Construction finance hub

Explore construction finance topics

Construction finance education

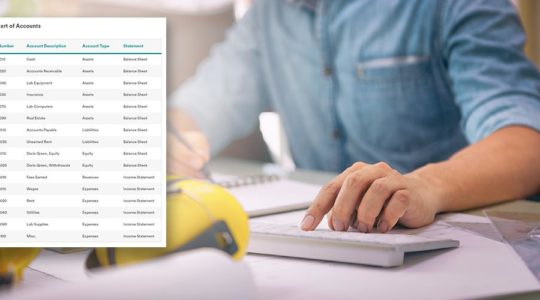

Intro to financial management

Financing for contractors

Construction accounting basics

Finance

calculators

How to calculate your DSO

How to calculate Collection Effectiveness Index

How to calculate Accounts Receivable Turnover

How to calculate Average Days Delinquent

Construction finance options

Retained Earnings

Retained earnings refers to the profit that a construction business is able to put in business savings after each successful project.

- Pros: Using savings has very little cost to the contractor. It’s your own money – you don’t have to pay interest or other fees to use it.

- Cons: It requires significant time, discipline, and efficient business management to build up enough business savings to draw from.

Line of Credit

A line of credit is a limited pool of money that your construction business can draw from as you need it. A line of credit can either be secured or unsecured.

- Pros: Provides cash flow as you need it, so you only pay interest on the amount you use.

- Cons: Typically carries a higher interest rate than a bank loan; requires good credit score and financial statements.

Invoice Factoring

Invoice factoring is a process in which you sell outstanding invoices or accounts receivable. Factoring is only available for invoices after they are issued but before they are due.

- Pros: No credit score required; no monthly payments; factoring company can manage your accounts receivable and collections processes

- Cons: Can affect communication with your customers, if they are not familiar with the process.

Debt Issuance

Debt issuance is typically only available to very large companies with several years of audited financial statements. To issue debt, the company will work with an investment bank to issue bonds or debt to investors.

Equity Offering

An equity offering is an option only for larger companies with a long history of good financial management. In an equity offering, the company’s owner sells stakes in their company to investors in either the private or public markets