Virginia

Preliminary Notice Deadlines

Virginia

Virginia

Virginia

Virginia

Virginia

The bond claim must be received by the general contractor within 90 days after the claimant’s last furnishing labor and/or materials to the project.

Virginia

Suit must be initiated more than 90 days, but less than 1 year from claimant's date of last furnishing.

Virginia

Virginia

The bond claim must be received by the general contractor within 90 days after the claimant’s last furnishing labor and/or materials to the project.

Virginia

Suit must be initiated more than 90 days, but less than 1 year from claimant's date of last furnishing.

Under Virginia’s Little Miller Act, every public works project valued at over $500,000 is required to have a payment bond posted by the prime contractor.

The parties entitled to make a claim on the bond are subcontractors, suppliers, laborers, and equipment lessors who contracted with the prime contractor or a first-tier subcontractor. Any parties more removed from the prime contractor are not eligible to make a claim against the bond. Also, while not specifically set forth in the statute, suppliers to suppliers are likely not covered as well.

First-tier subcontractors (i.,e. those who contracted directly with the prime contractor) are not required to serve a bond claim, they may initiate an action without such notice. However, it may be wise to do so anyway to get your payment dispute the proper attention.

For all other claimants protected under VA’s bond claim laws, a notice of bond claim must be served within 90 days of last furnishing labor and/or materials to the project to secure their right to file an action against the bond.

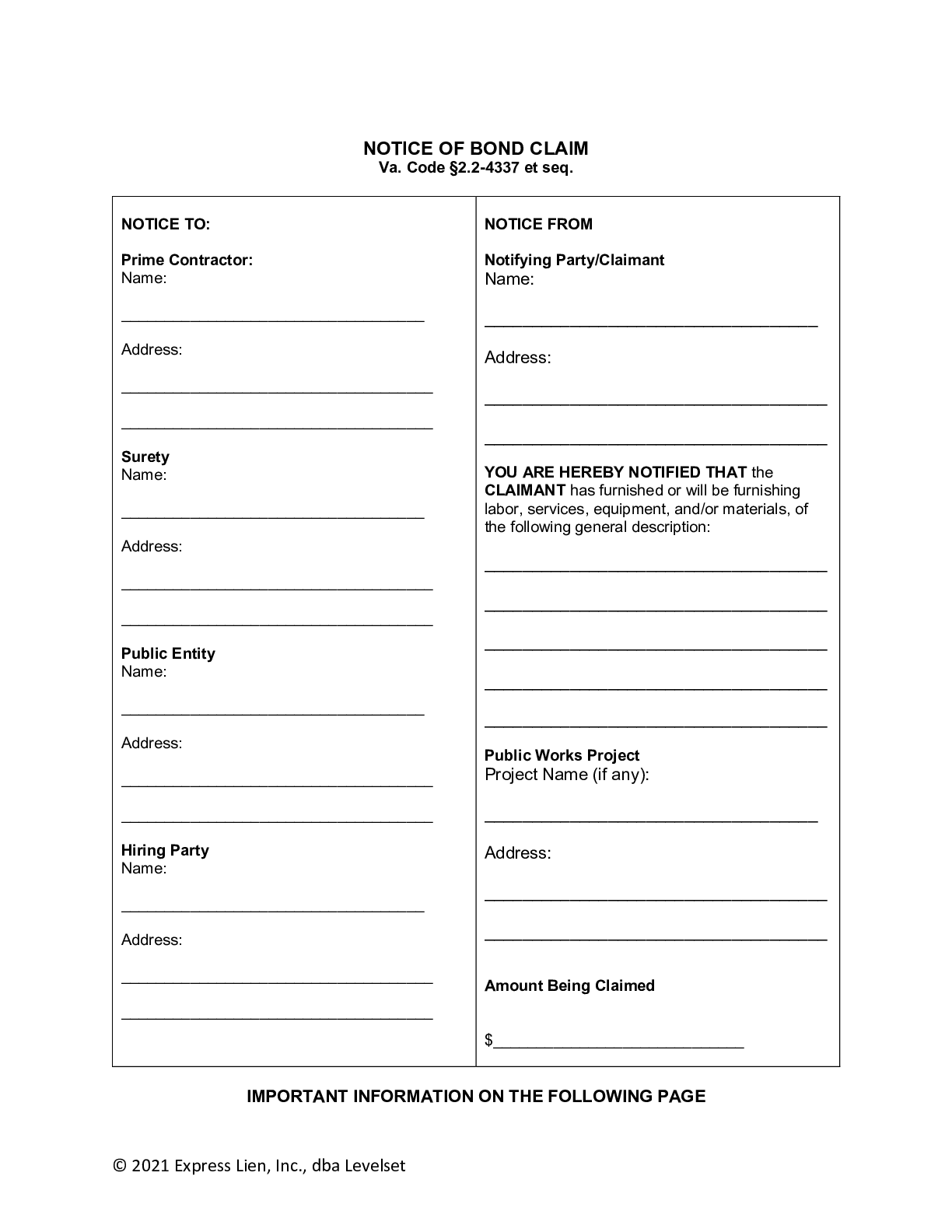

In Virginia, a bond claim (also referred to as a Notice of Bond Claim) is only required to contain (1) the amount claimed, and (2) the identity of the party for whom labor and/or material was furnished.

It may, however, be best practice to also include a property description, a brief description of the labor and/or materials provided, and the identity of the claimant’s hiring party, the prime contractor and contracting public entity as well.

→ Download a free Virginia Notice of Bond Claim form here

In Virginia, the notice of bond claim is only required to be served on the prime contractor who provided the payment bond. Also, while not specifically required, the claim may be a good idea to send the claim to the contracting public entity and to the surety who posted the bond (if known) as well.

• See: Don’t Surprise the Surety – Streamline Getting Paid on Bond Claims

Virginia bond claims must be served on the general contractor via registered or certified mail. Note that according to a recent Virginia Circuit Court decision (R.T. Atkinson Building Corp. v. Archer Western Const. et al.), the claim must be received by the GC within the 90-day time period, not just mailed; thus actual acceptance is required to be validly served.

An action to enforce a payment bond claim in Virginia must be initiated more than 90 days, but no later than 1 year after the claimant’s last date of furnishing labor and/or materials to the project. Note that even if the language contained on the bond itself doesn’t limit actions to a specific time period, this deadline still applies.

Before filing a lawsuit, consider these 4 Steps to Take After Filing a Bond Claim

I filed the bond claim before the deadline but Levelset is still saying our payment is not protected. In the meantime my customer has filed...

Claim against bond.Hi, We are a Subcontractor to a Prime Contractor that has filed for bankruptcy. We performed work for the Prime Contractor on a State Department...

How can I collect the balance due for Commission Sales/Estimating from a GC?A GC owes me money ($10,248.88) for commission sales and estimating. I have a copy of his Payment & Performance Bond. How can I collect...

This is a Virginia Bond Claim form (also referred to as a Virginia Notice of Bond Claim). This form can be filled out with a...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Virginia, and are not paid, you can file a “lien” against the project pursuant to Virginia’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Virginia’s Little Miller Act is found in Virginia Code, Title 2.2, Chapter 43, and is reproduced below. Updated as of March 2021.

A. Except in cases of emergency, all bids or proposals for nontransportation-related construction contracts in excess of $500,000 or transportation-related projects authorized under Article 2 (§ 33.2-208 et seq.) of Chapter 2 of Title 33.2 that are in excess of $250,000 and partially or wholly funded by the Commonwealth shall be accompanied by a bid bond from a surety company selected by the bidder that is authorized to do business in Virginia, as a guarantee that if the contract is awarded to the bidder, he will enter into the contract for the work mentioned in the bid. The amount of the bid bond shall not exceed five percent of the amount bid.

B. For nontransportation-related construction contracts in excess of $100,000 but less than $500,000, where the bid bond requirements are waived, prospective contractors shall be prequalified for each individual project in accordance with § 2.2-4317.H owever, a locality may waive the requirement for prequalification of a bidder with a current Class A contractor license for contracts in excess of $100,000 but less than $300,000 upon a written determination made in advance by the local governing body that waiving the requirement is in the best interests of the locality. A locality shall not enter into more than 10 such contracts per year.

C. No forfeiture under a bid bond shall exceed the lesser of (i) the difference between the bid for which the bond was written and the next low bid, or (ii) the face amount of the bid bond.

D. Nothing in this section shall preclude a public body from requiring bid bonds to accompany bids or proposals for construction contracts anticipated to be less than $500,000 for nontransportation-related projects or $250,000 for transportation-related projects authorized under Article 2 (§ 33.2-208 et seq.) of Chapter 2 of Title 33.2 and partially or wholly funded by the Commonwealth.

A. Except as provided in subsection H, upon the award of any (i) public construction contract exceeding $500,000 awarded to any prime contractor; (ii) construction contract exceeding $500,000 awarded to any prime contractor requiring the performance of labor or the furnishing of materials for buildings, structures or other improvements to real property owned or leased by a public body; (iii) construction contract exceeding $500,000 in which the performance of labor or the furnishing of materials will be paid with public funds; or (iv) transportation-related projects exceeding $350,000 that are partially or wholly funded by the Commonwealth, the contractor shall furnish to the public body the following bonds:

1. A performance bond in the sum of the contract amount conditioned upon the faithful performance of the contract in strict conformity with the plans, specifications and conditions of the contract. For transportation-related projects authorized under Article 2 (§ 33.2-208 et seq.) of Chapter 2 of Title 33.2, such bond shall be in a form and amount satisfactory to the public body.

2. A payment bond in the sum of the contract amount. The bond shall be for the protection of claimants who have and fulfill contracts to supply labor or materials to the prime contractor to whom the contract was awarded, or to any subcontractors, in furtherance of the work provided for in the contract, and shall be conditioned upon the prompt payment for all materials furnished or labor supplied or performed in the furtherance of the work. For transportation-related projects authorized under Article 2 (§ 33.2-208 et seq.) of Chapter 2 of Title 33.2 and partially or wholly funded by the Commonwealth, such bond shall be in a form and amount satisfactory to the public body.

As used in this subdivision, “labor or materials” includes public utility services and reasonable rentals of equipment, but only for periods when the equipment rented is actually used at the site.

B. For nontransportation-related construction contracts in excess of $100,000 but less than $500,000, where the performance and payment bond requirements are waived, prospective contractors shall be prequalified for each individual project in accordance with § 2.2-4317.H owever, a locality may waive the requirement for prequalification of a contractor with a current Class A contractor license for contracts in excess of $100,000 but less than $300,000 upon a written determination made in advance by the local governing body that waiving the requirement is in the best interests of the locality. A locality shall not enter into more than 10 such contracts per year.

C. Each of the bonds shall be executed by one or more surety companies selected by the contractor that are authorized to do business in Virginia.

D. If the public body is the Commonwealth, or any agency or institution thereof, the bonds shall be payable to the Commonwealth of Virginia, naming also the agency or institution thereof. Bonds required for the contracts of other public bodies shall be payable to such public body.

E. Each of the bonds shall be filed with the public body that awarded the contract, or a designated office or official thereof.

F. Nothing in this section shall preclude a public body from requiring payment or performance bonds for construction contracts below $500,000 for nontransportation-related projects or $350,000 for transportation-related projects authorized under Article 2 (§ 33.2-208 et seq.) of Chapter 2 of Title 33.2 and partially or wholly funded by the Commonwealth.

G. Nothing in this section shall preclude the contractor from requiring each subcontractor to furnish a payment bond with surety thereon in the sum of the full amount of the contract with such subcontractor conditioned upon the payment to all persons who have and fulfill contracts that are directly with the subcontractor for performing labor and furnishing materials in the prosecution of the work provided for in the subcontract.

H. The performance and payment bond requirements of subsection A for transportation-related projects that are valued in excess of $250,000 but less than $350,000 may only be waived by a public body if the bidder provides evidence, satisfactory to the public body, that a surety company has declined an application from the contractor for a performance or payment bond.

A. In lieu of a bid, payment, or performance bond, a bidder may furnish a certified check, cashier’s check, or cash escrow in the face amount required for the bond.

B. If approved by the Attorney General in the case of state agencies, or the attorney for the political subdivision in the case of political subdivisions, a bidder may furnish a personal bond, property bond, or bank or savings institution’s letter of credit on certain designated funds in the face amount required for the bid, payment, or performance bond. Approval shall be granted only upon a determination that the alternative form of security proffered affords protection to the public body equivalent to a corporate surety’s bond.

C. The provisions of this section shall not apply to the Department of Transportation.

A public body may require bid, payment, or performance bonds for contracts for goods or services if provided in the Invitation to Bid or Request for Proposal.

No action against the surety on a performance bond shall be brought unless within five years after completion of the contract. For the purposes of this section, completion of the contract is the final payment to the contractor pursuant to the terms of the contract. However, if a final certificate of occupancy, or written final acceptance of the project, is issued prior to final payment, the five-year period to bring an action shall commence no later than 12 months from the date of the certificate of occupancy or written final acceptance of the project.

No action may be brought by a state public body on any construction contract, including construction contracts governed by Chapter 43.1 (§ 2.2-4378 et seq.), unless such action is brought within 15 years after completion of the contract. For the purposes of this section, completion of the contract is the final payment to the contractor pursuant to the terms of the contract. However, if a final certificate of occupancy or written final acceptance of the project is issued prior to final payment, the 15-year period to bring an action shall commence no later than 12 months from the date of the certificate of occupancy or written final acceptance of the project. In no case shall such action be brought more than five years after written notice by the state public body to the contractor of a defect or breach giving rise to the cause of action. The state public body shall not unreasonably delay written notice to the contractor.

No action may be brought by a state public body on any architectural or engineering services contract, including architectural or engineering services contracts governed by Chapter 43.1 (§ 2.2-4378 et seq.), unless such action is brought within 15 years after completion of the contract. For the purposes of this section, completion of the contract is the final payment to the contractor pursuant to the terms of the contract. However, if the architectural or engineering services are for a construction project for which a final certificate of occupancy or written final acceptance of the project is issued prior to final payment, the 15-year period to bring an action shall commence no later than 12 months from the date of the certificate of occupancy or written final acceptance of the project. In no case shall such action be brought more than five years after written notice by the state public body to the contractor of a defect or breach giving rise to the cause of action. The state public body shall not unreasonably delay written notice to the contractor.

A. Any claimant who has a direct contractual relationship with the contractor and who has performed labor or furnished material in accordance with the contract documents in furtherance of the work provided in any contract for which a payment bond has been given, and who has not been paid in full before the expiration of 90 days after the day on which the claimant performed the last of the labor or furnished the last of the materials for which he claims payment, may bring an action on the payment bond to recover any amount due him for the labor or material. The obligee named in the bond need not be named a party to the action.

B. Any claimant who has a direct contractual relationship with any subcontractor but who has no contractual relationship, express or implied, with the contractor, may bring an action on the contractor’s payment bond only if he has given written notice to the contractor within 90 days from the day on which the claimant performed the last of the labor or furnished the last of the materials for which he claims payment, stating with substantial accuracy the amount claimed and the name of the person for whom the work was performed or to whom the material was furnished. Notice to the contractor shall be served by registered or certified mail, postage prepaid, in an envelope addressed to such contractor at any place where his office is regularly maintained for the transaction of business. Claims for sums withheld as retainages with respect to labor performed or materials furnished, shall not be subject to the time limitations stated in this subsection.

C. Any action on a payment bond shall be brought within one year after the day on which the person bringing such action last performed labor or last furnished or supplied materials.

D. Any waiver of the right to sue on the payment bond required by this section shall be void unless it is in writing, signed by the person whose right is waived, and executed after such person has performed labor or furnished material in accordance with the contract documents.

A. Except as provided in this section, all proceedings, records, contracts and other public records relating to procurement transactions shall be open to the inspection of any citizen, or any interested person, firm or corporation, in accordance with the Virginia Freedom of Information Act (§ 2.2-3700 et seq.).

B. Cost estimates relating to a proposed procurement transaction prepared by or for a public body shall not be open to public inspection.

C. Any competitive sealed bidding bidder, upon request, shall be afforded the opportunity to inspect bid records within a reasonable time after the opening of all bids but prior to award, except in the event that the public body decides not to accept any of the bids and to reopen the contract. Otherwise, bid records shall be open to public inspection only after award of the contract.

D. Any competitive negotiation offeror, upon request, shall be afforded the opportunity to inspect proposal records within a reasonable time after the evaluation and negotiations of proposals are completed but prior to award, except in the event that the public body decides not to accept any of the proposals and to reopen the contract. Otherwise, proposal records shall be open to public inspection only after award of the contract.

E. Any inspection of procurement transaction records under this section shall be subject to reasonable restrictions to ensure the security and integrity of the records.

F. Trade secrets or proprietary information submitted by a bidder, offeror, or contractor in connection with a procurement transaction or prequalification application submitted pursuant to subsection B of § 2.2-4317 shall not be subject to the Virginia Freedom of Information Act (§ 2.2-3700 et seq.); however, the bidder, offeror, or contractor shall (i) invoke the protections of this section prior to or upon submission of the data or other materials, (ii) identify the data or other materials to be protected, and (iii) state the reasons why protection is necessary. A bidder, offeror, or contractor shall not designate as trade secrets or proprietary information (a) an entire bid, proposal, or prequalification application; (b) any portion of a bid, proposal, or prequalification application that does not contain trade secrets or proprietary information; or (c) line item prices or total bid, proposal, or prequalification application prices.