Georgia Prompt Payment Requirements

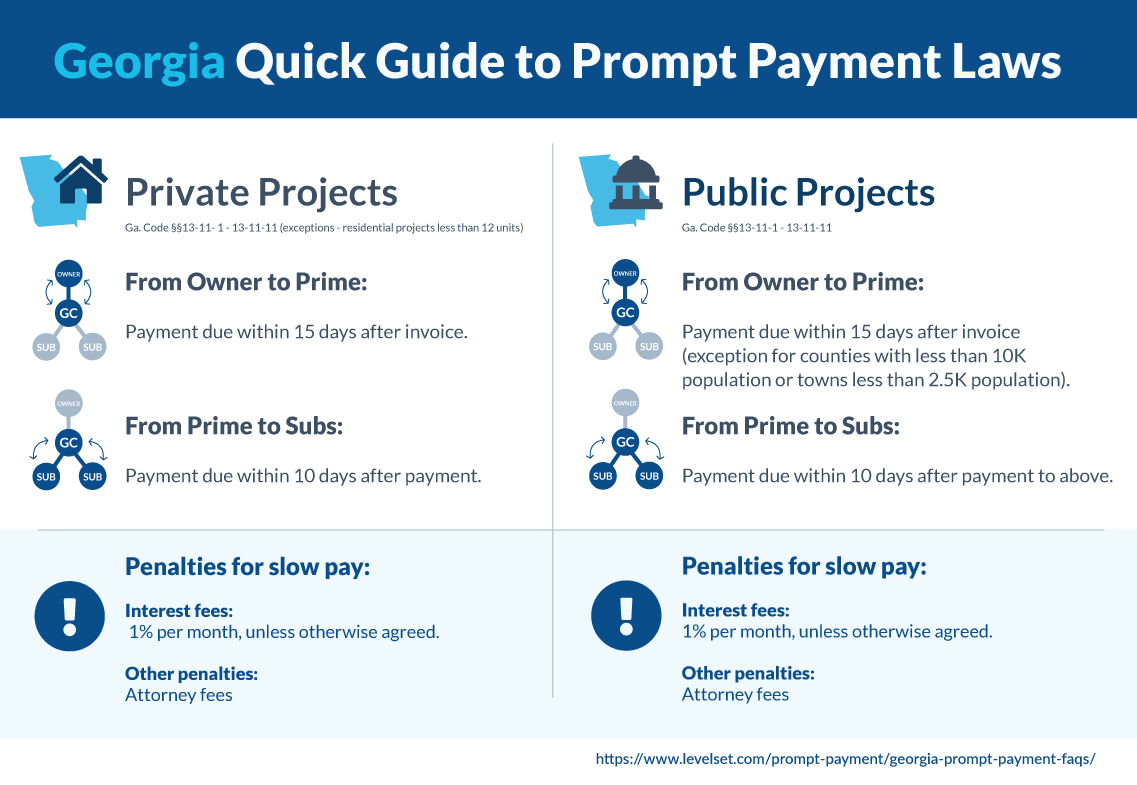

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

For Prime (General) Contractors, payment is due within 15 days of request for payment.

Subcontractors

For Subcontractors, payment is due within 10 days after payment is received above.

Suppliers

For Suppliers, payment is due within 10 days after payment is received above.

Interest & Fees

Interest at 1% month; unless otherwise agreed. Attorney fees awarded to the prevailing party.

Prime Contractors

For Prime (General) Contractors, payment due within 15 days of request for payment. Note, regulation doesn't apply to counties of less than 10,000 people or towns of less than 2,500 people.

Subcontractors

For Subcontractors, payment due within 10 days after payment is received above.

Suppliers

For Suppliers, payment due within 10 days after payment is received above.

Interest & Fees

Interest at 1% month; unless otherwise agreed. Attorneys fees awarded to prevailing party.

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

In Georgia, the same set of prompt payment rules apply to both public and private construction jobs. These statutes can be found in O.C.G.A. §§13-11-1 to 13-11-11. These timeframes apply to almost every construction project in Georgia, with two notable exceptions.

- In the residential projects world, these regulations don’t apply to residential projects of 12 units or fewer

- As for public projects, the prompt pay deadlines won’t apply in counties of less than 10,000 people, or towns with a population of less than 2,500.

Once a contractor has satisfied the conditions of their contract, they are entitled to payment. A proper invoice, submitted to the owner according to the contract payment terms, will start the clock on the payment deadline. Upon receipt, the owner will have 15 days to release payment to the prime contractor. Payments are considered received when the funds are actually received in the contractor or sub’s bank account.

Now that the prime contractor has received project funds from the owner, they will then have 10 days to pass payment down to any subs or suppliers hired by them. This same 10-day period applies to all other payments down the chain. Payment is considered “paid” when the money is actually received in the contractor’s bank account.

The statutes provide a list of acceptable reasons to withhold payments. Any payments that are late or wrongfully withheld will be subject to interest accruing on the unpaid balance. The default rule is 1% per month, but the parties can agree ahead of time to a different rate of interest in their contract. In addition to interest penalties, in an action to enforce a prompt payment claim, the prevailing party will be awarded reasonable attorney fees. The payment deadlines and interest rates will act as the default rule, the parties can agree by contract to alter these if they so choose.