Hawaii Payment Terms Overview

- Private Jobs

- Public Jobs

- Top Links

Pay when Paid Valid (Likely Enforceable as Pay If Paid if Clear)

In Hawaii, pay when paid clauses are likely enforceable as pay if paid clauses sufficient to be a condition precedent to payment. HRS § 444-25 states that If payment is contingent upon receipt of funds, the contractor shall clearly state this fact in the contractor's solicitation of bids.

Pay If Paid Likely Valid

Likely enforceable. No Hawaii courts have specifically addressed the issue – but Hawaii statutes seem to allow for the enforcement of pay if paid clauses. HRS Sec. 444-25: “If payment is contingent upon receipt of funds, the contractor shall clearly state this fact in the contractor’s solicitation of bids.”

Trust Fund Statute Does Not Exist

Hawaii does not have a trust fund statute that specifically governs the treatment of construction funds prior to payment.

Retainage Unregulated

Hawaii does not regulate retainage amounts or process on private jobs. Accordingly, retainage on private projects is set and governed solely through contract.

Payment Due to Subs/Suppliers in 10 Days

For Subs & Suppliers, payment must be made within 10 days of invoice, but may be withheld until funds received from escrow or trust if lower-tiered party was made aware of such limitation in bid process. There is no regulation of time for payment from owner to prime on private projects in Hawaii.

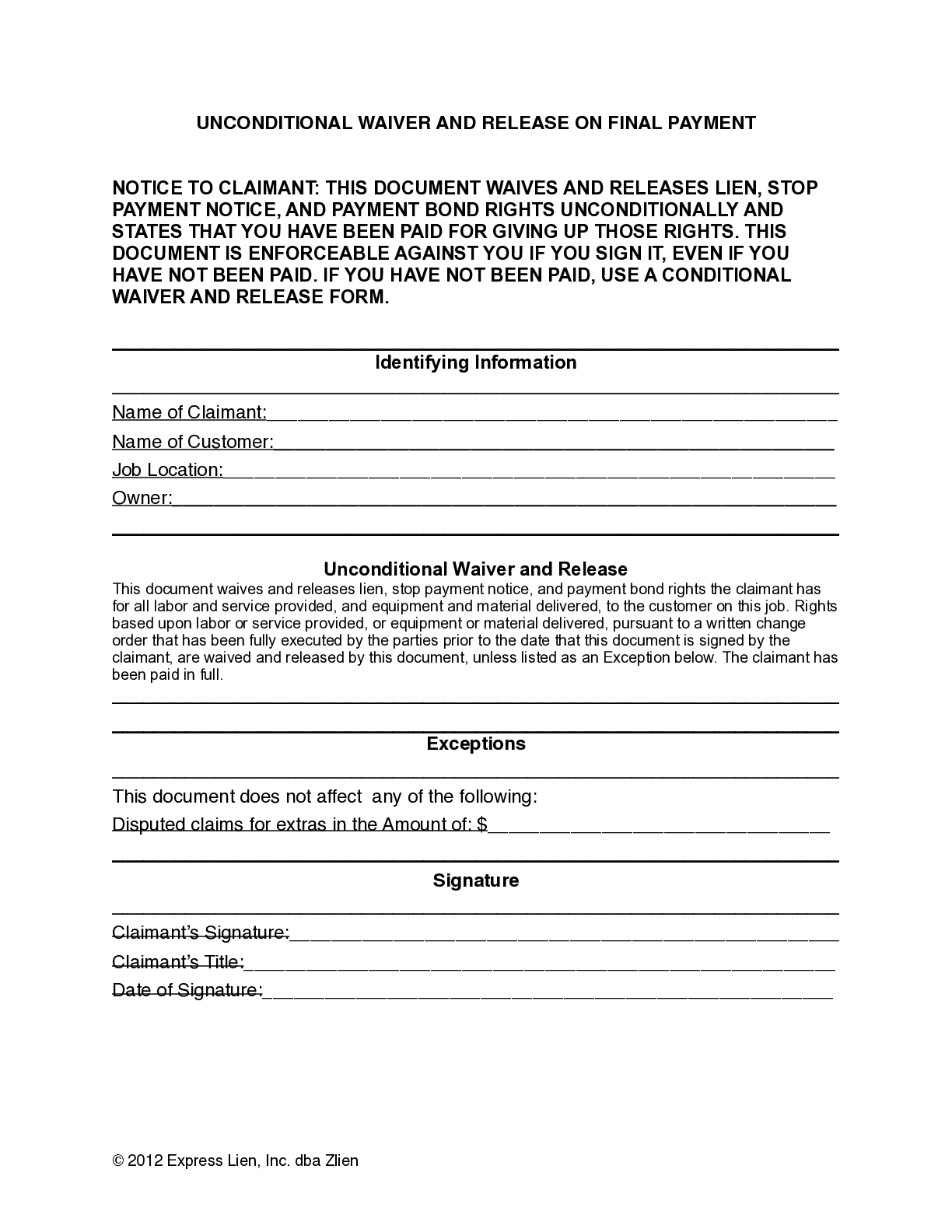

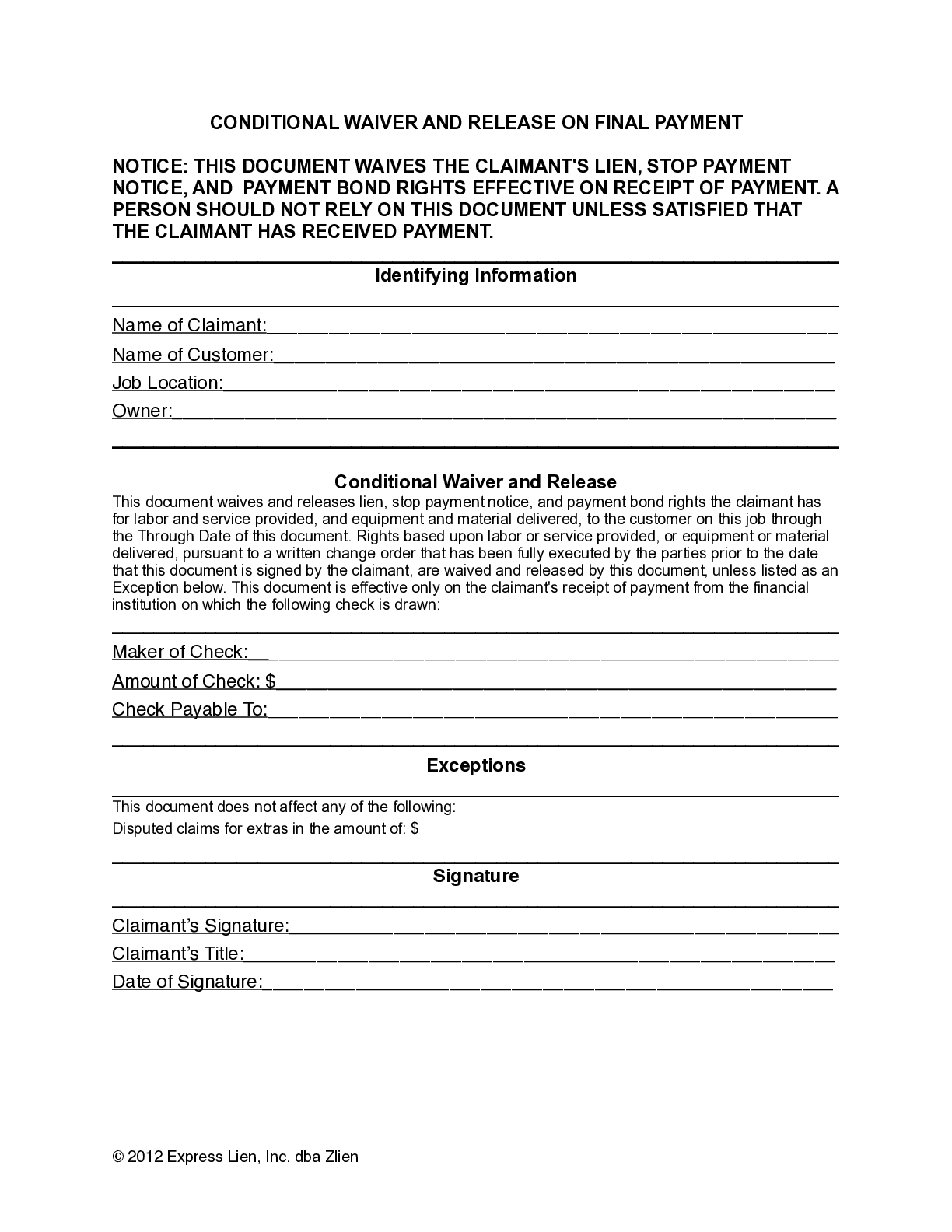

Lien Waiver Form Not Regulated

Hawaii does not mandate the use of a particular lien waiver form by statute, so parties are free to use and form with any words they want. Additionally, Hawaii does not regulate the timing of lien waivers, so participant on Hawaii projects must be careful to review contracts and pay attention to both the timing and content of waivers.

Pay When Paid Likely Valid as Pay If Paid

Likely enforceable. No Hawaii courts have specifically addressed the issue – but Hawaii statutes seem to allow for the enforcement of pay-if-paid clauses. HRS Sec. 444-25: “If payment is contingent upon receipt of funds, the contractor shall clearly state this fact in the contractor’s solicitation of bids.”

Pay If Paid Likely Enforceable

Likely enforceable. No Hawaii courts have specifically addressed the issue – but Hawaii statutes seem to allow for the enforcement of pay-if-paid clauses. HRS Sec. 444-25: “If payment is contingent upon receipt of funds, the contractor shall clearly state this fact in the contractor’s solicitation of bids.”

Trust Fund Statute Does Not Exist

Hawaii does not have a trust fund statute that specifically governs the treatment of construction funds prior to payment.

Retainage Limited to 5%

A contractor or subcontractor may retain no more than 5% of any partial payment due under a subcontract. Once 50% completion has been reached, if performance is satisfactory, the public entity may pay any retainage amount previously withheld.

Payment Due to Subs/Suppliers in 10 Days

Payment to subs/suppliers is due within 10 days after payment received from above. Payment to GCs due within 30 days of invoice.

Construction payment is highly regulated all over the United States, and this includes Hawaii. every state has at least some legislation related to payment timing, what percentage of payment may be withheld, how lien rights or other security instruments play into the payment scheme, and more. All of these legislative directives, however, must be balanced with the ability of construction participants to freely contract as they see fit.

In Hawaii, the scales generally tip toward freedom of contract (with a few exceptions). Generally, on private projects, property developers, contractors, and suppliers can enter into construction contracts that control payment terms with very little oversight or limiting regulation from statute. Hawaii allows parties on most private projects to set the the retainage amount process, the timing and content of lien waivers, and even agree to shift the risk of nonpayment to parties lower on the payment chain through settingh pay if paid provisions, as specific conditions precedent to payment.

All of this means that construction participants on projects in Hawaii should be very careful and thorough in reviewing their contracts, and every payment document to be exchanged. This is especially since some pay if paid provisions are included in “standard” construction contracts, and lien rights can be waived prior to work.

Lien waivers are generally unregulated in Hawaii. Not only may parties may use any form with any wording they want, lien rights can be waived at any time, even in a contract prior to furnishing work.

There are some key laws that regulate the construction payment process in Alaska, which include:

- Lien Rights Laws

- Preliminary Notices

- Lien Waivers

- Mechanic Liens

- Bond Claims

- Retainage Laws

- Prompt Payment Laws

Public projects in Hawaii have a little more regulation governing the payment terms. Retainage is limited to 5%, and can be released upon 50% project completion. Payment is required to be made within certain timeframes (10 day from payment from above for subs/suppleirs; within 30 days of invoice for Gas) pursuant to “prompt pay” statutes.

Note, however, that the applicability and enforceability of pay when paid and pay if paid provisions apply equally to public projects, as well, so the other heightened regulations is not an excuse to not be diligent with respect to reviewing contracts. While no Hawaii courts have specifically addressed the issue of pay if paid clauses on public projects, Hawaii statutes seem to specifically allow for the enforcement of pay-if-paid clauses in HRS Sec. 444-25, which states: “If payment is contingent upon receipt of funds, the contractor shall clearly state this fact in the contractor’s solicitation of bids.”

It’s important for everyone on a construction project to treat one another fairly. But, when it comes to signing construction contracts in Hawaii, exchanging payment applications, and eventually, making or receiving payment . . . it’s important to know the rules of the game. This page provides a resource to you to really understand those rules.