Nevada

Preliminary Notice Deadlines

Nevada

Nevada

Nevada

Nevada

If you did not contract with the prime contractor, must serve a preliminary notice upon the prime contractor within 30 days of first furnishing labor and/or materials to the project.

Nevada

If you did not contract with the prime contractor, must serve a written notice of claim to the prime contractor within 90 days of last furnishing labor and/or materials to the project.

Nevada

Nevada

If you did not contract with the prime contractor, must serve a preliminary notice upon the prime contractor within 30 days of first furnishing labor and/or materials to the project.

Nevada

If you did not contract with the prime contractor, must serve a written notice of claim to the prime contractor within 90 days of last furnishing labor and/or materials to the project.

Nevada

The Nevada bond claim laws apply to any State, county, city, town, school district, public agency of the State, or any of its political subdivisions for the construction, alteration, or repair of public buildings our improvements where the contract price is for $100,000 or more.

There are a separate set of statutes regarding bond claims which cover all state highway projects.

In Nevada, first and second-tier subcontractors, laborers, material suppliers, equipment lessors, architects, and employee benefit trust funds have the right to make a claim on a bond provided the labor and/or material furnished was in excess of $500. No party more remote than the second-tier is entitled to protection. Further, if the claimant is required to be licensed to perform their work, that party must be licensed in order to make a claim on the bond.

• See: Guide to Contractor Licensing in Nevada

Note that while the general protection provided is the ability to make a claim on the bond, if the property/improvement is used for a private or nongovernmental purpose, the property may be liened just as a private project. In this case, the same requirements apply as a regular Nevada mechanic’s liens.

On all projects except highway construction, the only party required to receive the bond claim is the general contractor. It may be best practice to also send notice of the bond claim to the surety, as well, if known.

On highway projects, the bond claim must be filed in triplicate with the Department of Transportation. One copy filed with the Department and the remaining copies are to be forwarded to the contractor and the surety. Although, it may be best practice to send a copy to each as well to ensure they receive notice of the claim.

On all projects except highway construction, the bond claim must be received by the general contractor within 90 days after the claimant last furnished labor and/or materials to the project.

While Nevada statutes specifically apply this rule only to parties without a direct contract with the general contractor supplying the bond, it is unclear if the courts apply this deadline to all claimants, or only to parties without a contractual relationship with the prime contractor. So it’s a good idea to send a claim if you were hired by the prime contractor just in case.

On highway construction projects, the bond claim must be filed with the Department of Transportation within 30 days of the final acceptance of the contract. Notice of final acceptance is required to be published in a newspaper of general circulation in the county where the contract was performed for 2 weeks, and one or more newspapers of general circulation through the state for 10 days.

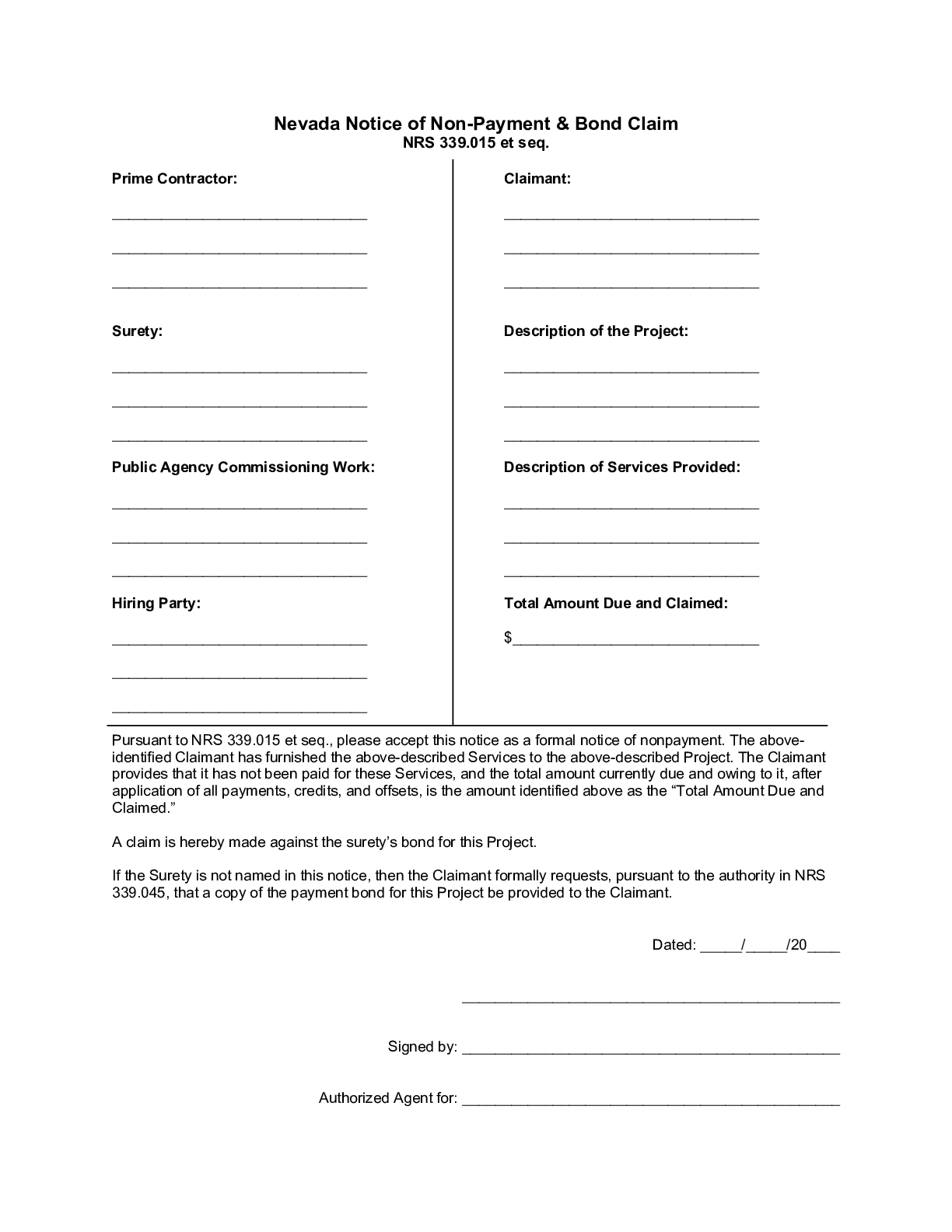

The only information required on a public works payment bond claim is the claimant’s information, the amount claimed and the and the name of the hiring party.However, it may be best practice to also include some identification of the project, and a description of the labor and or material furnished.

→ Download a free Nevada Bond Claim form here

On highway construction projects, the bond claim must include a statement that the claimant’s claim against the contractor or subcontractor has not been paid, and must be executed and verified before a notary public.

Bond claims must be sent by registered or certified mail, with postage prepaid, to the residence of the contractor, or any office or other location where the contractor conducts business.

Highway project claims need to be filed with the Department in triplicate. One copy is filed with the Department, while the other two are forwarded to the contractor and the surety.

The deadline to enforce a Nevada payment bond claim is more than 90 days after the last date of furnishing labor and/or materials to the project, but no later than 1 year after the last date of furnishing.

For highway construction bond claims, the an action to enforce the claim is no later than 6 months after the Department’s final acceptance of the contract.

I was a subcontractor on federal job and we havent been on the job site since Sept last year. Can I still do a Bond...

What date should I use as the end date: the day we were put on hold or when it was cancelled?We were working on a project until we were put on hold on April 2019 and have not worked on it at all but the...

what can we doIm a sub for a sub that did work on a government project on Nellis Air Force Base in Las Vegas Nv. The last day...

Nevada Notice of Nonpayment & Bond Claim Form This is a Nevada Notice of Nonpayment & Bond Claim form (also referred to as a Public Project...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Nevada, and are not paid, you can file a “lien” against the project pursuant to Nevada’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Nevada’s Little Miller Act is found in Nevada Revised Statutes §§339.015 et seq. and is reproduced below. Updated as of January 2021.

As used in this chapter:

1. “Claimant” includes a natural person, firm, partnership, association or corporation.

2. “Contracting body” means the State, county, city, town, school district, or any public agency of the State or its political subdivisions which has authority to contract for the construction, alteration or repair of any public building or other public work or public improvement.

1. Before any contract, except one subject to the provisions of chapter 408 of NRS, exceeding $100,000 for any project for the new construction, repair or reconstruction of any public building or other public work or public improvement of any contracting body is awarded to any contractor, the contractor shall furnish to the contracting body the following bonds which become binding upon the award of the contract to the contractor:

(a) A performance bond in an amount to be fixed by the contracting body, but not less than 50 percent of the contract amount, conditioned upon the faithful performance of the contract in accordance with the plans, specifications and conditions of the contract. The bond must be solely for the protection of the contracting body which awarded the contract.

(b) A payment bond in an amount to be fixed by the contracting body, but not less than 50 percent of the contract amount. The bond must be solely for the protection of claimants supplying labor or materials to the contractor to whom the contract was awarded, or to any of his or her subcontractors, in the prosecution of the work provided for in such contract.

2. If a general contractor has been awarded a contract, except one subject to the provisions of chapter 408 of NRS, by the State Public Works Division of the Department of Administration for any project for new construction, repair or reconstruction of any public building or other public work or public improvement, each of the subcontractors of the general contractor who will perform work on the contract that exceeds $50,000 or 1 percent of the proposed project, whichever amount is greater, shall furnish a bond to the Division in an amount to be fixed by the Division.

3. Each of the bonds required pursuant to this section must be executed by one or more surety companies authorized to do business in the State of Nevada. If the contracting body is the State of Nevada or any officer, employee, board, bureau, commission, department, agency or institution thereof, the bonds must be payable to the State of Nevada. If the contracting body is other than one of those enumerated in this subsection, the bonds must be payable to the other contracting body.

4. Each of the bonds must be filed in the office of the contracting body which awarded the contract for which the bonds were given.

5. This section does not prohibit a contracting body from requiring bonds.

1. Subject to the provisions of subsection 2, any claimant who has performed labor or furnished material in the prosecution of the work provided for in any contract for which a payment bond has been given pursuant to the provisions of subsection 1 of NRS 339.025, and who has not been paid in full before the expiration of 90 days after the date on which the claimant performed the last of such labor or furnished the last of such materials for which the claimant claims payment, may bring an action on such payment bond in his or her own name to recover any amount due the claimant for such labor or material, and may prosecute such action to final judgment and have execution on the judgment.

2. Any claimant who has a direct contractual relationship with any subcontractor of the contractor who gave such payment bond, but no contractual relationship, express or implied, with such contractor, may bring an action on the payment bond only:

(a) If the claimant has, within 30 days after furnishing the first of such materials or performing the first of such labor, served on the contractor a written notice which shall inform the latter of the nature of the materials being furnished or to be furnished, or the labor performed or to be performed, and identifying the person contracting for such labor or materials and the site for the performance of such labor or materials; and

(b) After giving written notice to such contractor within 90 days from the date on which the claimant performed the last of the labor or furnished the last of the materials for which the claimant claims payment. Each written notice shall state with substantial accuracy the amount claimed and the name of the person for whom the work was performed or the material supplied, and shall be served by being sent by registered or certified mail, postage prepaid, in an envelope addressed to such contractor at any place in which the contractor maintains an office or conducts business, or at the residence of the contractor.

1. The contracting body shall furnish a certified copy of any payment bond and the contract for which such bond was given to any person who makes an application for such copy and who submits an affidavit stating that the person:

(a) Has supplied labor or material for the completion of the work provided for in the contract, and that the person has not been fully paid for such labor or material;

(b) Is the defendant in an action brought on a payment bond; or

(c) Is surety in a payment bond on which an action has been brought.

2. Every such applicant shall pay for each certified copy a fee fixed by the contracting body to cover the actual cost of the preparation of such copy.

3. A certified copy of any payment bond and of the contract for which such bond was given shall constitute prima facie evidence of the contents, execution and delivery of the original of such bond and contract.

1. Every action on a payment bond as provided in NRS 339.035 shall be brought in the appropriate court of the political subdivision where the contract for which the bond was given was to be performed.

2. No such action may be commenced after the expiration of 1 year from the date on which the claimant performed the last of the labor or furnished the last of the materials for the payment of which such action is brought.

1. It is unlawful for any representative of a contracting body, in issuing an invitation for bids, to require that any bond specified in NRS 339.025 be furnished by a particular surety company or through a particular agent or broker.

2. Any person who violates the provisions of this section is guilty of a misdemeanor.

1. Any person who has furnished labor, materials, provisions, implements, machinery, means of transportation or supplies used or consumed by such contractor or the contractor’s subcontractors in or about the performance of the work contracted to be done, and whose claim therefor has not been paid by such contractor or subcontractors, and who desires to be protected under the bond, shall file with the Department a claim in triplicate within 30 days from the date of final acceptance of the contract as provided in NRS 408.387, and such claim shall be executed and verified before a notary public and contain a statement that the same has not been paid. One copy shall be filed in the office of the Department and the remaining copies shall be forwarded to the contractor and surety.

2. Any such person so filing a claim may at any time within 6 months thereafter commence an action against the surety or sureties on the bond for the recovery of the amount of the claim and the filing of such claim shall not constitute a claim against the Department. Failure to commence such action upon the bond and the sureties within 6 months after date of the Department’s final acceptance will bar any right of action against such surety or sureties.