Florida

Notice of Commencement Requirement

Florida

Ready? File your Florida

NOC Today with Levelset

Florida

Florida

Florida

Florida

Florida

Florida

Everyone on a construction job is interested in the Florida Notice of Commencement. This is because it affects everyone’s rights and obligations. Since the process is so complicated, everyone is probably also a bit confused about it.

Generally speaking, a Notice of Commencement is a form publicly filed in county records to signify that a construction project is beginning. The form contains information identifying the people involved with the project, such as who the property owner and construction lender are. And the form typically identifies the project itself, such as the type of work being performed and the location of the work.

The overall process and implications may be complex, but the forms themselves are easy. And this is the case in Florida.

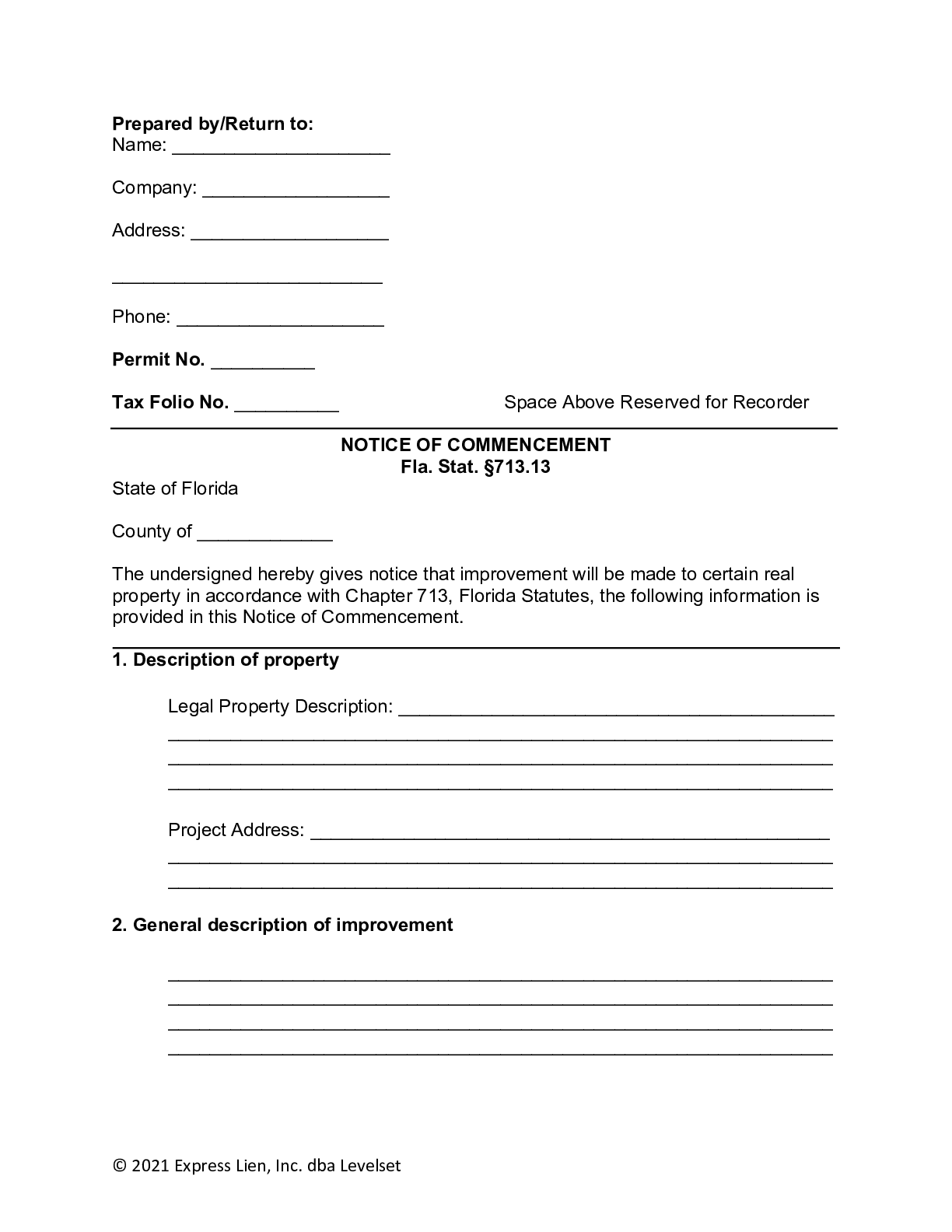

In Florida, the Notice of Commencement Form is very simple. In fact, most counties will provide you with the form you need. Or, of course, you can make the NOC process really easy by just filing the document online. The form itself is the only thing easy about these notices in Florida.

This page provides frequently asked questions, forms, and other helpful information about Florida’s Notice of Commencement. Depending on your role, you may need deeper and more specific help with NOCs. For that:

Watch this short video to learn the important Notice of Commencement requirements in Florida.

Yes. Florida has a very specific and complicated Notice of Commencement requirement that applies to all private jobs when the value is over $5,o00. The $5,000 threshold is quite low, and as a result, if you’re involved with a commercial, residential, industrial, or other private projects in Florida, the odds are substantially high that a Notice of Commencement is required on the job.

The Florida law very specifically requires that a Notice of Commencement get filed on all Florida jobs. There are legal consequences to all parties on a construction job if the Notice of Commencement is not filed. Plus, without an effective Notice of Commencement, an owner or contractor will struggle to pull the permits required for their job.

• See the question on our Expert Center: Does an NOC need to list all items we plan to get permits for?

The requirement to file the Florida Notice of Commencement is usually on the property owner. There is a single exception to this. Whenever the project has a construction loan on it, then the duty to file the Notice of Commencement rests with the bank (i.e. the construction lender), and the property owner is relieved of this task. And this burden really, really is relieved. If the construction lender screws it up or doesn’t get the notice filed, the construction lender must protect the owner against any liens and against the risk of paying twice.

Interestingly, regardless of who is required to file the Notice of Commencement, it’s crystal clear within the Florida statutes that the owner, and only the owner, must sign it! The owner may designate an agent in the NOC, and the owner may have a lender and be relieved of filing the notice…but in either case, and in any case, the owner must sign the Notice of Commencement document. The statute’s specific language says this, “The owner must sign the notice of commencement and no one else may be permitted to sign in his or her stead.” And, if the work is for the common area of a condominium, the condo association can sign.

• Further, note that even if the property is being sold and repairs are being done, the Notice of Commencement must be signed by the current owner of the property.

• Great, detailed discussion of this in our Expert Center in answer to this question: Who needs to file a notice of commencement in Florida?

Unfortunately, the timing requirements for Florida Notices of Commencement have a few nuances. It’s important to get it right. Before addressing those nuances, the short answer here is that the notice must be filed before the work starts on the project.

Here, however, are some important details:

The Florida statute has this to say about where the Florida Notice of Commencement must be filed: “…shall record a notice of commencement in the clerk’s office and forthwith post either a certified copy thereof or a notarized statement that the notice of commencement has been filed for recording along with a copy thereof.”

This is requiring 2 different steps to get the Notice of Commencement properly filed.

1. Getting it Filed

Actually delivering it to the clerk’s office in the county where the construction project is located. The actual office may change from county-to-county, and so you’ll need to investigate this. Generally speaking, this information is easy to find. Here is a list of all the Florida county recorders’ offices along with their contact information and filing requirements.

• You can also file your Florida Notice of Commencement electronically here.

2. Getting it Posted

The second part of the requirement is that property owners must make sure that the Notice of Commencement document is displayed at the project job site.

Yes. In states that have NOC requirements, like Florida, it’s common that an “Owner’s Designee” can be appointed in the NOC itself. This is allowed in Florida.

The point of an owner designee is that the owner can appoint some agent (i.e. an attorney, a property manager, a construction manager, etc.) to act as their designated agent for the construction job. This would be the point of contact who would receive project correspondence, like notice to owner documents. Owners should be careful about this. The owner must be comfortable that the owner designee is going to do the difficult job of keeping track of everyone’s payments. If a mistake is make, it is the owner – and not the designee – who is ultimately liable.

In order for the Notice of Commencement to be valid, it must contain the following information:

Property owners (and, if applicable, construction lenders) must be careful when distributing money on a construction project. It’s important that everyone on the job be paid. If anyone goes unpaid on the project — including all laborers, subcontractors, suppliers, and vendors — the owner could ultimately be responsible for paying twice for the same work, and lenders could have the title of the property compromised! This, of course, is highly undesirable.

The Florida Notice of Commencement process helps owners and lenders avoid this undesirable outcome. When a Notice of Commencement is filed, owners and lenders can protect themselves against these risks by following the payment process outlined in the Florida statues. If the NOC is filed and payments are made pursuant to the statutory process, then the owner will be insulated against this risk.

It’s important to note that filing the NOC is not enough to get this protection. It’s just a step — the first step. The owner/lender must still make sure that they make “proper payments.”

• We explore how to always make proper payments in the Florida Notice of Commencement Checklist & Lien Risk Guide For Owners.

For subcontractors and suppliers in Florida, a Notice of Commencement affects their lien priority. If a NOC is filed, any mechanics liens will relate back to that date for the purpose of determining priority. This means that, if an unpaid supplier files a Florida mechanics lien two weeks after the project ends, the law treats their lien as if it were filed on the date that the Notice of Commencement were filed!

YES!

NOCs in Florida expire one year after they are filed. This is really important. Look at the NOC filing date. Count one year. That’s when the NOC expires.

Property owners and lenders should pay close attention to this date. When a NOC expires in Florida, it becomes “void,” any payments made after such expiration will be considered “improper,” exposing the owner to the risk of having to pay for construction work twice. If the project (or payments for a project) are continuing beyond the one year period, owners and lenders must file a second Notice of Commencement before the first one expires!

The statute does provide a single exception to this: “If the [construction] contract…expresses a period of time for completion for the construction of the improvement greater than 1 year, the notice of commencement must state that it is effective for a period of 1 year plus any additional period of time.” This will make the notice of commencement effective until that extended period of time. But, it must be enumerated specifically in the construction contract and the NOC.

Yes. In Florida, this notice must be signed by the owner, and notarized. The statutory form provided under § 713.13(1)(d) specifically includes a notarization block.

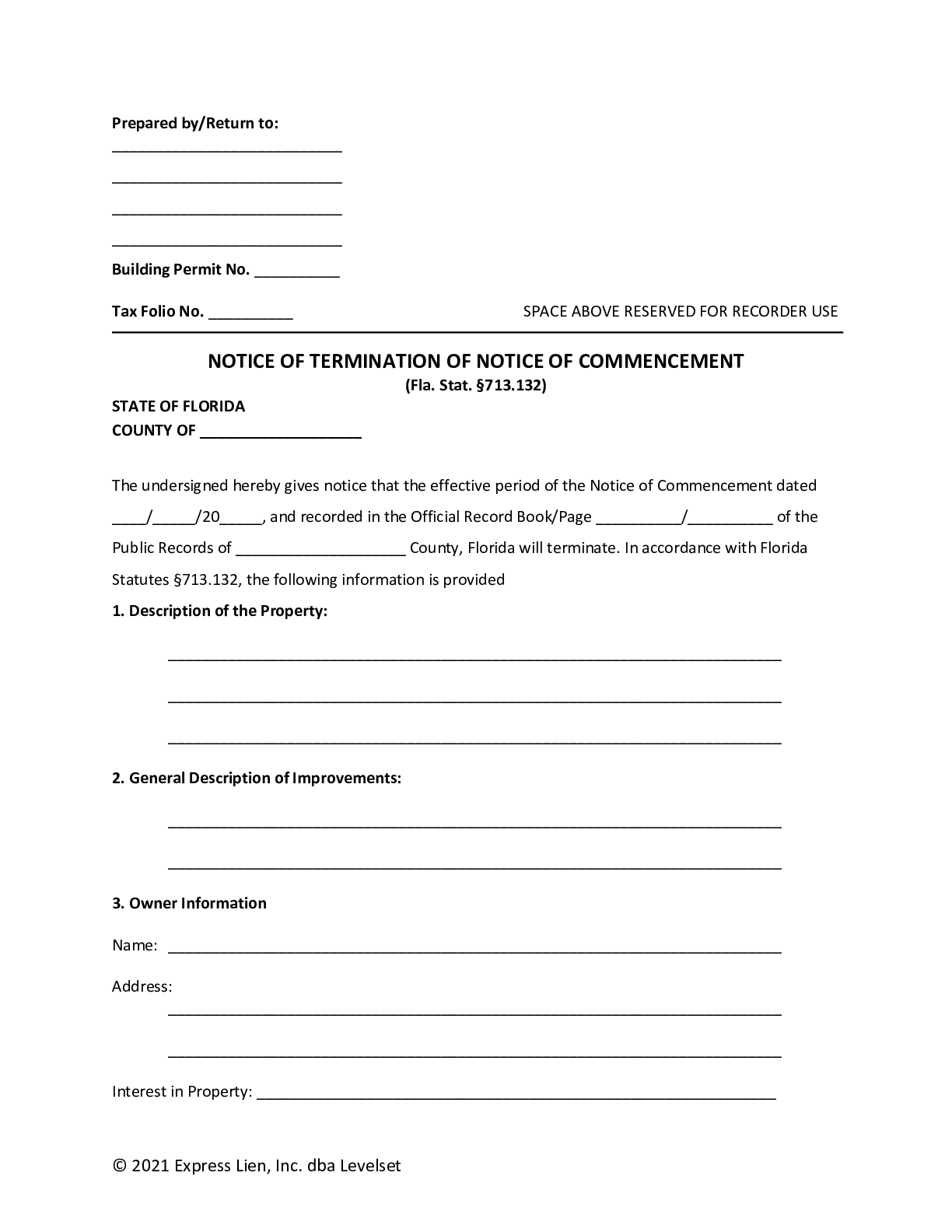

No, the Notice of Commencement in Florida does not need to be terminated or released, and there is no process for filing a “Notice of Completion” or any other document to signify that the project has been completed.

However, it is possible for a Florida Notice of Commencement to be terminated. The Florida statutes provide for this specifically in §713.132, stating that “an owner may terminate the period of effectiveness of a notice of commencement by executing, swearing to, and recording a notice of termination.”

It’s most common to see Notices of Termination filed whenever the owner or lender did something wrong with the original NOC, and needs to “re-do” or re-file it. In this case, the first NOC will be terminated and a second NOC will be filed. Whenever a Notice of Termination is filed, any and all contractors and suppliers who contributed to the job beforehand should pay close attention…because their lien rights can be impacted. If unpaid, they will likely want to file a mechanics lien on the job.

No. The Notice of Commencement requirement in Florida is exclusively for the property owners and construction lenders. Contractors and suppliers do not need to file a NOC, but they do have their own preliminary notice requirements — called a notice to owner in Florida.

• Learn more about the contractor & supplier’s Florida Notice to Owner requirement here: Ultimate Guide to Florida’s Notice to Owner Requirement.

A Florida Notice of Commencement does not impact whether you are required to deliver a notice to owner in Florida, or not. All parties furnishing labor or materials on a project are required to send notice to owner in Florida, in all situations regardless of any other filing. The filing of a Notice of Commencement does not change this requirement.

However, the notice of commencement can definitely impact who needs to receive your Florida NTO.

Florida NOCs must identify: (i) the property owner’s designee, if there is one; and (ii) the construction lender, if there is one. If either of these parties are identified on the notice of commencement, they must receive the NTO in order for the contractor/supplier to protect their lien rights. In the case for the owner designee especially, there may be no other place where this party will be identified other than the NOC.

Mostly, no. In Florida, anyone furnishing labor or materials to a construction project has a right to file a mechanics lien if they are unpaid. This underlying right, the associated deadlines, and all the associated requirements are unaffected by the filing (or non-filing) of a Florida Notice of Commencement. Deadlines for notices and liens are not measured from the date Notice of Commencement is filed. Instead, they are typically measured from the date you begin work.

However, the Notice of Commencement does have 2 specific places where a contractor & suppliers lien rights can be impacted.

1) The Priority of the Lien

The “priority of a lien” refers to which liens are considered to be “first in line” to get paid. If a NOC is filed, the “priority” of all mechanics liens “relate back” to the date of the NOC’s filing, and all lien claims have the exact same priority. If a NOC is not filed, the priority of the lien is the date of the filing, and whichever lien is filed first has the higher priority.

• See: FL Subcontractor Lien Has Priority Despite Notice of Commencement Error

2) The Extent of The Owner’s & Lender’s Liability for the Lien

The second place a NOC impacts lien rights is in the protection given to owners and lenders in some circumstances. Namely, if a Notice of Commencement is properly and timely filed, and the property owner/construction lenders always makes “proper payments,” the value of a mechanics lien claim against the job will be limited the dollar amounts that the owner/lender has not yet paid out to the general contractor. This means, in other words, that a lien can only be filed for the “unpaid balance” on the job.

However, if a contractor or supplier has sent their Notice to Owner, this should not ever be a problem, because the property owner cannot make a “proper payment” without getting an executed lien waiver directly from the sub/supplier who sent the notice. Therefore, the only way you can lose your right to lien is if you signed a lien release and weren’t actually paid!! Don’t do that!

• For more on lien waivers, see: Florida Lien Waiver Forms & Guide – All You Need to Know

Florida requires that the property owner or the owner’s agent post the Notice of Commencement conspicuously on the job site before the project begins. So, if you’re a contractor that is actually working on the job site, you should be able to find the NOC somewhere on the job site itself.

However, it is extremely possible that you will not find it. Or, perhaps you are a supplier or vendor and will not physically be at the job site. In these cases, you’ll want to check with the county recorder’s office to get a copy of the Notice of Commencement. These documents are public records and are available to you, except that they can be hard to find sometimes, and if a NOC was not filed on the job, it may be difficult to know this for sure.

Finally, in some states, there is a formal process to request documentation like this from the owner or lender. However, there is no such process in Florida.

• For a more detailed discussion of this, see our article: How to Find the Notice of Commencement for a Florida Construction Project.

No. The Florida Notice of Commencement requirement is specifically for private construction jobs in Florida. This requirement does not apply to any state, county, municipal, city, or county projects. Further, it does not apply to any federal government projects in Florida because Federal projects are regulated by the Federal Miller Act, which does not have a Notice of Commencement requirement for any of its jobs anywhere in the world.

If you’re struggling with figuring out what type of project you’re on and what rules may apply, you may find help in this article: The Types of Construction Jobs: What They Are and Why You Should Care.

I am a Sr. Project Manager for a large Florida based construction firm. In the past (with a previous company) we had never received Notice...

What do I do if there is not a Notice of Commencement filed and only a bond on a public project in the state of Florida?We are the subcontractor an athletic field at a public high school in Sarasota, FL. The GC has indicated a notice of commencement is not...

Is it the construction company's responsibility to get an NOC renewed after it expires?We currently file the NOC before a project starts. But there is a debate within the team on if we have to renew the NOC...

Complies with the statute. Forms for every county!

This free Florida Notice of Termination form, also referred to as a Notice of Termination of Notice of Commencement, is used in the state of...

Florida’s Notice of Commencement rules requires that the property owner have this notice form recorded and filed before the start of any Florida construction project that is...

This free Florida Notice of Commencement form is used in the state of Florida to formally designate the beginning of the project. In Florida, projects...

Florida’s private mechanic’s lien statute is found within Title XL (Real & Personal Property) and Chapter 713 (Liens, Generally). §713.13 provides the rules for the “Notice of Commencement” process. You can read the law directly on the state legislature’s website here, and it is reproduced below. Further, §713.13 is a selected excerpt from the full construction lien statute in Florida. You can see this full statute on our Florida Mechanics Lien FAQs page.

(1)

(a) Except for an improvement that is exempt under s. 713.02(5), an owner or the owner’s authorized agent before actually commencing to improve any real property, or recommencing completion of any improvement after default or abandonment, whether or not a project has a payment bond complying with s. 713.23, shall record a notice of commencement in the clerk’s office and post either a certified copy thereof or a notarized statement that the notice of commencement has been filed for recording along with a copy thereof. The notice of commencement must contain all of the following information:

1. A description sufficient for identification of the real property to be improved. The description must include the legal description of the property and the street address and tax folio number of the property if available or, if the street address is not available, such additional information as will describe the physical location of the real property to be improved.

2. A general description of the improvement.

3. The name and address of the owner, the owner’s interest in the site of the improvement, and the name and address of the fee simple titleholder, if other than such owner. A lessee who contracts for the improvements is an owner as defined in s. 713.01 and must be listed as the owner together with a statement that the ownership interest is a leasehold interest.

4. The name and address of the contractor.

5. The name and address of the surety on the payment bond under s. 713.23, if any, and the amount of such bond.

6. The name and address of any person making a loan for the construction of the improvements.

7. The name and address within the state of a person other than himself or herself who may be designated by the owner as the person upon whom notices or other documents may be served under this part; and service upon the person so designated constitutes service upon the owner.

(b) The owner, at his or her option, may designate a person in addition to himself or herself to receive a copy of the lienor’s notice as provided in s. 713.06(2)(b), and if he or she does so, the name and address of such person must be included in the notice of commencement.

(c) If the contract between the owner and a contractor named in the notice of commencement expresses a period of time for completion for the construction of the improvement greater than 1 year, the notice of commencement must state that it is effective for a period of 1 year plus any additional period of time. Any payments made by the owner after the expiration of the notice of commencement are considered improper payments.

(d) A notice of commencement must be in substantially the following form:

Permit No……. Tax Folio No…….

NOTICE OF COMMENCEMENT

State of……

County of……

The undersigned hereby gives notice that improvement will be made to certain real property, and in accordance with Chapter 713, Florida Statutes, the following information is provided in this Notice of Commencement.

1. Description of property: …(legal description of the property, and street address if available)….

2. General description of improvement:…….

3. Owner information or Lessee information if the Lessee contracted for the improvement:

a. Name and address:…….

b. Interest in property:…….

c. Name and address of fee simple titleholder (if different from Owner listed above):…….

4.

a. Contractor: …(name and address)….

b. Contractor’s phone number:…….

5. Surety (if applicable, a copy of the payment bond is attached):

a. Name and address:…….

b. Phone number:…….

c. Amount of bond: $…….

6.

a. Lender: …(name and address)….

b. Lender’s phone number:…….

7. Persons within the State of Florida designated by Owner upon whom notices or other documents may be served as provided by Section 713.13(1)(a)7., Florida Statutes:

a. Name and address:…….

b. Phone numbers of designated persons:…….

8.

a. In addition to himself or herself, Owner designates……………… of ……………… to receive a copy of the Lienor’s Notice as provided in Section 713.13(1)(b), Florida Statutes.

b. Phone number of person or entity designated by owner:…….

9. Expiration date of notice of commencement (the expiration date will be 1 year after the date of recording unless a different date is specified)…….

WARNING TO OWNER: ANY PAYMENTS MADE BY THE OWNER AFTER THE EXPIRATION OF THE NOTICE OF COMMENCEMENT ARE CONSIDERED IMPROPER PAYMENTS UNDER CHAPTER 713, PART I, SECTION 713.13, FLORIDA STATUTES, AND CAN RESULT IN YOUR PAYING TWICE FOR IMPROVEMENTS TO YOUR PROPERTY. A NOTICE OF COMMENCEMENT MUST BE RECORDED AND POSTED ON THE SITE OF THE IMPROVEMENT BEFORE THE FIRST INSPECTION. IF YOU INTEND TO OBTAIN FINANCING, CONSULT WITH YOUR LENDER OR AN ATTORNEY BEFORE COMMENCING WORK OR RECORDING YOUR NOTICE OF COMMENCEMENT.

…(Signature of Owner or Lessee, or Owner’s or Lessee’s Authorized Officer/ Director/Partner/Manager)…

…(Signatory’s Title/Office)…

The foregoing instrument was acknowledged before me by means of [] physical presence or sworn to (or affirmed) by [] online notarization this…… day of……, …(year)…, by …(name of person)… as …(type of authority,… e.g. officer, trustee, attorney in fact)… for …(name of party on behalf of whom instrument was executed)….

…(Signature of Notary Public – State of Florida)…

…(Print, Type, or Stamp Commissioned Name of Notary Public)…

Personally Known…… OR Produced Identification……

Type of Identification Produced………………

(e) A copy of any payment bond must be attached at the time of recordation of the notice of commencement. The failure to attach a copy of the bond to the notice of commencement when the notice is recorded negates the exemption provided in s. 713.02(6). However, if a payment bond under s. 713.23 exists but was not attached at the time of recordation of the notice of commencement, the bond may be used to transfer any recorded lien of a lienor except that of the contractor by the recordation and service of a notice of bond pursuant to s. 713.23(2). The notice requirements of s. 713.23 apply to any claim against the bond; however, the time limits for serving any required notices shall, at the option of the lienor, be calculated from the dates specified in s. 713.23 or the date the notice of bond is served on the lienor.

(f) The giving of a notice of commencement is effective upon the filing of the notice in the clerk’s office.

(g) The owner must sign the notice of commencement and no one else may be permitted to sign in his or her stead.

(h) The authority issuing a building permit must accept a recorded notice of commencement from an owner or the owner’s authorized agent if the notice of commencement is in the form provided in paragraph (d).

(2) If the improvement described in the notice of commencement is not actually commenced within 90 days after the recording thereof, such notice is void and of no further effect.

(3) The recording of a notice of commencement does not constitute a lien, cloud, or encumbrance on real property, but gives constructive notice that claims of lien under this part may be recorded and may take priority as provided in s. 713.07. The posting of a copy does not constitute a lien, cloud, or encumbrance on real property, nor actual or constructive notice of any of them.

(4) This section does not apply to an owner who is constructing improvements described in s. 713.04.

(5)

(a) A notice of commencement that is recorded within the effective period may be amended to extend the effective period, change erroneous information in the original notice, or add information that was omitted from the original notice. However, in order to change contractors, a new notice of commencement or notice of recommencement must be executed and recorded.

(b) The amended notice must identify the official records book and page where the original notice of commencement is recorded, and a copy of the amended notice must be served by the owner upon the contractor and each lienor who serves notice before or within 30 days after the date the amended notice is recorded.

(6) Unless otherwise provided in the notice of commencement or a new or amended notice of commencement, a notice of commencement is not effectual in law or equity against a conveyance, transfer, or mortgage of or lien on the real property described in the notice, or against creditors or subsequent purchasers for a valuable consideration, after 1 year after the date of recording the notice of commencement.

(7) A lender must, prior to the disbursement of any construction funds to the contractor, record the notice of commencement in the clerk’s office as required by this section; however, the lender is not required to post a certified copy of the notice at the construction site. The posting of the notice at the construction site remains the owner’s obligation. The failure of a lender to record the notice of commencement as required by this subsection renders the lender liable to the owner for all damages sustained by the owner as a result of the failure. Whenever a lender is required to record a notice of commencement, the lender shall designate the lender, in addition to others, to receive copies of notices to owner. This subsection does not give any person other than the owner a claim or right of action against a lender for failure to record a notice of commencement.

(1) An owner may terminate the period of effectiveness of a notice of commencement by executing, swearing to, and recording a notice of termination that contains all of the following:

(a) The same information that is in the notice of commencement.

(b) The official records’ reference numbers and recording date affixed by the recording office on the recorded notice of commencement.

(c) A statement of the date as of which the notice of commencement is terminated, which date may not be earlier than 30 days after the notice of termination is recorded.

(d) A statement specifying that the notice applies to all the real property subject to the notice of commencement or specifying the portion of such real property to which it applies.

(e) A statement that all lienors have been paid in full.

(f) A statement that the owner has, before recording the notice of termination, served a copy of the notice of termination on each lienor who has a direct contract with the owner or who has timely served a notice to owner, and a statement that the owner will serve a copy of the notice of termination on each lienor who timely serves a notice to owner after the notice of termination has been recorded. The owner is not required to serve a copy of the notice of termination on any lienor who has executed a waiver and release of lien upon final payment in accordance with s. 713.20.

(2) An owner has the right to rely on a contractor’s affidavit given under s. 713.06(3)(d), except with respect to lienors who have already given notice, in connection with the execution, swearing to, and recording of a notice of termination. However, the notice of termination must be accompanied by the contractor’s affidavit.

(3) An owner may record a notice of termination at any time after all lienors have been paid in full or pro rata in accordance with s. 713.06(4).

(4) If an owner or a contractor, by fraud or collusion, knowingly makes any fraudulent statement or affidavit in a notice of termination or any accompanying affidavit, the owner and the contractor, or either of them, is liable to any lienor who suffers damages as a result of the filing of the fraudulent notice of termination, and any such lienor has a right of action for damages .

(5) A notice of termination must be served before recording on each lienor who has a direct contract with the owner and on each lienor who has timely and properly served a notice to owner in accordance with this part before the recording of the notice of termination. A notice of termination must be recorded in the official records of the county in which the improvement is located. If properly served before recording in accordance with this subsection, the notice of termination terminates the period of effectiveness of the notice of commencement 30 days after the notice of termination is recorded in the official records or a later date stated in the notice of termination as the date on which the notice of commencement is terminated. However, if a lienor who began work under the notice of commencement before its termination lacks a direct contract with the owner and timely serves his or her notice to owner after the notice of termination has been recorded, the owner must serve a copy of the notice of termination upon such lienor, and the termination of the notice of commencement as to that lienor is effective 30 days after service of the notice of termination.