If you’re a property owner or property developer about to embark on a construction project in Florida, you’re likely full of questions about the process of obtaining a building permit, completing and filing the notice of commencement, and ultimately, getting out of your Florida construction project alive with a job that finishes on time, on budget, and stays free and clear of any expensive lien claims.

It’s this last item that is the scariest: lien claims.

In Florida, as it is all across the United States, any subcontractor or supplier to a construction job can file a mechanics lien if they’re unpaid for work or materials provided to the job. And if a lien claim is filed against your job, regardless of whether you already paid the general contractor, you may be required to pay the claim. This means you can pay for the same work twice!!

The Florida laws provide protections to property owners like you against this happening…but you’ll need to jump through some hoops and pay close, close attention to all the dollars being spent on the project.

The Florida process to protect property owners against lien claims and double-payment starts with the Florida Notice of Commencement.

This is a detailed guide and checklist for property owners to understand the properly utilize the notice of commencement & Florida lien waiver process to avoid expensive claims and problems on their Florida construction jobs.

Waiver Forms

lawyers to meet Florida's lien waiver rules.

Download or send a form today.

Video: What is a Florida Notice of Commencement?

In case you’re not familiar with the Notice of Commencement, this short video explains the important Notice of Commencement requirements in Florida.

1. Check Out Your General Contractor

Before getting into the building permit, the notice of commencement, the lien waiver tracking, and all the logistics that property owners must juggle on Florida construction jobs, let’s start with the most crucial thing that can make or break your project: the general contractor.

There is a lot of helpful information available to owners to help them choose a general contractor for their job. One really good article about choosing a GC in Florida specifically was written by Florida construction attorney Charles Jimerson in 10 Things To Consider When Selecting A General Contractor in Florida. Government agencies also frequently publish information to help owners with this process. One good federal resource is the “Hiring A Contractor” page from the Federal Trade Commission. It’s common for owners to also consult review websites like Angie’s List to see reviews from other owners.

When it comes to choosing a contractor property owners need to evaluate two separate things.

First, they need to find a contractor who is going to do a quality job, on time, and on budget. This is where you’ll find ample reviews and social proof about most general contractors.

Second, however, you need to evaluate whether you’ll run into any cash or payment problems with the general contractor. Information about this is more difficult to find. Perhaps, however, knowing whether general contractors have had payment and cash problems on other jobs, whether they have had disputes with subs & suppliers in the past, and similar information is more important than the first evaluation item.

The first item on the Florida Property Owner Checklist is to evaluate your general contractor. You can look up your contractor’s Levelset profile to see their payment behavior, any liens filed, or any other payment warnings…all of which, during the course of a job, can come home to roost and cause you problems.

2. Make Sure You File The Florida Notice of Commencement Correctly & On Time

After you’ve checked out your general contractor and the project is scheduled to get underway, the next thing you’ll need to do is file a Florida notice of commencement. Getting this document filed correctly and on time is extremely important to you as an owner, as it represents the only way to protect your property against mechanics lien claims. The next sections will guide you through getting your NOC filed in the right place, with the right form, and in the right time.

What is the Florida NOC Requirement?

In Florida, property owners are required to file a notice of commencement before the start of any job that is more than $5,000. The only way a property owner can protect herself against mechanics lien claims is to make sure this notice gets filed correctly and timely.

It is worth noting that property owners are relieved from having to file their notice of commencement — and from tracking & managing payments and lien releases at all — whenever a construction lender is involved with the project. If the owner has a construction loan to complete the job, the construction lender assumes the obligation to file the notice of commencement and to track all payments to contractors, suppliers, and vendors. In the event of any mismanagement or mistake by the construction lender, the lender is required to indemnify the owner. As such, matters are much simpler for owners when a construction lender is on the job. For more details about the NOC requirement in Florida and who must file it, check out this question in our expert center: Who needs to file a notice of commencement in Florida?

How Does The Florida Notice of Commencement Help Property Owners?

As mentioned above, the Notice of Commencement process in Florida is extremely important to property owners because it represents the only way to protect the property against mechanics lien claims. See also: Florida Mechanics Lien FAQs & Resources.

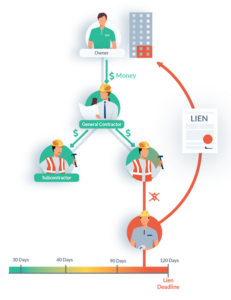

Generally speaking, property owners (and, if applicable, construction lenders) must be careful when distributing money on a construction project. If anyone goes unpaid on the project — including all laborers, subcontractors, suppliers, and vendors — the owner could ultimately be responsible for paying twice for the same work, and lenders could have the title of the property compromised! The graphic on the right illustrates how this could happen.

Generally speaking, property owners (and, if applicable, construction lenders) must be careful when distributing money on a construction project. If anyone goes unpaid on the project — including all laborers, subcontractors, suppliers, and vendors — the owner could ultimately be responsible for paying twice for the same work, and lenders could have the title of the property compromised! The graphic on the right illustrates how this could happen.

This, of course, is highly undesirable.

The Florida Notice of Commencement process helps owners and lenders because it establishes a process that — if followed — will empower owners to avoid this undesirable outcome.

It’s important to note that filing the NOC is not enough by itself to get this project. It’s just a step — the first step. To protect themselves against lien claims, the property owner must follow this entire checklist!

What Must Be Included on a Notice of Commencement Form in Florida?

The Notice of Commencement is still the first step for property owners, and the ultimate pre-requisite to eliminate the risk of double payment. Accordingly, it’s super, super important that owners get the notice of commencement done right!

One element of getting this done right is to make sure you are using the right form, and that you’re including all of the required information. You can see a list of county forms later in this post, here. It is also important that the Florida Notice of Commencement includes all of the required information.

The statute regulating the Florida NOC is replicated on our FL NOC FAQs page here. The statute provides that all NOCs must contain the following information:

- Legal property description of the job site (Need help with this, see the Levelset Legal Property Description Cheat Sheet.];

- A general description of the improvement/construction;

- The name and address of the owner;

- The name and address of the general contractor;

- The name and address of the surety for any payment bond (if there is one);

- The name and address of any construction lender (if any)

- The name and address of the owner designee (if any)

Should The Owner Appoint an Owner Designee on Florida Jobs?

As you can see in the above section, a Florida notice of commencement must include identification of the “owner designee” if there is one on the job. You may be wondering what this is, and whether or not you should appoint one.

What is the Owner Designee in Florida?

The Florida Notice of Commencement law describes the Owner Designee as follows:

[A] person…designated by the owner as the person upon whom notices [to owner] or other documents may be served…and service upon the person so designated constitutes service upon the owner…

As you’ll see throughout this Checklist, the property owner has a lot of documentation to receive, request, and manage during the course of a construction project in Florida. It’s possible that they don’t want to do it all. They may want to use a third party as their agent to receive, request, and manage all of this documentation. A construction attorney, for example.

The “owner designee” is this third party. The owner can designate someone else, other than themselves, to receive all construction notices on the job, all lien notices, etc..

Should You Appoint an Owner Designee?

Whether or not you should appoint an owner designee is a personal choice, and probably depends on how much you understand about the process (i.e. this Checklist), and how much you trust the person you’ll be appointing.

If you don’t designate an owner designee, you’re going to see everything first hand that you’ll need to see to protect your property against lien claims and the risk of double payment. If you do designate an owner designee, you won’t see very much of it at all, and you’ll be relying on a third party to handle everything.

If you appoint an owner designee, you’ll want to make sure that the third party is insured against errors and omissions. In this case, if some mistake is made, you can recover any damages from your owner designee. This is a really great option for property owners if they can get it.

Some bad “owner designee” options include: (i) A third party that doesn’t have clear errors & omissions insurance and liability; and/or (ii) Letting your general contractor be your designee! Letting your general contractor be your designee is a terrible idea, even if you have a lot of trust in the contractor.

When Must The Owner File The Notice of Commencement?

The timing requirements for Florida notices of commencement have a few nuances. It’s important to get it right. Filing the notice of commencement at the wrong time is just as bad as not filing it at all!!

The short answer here is that the notice must be filed before the work starts on the project.

The long answer is that there are lot of “traps” for property owners in the timing of NOC filings. In fact, in 2008, the Florida Senate was considering revisions to the FL Notice of Commencement requirements (which did not pass) in large part because of these “property owner traps.” There is a great review of all these traps, which are also explained here in this checklist, here: Review of Florida Construction Lien Law, Committee on Regulated Industries, The Florida Senate, Interim Report 2009-124 (October 2008).

Here are some important details:

Don’t File The Notice Before The Mortgage Loan is Filed

If there is a loan, do not file the notice of commencement before the mortgage is recorded! This results in the construction liens taking priority over the mortgage. Too many homeowners file their NOC before finishing the mortgage process because they mistakenly believe they must file the NOC to get their building permit. They do not! And, in fact, in many cases, they should not!

Here is the Florida Senate discussion of this issue:

Another issue with the NOC is that many homeowners are filing the NOC prior to their lender recording the mortgage. This results in the construction liens taking priority over the mortgage. The reason that many homeowners file the NOC prior to finalizing their mortgage is that contractors mistakenly believe that the NOC is required in order to receive a building permit. The reason that contractors think that the NOC is required is because many county and city building officials include the NOC on their building permit checklist.

Don’t File The NOC Too Eary — It Must Be Within 90 Days of The Job’s Start

The filing has to be within 90 days of when the project begins. In other words, you need to get the NOC recorded before work begins on the project, but not too soon before. Work must start within 90 days from the NOC’s filing.

In the Florida Senate report above linked, the writing staff recommended changing this rule because it was a trap for property owners. The rule did not change…but their discussion of this is helpful to understand how this can create a problem:

Change the provisions requiring payments to become improper payments when a Notice of Commencement expires because work did not commence within 90 days of recordation or because the time runs out. Consumer advocates and Florida Bar representatives suggest that this is a consumer “trap.” By eliminating the improper payment provisions, the “trap” can be eliminated.

Where to File The NOC: Florida County Forms & Filing Websites

Where do you file your Florida Notice of Commencement? The answer is that you need to file the NOC with the county clerk’s office in the county where the project is located and you must post a copy of the NOC on the job site itself.

Which County Office Records Notices of Commencement?

It can be difficult to figure out which county office will record the notice of commencement. The below list provides links to the county clerk websites for the specific office where NOCs can be filed.

- Alachua County Lien Filing Recorder’s Site

- Baker County Lien Filing

- Bay County Lien Filing Recorder’s Site

- Bradford County Lien Filing Recorder’s Site

- Brevard County Lien Filing

- Broward County Lien Filing

- Calhoun County Lien Filing Recorder’s Site

- Charlotte County Lien Filing Recorder’s Site

- Citrus County Lien Filing Recorder’s Site

- Clay County Lien Filing Recorder’s Site

- Collier County Lien Filing

- Columbia County Lien Filing Recorder’s Site

- DeSoto County Lien Filing Recorder’s Site

- Dixie County Lien Filing Recorder’s Site

- Duval County Lien Filing

- Escambia County Lien Filing Recorder’s Site

- Flagler County Lien Filing Recorder’s Site

- Franklin County Lien Filing

- Gadsen County Lien Filing Recorder’s Site

- Gilchrist County Lien Filing Recorder’s Site

- Glades County Lien Filing Recorder’s Site

- Gulf County Lien Filing

- Hamilton County Lien Filing

- Hardee County Lien Filing Recorder’s Site

- Hendry County Lien Filing

- Hernando County Lien Filing

- Highlands County Lien Filing Recorder’s Site

- Hillsborough County Lien Filing

- Holmes County Lien Filing Recorder’s Site

- Indian River County Lien Filing

- Jackson County Lien Filing

- Jefferson County Lien Filing Recorder’s Site

- LaFayette County Lien Filing Recorder’s Site

- Lake County Lien Filing

- Lee County Lien Filing

- Leon County Lien Filing Recorder’s Site

- Levy County Lien Filing

- Liberty County Lien Filing Recorder’s Site

- Madison County Lien Filing

- Manatee County Lien Filing

- Marion County Lien Filing

- Martin County Lien Filing Recorder’s Site

- Miami-Dade County Lien Filing

- Monroe County Lien Filing

- Nassau County Lien Filing Recorder’s Site

- Okaloosa County Lien Filing Recorder’s Site

- OkeechobeeCounty Lien Filing Recorder’s Site

- Orange County Lien Filing

- Osceola County Lien Filing

- Palm Beach County Lien Filing

- Pasco County Lien Filing

- Pinellas County Lien Filing

- Polk County Lien Filing

- Putnam County Lien Filing

- Santa Rosa County Lien Filing

- Sarasota County Lien Filing

- Seminole County Lien Filing

- St. Johns County Lien Filing Recorder’s Site

- St. Lucie County Lien Filing

- Sumter County Lien Filing

- Suwanee County Lien Filing Recorder’s Site

- Taylor County Lien Filing

- Union County Lien Filing Recorder’s Site

- Volusia County Lien Filing Recorder’s Site

- Wakulla County Lien Filing

- Walton County Lien Filing Recorder’s Site

- Washington County Lien Filing

How much will it cost to file a Florida notice of commencement?

The cost to file a notice of commencement will differ from county-to-county, and may also be impacted by your notice document itself. For example, you may be charged extra if your notice paper is not the right size, or if the page’s margins are not as prescribed by the county’s specific rules. You will also be charged per page, and so any NOC attachments can make the register ring. Generally speaking, using Broward County as an example, the filing fees will be $10 for the first page and $8.50 for each additional page of the same document, plus for certified copies, you’ll have to pay $1 for each page of the document and $2 for certification of each document.

Most notices of commencements can be filed in Florida for about $25.

Can I file a Florida notice of commencement electronically?

The best way to file your Florida notice of commencement is to do it electronically. This is the fastest and easiest way to do it, and you can get immediate confirmation that it’s done. You can file your notice of commencement within any county electronically through Levelset.

Can I file a Florida Notice of Commencement in Person or by Mail?

Yes. In every county, you can file your NOC in person, and via mail. Keep the following in mind:

If you file in person: If you go in person check the county’s hours and location. Both of which can be quirky when it comes to NOC filings. Some counties have different offices and only some will record NOCs. Some counties also have hours for NOC filings. County clerk recorder offices are notorious for not going out of their way to help you, so make sure you get the details right, or you’ll find yourself going back again and again;

If you file by mail: If you send by mail make sure you understand the county’s backlog, if any. You don’t want the NOC to be late because it’s sitting in the county’s mail pile. And remember that if any little thing is wrong, it’s going to get mailed back, and this process (the mail back and forth) is going to take some time.

3. Track Subs & Suppliers & Carefully Collect Lien Releases

You now have your notice of commencement filed properly and on time. You’ve completed the first step. As complicated as that may have seemed, getting your project’s notice of commencement recorded is the easy part. To take advantage of Florida’s legal protections for property owners and to avoid paying for your construction job twice you need to carefully track the subcontractors and suppliers on your job and collect lien releases with every payment. These next sections will discuss how.

The Difference between Proper Payments & Improper Payments

To understand why you’ll need to keep track of all this stuff, you’ll need to understand how the Florida lien laws protect you as a property owner from dealing with mechanic liens and paying twice. In Florida, owners and lenders can make payments to their contractor as a “proper payment,” or an “improper payment.”

When a payment is “proper,” the property owner is protected against any lien claims whatsoever related to the payment. In other words, if the property owner always makes “proper payments” on their job, they will be 100% insulated and protected from any and all lien risks.

However, when a payment is “improper,” the property owner is exposed to lien claims filed by any laborers, contractors, subcontractors, suppliers, or vendors.

And here is the difference between “proper” and “improper” payments in Florida.

Proper Payments: Whenever the owner or lender makes a payment to the general contractor, the payment is proper if lien releases are collected from all subcontractors and suppliers who provided the owner with a 45 day notice to owner.

Improper Payments: Whenever the owner or lender makes a payment to the general contractor, the payment is improper if a lien release is not collected from a subcontractor or supplier who provided the owner with a 45 day notice to owner.

So, very simply put:

- If you received a NTO from a contractor or supplier;

- You need to always, 100% of the time, get a lien release from the contractors and suppliers whenever you issue a payment to the contractor that includes work performed or materials provided by that contractor or suppliers.

Head hurting? More explanation below.

How to keep track of all subcontractors & suppliers who send a Notice to Owner

Before digging into the complexity of requesting, collecting, and tracking lien releases throughout the course of your Florida job, let’s first address something more simple, but a definite prerequisite of staying on top of this process: keeping track of all the subcontractors and suppliers.

The good news is that every Florida contractor or supplier who could possibly file a mechanics lien against your job must give you a notice with all of their information. This Notice to Owner requirement is excellent news for property owners, and property owners should be ecstatic to receive them. They make the administration of project payments much easier.

As a property owner, you’ll want to keep a list of every subcontractor and supplier who gives you notice. You’ll need this each and every time payment is administered on the job. Some owners will use a “Lien Waiver Tracking Spreadsheet” to keep track of all the subs & suppliers. It’s better to use software if you can. Something like Levelset can help with his.

Require Lien Releases (a/k/a Lien Waivers) with every single payment

While not required, it’s extremely common on Florida construction jobs that payments are made to the general contractor monthly.

In this monthly construction payment process, the general contractor will submit a payment application to the property owner on a designated day once each month. The payment application will identify all of the work performed and materials furnished to the job during that “payment period.” The pay application may be accompanied by a “schedule of values” document, which will enumerate each and every line item of work. Learn more about this process by reading this article: Pay Apps: A Simple Overview

From the general contractor’s pay app submission, the property owner should be able to see which subcontractors and suppliers performed work or delivered materials in the payment period. Here’s what you need to do as a property owner:

- Look at the GC’s pay application and get a list of all subs & suppliers who did work or provided materials in the pay period;

- Compare those subs & suppliers with your list of subs & suppliers who provided you with a NTO (Notice to Owner);

- You need to collect and have in-hand an executed lien release (also known as a “lien waiver“) from each of these subs and suppliers.

Here are some details to help you with this.

How to figure out which subs & suppliers did work in a pay period

In the above section, we mention that “the property owner should be able to see which subcontractors and suppliers performed work or delivered materials in the payment period” from the general contractor’s pay app submission. But this is not always easy.

When you get a GC’s payment application, you may not be able to easily see which subcontractors and suppliers are involved, and which are not.

So what to do?

Florida Construction Attorney Larry Leiby has a great article about how the owner can best manage a construction job: An Owner’s Rights and Duties Under The Florida Construction Lien Law. In Leiby’s article, he goes into this particular problem with the following:

One way to determine how much is owed to subs and suppliers is to require from the contractor an affidavit reciting the status of payments to such persons, as well as the status of payments to laborers (who are not required to serve a notice to owner)…

In other words, the property owner — you — can require the GC to submit an “Affidavit” identifying which subs & suppliers are involved in a pay application. This is called a “Request for Sworn Statement of Account” in Florida.

But…unfortunately…this might not be enough!

How can you believe that the general contractor is telling the truth? Or how can you trust that the GC is organized enough to keep track of this for you? Or, what if the GC just simply makes a mistake.

Owners can go a step further.

For every subcontractor and supplier who sent a NTO, the owner can request a sworn statement of action directly from them!

If you send a request for a sworn statement of account and the receiving party does not reply within 30 days, the receiving party will lose their lien rights for the payment. While this can be beneficial, as you can see, the 30-day time period is a bit problematic. It will be extremely difficult to hold off the general contractor’s demands for payment for that waiting period, and further, you may be obligated in the contract to make payment before the 30 days expires!

In summary: With every pay application, it is your job as the owner to make sure you receive a lien release from each and every subcontractor, supplier, and vendor who has contributed to the job for that pay period. To get lien releases from all of these parties, you’ll need to know who they are. To figure that out, you may need to submit a “Request for Sworn Statement of Accounts” from everyone. But yes, this is a huge pain in the neck.

You can make a request for a sworn statement of account here at Levelset.

How To Request Lien Releases / Lien Waivers

Owners must get lien releases from everyone who is getting paid on the job. This is no small feat.

The subject of lien releases (a/k/a lien waivers) is a big one, and we’ve covered it extensively in our Construction Payment Resources. To learn more about the lien waiver document itself, you may want to refer to our Ultimate Guide to Lien Waivers. To learn more specifically about how to request, track, and otherwise manage a lien waiver collection process, you should refer to our How to Handle Requesting & Tracking Lien Waivers.

And finally, to learn more specifics about lien waivers and lien releases in Florida (which is extremely relevant for you as the owner), you should refer to our Florida Lien Waiver FAQs and Resources.

For Florida property owners, obtaining lien releases is extremely important. If lien releases are collected when payment is made, then the payment is considered a “proper payment” and the owner is protected against any and all lien claims. However, if a lien release is not collected, the payment is considered “improper,” and the owner is subjected to lien risk.

In the 2008 Florida Senate report about the notice of commencement process in Florida, the report states that “according to a consumer advocate, this [not collecting lien releases properly] is a common mistake that homeowners make and can lead to paying twice.” And we would say that the consumer advocate is right. This is an extremely difficult and nuanced process.

Nevertheless, the obligation to collect these lien releases falls on the homeowner.

Florida property owners can make the lien waiver request process a bit easier by using Levelset to sent and track these requests.

Dealing with the Payment/Lien Release Catch-22

Let’s say that you file the notice of commencement, you keep track of all the contractors and suppliers who send NTOs, you figure out which subs & suppliers need to provide you with lien releases, and you make the request to all of those subs and suppliers. In other words, you do everything perfectly right.

Well, then you’re going to confront a major, major problem. The subcontractors and suppliers are going to refuse to sign your lien waiver. And they are going to have a really good reason for their refusal: they haven’t been paid!

This is a famous construction payment problem. The catch-22. You want a lien release in order to make payment, but the contractor/supplier wants payment to provide the lien release. We discuss this in more detail in a post about the differences between unconditional lien waivers and conditional lien waivers.

You have a few options here.

Option 1: Be a hard ass

Your first option is you can just be a hard ass about this.

Your contract with the general contractor likely requires lien waivers from all subs and suppliers as a condition to make payment to the GC. While the GC will claim that she can’t make payment to these subs/suppliers without getting payment from you, you can just be difficult and explain to the GC that this is their problem, not yours. And, hope that it works out.

It may be truly difficult, though, because the GC will truly need your payment to get the subs & suppliers paid. This leaves you with only one other option: joint checks.

Option 2: Joint Checks

In the above-linked Leiby article, this is the advice provided to owners in this situation:

In some cases the contractor may not have the funds to pay the subs and suppliers without receiving payment from you. If that is the case, you should consider making joint payments to the contractor and each sub or supplier in order to get the releases.

Joint checks are extremely common in the construction industry. Simply put, a joint check is a check made to two or more parties. One common joint check example is when a property owner (i.e. you) writes a check to the general contractor and a subcontractor/supplier. This way, you can be certain that the subcontractor or supplier is actually getting paid after you provide payment to the GC. You can learn more in our article about this device, the Ultimate Guide to Joint Check Agreements.

4. Close Out The Job With A Final Payment Affidavit

We’ve finally made it to the end of your construction job. As you prepare to process the general contractor’s final payment for the job, there is one last important step: The Contractor’s Final Payment Affidavit.

The final payment affidavit is very similar to the sworn statements that owners can request and receive during the progress of a job. When the owner receives the “final affidavit” from the general contractor, the owner cannot simply rely on it. The owner must still dig into the sub-tiers, the subcontractors, and the suppliers to determine who has been paid and who hasn’t been paid.

Owners should follow the process above (i.e. the process for progress payments) for the final payment.

3 Common Mistakes Property Owners Make That Results In Liens & Paying For Work Twice

In the above and lengthy discussion, you have a checklist of everything you must do to protect yourself against double payment on a construction project. But, to conclude this article, let’s boil things down a little and zero in on the most common mistakes that owners make that results in liens and paying for work twice.

1. Not Filing the Notice of Commencement At All

The first mistake that Florida property owners make on construction jobs is not filing the Florida Notice of Commencement at all. It’s complicated, it’s nuanced, it’s a pain in the neck to get filed, etc., etc. And as a result, people just don’t file it. This will cause problems with getting the building permit, getting the project inspections to happen, and other issues as well. But, importantly to this discussion about mechanics lien and double-payment risks, it fails to take care of Step 1 for proeprty owner protection. It leaves property owners completely exposed.

Don’t do this. Get that Notice of Commencement filed!

2. Not Filing the Notice of Commencement on Time

The second mistake is that property owners fail to get their notice of commencement filed on time. This mistake happens for a variety of reasons – the owner may drag their feet, the owner may slip up with the filing and get it filed too late, the owner may file it too early, etc. This is a big mistake because filing an untimely NOC is just as bad as not filing one at all.

Don’t do this! Get your NOC filed on time!

3. Not Keeping Track of Subs, Suppliers, & Lien Waivers…Thus Defeating The NOC’s Purpose

The third and final mistake that owners make is not keeping track of the subcontractors and suppliers on their job and not collecting lien releases from them. This is an understandable mistake because the process is very time consuming and difficult. But, it’s extremely important. If it doesn’t get done, the fact is that the property owner is quite exposed to serious financial risks.

Don’t let this happen. Keep track of the subs and suppliers on your job, and request lien waivers from them.