Washington Prompt Pay statutes

Washington Prompt Pay statutes

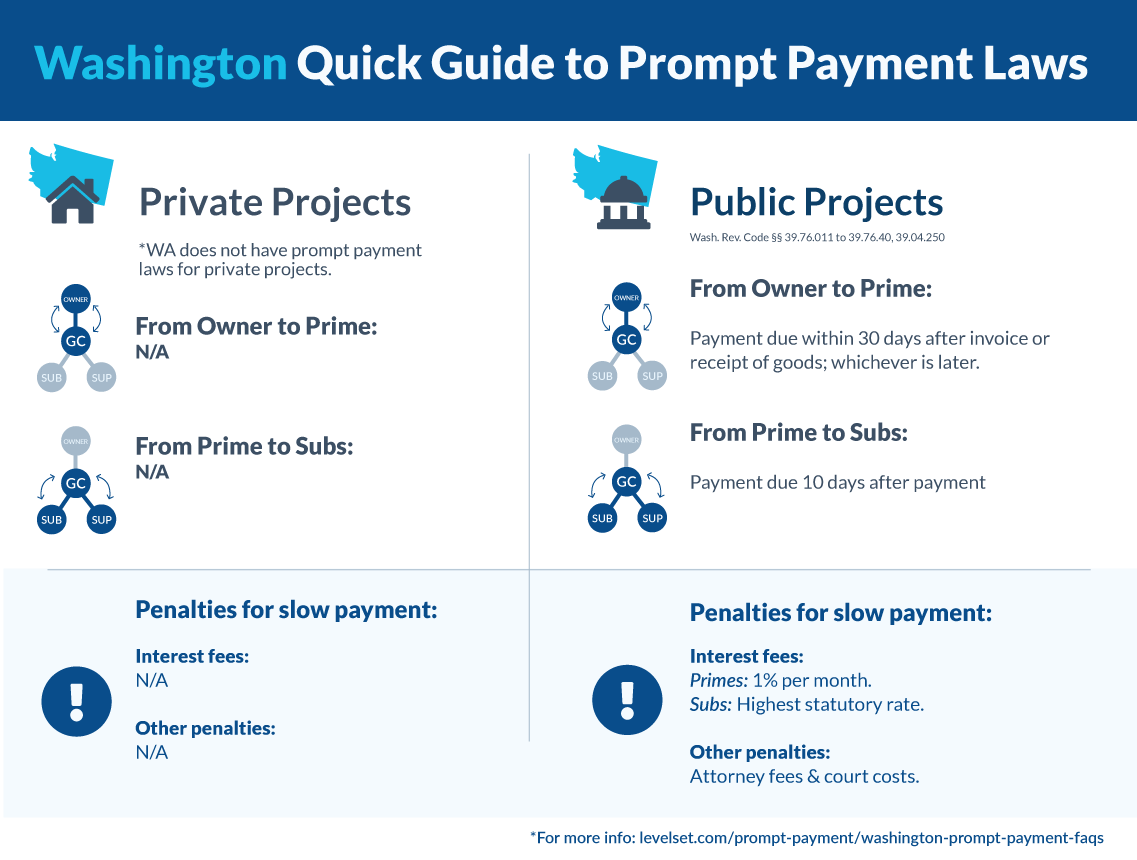

The Washington Prompt Pay Act is a set of statutes found in Wash. Rev. Code Title 38- Public Contracts and Indebtedness. These rules apply only to Washington public projects, this includes work commissioned by the state, county, city, town, schools or any other Washington public body.

Under these prompt payment statutes, owners and contractors on public jobs must pay submitted invoices within a certain period of time or face interest penalties and potential attorneys fees if the debt ends up in court.

Payments from the public entity to the prime contractor

Timing of payments

The payment deadline for the public entity to pay the prime contractor (general contractor) is generally dictated by the terms of the contract. However, payment must be made no later than 30 days after the date the invoice was received or the receipt of services; whichever is later. The statute does provide an exception if the project is funded by a grant or other federal money and is yet to be received by the public contracting agency.

If that’s the case, then the entity will be excused from this obligation. Any funds that are improperly withheld will be subject to an interest rate of 1%, or at least $1 per month. Not only that but if the dispute goes to court, then the prevailing party will be awarded attorney fees as well.

Withholding payments

The public entity is allowed to withhold payment for either unsatisfactory performance or if the payment request doesn’t comply with the contractual requirements. If the agency decides to withhold funds, they must notify the prime contractor that payment is withheld and the reasons for doing so, within 8 days of receipt of the payment request. The amount they are allowed to If the reason for withholding is due to defective work, once the prime corrects the defective work, payment should be made within 30 days.

Payments from the prime to subs

Timing of payments

Once the prime contractor receives payment from the public entity, they, in turn, have 10 days to release payment to their subs and suppliers. This applies to every tier down the payment chain, 10 days from receipt.

Payments that are improperly withheld are subject to a different interest rate than the one prescribed for payments from the public entity. This is the highest rate of interest permissible, under RCW §19.52.025 and is set by the State Treasurer. This number is published once a month in the Washington State Register, which has been set at 12% a year for some time now.

Withholding payments

Contractors are also allowed to withhold payment for unsatisfactory performance based on the contract terms between the parties. They are also required to provide notice that payment is not forthcoming, but the statute is less clear. It merely states that they must provide the subcontractor notice as soon as practicable after determining the cause for withholding.

However, this must be sent before the payment becomes due. If the reason for withholding is due to defective work, and the work or materials are remedied, the contractor must remit payment within 8 days. Additionally, if funds are to be withheld from subcontractors the general contractor must also provide a copy of the notice to the public entity contracting the job. Failure to comply with any of these notice requirements will result in late payment and interest will accrue after the 8-day deadline.

Withholding retainage on Washington projects

As for withholding payments for retainage purposes, the rate and release timing is also regulated on public projects in Washington. The statute requires that retainage be withheld on all public project. The percentage that’s withheld cannot exceed 5%, and that applies to both direct contracts and subcontracts. However, Washington laws do provide a few different options for contractors when it comes to retainage practices.

First, a contractor can elect to substitute a bond instead of having cash retainage withheld. Another option is at any point in time, a contractor has the option to have retainage reduced to 100% of the remaining contract price. This can be a useful mechanism for contractors having cash flow issues near the end of the project.

And lastly, the contractor can choose to have the retained funds held in an interest-bearing account. The interest accrued being payable to the contractor when retainage becomes due. Once the contract is satisfactorily completed, the withheld retainage must be released within 60 days.

Bottom line

Working on public projects can be a complicated, yet lucrative prospect. And, as with any construction project, payment issue can arise all the time. The Washington Prompt Pay Act is meant to protect contractors and suppliers on such projects by establishing a default payment schedule that must be complied with. These are important deadlines to know both for enforcing your right to timely payment, as well as ensuring that you pay your subs and suppliers on time.

Additional resources

- Washington Prompt Payment Act Overview & FAQs

- How to Make a Claim Under Prompt Payment Laws

- How to Get Paid on Washington State Public Projects

Washington Prompt Pay statutes

Washington Prompt Pay statutes