Maine

Preliminary Notice Deadlines

Maine

Maine

Maine

Maine

Maine

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project.

Maine

Maine

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project.

In Maine, all furnishers of labor, materials, or rental equipment to a general contractor or first-tier subcontractor may make a claim against the bond on a public project. All public projects in excess of $125,000 are required to have a bond.

Note that if the contract is entered into with a city, town, county, school district, or other municipal corporation, a claimant may be able to claim a mechanic’s lien on the property itself by following the same steps as to file a mechanic’s lien on a private project. This may mean that a general contractor would have lien rights in this circumstance.

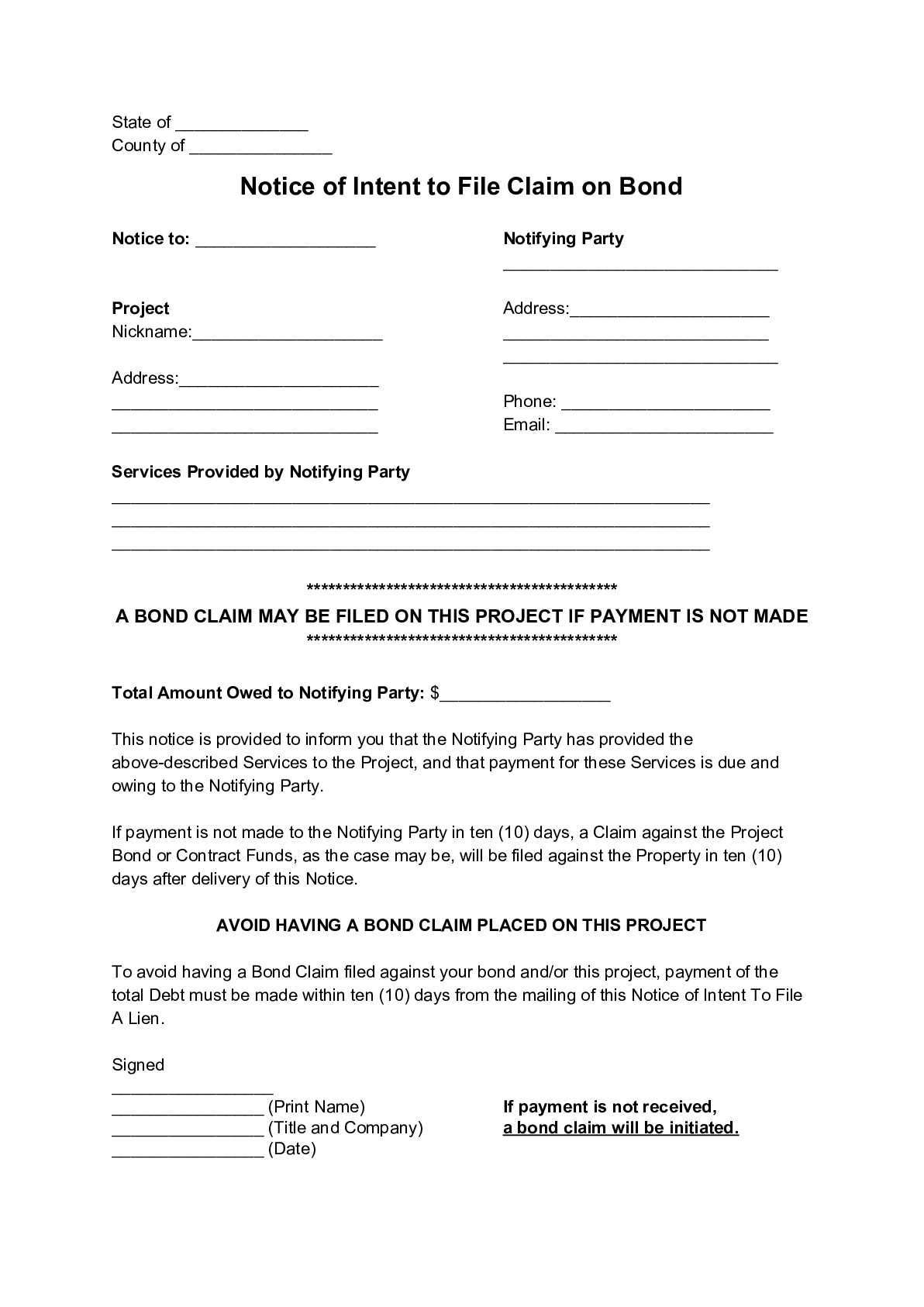

Second tier subcontractors must file notice within 90 days of last labor and/or materials. While first tier subcontractors are not technically required to give final notice by statute, it is likely good practice follow the same requirements as a second-tier sub.

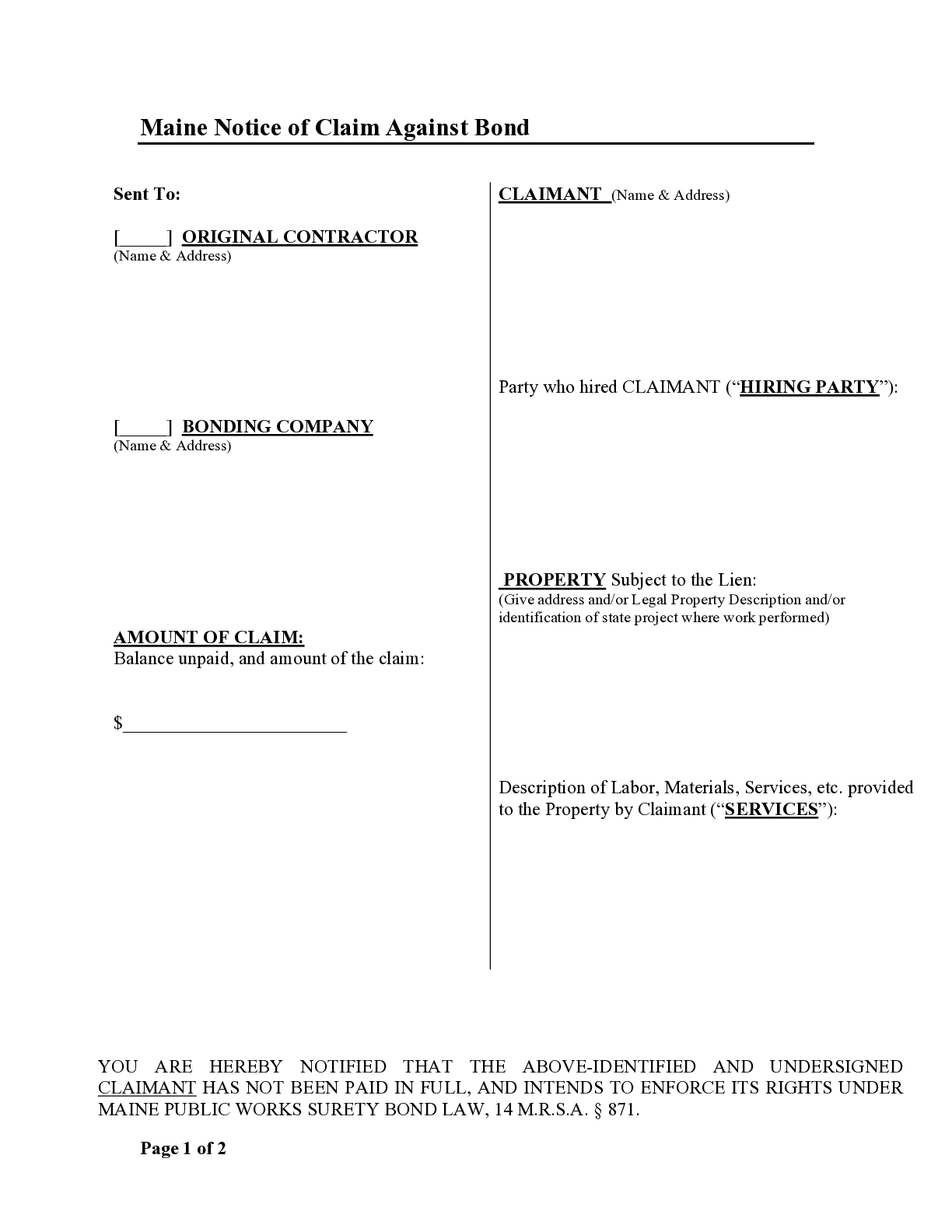

In Maine, only the general contractor is required to receive the claim, however, it may be best practice to also send notice of the claim to the public entity and the surety (if known).

Suit must be filed after 90 days, but within one year of the claimant’s last furnishing of labor and/or materials to the project.

The amount claimed and the name of the party for whom labor/ materials were supplied. It is likely best practice to include a description of the work labor and/or material furnished, and some identification of the project, as well.

Maine does not have statutory lien waiver forms, and therefore, you can use any lien waiver forms. Since lien waivers are unregulated, be careful when reviewing and signing lien waivers. See this article: Should You Sign That Lien Waiver?.

Maine state law is unclear or silent about whether contractors and suppliers can waive their lien rights before any work on the project begins. Accordingly, you want to proceed with caution on this subject. You can learn more about such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

No, suppliers to suppliers likely cannot file a bond claim in Maine.

Registered or certified mail. While there is no specific receipt requirement in Maine, it is generally best to obtain proof of actual receipt.

I missed a claim deadline and my payment is not protected. I am wanting to know the step I need to take in order to...

We Filed a Bond ClaimWe 're a Manufacturer supplier, and supplied material to a DBE company that supplied material to a sub-contractor. The DBE company had filed for Bankruptcy...

bond claimI am a subcontractors who filed a lein 4 months ago in flordia, the contractor has not paid, but provided his surety. How do I...

On state projects, a claimant may protect its right to payment by filing a claim against the prime contractor’s bond by delivering notice of said...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Maine, and are not paid, you can file a “lien” against the project pursuant toMaine ‘s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Maine’s Little Miller Act is found in Maine Revised Statutes, Title 14, Civil Part 2, Chapter 205, Sub-chapter 3..

1. Title. This section shall be known and may be cited as the “Public Works Contractors’ Surety Bond Law of 1971”.

2. Person and claimant. The terms “person” and “claimant” and the masculine pronoun as used in this section shall include individuals, associations, corporations or partnerships.

3. Surety bonds. Except as provided in Title 5, section 1745, before any contract exceeding $125,000 in amount for the construction, alteration or repair of any public building or other public improvement or public work, including highways, is awarded to any person by the State or by any political subdivision or quasi-municipal corporation or by any public authority, that person must furnish to the State or to the other contracting body, as the case may be, the following surety bonds:

A. A performance bond in an amount equal to the full contract amount, conditioned upon the faithful performance of the contract in accordance with the plans, specifications and conditions thereof. Such a bond is solely for the protection of the State or the contracting body awarding the contract, as the case may be. A performance bond issued pursuant to this paragraph must include on its face the name of and contact information for the surety company that issued the bond; and

B. A payment bond in an amount equal to the full amount of the contract solely for the protection of claimants supplying labor or materials to the contractor or the contractor’s subcontractor in the prosecution of the work provided for in the contract. The term “materials” includes rental of equipment. A payment bond issued pursuant to this paragraph must include on its face the name of and contact information for the surety company that issued the bond.

When required by the contracting authority, the contractor shall furnish bid security in an amount the contracting authority considers sufficient to guarantee that if the work is awarded the contractor will contract with the contracting agency.

The bid security may be in the form of United States postal money order, official bank checks, cashiers’ checks, certificates of deposit, certified checks, money in escrow, bonds from parties other than bonding companies subject to an adequate financial standing documented by a financial statement of the party giving the surety, bond or bonds from a surety company or companies duly authorized to do business in the State.

The bid security may be required at the discretion of the contracting authority to ensure that the contractor is bondable.

The bid securities other than bid bonds must be returned to the respective unsuccessful bidders. The bid security of the successful bidder must be returned to the contractor upon the execution and delivery to the contracting agency of the contract and performance and payment bonds, in terms satisfactory to the contracting agency for the due execution of the work.

In the case of contracts on behalf of the State, the bonds must be payable to the State and deposited with the contracting authority. In the case of all other contracts subject to this section, the bonds must be payable to and deposited with the contracting body awarding the contract.

3-A. Letter of credit. Notwithstanding the surety bond requirements of subsection 3, at the discretion of the State or other contracting authority, a person may provide an irrevocable letter of credit in lieu of the performance bond required by subsection 3, paragraph A or the payment bond required by subsection 3, paragraph B, or both, to the State or the contracting authority, as the case may be. For purposes of this subsection, “letter of credit” has the same meaning as in Title 11, section 5-1102, subsection (1), paragraph (j).

A. The letter of credit must be:

(1) Issued in favor of the State or other contracting authority by a federally insured financial institution;

(2) In a form satisfactory to the State or other contracting authority; and

(3) In an amount equal to the full amount of the contract.

B. In order to issue an irrevocable letter of credit as an alternative to a surety bond under this subsection, a financial institution or its parent company must:

(1) Maintain a long-term unsecured debt rating of at least “A3” issued by Moody’s Investors Service, Inc. or “A-” issued by Standard and Poor’s Corporation;

(2) Maintain a short-term commercial paper rating within the 3 highest categories established by Moody’s Investors Service, Inc. or Standard and Poor’s Corporation; or

(3) Be certified in writing by the Superintendent of Financial Institutions that the financial institution’s capital ratios, as calculated in the most recent quarterly consolidated report of condition and income, meet or exceed the requirements for well-capitalized financial institutions.

C. If the letter of credit has an expiration date that is earlier than the date of acceptance of performance of the contract in accordance with the plans, specifications and conditions of the contract, a replacement letter of credit that meets the specifications of paragraph A must be delivered to the State or other contracting authority not later than 30 days prior to that expiration date.

4. Actions. Any person who has furnished labor or material to the contractor or to a subcontractor of the contractor in the prosecution of the work provided for in a contract in respect to which a payment bond has been furnished under subsection 3, paragraph B, and who has not been paid in full before the expiration of 90 days after the day on which the last of the labor was performed by that person or material was furnished or supplied by that person for which a claim is made, may bring an action on the payment bond in that person’s own name for the amount, or the balance thereof, unpaid at the time of the institution of the action. Any such claimant having a direct contractual relationship with a subcontractor of the contractor furnishing such a payment bond but no contractual relationship, express or implied, with that contractor does not have the right of action upon that payment bond unless the claimant has given written notice to the contractor within 90 days from the date on which the claimant performed the last of the labor, or furnished or supplied the last of the material for which the claim is made, stating with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed. Such a notice must be served by registered or certified mail, postage prepaid, in an envelope addressed to the contractor at any place the contractor maintains an office or conducts business, or at the contractor’s residence.

Any such action may not be commenced after the expiration of one year from the date on which the last of the labor was performed or material was supplied for the payment of which the action is brought, except that in the case of a material supplier, when the amount of the claim is not ascertainable due to the unavailability of final quantity estimates, the action may be commenced before the expiration of one year from the date on which the final quantity estimates are determined. The notice of claim from the material supplier to the contractor furnishing the payment bond must be filed before the expiration of 90 days following the determination by the contracting authority of the final quantity estimates.

The contracting body and the agent in charge of its office shall furnish to anyone making written application therefor who states that the person has supplied labor or materials for such work and payment therefor has not been made, or that the person is being sued on any such bond, or that the person is the surety thereon, a certified copy of the bond and the contract for which it was given, which copy is prima facie evidence of the contents, execution and delivery of the original. Applicants shall pay for the certified copies such reasonable fees as the contracting body or the agent in charge of its office fixes to cover the actual cost of preparation thereof.

5. Application. This section shall not apply to any contract awarded pursuant to any invitation for bids issued on or before September 23, 1971 or to any bonds furnished in respect to any such contract.

6. Jurisdiction. An action on a performance bond furnished under subsection 3, paragraph A or an action on a payment bond furnished under subsection 3, paragraph B in accordance with subsection 4 must be brought in the county in this State where the construction, alteration or repair of the public building or other public improvement or public work is located.