New York Lien Waiver Rules

- Rules At A Glance

- Top Links

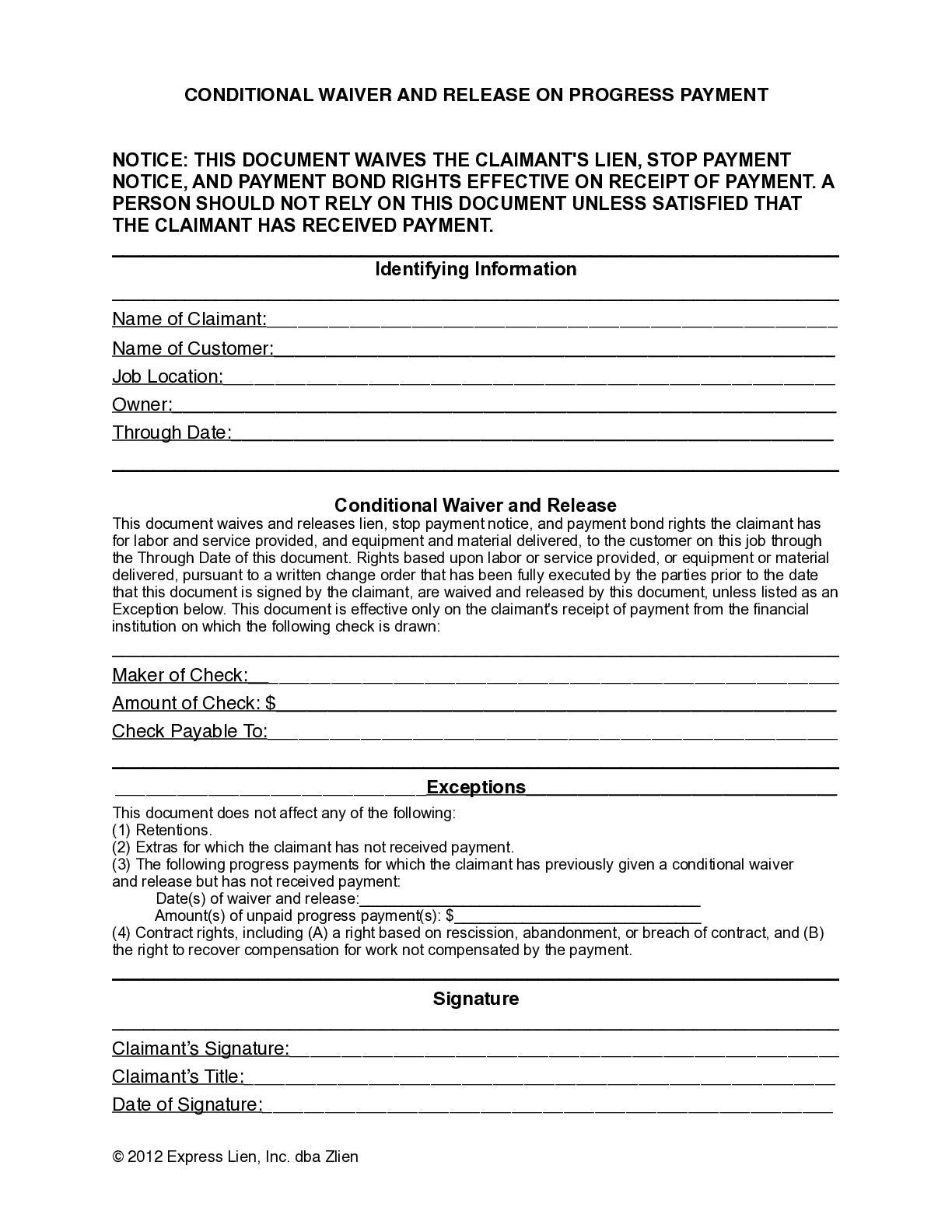

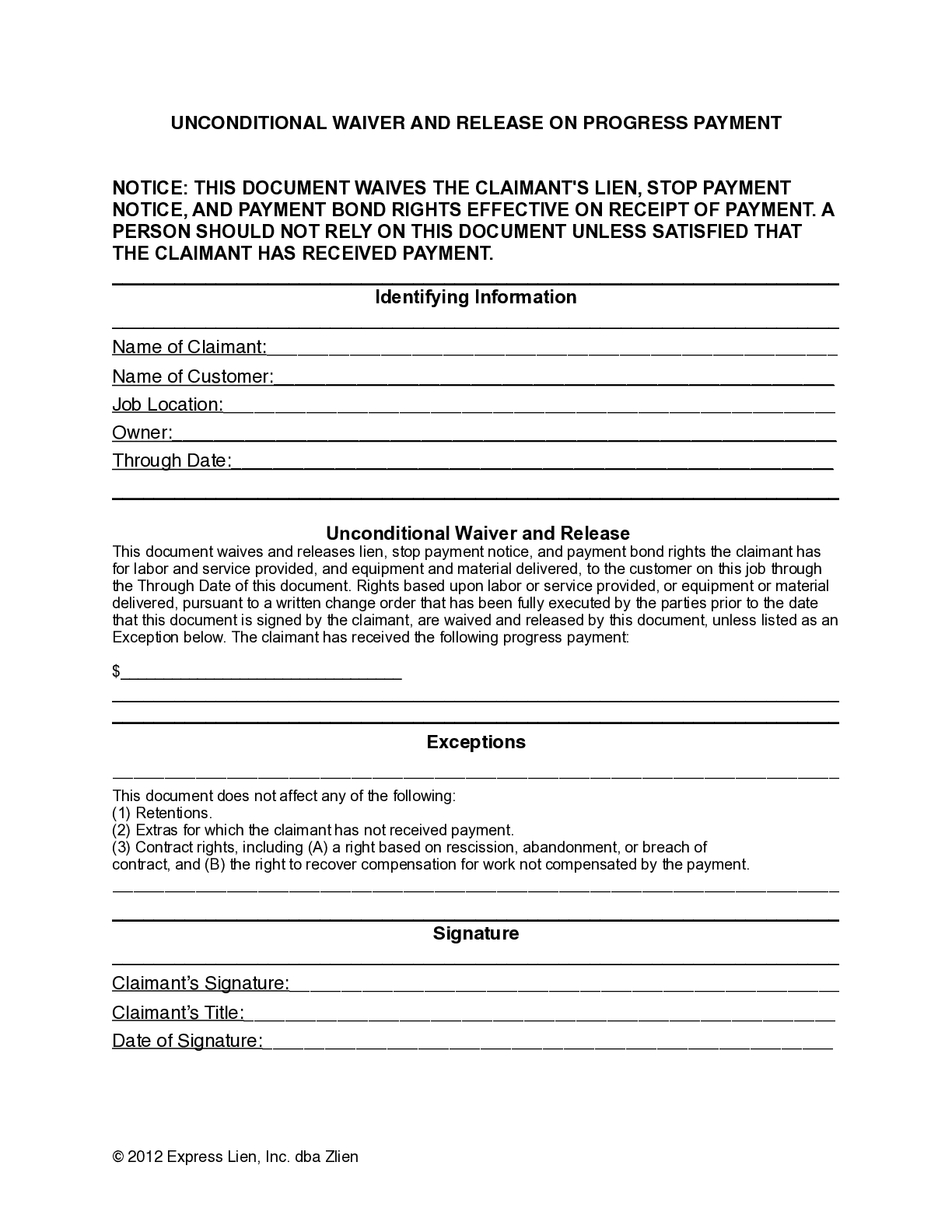

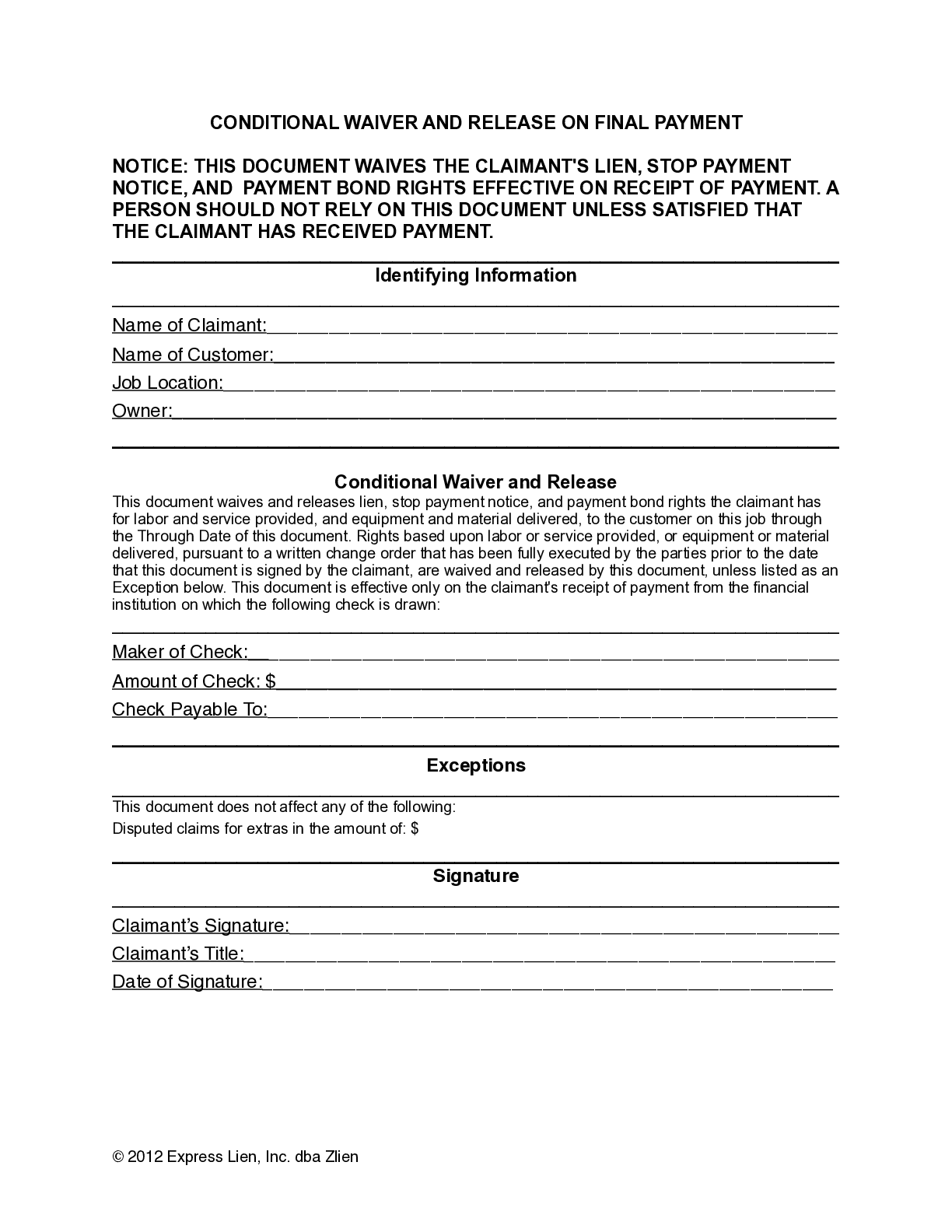

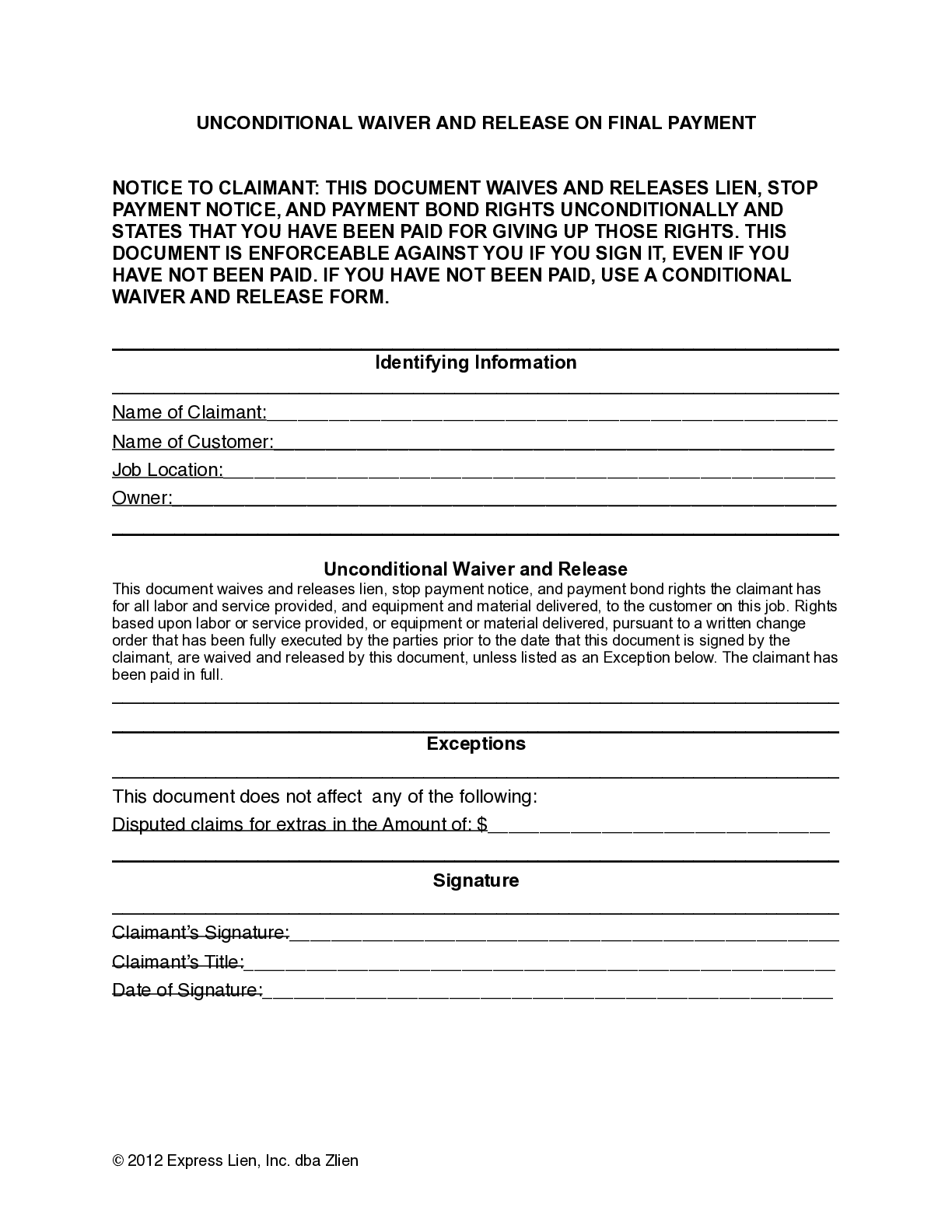

No Specific Form

New York does not require any specific lien waiver form. Any form may be used.

Notarization Not Required

New York does not require lien waivers to be notarized.

Cannot Waive Rights in Contract

New York does not allow lien waivers in the contract.

Cannot Waive Rights Before Payment

New York lien law specifically prohibits lien waivers prior to payment. Lien waivers are effective only if delivered simultaneously with, or after, payment is made.

Lien waivers are pretty complex documents. But they are also unassuming because of how frequently they get exchanged on construction jobs across the country, and in Illinois. A lien waiver is basically a receipt that payment has been made for work or materials on a job. These documents are exchanged at the time of payment, and commonly attached to subcontractor pay applications or vendor invoices.

There are different types of lien releases for different types of situations. And these documents have significant consequences for everyone on a job — as it connects directly to everyone’s right to cash! Also, one pesky aspect of lien waivers is that the process of sending, requesting, tracking, and collecting lien waivers is an administrative pain that slows down the payment on a project.

Knowing everything you can about lien waivers will allow you to make your process faster. And if your process is faster, your cash will move faster; and that’s good news for everyone on the project!

- For more on lien waivers in general, see: The Ultimate Guide to Lien Waivers in Construction

New York lien waiver laws

New York lien waivers don’t have specific requirement with respect to form or language, but they do have specific requirements with respect to when they can be effective.

In New York, there aren’t specific laws that detail what a lien waiver should say, or how exactly a lien waiver should look. This means that parties on a New York job have a lot of leeway in determining the contents of the lien waivers that they request or provide. This, in turn, means that unscrupulous parties can take advantage of the lax rules regarding the lien waiver form to include overreaching clauses.

There are some significant limitations on how and when contractors, subcontractors, and suppliers can waive their lien rights in New York, though. Since protecting lien rights is public policy in many states, there are often protections in place to make sure those rights aren’t unfairly side-stepped. New York, in particular, specifically prohibits lien waivers prior to payment. Lien waivers are effective only if delivered simultaneously with, or after, payment is made.

It’s important to make sure that lien waivers aren’t accidentally or purposefully overreaching), and that they are given at the right time and in exchange for payment. The resources, forms, guides, and frequently asked questions about New York Lien Waivers on this page will help you get it right.