West Virginia

Preliminary Notice Deadlines

West Virginia

West Virginia

West Virginia

West Virginia

West Virginia

West Virginia

West Virginia

In West Virginia, parties who furnish labor or materials to the general contractor or first-tier subcontractors are protected. Suppliers to suppliers are not covered. While a material supplier is protected, labor performed by a material supplier is not.

It is unclear whether any claim in West Virginia is required, other than initiating suit to recover against the bond. If the bond itself contains specific requirements, it is likely advisable to follow the requirements set forth.

N/A. See bond.

N/A. See bond.

N/A. See bond. Note, however, that pay-if-paid clauses are not considered against public policy in West Virginia, so a claimant is not allowed to make a claim against either the hiring party, or the general contractor’s bond if the general contractor hasn’t been paid by the property owner/public entity.

N/A. See bond.

N/A. See bond.

EFI Solutions has a direct contract with a General Contractor on a project in Glenwood, WV. We are having difficulty collecting the remaining balance even...

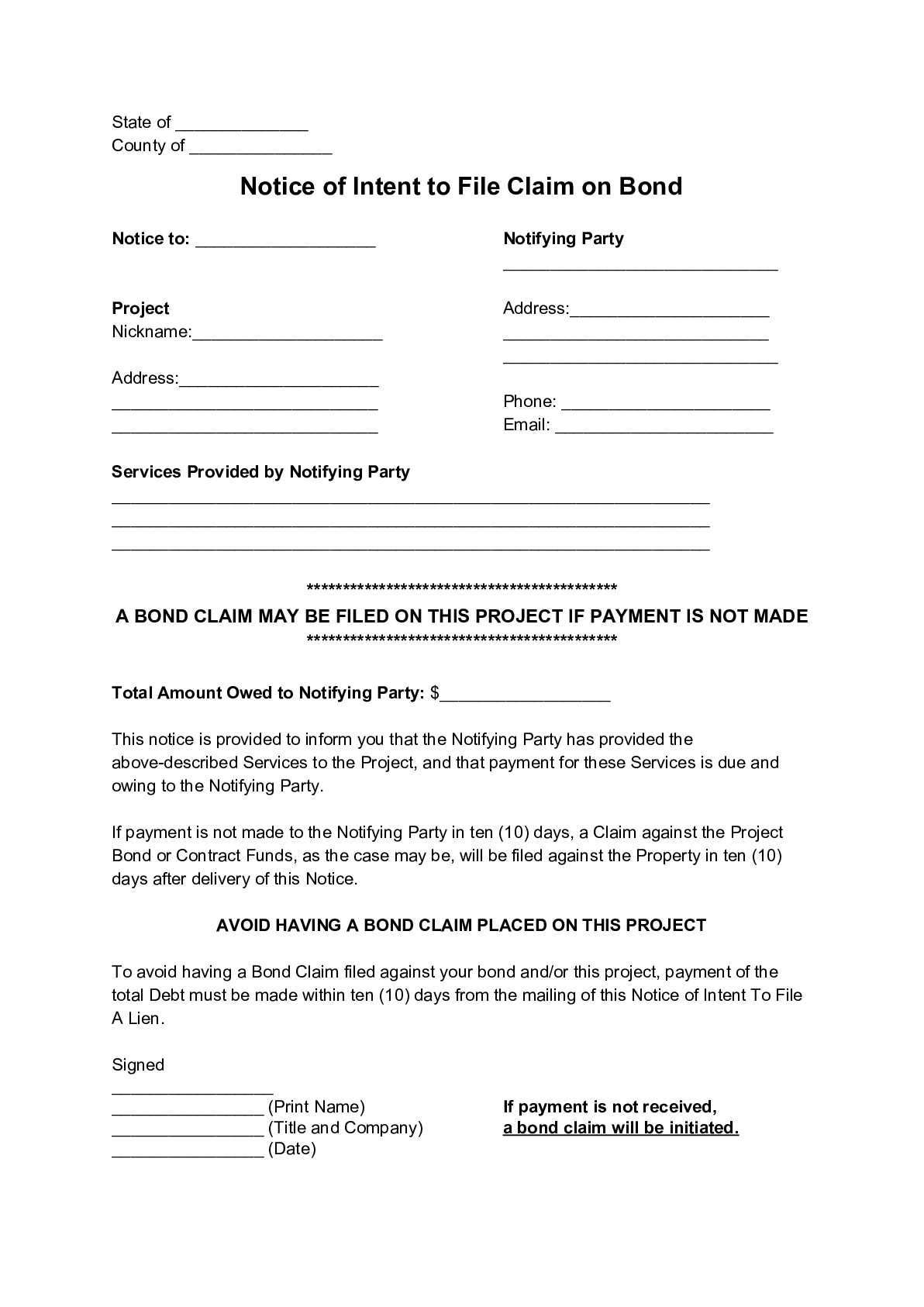

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in West Virginia, and are not paid, you can file a “lien” against the project pursuant to West Virginia’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” West Virginia’s Little Miller Act is found in West Virginia Code, Chapter 5 Article 22, and Chapter 38, Article 2, and is reproduced below.

(a) This section and the requirements set forth in this section may be referred to as the “West Virginia Fairness In Competitive Bidding Act.”

(b) As used in this section:

(1) “Lowest qualified responsible bidder” means the bidder that bids the lowest price and that meets, as a minimum, all the following requirements in connection with the bidder’s response to the bid solicitation. The bidder must certify that it:

(A) Is ready, able and willing to timely furnish the labor and materials required to complete the contract;

(B) Is in compliance with all applicable laws of the state of West Virginia; and

(C) Has supplied a valid bid bond or other surety authorized or approved by the contracting public entity.

(2) “The state and its subdivisions” means the State of West Virginia, every political subdivision thereof, every administrative entity that includes such a subdivision, all municipalities and all county boards of education.

(3) “State spending unit” means a department, agency or institution of the state government for which an appropriation is requested, or to which an appropriation is made by the Legislature.

(c) The state and its subdivisions shall, except as provided in this section, solicit competitive bids for every construction project exceeding $25,000 in total cost. A vendor who has been debarred pursuant to the provisions of sections thirty-three-a through thirty-three-f, inclusive, article three, chapter five-a of this code may not bid on or be awarded a contract under this section. All bids submitted pursuant to this chapter shall include a valid bid bond or other surety as approved by the State of West Virginia or its subdivisions.

(d) Following the solicitation of bids, the construction contract shall be awarded to the lowest qualified responsible bidder who shall furnish a sufficient performance and payment bond. The state and its subdivisions may reject all bids and solicit new bids on the project.

(e) The apparent low bidder on a contract valued at more than $250,000 for the construction, alteration, decoration, painting or improvement of a new or existing building or structure with a state spending unit shall submit a list of all subcontractors who will perform more than $25,000 of work on the project including labor and materials. This section does not apply to other construction projects such as highway, mine reclamation, water or sewer projects. The list shall include the names of the bidders and the license numbers as required by article eleven, chapter twenty-one of this code. This information shall be provided to the state spending unit within one business day of the opening of bids for review prior to the awarding of a construction contract. If no subcontractors who will perform more than $25,000 of work are to be used to complete the project it will be noted on the subcontractor list. Failure to submit the subcontractor list within one business day after the deadline for submitting bids shall result in disqualification of the bid.

(f) Written approval must be obtained from the state spending unit before any subcontractor substitution is permitted. Substitutions are not permitted unless:

(1) The subcontractor listed in the original bid has filed for bankruptcy;

(2) The state spending unit refuses to approve a subcontractor in the original bid because the subcontractor is under a debarment pursuant to section thirty-three-d, article three, chapter five-a of this code or a suspension under section thirty-two, article three, chapter five-a of this code; or

(3) The contractor certifies in writing that the subcontractor listed in the original bill fails, is unable or refuses to perform the subcontract.

(g) The contracting public entity may not award the contract to a bidder which fails to meet the minimum requirements set out in this section. As to any prospective low bidder which the contracting public entity determines not to have met any one or more of the requirements of this section or other requirements as determined by the public entity in the written bid solicitation, prior to the time a contract award is made, the contracting public entity shall document in writing and in reasonable detail the basis for the determination and shall place the writing in the bid file. After the award of a bid under this section, the bid file of the contracting public agency and all bids submitted in response to the bid solicitation shall be open and available for public inspection.

(h) A public official or other person who individually or together with others knowingly makes an award of a contract under this section in violation of the procedures and requirements of this section is subject to the penalties set forth in section twenty-nine, article three, chapter five-a of the code of West Virginia.

(i) No officer or employee of this state or of any public agency, public authority, public corporation or other public entity and no person acting or purporting to act on behalf of such officer or employee or public entity shall require that any performance bond, payment bond or surety bond required or permitted by this section be obtained from any particular surety company, agent, broker or producer.

(j) All bids shall be open in accordance with the provisions of section two of this article, except design-build projects which are governed by article twenty-two-a of this chapter and are exempt from these provisions.

(k) Nothing in this section shall apply to: (1) Work performed on construction or repair projects by regular full-time employees of the state or its subdivisions; (2) Prevent students enrolled in vocational educational schools from being utilized in construction or repair projects when the use is a part of the student’s training program; (3) Emergency repairs to building components and systems. For the purpose of this subdivision, the term emergency repairs means repairs that if not made immediately will seriously impair the use of building components and systems or cause danger to persons using the building components and systems; and (4) Any situation where the state or subdivision thereof reaches an agreement with volunteers, or a volunteer group, in which the governmental body will provide construction or repair materials, architectural, engineering, technical or other professional services and the volunteers will provide the necessary labor without charge to, or liability upon, the governmental body. Back to Top

(a) The public entity accepting public contract bids shall, in its resolution providing for the contract or purchase and for the advertisement for bids, designate the time and place that the bids will be received and shall at that time and place publicly open the bids and read them aloud. No public entity may accept or take any bid, including receiving any hand delivered bid, after the time advertised to take bids. No bid may be opened on days which are recognized as holidays by the United States postal service. No public entity may accept or consider any bids that do not contain a valid bid bond or other surety approved by the state of West Virginia or its subdivisions. (b) The provisions and requirements of this section, section one of article twenty-two of this chapter, the requirements stated in the advertisement for bids and the requirements on the bid form may not be waived by any public entity. The public entity may only reject an erroneous bid after the opening if all of the following conditions exist: (1) An error was made; (2) the error materially affected the bid; (3) rejection of the bid would not cause a hardship on the public entity involved, other than losing an opportunity to receive construction projects at a reduced cost; and (4) enforcement of the bid in error would be unconscionable. If a public entity rejects a bid, it shall maintain a file of documented evidence demonstrating that all the conditions set forth in this subdivision existed. If the public entity determines the bid to be erroneous, the public entity shall return the bid security to the contractor. (c) A contractor who withdraws a bid under the provisions of this section may not resubmit a bid on the same project. If the bid withdrawn is the lowest bid, the next lowest bid may be accepted. Back to Top

(a) This section may be known and cited as The Fair and Open Competition in Governmental Construction Act.

(b) Legislative findings. — The Legislature finds that to promote and ensure fair competition on governmental, governmental funded or governmental assisted construction projects that open competition in governmental construction contracts is necessary. The Legislature also finds that when a governmental entity awards a grant, tax abatement or tax credit that it should be an open and fair process. Therefore, to prevent discrimination against governmental bidders, offerors, contractors or subcontractors based upon labor affiliation or the lack thereof, the Legislature declares that project labor agreements should not be part of the competitive bid process or be a condition for a grant, tax abatement or tax credit.

(c) Definitions. — For purposes of this section:

(1) “Construction” means the act, trade or process of building, erecting, constructing, adding, repairing, remodeling, rehabilitating, reconstructing, altering, converting, improving, expanding or demolishing of a building, structure, facility, road or highway, and includes the planning, designing and financing of a specific construction project.

(2) “Governmental entity” means the state, a political subdivision or any agency or spending unit thereof.

(3) “Project labor agreement” means any pre-hire collective bargaining agreement with one or more labor organizations that establishes the terms and conditions of employment for a specific construction project.

(d) Prohibition–Competitive bid. — Commencing July 1, 2015, a governmental entity or a construction manager acting on behalf of a governmental entity, seeking a construction bid solicitation, awarding a construction contract or obligating funds to a construction contract, shall not include the following in the bid specifications, bid requests, project agreements or any other controlling documents for the construction project:

(1) A requirement or prohibition that a bidder, offeror, contractor or subcontractor must enter into or adhere to a project labor agreement;

(2) A term, clause or statement that infers, either directly or indirectly, that a bidder, offeror, contractor or subcontractor must enter into or adhere to a project labor agreement;

(3) A term, clause or statement that rewards or punishes a bidder, offeror, contractor or subcontractor for becoming or remaining, or refusing to become or remain a signatory to, or for adhering or refusing to adhere to, a project labor agreement; or

(4) Any other provision dealing with project labor agreements.

(e) Prohibition–Grant, tax abatement or tax credit. — Commencing July 1, 2015, a governmental entity may not award a grant, tax abatement or tax credit for construction that is conditioned upon a requirement that the awardee include any prohibited provision set out in subsection (d) of this section.

(f) Exclusions. –This section does not:

(1) Prohibit a governmental entity from awarding a contract, grant, tax abatement or tax credit to a private owner, bidder, contractor or subcontractor who enters into or who is party to an agreement with a labor organization, if being or becoming a party or adhering to an agreement with a labor organization is not a condition for award of the contract, grant, tax abatement or tax credit, and if the governmental entity does not discriminate against a private owner, bidder, contractor or subcontractor in the awarding of that contract, grant, tax abatement or tax credit based upon the status as being or becoming, or the willingness or refusal to become, a party to an agreement with a labor organization.

(2) Prohibit a private owner, bidder, contractor or subcontractor from voluntarily entering into or complying with an agreement entered into with one or more labor organizations in regard to a contract with a governmental entity or funded, in whole or in part, from a grant, tax abatement or tax credit from the governmental entity.

(3) Prohibit employers or other parties from entering into agreements or engaging in any other activity protected by the National Labor Relations Act, 29 U. S. C. §§ 151 to 169.

(4) Interfere with labor relations of parties that are left unregulated under the National Labor Relations Act, 29 U. S. C. §§ 151 to 169.

(g) Exemptions. — The head of a governmental entity may exempt a particular project, contract, subcontract, grant, tax abatement or tax credit from the requirements of any or all of the provisions of subsections (d) and (e) of this section if the governmental unit finds, after public notice and a hearing, that special circumstances require an exemption to avert an imminent threat to public health or safety. A finding of special circumstances under this subsection may not be based on the possibility or presence of a labor dispute concerning the use of contractors or subcontractors who are nonsignatories to, or otherwise do not adhere to, agreements with one or more labor organizations or concerning employees on the project who are not members of or affiliated with a labor organization. Back to Top

It shall be the duty of the state commissioner of public institutions, and of all county courts, boards of education, boards of trustees, and other legal bodies having authority to contract for the erection, construction, improvement, alteration or repair of any public building or other structure, or any building or other structure used or to be used for public purposes, to require of every person to whom it shall award, and with whom it shall enter into, any contract for the erection, construction, improvement, alteration or repair of any such public building or other structure used or to be used for public purposes, that such contractor shall cause to be executed and delivered to the secretary of such commissioner or other legal body, or other proper and designated custodian of the papers and records thereof, a good, valid, solvent and sufficient bond, in a penal sum equal at least to the reasonable cost of the materials, machinery, equipment and labor required for the completion of such contract, and conditioned that in the event such contractor shall fail to pay in full for all such materials, machinery, equipment and labor delivered to him for use in the erection, construction, improvement, alteration or repair of such public building or other structure, or building or other structure used or to be used for public purposes, then such bond and the sureties thereon shall be responsible to such materialman, furnisher of machinery or equipment, and furnisher or performer of such labor, or their assigns, for the full payment of the full value thereof. No officer or employee of this state or of any public agency, public authority, public corporation, or other public entity, and no person acting or purporting to act on behalf of such officer or employee or public entity shall require that any surety bond required or permitted by this section be obtained from any particular surety company, agent, broker or producer. All such bonds shall have as surety thereon either some incorporated bonding and/or surety company authorized to carry on business in this state, or in lieu of such corporate surety the contractor may deposit as security for such bond with the said state commissioner of public institutions, county court, board of education, board of trustees or other legal body having authority so to contract, a sum in cash or bonds and securities of the United States of America or of the state of West Virginia of sufficient amount and value equal at least to the reasonable cost of materials, machinery, equipment and labor required for the completion of such contract. Immediately upon the acceptance of either of said bonds by the state commissioner of public institutions, county court, board of education and board of trustees, or other legal body, the bond shall be recorded by the secretary of such commissioner or other legal body, or by the proper designated custodian of the papers or records thereof, in the office of the clerk of the county court of the county or counties wherein such work is to be done and where such materials, machinery or equipment are to be delivered, and no such contract shall be binding and effective upon either party or parties thereto until such bond has been executed, delivered and recorded as aforesaid. Nothing in this article shall be construed to give a lien upon such a public building or improvement as is mentioned in this section, or upon the land upon which such public building or improvement is situated. Back to Top