Contractors, subcontractors, and suppliers are entitled to prompt payment on construction projects in Texas. In this article, we’ll show you how to figure out if your project is covered by the Texas Prompt Payment Act, what the penalties are for late payments, and how to demand payment using prompt payment laws.

Prompt payment on construction projects in Texas is governed by both state law and the federal law. The national Prompt Payment Act applies to federal projects of a certain size. In Texas, prompt payment statutes cover both public and private construction projects, though the requirements for each differ slightly. If you are working on a project that’s covered by prompt payment laws, and payment is delayed beyond the timeframe allowed, it’s time to take action and demand payment.

The law in Texas requires prompt payment

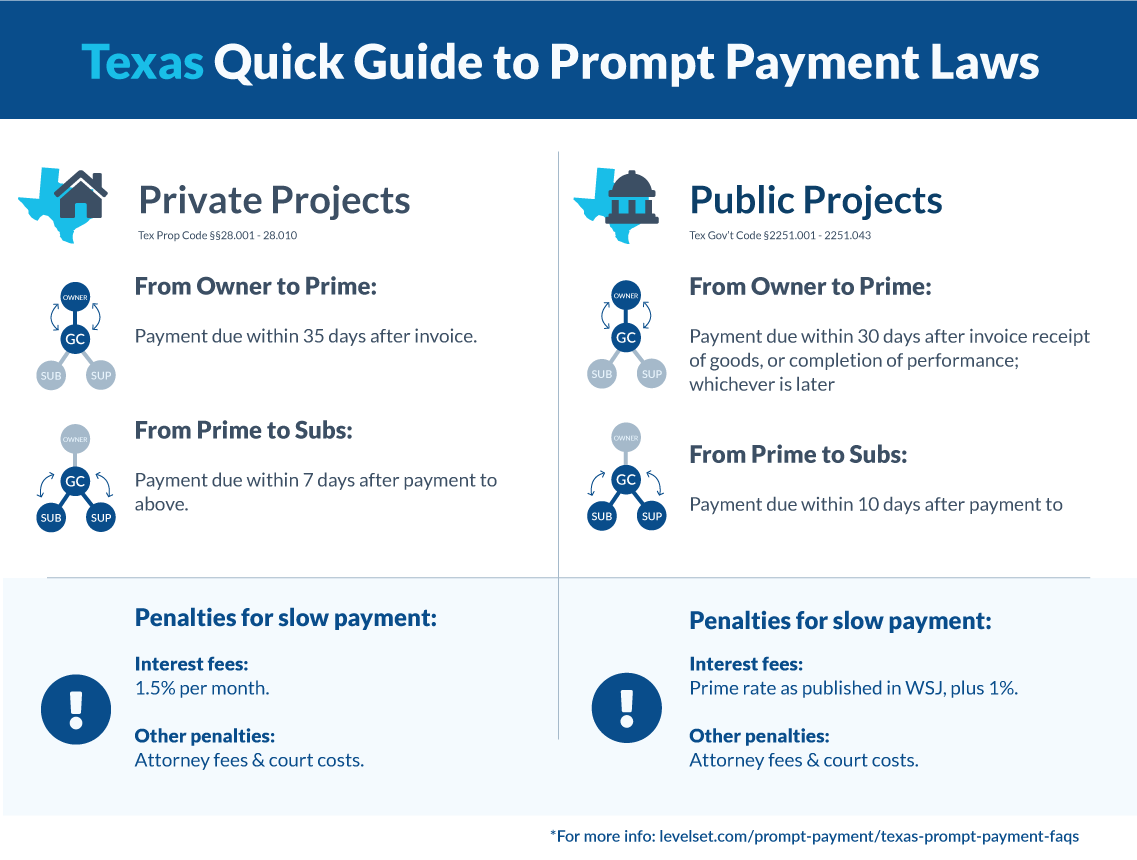

Prompt payment requirements in Texas are actually laid out in two separate laws. These two statutes work together to set deadlines for payments on both public and private construction projects. Payments on public projects are governed in Texas Government Code Chapter 2251 (Payment for Goods & Services), while payments on private construction projects are governed by Texas Property Code Chapter 28 (Prompt Payment to Contractors and Subcontractors). Confusing, I know. Don’t worry: It will all become clearer shortly.

What ‘prompt payment’ means in Texas

The law requires prompt payment on both public and private projects, setting deadlines for payments from:

- The owner to prime contractors

- Prime contractors to subcontractors

- Subcontractors to lower tier subs & suppliers

Public project deadlines

- Owner to prime contractor: 31 days

The law calculates the deadline by either the day goods or services were received, or the day the agency received the invoice, whichever is later. - Prime to subcontractor: 10 days

The law calculates the deadline from the day the prime receives payment from the owner. - Sub to sub/supplier: 10 days

The law calculates the deadline from the day the sub receives payment from the party above them.

Private project deadlines

- Owner to prime contractor: 35 days

The law calculates the deadline from the day the owner receives a proper invoice from the prime contractor. - Prime to subcontractor: 7 days

The law calculates the deadline from the day the prime receives payment from the owner. - Sub to sub/supplier: 7 days

The law calculates the deadline from the day the sub receives payment from the party above them.

Exceptions: When Texas allows late payments

Disputes

On private projects, Texas allows construction parties to withhold payment for a “good faith dispute.” On public projects, the law allows an exception for “bona fide disputes,” delays caused by the terms of another federal contract, grant, etc, or delays caused by an invoice being incorrectly sent.

As for good faith disputes, the law doesn’t specifically say what this means. Texas defines a good faith dispute as “a dispute regarding whether the work was performed in a proper manner.” That may be hard to prove – ultimately, it’s likely up to the court to decide.

The law allows a different withholding rate for a good faith dispute depending on whether the project is a residential or not. On a residential project, the paying party withholding payment can withhold up to 110% of the difference of the disputed amount. On a non-residential project, the limit is 100% of the difference.

For example:

If Subcontractor ABC submits an invoice for $100K, but Contractor XYZ believes the work is only worth $90K, the difference is $10k. If a residential project, Contractor XYZ can withhold $11k, or 110% of the difference. On a non-residential project, they can hold a maximum of $10k.

Lender non-payment

On private projects, the law changes a bit if the lender doesn’t send a requested payment to the owner on time. In that case, the deadline for the owner to pay the prime contractor changes from 35 days from receipt of invoice to 5 days after receiving funds from the lender.

Retainage

Texas has retainage laws that permit owners and GCs to withhold retainage up to 10%. They are generally required to pay retainage within 30 days of the completion of a project. Prompt payment laws in Texas don’t affect a party’s ability to withhold retainage.

Mineral development and oilfield services

The Texas statute exempts private mine or oil projects from prompt payment requirements.

How to demand prompt payment in Texas

If payment to a contractor, sub, or supplier is late, confirm whether any of the exemptions above apply to your situation. If not, then the paying party is violating prompt payment laws in Texas. It’s time to demand payment under the law.

Step 1: Write a prompt payment demand letter

While Texas’ prompt payment statutes don’t explicitly state that you must send a demand letter or request for payment before you can file a claim, it is still a good idea to start here.

A demand letter gets the attention of the paying party, and can help you get paid without taking the case to court. If it does require a court action, documenting your communication will never hurt. The more evidence you have of a valid claim, the better.

A prompt payment demand letter should generally include:

- The statute that applies, and the payment deadline

- On private projects, that’s Tex. Prop. Code §§28.001 – 28.010.

- On public projects, it’s Tex. Gov’t. Code §§2251.001 – 2251.043.

- Penalties you will seek if the party doesn’t pay

- On private projects, interest is charged at 1.5%

- On public projects, interest is charged at 1%

- Attorney fees

- The invoice number or payment application number that hasn’t been paid

- The payment amount due

- The consequences of non-payment

- Stop work if unpaid within 10 days (private projects only)

- File a lawsuit

Send the letter by certified mail. Send the demand to the hiring party and/or the property owner. If there is a lender on the project, send the payment demand to them as well. This serves as more proof of the communication between you and the party or parties above you.

Need help writing a demand?

Download a free prompt payment demand letter template from Levelset.

Step 2: Walk off the job

This step only applies to private projects. The Texas statute governing prompt payment on public projects doesn’t stipulate a contractor’s right to stop work. If you’re working on a public project, skip to Step 3.

On a private project, Texas gives unpaid contractors the right to walk off the job. However, the law does require you to provide written notice. After notice, the hiring party has 10 days to submit payment in full (minus withholding for any of the exceptions listed above).

If the hiring party hasn’t paid within 10 days after receiving your demand letter, then you are legally entitled to walk off the job.

Step 3: File a prompt payment claim in Texas court

This is where the prompt payment laws really gain some serious teeth. Filing a prompt payment claim in civil court is the best way to recover not only the original payment, but interest penalties and attorney fees as well.

Always protect your payment rights

Texas has gone to great lengths to protect payment rights for construction businesses. Unfortunately, many of their efforts have simply complicated the payment process. Contractors end up confused about the rights they actually have, and how to protect them.

If you are struggling to get paid on a construction project in Texas, you don’t have to choose one remedy or another. For example, you can protect your right to file a lien while you are demanding prompt payment under the law. Because the notice deadlines for filing a mechanics lien in Texas are different than the prompt payment deadlines, it’s important to understand and take advantage of both.

Contractors in Texas have a number of remedies available in the event that payments are late, or if they don’t arrive at all. But the laws only protect you if you understand them and know how to use them. Take the time to brush up on Texas construction laws and payment resources. And start your next construction project with the confidence that comes with knowing how to deal with late payment.