Tennessee Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

For Prime Contractors, progress payment must be made within 30 days after invoice, provided invoice delivered in accordance with the schedule set forth by the contract.

Subcontractors

For Subcontractors, payment due within 30 days after invoice, provided invoice delivered in accordance with the schedule set forth by the contract.

Suppliers

For Suppliers, payment due within 30 days after invoice, provided invoice delivered in accordance with the schedule set forth by the contract.

Interest & Fees

The interest rate under Tennessee's Prompt Pay Act is 1.5% per month. Attorneys' fees are awarded to the prevailing party only when the nonpaying party was determined to have acted in bad faith.

Prime Contractors

For Prime (General) Contractors, payment due within 45 days from invoice. Can be modified by contract.

Subcontractors

For Subcontractors, payment due within 30 days from payment received from above.

Suppliers

For Suppliers, payment due within 30 days from payment received from above.

Interest & Fees

Interest at 1.5% month. Attorney fees may be awarded by court.

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Note: Tennessee enacted legislation that changed some of the prompt payment rules effective July 1, 2020. This page has been updated to reflect those changes.

Projects Covered by Prompt Payment in Tennessee

Tennessee has two separate prompt payment acts that cover both private and public construction projects. They provide certain deadlines for payment and impose penalties in the form of interest for non-compliance.

Private Projects

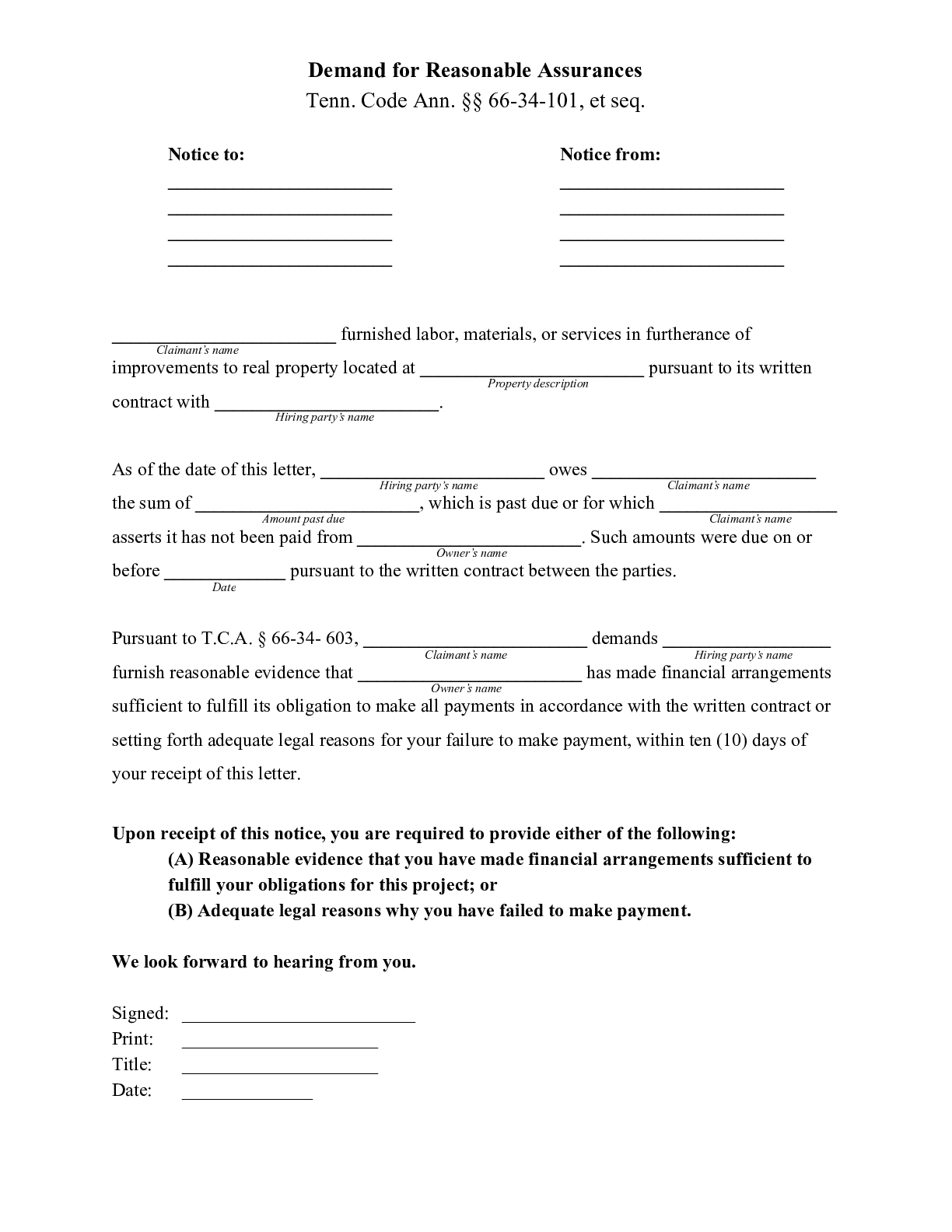

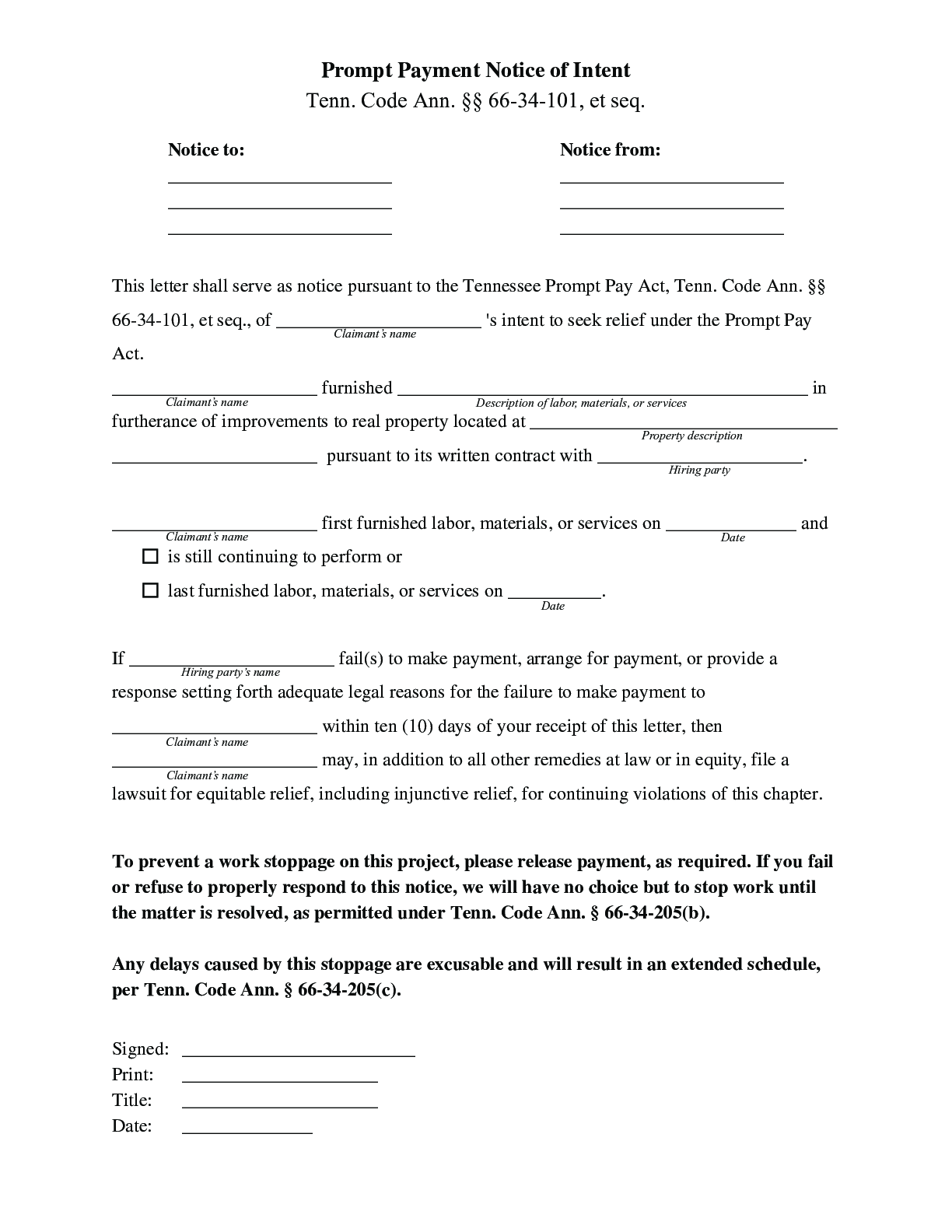

Tennessee’s prompt payment laws on all private construction projects can be found in Tenn. Code §66-34-101 et seq. These rules apply to all private projects, with the exception of residential projects of 4 or fewer units.

Deadlines for Payment on Private Projects

The prompt payment provisions for private projects cover all types of contracts, with the exception of residential projects of 4 units or fewer. A general contractor will be entitled to payments when they perform in accordance with the contract terms and submit a pay application according to the payment schedule. Once the pay app is submitted, the owner must remit payment within 30 days.

As for payment from the GC, unlike other prompt pay laws, the timing isn’t connected to when the GC received payment. Rather the same timing mechanism applies, once a pay application is submitted in accordance with the payment schedule set forth in the subcontract, payment should be made within 30 days.

Penalties for Late Payment on Private Projects

Any payments that are wrongfully withheld are subject to the accrual of interest. If a late payment interest is provided in the contract, then that rate will apply. If not, interest accrues at 1.5% per month.

Public Projects

Payments on public works projects in Tennessee are regulated by Tenn. Code §12-4-701 et seq.

Deadlines for Payment on Public Projects

The prompt payment provisions on public projects act as default pay periods if the contract is silent on the issue. Payment from the public entity must be made within 45 days from the receipt of the prime contractor’s invoice, barring any good faith dispute as to performance. Once the prime has received payment, all other payments must be made within 30 days of receipt of payment.

Penalties for Late Payment on Public Projects

Any wrongfully withheld payments will be subject to a 1.5% per month interest rate, accruing the day after payment becomes due. If still unpaid for 60 days, the interest accrued up to that point will be added to the principal amount of the debt, and continue to accrue on the increased amount.