New Mexico

Preliminary Notice Deadlines

New Mexico

New Mexico

New Mexico

New Mexico

New Mexico

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from final settlement of the contract.

New Mexico

New Mexico

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from final settlement of the contract.

In New Mexico, protection is extended to almost all parties below the general contractor who furnish labor and/or materials to a public project, provided that project is in excess of $25,000. Suppliers to suppliers may be covered.

Note, however, that any subcontractor who submits a bid of more than $60,000 on a public project must be registered with the labor and industrial division of the state labor department.

The bond claim must be received by the general contractor within 90 days after the claimant last furnishes labor and/or material to the project. Note that parties with a direct contractual relationship with the general contractor are not required to give notice of the bond claim within any specific time period.

While the general contractor is the only party statutorily required to receive the bond claim, it is likely advisable to also send a copy to the public entity in charge of the project.

Suit to enforce the bond claim must be initiated within one year of final payment to the prime contractor, but after the claim is given to the general contractor. Notice of suit filing must be sent to the obligee on the bond 30 days prior to filing suit.

Bond claims in New Mexico must include the amount claimed and the name of the contractor/ subcontractor to whom the material was furnished or for whom the labor was done or performed.

New Mexico does not have statutory lien waiver forms, and therefore, you can use any lien waiver forms. Since lien waivers are unregulated, be careful when reviewing and signing lien waivers. See this article: Should You Sign That Lien Waiver?.

New Mexico state law is unclear or silent about whether contractors and suppliers can waive their lien rights before any work on the project begins. Accordingly, you want to proceed with caution on this subject. You can learn more about such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

Maybe. Suppliers to suppliers may be able to file a bond claim in New Mexico. The law is not clear.

Learn more about Bond Claim Rights for Suppliers to Suppliers

New Mexico bond claims must be sent via registered mail, or personal service.

We are a subcontractor not the GC. We have not been able to get paid. We built a metal building for an oil company on state land.

If you filed a bond claim what are the time lines for the bond company to pay?Company went out of business so I filed a claim on the bond

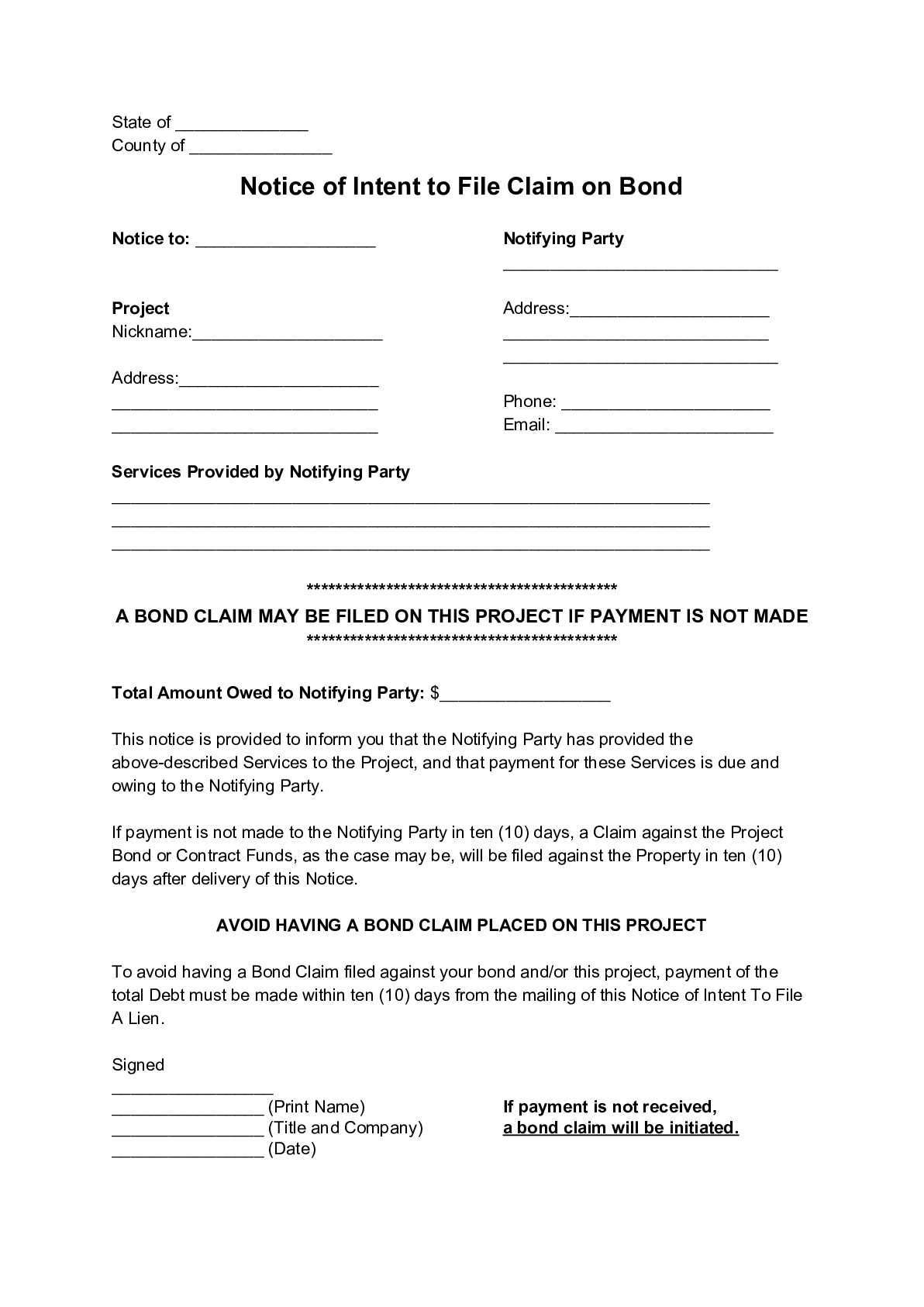

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a claimant...

When you perform work on a state construction project in New Mexico, and are not paid, you can file a “lien” against the project pursuant to New Mexico’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

New Mexico’s Little Miller Act is found in New Mexico Statutes Chapter 13, Article 4, and is reproduced below.

A. When a construction contract is awarded in excess of twenty-five thousand dollars ($25,000), the following bonds or security shall be delivered to the state agency or local public body and shall become binding on the parties upon the execution of the contract. If a contractor fails to deliver the required performance and payment bonds, the contractor’s bid shall be rejected, its bid security shall be enforced to the extent of actual damages. Award of the contract shall be made pursuant to the Procurement Code [13-1-28 NMSA 1978] in the following manner:

(1) a performance bond satisfactory to the state agency or local public body, executed by a surety company authorized to do business in this state and said surety to be approved in federal circular 570 as published by the United States treasury department or the state board of finance or the local governing authority, in an amount equal to one hundred percent of the price specified in the contract; and

(2) a payment bond satisfactory to the state agency or local public body, executed by a surety company authorized to do business in this state and said surety to be approved in federal circular 570 as published by the United States treasury department or the state board of finance or the local governing authority, in an amount equal to one hundred percent of the price specified in the contract, for the protection of all persons supplying labor and material to the contractor or its subcontractors for the performance of the work provided for in the contract.

B. The state purchasing agent or the central purchasing office may reduce the amount of the performance bond required prior to solicitation to not less than fifty percent of the contract price if it is determined to be less costly or more advantageous to the state agency or local public body to self-insure a part of the performance of the contractor.

C. The state purchasing agent or the central purchasing office may reduce the amount of the payment bond required prior to solicitation of not less than fifty percent of the contract price if it is determined that it is in the best interest of the state agency or local public body to do so. Factors to be considered in order to make such a determination include, but are not limited to:

(1) the value and number of subcontracts to be awarded by the contractor; and

(2) the value of the contract.

D. Nothing in this section shall be construed to limit the authority of the state agency or local public body to require a performance bond or other security in addition to those bonds, or in circumstances other than specified in Subsection A of this section.

E. For contracts under twenty-five thousand dollars ($25,000) the state agency or local public body may impose in its sole and complete discretion the requirements of Subsections A, B and C of this section.

A. The state shall have the right to sue on the payment bond for all taxes due arising out of construction services rendered under a contract, in respect of which a payment bond is furnished under Section 13-4-18 NMSA 1978 by a contractor that does not have its principal place of business in New Mexico, and to prosecute such action to final execution and judgment for the sum due. The court may allow, as part of the costs, interest and reasonable attorney fees.

B. Every person, firm or corporation that has furnished labor or materials in the prosecution of work provided for in a contract, in respect of which a payment bond is furnished under Section 13-4-18 NMSA 1978, and that has not been paid in full for the labor or materials before the expiration of a period of ninety days after the day on which the last of the labor was done or performed or materials were furnished or supplied for which claim is made, shall have the right to sue on the payment bond for the amount of the balance unpaid at the time of the institution of the suit and to prosecute such action to final execution and judgment for the sum or sums justly due for the labor done or performed or materials furnished to be used in the construction of the project; provided, however, that sums justly due shall be determined according to the subcontract or other contractual relationship directly with the contractor furnishing the payment bond. A person having a direct contractual relationship with a subcontractor but no contractual relationship, express or implied, with the contractor furnishing the payment bond shall have a right of action upon the payment bond upon giving written notice to the contractor, within ninety days from the date on which the person did or performed the last of the labor or furnished or supplied the last of the materials for which the claim is made, stating with substantial accuracy the amount claimed and the name of the party to whom the materials were furnished or supplied or for whom the labor was done or performed. Notice shall be served by mailing the notice by registered mail, postage prepaid, in an envelope addressed to the contractor at any place the contractor maintains an office or conducts business or at the contractor’s residence or in any manner in which the service of summons in civil process is authorized by law.

C. The claimant in the suit shall notify the obligee named in the bond of the beginning of such action, stating the amount claimed, and no judgment shall be entered in the action within thirty days after giving notice. The obligee and any person, firm, corporation or the state having a cause of action on the bond may be admitted on motion as a party to the action, and the court shall determine the rights of all parties thereto. If the amount realized on the bond is insufficient to discharge all claims in full, the amount shall be distributed among the parties entitled thereto pro rata.

D. Except for suits by the state with respect to taxes that shall be brought in the name of the revenue processing division of the taxation and revenue department, every suit instituted under this section shall be brought in the name of the state for the use of the person suing in the district court in any judicial district in which the contract was to be performed and executed or where the claimant resides, but no such suit, including one brought by the revenue processing division, shall be commenced after the expiration of one year after the date of final settlement of the contract. The date of final settlement, for purposes of this section, is that date set by the obligee in the final closing and settlement of payment, if any, due the contractor. The state shall not be liable for the payment of any costs or expenses of any such suit.

E. The obligee named in the bond is authorized and directed to furnish to any person, firm or corporation making application therefor that submits an affidavit that the person, firm or corporation has supplied labor or materials for such work and payment has not been made or that the person, firm or corporation is being sued on any such bond or to furnish to the revenue processing division of the taxation and revenue department a certified copy of the bond and the contract for which it was given, which copy shall be prima facie evidence of the contents, execution and delivery of the original, and, in case final settlement of the contract has been made, a certified statement of the date of such settlement, which shall be conclusive as to such demand upon it. Applicants shall pay for the certified copies and certified statements such fees as the obligee fixes to cover the cost of preparation.

Whenever in its judgment any surety on such bond shall be insolvent, or for any cause is not a proper or sufficient surety, the obligee may require the contractor to furnish a new or additional bond or security within ten days; and thereupon, if the obligee shall so order, all work on said contract shall cease until such new or additional bond or security shall be furnished. If not furnished within said time, the obligee may at its option take over and complete said work as the agent and at the expense of the contractor and sureties, either doing the work on force account or letting the same by contract, and shall be entitled to use any equipment, materials and supplies of the delinquent contractor in completing said work.