Florida

Preliminary Notice Deadlines

Florida

Florida

Florida

Florida

If you did not contract with the prime contractor, must deliver a Notice to Contractor to the prime contractor within 45 days of first furnishing labor and/or materials to the project.

Florida

For those who did not contract directly with the prime, must deliver a Notice of Nonpayment to the prime contractor and the surety within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well).

Florida

Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project. Unless a Notice of Contest of Claim Against Payment Bond is filed and served. Then the deadline is just 60 days from receipt of the notice.

Florida

If you did not contract with the prime contractor, must deliver a Notice to Contractor to the prime contractor within 45 days of first furnishing labor and/or materials to the project.

Florida

For those who did not contract directly with the prime, must deliver a Notice of Nonpayment to the prime contractor and the surety within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well).

Florida

Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project. Unless a Notice of Contest of Claim Against Payment Bond is filed and served. Then the deadline is just 60 days from receipt of the notice.

Florida’s Little Miller Act, that governs payment bond requirements and claims, covers all public projects (state, county, local, etc.) where the original contract price is valued at $200,000 or more.

On public projects of less than the $200,000 amount, there will likely still be a payment bond on the project. However, the terms of the bond itself will govern notice, and claim requirements.

• Learn more: Get a Copy of the Payment Bond If You’re On a Public Project

In Florida, with the exception of the general contractor, the same parties who are allowed to file a mechanic’s lien on a private project are generally allowed to make a bond claim on a public project. However, suppliers to suppliers likely cannot file a bond claim in Florida.

Note that for construction-management or design-build contracts, if the payment bond amount does not specifically include the cost of the design or other non-construction services, parties performing these services are not covered by the bond.

A Florida bond claim, must be received more than 45 days after the claimant’s first furnishing of labor and/or materials to the project, but within 90 days after the claimant’s last furnishing of labor and/or materials to the project. Only those who didn’t contract directly with the prime contractor are required to send one, however, it may be a good idea to send one regardless; that way you can initiate the claim process and potentially avoid a lawsuit.

Pay-when-paid language in a contract between the general and a sub is not a defense for the surety against that subs claim for payment under the bond.

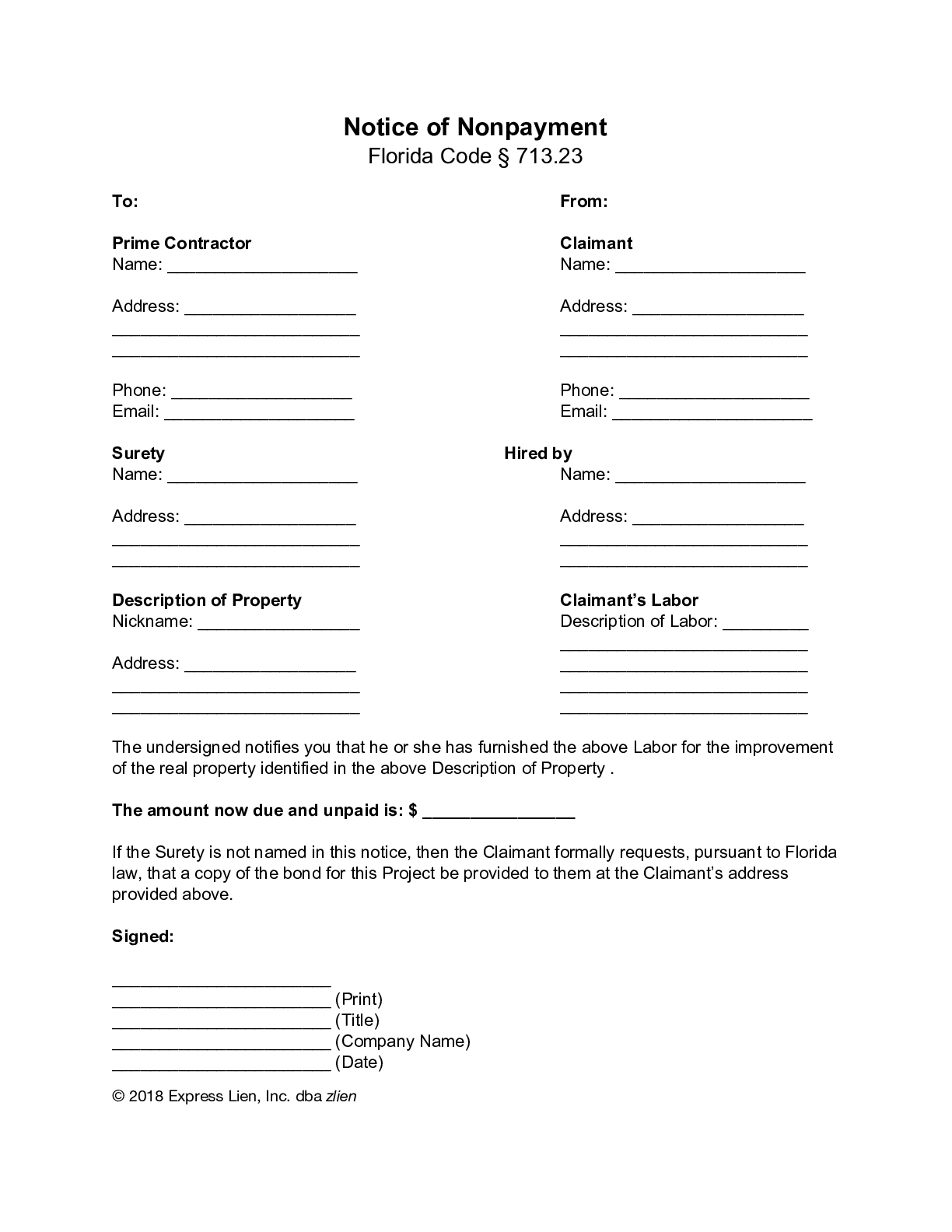

In Florida, a bond claim (Notice of Nonpayment) must include the following information:

• Claimant’s information;

• Prime contractor’s information;

• Surety’s information;

• Description of labor and/or materials already provided;

• Property description;

• Total amount unpaid;

• Amount of unpaid retainage;

• Amount paid to date; &

• Description of labor and/or materials to be provided, and the corresponding amount expected to become due.

→ Download a free Florida Notice of Nonpayment (public bond claim) form here

In Florida, the bond claim must be delivered to the general contractor and the surety. If the claimant so desires, a copy of the claim could also be sent to the contracting public entity as well.

A Florida Notice of Nonpayment can be served by actual delivery to the person being served; by registered, Global Express Guaranteed, or certified mail, with postage prepaid; or by posting on the job site if service can’t be accomplished by the previous two methods.

There are a lot of questions on this page about who can make a Florida bond claim, when it must be made, what types of rules apply, and more. But you may be wondering something more practical; how do I actually make a bond claim in Florida?

• For a full breakdown of the bond claim process, see: How to Make a Florida Payment Bond Claim

Generally, a lawsuit to enforce a bond claim in Florida must be initiated within 1 year of claimant’s last furnishing of labor and/or materials to the project.

However, this time period may be shortened if the general contractor files a Notice of Contest of Claim Against Payment Bond. If the prime contractor files this notice, suit must be initiated within 60 days of the date on which that notice is mailed to the claimant by the clerk.

I am a subcontractors who filed a lein 4 months ago in flordia, the contractor has not paid, but provided his surety. How do I...

Filing a surety bond lien for a Florida storm clean up projectHello! I am a subcontractor on a job in Florida for storm clean up work. We provided equipment and staffing for cleaning up roads and...

How do I have a lien extinguished by statuteI own a home in Fla. and git into it with the GC over shoddy work. He subsequently filed a mechanics lien through his attorney....

This Notice of Nonpayment for private bond claim form can be used to make a claim on the bond itself. In Florida, when a Payment...

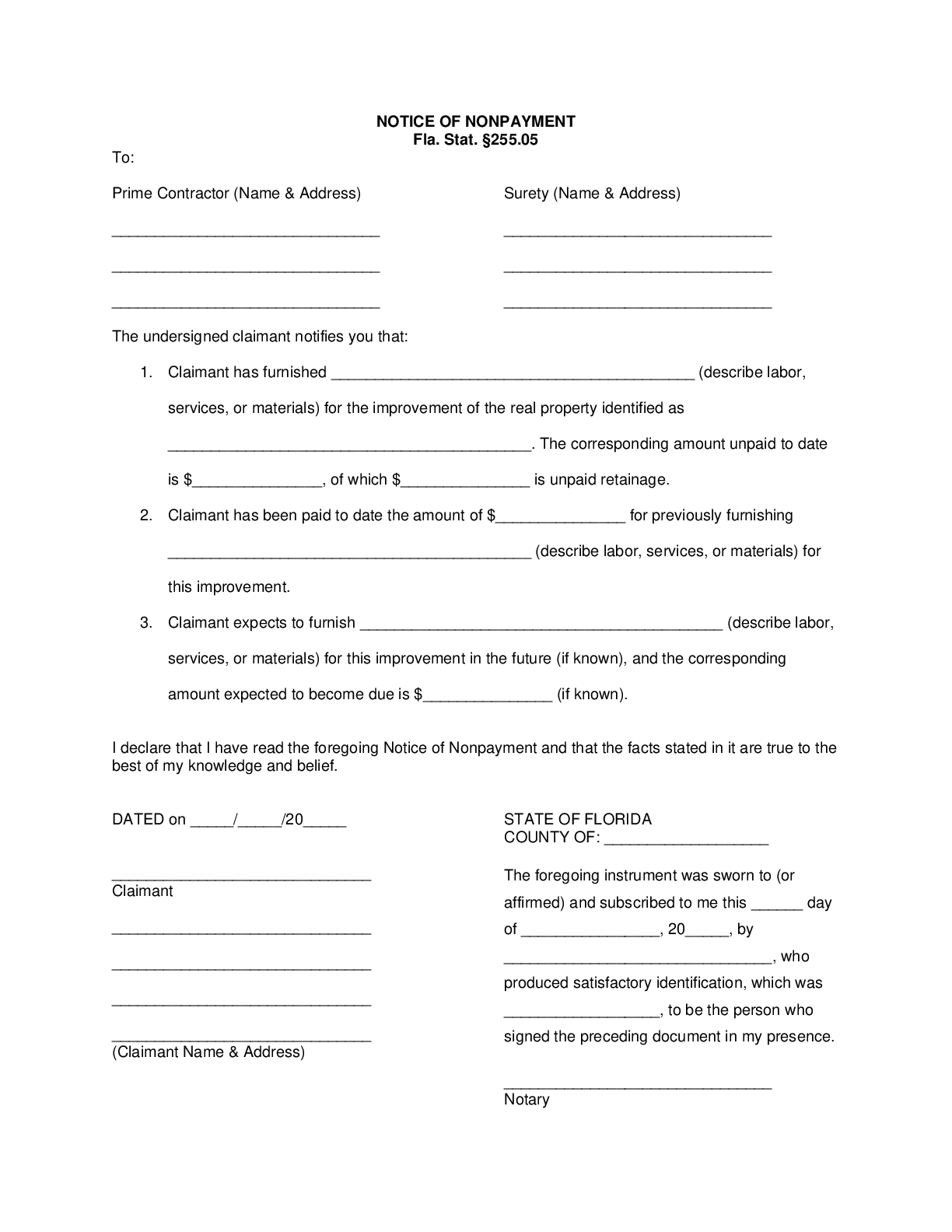

Florida Notice of Nonpayment Form (Public Bond Claim) This is a Florida Notice of Nonpayment form (also referred to as a Public Project Bond Claim). This...

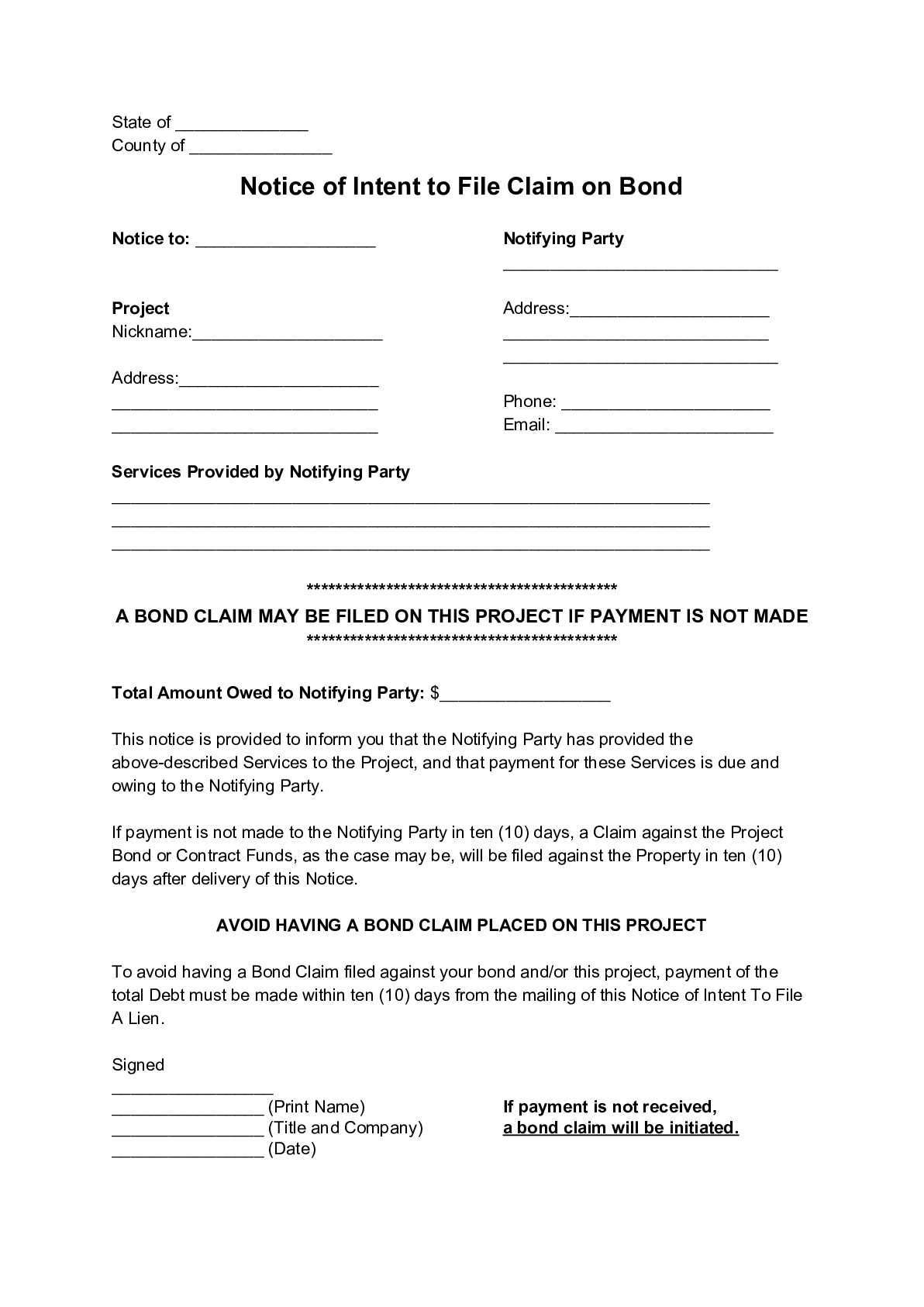

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

Under Florida’s Little Miller Act, on almost every public project (i.e. funded by the state, local, or municipal government entity) the prime contractor is required to post a payment bond. If unpaid on a public works project, a party can make a claim against that payment bond. Florida’s Little Miller Act is codified in Florida Statutes, title XVIII, Chapter 255, §255.05, and is reproduced below. Updated as of 2023.

(1) A person entering into a formal contract with the state or any county, city, or political subdivision thereof, or other public authority or private entity, for the construction of a public building, for the prosecution and completion of a public work, or for repairs upon a public building or public work shall be required, before commencing the work or before recommencing the work after a default or abandonment, to execute and record in the public records of the county where the improvement is located, a payment and performance bond with a surety insurer authorized to do business in this state as surety. A public entity may not require a contractor to secure a surety bond under this section from a specific agent or bonding company.

(a) The bond must state on its front page:

1. The name, principal business address, and phone number of the contractor, the surety, the owner of the property being improved, and, if different from the owner, the contracting public entity.

2. The contract number assigned by the contracting public entity.

3. The bond number assigned by the surety.

4. A description of the project sufficient to identify it, such as a legal description or the street address of the property being improved, and a general description of the improvement.

(b) Before commencing the work or before recommencing the work after a default or abandonment, the contractor shall provide to the public entity a certified copy of the recorded bond. Notwithstanding the terms of the contract or any other law governing prompt payment for construction services, the public entity may not make a payment to the contractor until the contractor has complied with this paragraph. This paragraph applies to contracts entered into on or after October 1, 2012.

(c) The bond shall be conditioned upon the contractor’s performance of the construction work in the time and manner prescribed in the contract and promptly making payments to all persons defined in s. 713.01 who furnish labor, services, or materials for the prosecution of the work provided for in the contract. A claimant may apply to the governmental entity having charge of the work for copies of the contract and bond and shall thereupon be furnished with a copy of the contract and the recorded bond. The claimant shall have a cause of action against the contractor and surety for the amount due him or her, including unpaid finance charges due under the claimant’s contract. Such action may not involve the public authority in any expense.

(d) When the work is done for the state and the contract is for $100,000 or less, no payment and performance bond shall be required. At the discretion of the official or board awarding such contract when such work is done for any county, city, political subdivision, or public authority, a person entering into such a contract that is for $200,000 or less may be exempted from executing the payment and performance bond. When such work is done for the state, the Secretary of Management Services may delegate to state agencies the authority to exempt any person entering into such a contract amounting to more than $100,000 but less than $200,000 from executing the payment and performance bond. If an exemption is granted, the officer or official is not personally liable to persons suffering loss because of granting such exemption. The Department of Management Services shall maintain information on the number of requests by state agencies for delegation of authority to waive the bond requirements by agency and project number and whether any request for delegation was denied and the justification for the denial.

(e) Any provision in a payment bond issued on or after October 1, 2012, furnished for public work contracts as provided by this subsection which further restricts the classes of persons protected by the bond, which restricts the venue of any proceeding relating to such bond, which limits or expands the effective duration of the bond, or which adds conditions precedent to the enforcement of a claim against the bond beyond those provided in this section is unenforceable.

(f) The Department of Management Services shall adopt rules with respect to all contracts for $200,000 or less, to provide:1. Procedures for retaining up to 5 percent of each request for payment submitted by a contractor and procedures for determining disbursements from the amount retained on a pro rata basis to laborers, materialmen, and subcontractors, as defined in s. 713.01.

2. Procedures for requiring certification from laborers, materialmen, and subcontractors, as defined in s. 713.01, before final payment to the contractor that such laborers, materialmen, and subcontractors have no claims against the contractor resulting from the completion of the work provided for in the contract.The state is not liable to any laborer, materialman, or subcontractor for any amounts greater than the pro rata share as determined under this section.

(g)

1. The amount of the bond shall equal the contract price, except that for a contract in excess of $250 million, if the state, county, municipality, political subdivision, or other public entity finds that a bond in the amount of the contract price is not reasonably available, the public owner shall set the amount of the bond at the largest amount reasonably available, but not less than $250 million.

2. For construction-management or design-build contracts, if the public owner does not include in the bond amount the cost of design or other nonconstruction services, the bond may not be conditioned on performance of such services or payment to persons furnishing such services. Notwithstanding paragraphs (c) and (e), such a bond may exclude persons furnishing such services from the classes of persons protected by the bond.

(2)

(a)

1. If a claimant is no longer furnishing labor, services, or materials on a project, a contractor or the contractor’s agent or attorney may elect to shorten the time within which an action to enforce any claim against a payment bond must be commenced by recording in the clerk’s office a notice in substantially the following form:

NOTICE OF CONTEST OF CLAIM AGAINST PAYMENT BOND

To: …(Name and address of claimant)…

You are notified that the undersigned contests your notice of nonpayment, dated ………………, …………, and served on the undersigned on ………………, …………, and that the time within which you may file suit to enforce your claim is limited to 60 days after the date of service of this notice.

DATED on ………………, ………….

Signed: …(Contractor or Attorney)…

The claim of a claimant upon whom such notice is served and who fails to institute a suit to enforce his or her claim against the payment bond within 60 days after service of such notice is extinguished automatically. The contractor or the contractor’s attorney shall serve a copy of the notice of contest on the claimant at the address shown in the notice of nonpayment or most recent amendment thereto and shall certify to such service on the face of the notice and record the notice. After the clerk records the notice with the certificate of service, the clerk shall serve, in accordance with s. 713.18, a copy of such recorded notice on the claimant and the contractor or the contractor’s attorney. The clerk of the court shall charge fees for such services as provided by law.

2. A claimant, except a laborer, who is not in privity with the contractor shall, before commencing or not later than 45 days after commencing to furnish labor, services, or materials for the prosecution of the work, serve the contractor with a written notice that he or she intends to look to the bond for protection. If the payment bond is not recorded before the commencement of work or before the recommencement of work after a default or abandonment as required by subsection (1), the claimant may serve the contractor with such written notice up to 45 days after the date that the claimant is served with a copy of the bond. A claimant who is not in privity with the contractor and who has not received payment for furnishing his or her labor, services, or materials shall serve a written notice of nonpayment on the contractor and a copy of the notice of nonpayment on the surety. The notice of nonpayment must be under oath and served during the progress of the work or thereafter but may not be served earlier than 45 days after the first furnishing of labor, services, or materials by the claimant or later than 90 days after the final furnishing of the labor, services, or materials by the claimant or, with respect to rental equipment, later than 90 days after the date that the rental equipment was last on the site of the improvement and available for use. Any notice of nonpayment served by a claimant who is not in privity with the contractor which includes sums for retainage must specify the portion of the amount claimed for retainage. An action for the labor, services, or materials may not be instituted against the contractor or the surety unless the notice to the contractor and notice of nonpayment have been served, if required by this section. Notices required or permitted under this section must be served in accordance with s. 713.18. A claimant may not waive in advance his or her right to bring an action under the bond against the surety. In any action brought to enforce a claim against a payment bond under this section, the prevailing party is entitled to recover a reasonable fee for the services of his or her attorney for trial and appeal or for arbitration, in an amount to be determined by the court or arbitrator, which fee must be taxed as part of the prevailing party’s costs, as allowed in equitable actions. The time periods for service of a notice of nonpayment or for bringing an action against a contractor or a surety are measured from the last day of furnishing labor, services, or materials by the claimant and may not be measured by other standards, such as the issuance of a certificate of occupancy or the issuance of a certificate of substantial completion. The negligent inclusion or omission of any information in the notice of nonpayment that has not prejudiced the contractor or surety does not constitute a default that operates to defeat an otherwise valid bond claim. A claimant who serves a fraudulent notice of nonpayment forfeits his or her rights under the bond. A notice of nonpayment is fraudulent if the claimant has willfully exaggerated the amount unpaid, willfully included a claim for work not performed or materials not furnished for the subject improvement, or prepared the notice with such willful and gross negligence as to amount to a willful exaggeration. However, a minor mistake or error in a notice of nonpayment, or a good faith dispute as to the amount unpaid, does not constitute a willful exaggeration that operates to defeat an otherwise valid claim against the bond. The service of a fraudulent notice of nonpayment is a complete defense to the claimant’s claim against the bond. The notice of nonpayment under this subparagraph must include the following information, current as of the date of the notice, and must be in substantially the following form:

NOTICE OF NONPAYMENT

To: …(name of contractor and address)…

…(name of surety and address)…

The undersigned claimant notifies you that:

1. Claimant has furnished …(describe labor, services, or materials)… for the improvement of the real property identified as …(property description) …. The corresponding amount unpaid to date is $……, of which $…… is unpaid retainage.

2. Claimant has been paid to date the amount of $…… for previously furnishing …(describe labor, services, or materials)… for this improvement.

3. Claimant expects to furnish …(describe labor, services, or materials) … for this improvement in the future (if known), and the corresponding amount expected to become due is $…… (if known).

I declare that I have read the foregoing Notice of Nonpayment and that the facts stated in it are true to the best of my knowledge and belief.

DATED on………………, ………….

…(signature and address of claimant)…

STATE OF FLORIDA

COUNTY OF…………

The foregoing instrument was sworn to (or affirmed) and subscribed before me by means of [] physical presence or sworn to (or affirmed) by [] online notarization this…… day of……, …(year)…, by …(name of signatory)…

….(Signature of Notary Public – State of Florida)…

…(Print, Type, or Stamp Commissioned Name of Notary Public)…

Personally Known………… OR Produced Identification…………

Type of Identification Produced…………………………..

(b) When a person is required to execute a waiver of his or her right to make a claim against the payment bond in exchange for, or to induce payment of, a progress payment, the waiver may be in substantially the following form:

WAIVER OF RIGHT TO CLAIM AGAINST THE PAYMENT BOND(PROGRESS PAYMENT)

The undersigned, in consideration of the sum of $ , hereby waives its right to claim against the payment bond for labor, services, or materials furnished through (insert date) to (insert the name of your customer) on the job of (insert the name of the owner) , for improvements to the following described project:

(description of project)

This waiver does not cover any retention or any labor, services, or materials furnished after the date specified.

DATED ON , .

(Claimant)

By:

(c) When a person is required to execute a waiver of his or her right to make a claim against the payment bond, in exchange for, or to induce payment of, the final payment, the waiver may be in substantially the following form:

WAIVER OF RIGHT TO CLAIM AGAINST THE PAYMENT BOND(FINAL PAYMENT)

The undersigned, in consideration of the final payment in the amount of $ , hereby waives its right to claim against the payment bond for labor, services, or materials furnished to (insert the name of your customer) on the job of (insert the name of the owner) , for improvements to the following described project:

(description of project)

DATED ON , .

(Claimant)

By:

(d) A person may not require a claimant to furnish a waiver that is different from the forms in paragraphs (b) and (c).

(e) A claimant who executes a waiver in exchange for a check may condition the waiver on payment of the check.

(f) A waiver that is not substantially similar to the forms in this subsection is enforceable in accordance with its terms.

(3) The bond required in subsection (1) may be in substantially the following form:

PUBLIC CONSTRUCTION BOND

Bond No. (enter bond number)

BY THIS BOND, We , as Principal and , a corporation, as Surety, are bound to , herein called Owner, in the sum of $ , for payment of which we bind ourselves, our heirs, personal representatives, successors, and assigns, jointly and severally.

THE CONDITION OF THIS BOND is that if Principal:

1. Performs the contract dated , between Principal and Owner for construction of , the contract being made a part of this bond by reference, at the times and in the manner prescribed in the contract; and

2. Promptly makes payments to all claimants, as defined in Section 255.05(1), Florida Statutes, supplying Principal with labor, materials, or supplies, used directly or indirectly by Principal in the prosecution of the work provided for in the contract; and

3. Pays Owner all losses, damages, expenses, costs, and attorney’s fees, including appellate proceedings, that Owner sustains because of a default by Principal under the contract; and

4. Performs the guarantee of all work and materials furnished under the contract for the time specified in the contract, then this bond is void; otherwise it remains in full force.Any action instituted by a claimant under this bond for payment must be in accordance with the notice and time limitation provisions in Section 255.05(2), Florida Statutes.

Any changes in or under the contract documents and compliance or noncompliance with any formalities connected with the contract or the changes does not affect Surety’s obligation under this bond.

DATED ON , .

(Name of Principal)

By (As Attorney in Fact)

(Name of Surety)

(4) The payment bond provisions of all bonds required by subsection (1) shall be construed and deemed statutory payment bonds furnished pursuant to this section and such bonds shall not under any circumstances be converted into common law bonds.

(5) In addition to the provisions of chapter 47, any action authorized under this section may be brought in the county in which the public building or public work is being constructed or repaired. This subsection shall not apply to an action instituted prior to May 17, 1977.

(6) All payment bond forms used by a public owner and all payment bonds executed pursuant to this section by a surety shall make reference to this section by number, shall contain reference to the notice and time limitation provisions in subsections (2) and (10), and shall comply with the requirements of paragraph (1)(a).

(7) In lieu of the bond required by this section, a contractor may file with the state, county, city, or other political authority an alternative form of security in the form of cash; a money order; a certified check; a cashier’s check; or a domestic corporate bond, note, or debenture as authorized in s. 625.317 . Any such alternative form of security is for the same purpose and subject to the same conditions as those applicable to the bond required by this section. The appropriate state, county, city, or other political subdivision shall determine the required value of an alternative form of security.

(8) When a contractor has furnished a payment bond pursuant to this section, he or she may, when the state, county, municipality, political subdivision, or other public authority makes any payment to the contractor or directly to a claimant, serve a written demand on any claimant who is not in privity with the contractor for a written statement under oath of his or her account showing the nature of the labor or services performed and to be performed, if any; the materials furnished; the materials to be furnished, if known; the amount paid on account to date; the amount due; and the amount to become due, if known, as of the date of the statement by the claimant. Any such demand to a claimant who is not in privity with the contractor must be served on the claimant at the address and to the attention of any person who is designated to receive the demand in the notice to contractor served by the claimant. The failure or refusal to furnish the statement does not deprive the claimant of his or her rights under the bond if the demand is not served at the address of the claimant or directed to the attention of the person designated to receive the demand in the notice to contractor. The failure to furnish the statement within 30 days after the demand, or the furnishing of a false or fraudulent statement, deprives the claimant who fails to furnish the statement, or who furnishes the false or fraudulent statement, of his or her rights under the bond. If the contractor serves more than one demand for statement of account on a claimant and none of the information regarding the account has changed since the claimant’s last response to a demand, the failure or refusal to furnish such statement does not deprive the claimant of his or her rights under the bond. The negligent inclusion or omission of any information deprives the claimant of his or her rights under the bond to the extent that the contractor can demonstrate prejudice from such act or omission by the claimant. The failure to furnish a response to a demand for statement of account does not affect the validity of any claim on the bond being enforced in a lawsuit filed before the date the demand for statement of account is received by the claimant.

(9) On any public works project for which the public authority requires a performance and payment bond, suits at law and in equity may be brought and maintained by and against the public authority on any contract claim arising from breach of an express provision or an implied covenant of a written agreement or a written directive issued by the public authority pursuant to the written agreement. In any such suit, the public authority and the contractor shall have all of the same rights and obligations as a private person under a like contract except that no liability may be based on an oral modification of either the written contract or written directive. Nothing herein shall be construed to waive the sovereign immunity of the state and its political subdivisions from equitable claims and equitable remedies. The provisions of this subsection shall apply only to contracts entered into on or after July 1, 1999.

(10) An action, except an action for recovery of retainage, must be instituted against the contractor or the surety on the payment bond or the payment provisions of a combined payment and performance bond within 1 year after the performance of the labor or completion of delivery of the materials or supplies. An action for recovery of retainage must be instituted against the contractor or the surety within 1 year after the performance of the labor or completion of delivery of the materials or supplies; however, such an action may not be instituted until one of the following conditions is satisfied:

(a) The public entity has paid out the claimant’s retainage to the contractor, and the time provided under s. 218.735 or s. 255.073(3) for payment of that retainage to the claimant has expired;

(b) The claimant has completed all work required under its contract and 70 days have passed since the contractor sent its final payment request to the public entity; or

(c) At least 160 days have passed since reaching substantial completion of the construction services purchased, as defined in the contract, or if not defined in the contract, since reaching beneficial occupancy or use of the project.

(d) The claimant has asked the contractor, in writing, for any of the following information and the contractor has failed to respond to the claimant’s request, in writing, within 10 days after receipt of the request:

1. Whether the project has reached substantial completion, as that term is defined in the contract, or if not defined in the contract, if beneficial occupancy or use of the project has occurred.

2. Whether the contractor has received payment of the claimant’s retainage, and if so, the date the retainage was received by the contractor.

3. Whether the contractor has sent its final payment request to the public entity, and if so, the date on which the final payment request was sent.

If none of the conditions described in paragraph (a), paragraph (b), paragraph (c), or paragraph (d) is satisfied and an action for recovery of retainage cannot be instituted within the 1-year limitation period set forth in this subsection, this limitation period shall be extended until 120 days after one of these conditions is satisfied.

(11) When a contractor furnishes and records a payment and performance bond for a public works project in accordance with this section and provides the public authority with a written consent from the surety regarding the project or payment in question, the public authority may not condition its payment to the contractor on the production of a release, waiver, or like documentation from a claimant demonstrating that the claimant does not have an outstanding claim against the contractor, the surety, the payment bond, or the public authority for payments due on labor, services, or materials furnished on the public works project. The surety may, in a writing served on the public authority, revoke its consent or direct that the public authority withhold a specified amount from a payment, which shall be effective upon receipt. This subsection applies to contracts entered into on or after October 1, 2012.

(12) Unless otherwise provided in this section, service of any document must be made in accordance with s. 713.18.