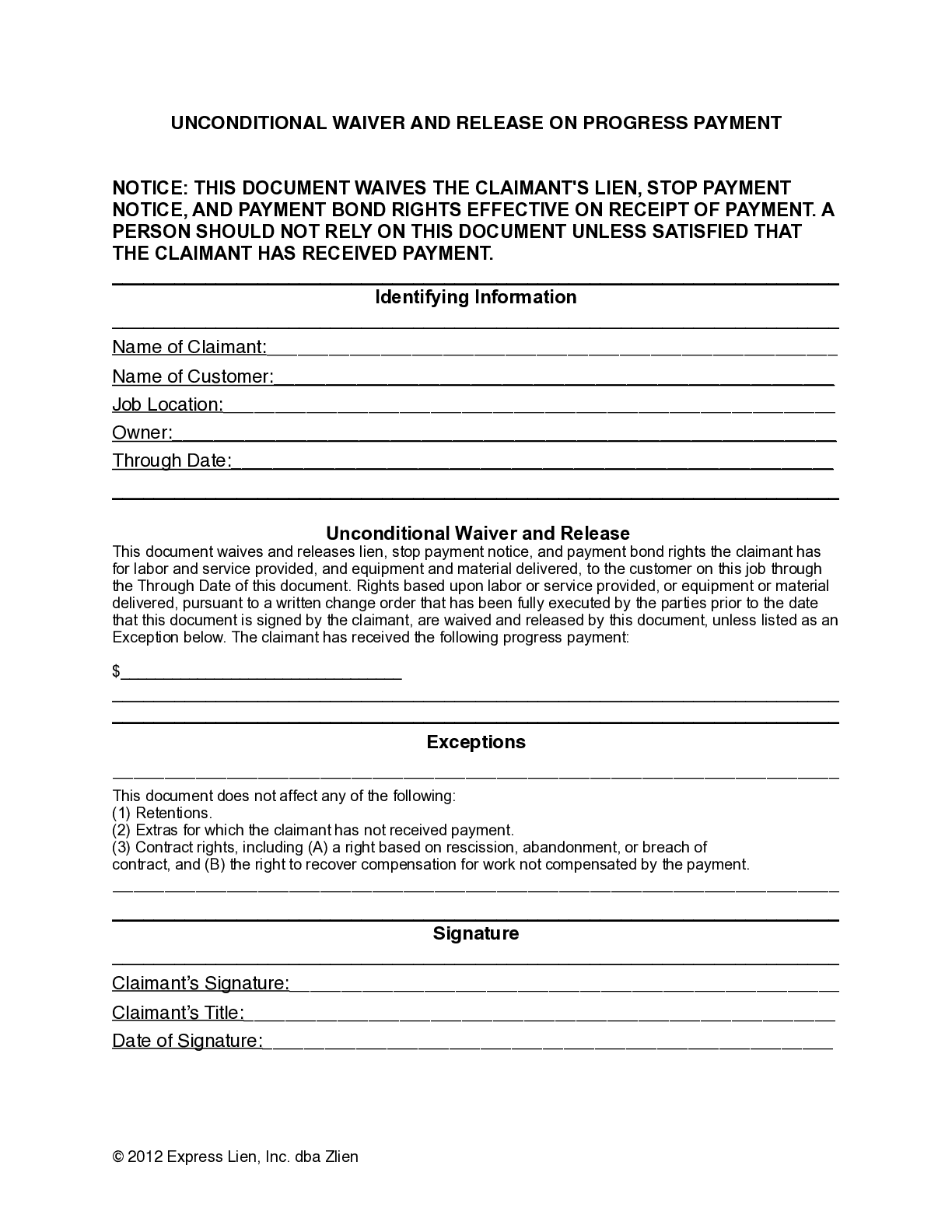

There are different types of lien releases for different types of situations. And these documents have significant consequences for everyone on a job — as it connects directly to everyone’s right to cash! Also, one pesky aspect of lien waivers is that the process of sending, requesting, tracking, and collecting lien waivers is an administrative pain that slows down the payment on a project.

Knowing everything you can about lien waivers will allow you to make your process faster. And if your process is faster, your cash will move faster; and that’s good news for everyone on the project!

- For more on lien waivers in general, see: The Ultimate Guide to Lien Waivers in Construction

Connecticut lien waiver laws

Connecticut lien waivers are unregulated. There are no specific forms to use, and the state does not have specific laws regulating the lien waiver exchange process. As a result, contractors, suppliers, vendors, lenders, and other project participants must manage the lien waiver process closely to avoid costly errors.

Whenever payment exchanges hands in the construction industry, parties typically exchange lien waivers to document the receipt of funds and the waiver of any mechanics lien rights. Many state laws set out the actual lien waiver form template that construction job participants must use. Connecticut is not one of those states.

The lack of regulation actually makes exchanging lien waivers more difficult in Colorado, and riskier. This slows down the construction payment process. Plus, lien waivers can be a source of confusion with lots of room for error. Below are some frequently asked questions about the lien waiver laws and requirements in Connecticut.