Oregon

Preliminary Notice Deadlines

Oregon

Oregon

Oregon

Oregon

Oregon

Must file Notice of Claim within 180 days of last furnishing labor and/or materials to the project.

Oregon

Enforcement lawsuit must be initiated within 2 years of last furnishing labor/materials.

Oregon

Oregon

Must file Notice of Claim within 180 days of last furnishing labor and/or materials to the project.

Oregon

Enforcement lawsuit must be initiated within 2 years of last furnishing labor/materials.

Under Oregon’s Little Miller Act, all public works projects valued at $100,000 or more are required to have a payment bond equal to the contract price.

However, if the contract is for highway, bridge, or transportation projects, the contract price threshold is projects valued at $50,000 or more.

Under Oregon law, any person who has supplied labor or materials for the performance of the work provided for in a public contract, including any person having a direct contractual relationship with the subcontractor, or an assignee of such person, or a person claiming monies due with the performance of the contract, is protected.

An Oregon bond claim must be sent to the required parties within 180 days after the claimant’s last date of furnishing labor and/or materials to the project. The time period is lengthened slightly to 200 days for contributions to an employee benefit plan.

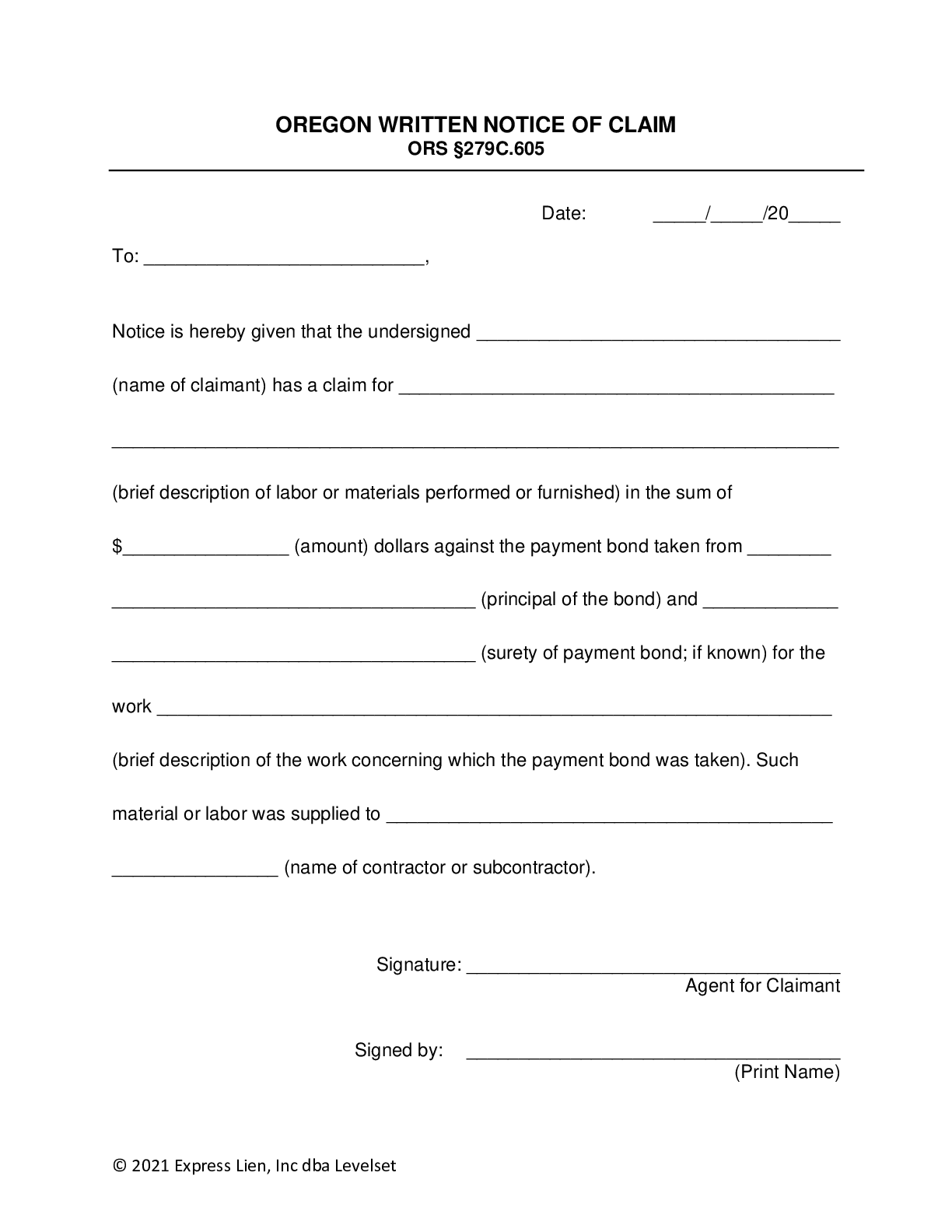

An Oregon payment bond claim is governed by Or. Rev. Stat. §279C.605, and should contain the following information:

• General contractor supplying the bond’s name;

• Public entity’s name;

• Claimant’s name;

• Description of labor and/or materials furnished;

• Project description;

• Amount claimed;

• Surety’s name (if known); &

• Hiring party’s name.

In Oregon, the claimant’s bond claim must be given to the contractor supplying the bond, the hiring subcontractor (if applicable), and to the contracting public entity.

Oregon bond claims must be served by registered or certified mail to any place the recipient maintains an office, conducts business, or their residence; notice may also be hand-delivered.

The specific wording of the statute seems to hold that sending the claim timely is sufficient, but it may be advisable to attempt to ensure the necessary parties receive the claim prior to the expiration of the 180-day period.

A suit to enforce the bond claim on a public project in Oregon must be initiated within 2 years from the claimant’s last furnishing of labor and/or materials to the project. Note that the claimant may be required to wait 6 months from requesting payment from the surety in order to recover attorney’s fees.

• See: Payment Bond Claims- How to Get Paid By a Surety Bond in Construction

Could you get back to me please so a contractor subed out work to a sub, that sub hired me for some work, then the...

Filing a lien in OregonSo we supplied material to a job in Oregon. The job is with the Hood River Co. School District. I sent out a preliminary notice...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When unpaid on a public works project in Oregon, subcontractors and suppliers can make a claim against the project’s payment bond using an Oregon Notice...

When you perform work on a state construction project in Oregon, and are not paid, you can file a “lien” against the project pursuant to Oregon’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Oregon’s Little Miller Act is found in Oregon Revised Statutes Title 26, Chapter 279C, and is reproduced below. Updated as of November 2021.

(1) Except as provided in ORS 279C. 390, a successful bidder for a public improvement contract shall promptly execute and deliver to the contracting agency the following bonds:

(a) A performance bond in an amount equal to the full contract price conditioned on the faithful performance of the contract in accordance with the plans, specifications and conditions of the contract. The performance bond must be solely for the protection of the contracting agency that awarded the contract and any public agency or agencies for whose benefit the contract was awarded. If the public improvement contract is with a single person to provide both design and construction of a public improvement, the obligation of the performance bond for the faithful performance of the contract required by this paragraph must also be for the preparation and completion of the design and related services covered under the contract. Notwithstanding when a cause of action, claim or demand accrues or arises, the surety is not liable after final completion of the contract, or longer if provided for in the contract, for damages of any nature, economic or otherwise and including corrective work, attributable to the design aspect of a design-build project, or for the costs of design revisions needed to implement corrective work. A contracting agency may waive the requirement of a performance bond. A contracting agency may permit the successful bidder to submit a cashier’s check or certified check in lieu of all or a portion of the required performance bond.

(b) A payment bond in an amount equal to the full contract price, solely for the protection of claimants under ORS 279C. 600.

(2) If the public improvement contract is with a single person to provide construction manager/general contractor services, in which a guaranteed maximum price may be established by an amendment authorizing construction period services following preconstruction period services, the contractor shall provide the bonds required by subsection (1) of this section upon execution of an amendment establishing the guaranteed maximum price. The contracting agency shall also require the contractor to provide bonds equal to the value of construction services authorized by any early work amendment in advance of the guaranteed maximum price amendment. Such bonds must be provided before construction starts.

(3) Each performance bond and each payment bond must be executed solely by a surety company or companies holding a certificate of authority to transact surety business in this state. The bonds may not constitute the surety obligation of an individual or individuals. The performance and payment bonds must be payable to the contracting agency or to the public agency or agencies for whose benefit the contract was awarded, as specified in the solicitation documents, and shall be in a form approved by the contracting agency.

(4) In cases of emergency, or when the interest or property of the contracting agency or the public agency or agencies for whose benefit the contract was awarded probably would suffer material injury by delay or other cause, the requirement of furnishing a good and sufficient performance bond and a good and sufficient payment bond for the faithful performance of any public improvement contract may be excused, if a declaration of such emergency is made in accordance with rules adopted under ORS 279A.065.

(5) This section applies only to public improvement contracts with a value, estimated by the contracting agency, of more than $100,000 or, in the case of contracts for highways, bridges and other transportation projects, more than $50,000.

(1) A contracting agency shall return the bid security of the successful bidder to the bidder after the bidder:

(a) Executes the public improvement contract; and

(b) Delivers a good and sufficient performance bond, a good and sufficient payment bond and any required proof of insurance.

(2) A bidder who is awarded a contract and who fails promptly and properly to execute the contract and to deliver the performance bond, the payment bond and the proof of insurance, when bonds or insurance are required, shall forfeit the bid security that accompanied the successful bid. The bid security shall be taken and considered as liquidated damages and not as a penalty for failure of the bidder to execute the contract and deliver the bonds and proof of insurance.

(3) The contracting agency may return the bid security of unsuccessful bidders to them when the bids have been opened and the contract has been awarded, and may not retain the bid security after the contract has been duly signed.

(1) Subject to the provisions of subsection (2) of this section, the Director of the Oregon Department of Administrative Services, a state contracting agency with procurement authority under ORS 279A.050, a local contract review board or, for contracts described in ORS 279A.050(3)(b), the Director of Transportation may exempt certain contracts or classes of contracts from all or a portion of the requirement for bid security and from all or a portion of the requirement that good and sufficient bonds be furnished to ensure performance of the contract and payment of obligations incurred in the performance.

(2) The contracting agency may require bid security and a good and sufficient performance bond, a good and sufficient payment bond, or any combination of such bonds, even though the public improvement contract is of a class exempted under subsection (1) of this section.

(3) The Director of Transportation may:

(a) Exempt contracts or classes of contracts financed from the proceeds of bonds issued under ORS 367.620(3)(a) from the requirement for bid security and from the requirement that a good and sufficient bond be furnished to ensure performance of the contract; or

(b) Reduce the amount of the required performance bond for contracts or classes of contracts financed from the proceeds of the bonds issued under ORS 367.620(3)(a) to less than 100 percent of the contract price.

(4) Any recoverable damages that exceed the amount of the performance bond required under subsection (3) of this section shall be the sole responsibility of the Department of Transportation.

(1) Every public improvement contract must contain a clause or condition that, if the contractor fails, neglects or refuses to pay promptly a person’s claim for labor or services that the person provides to the contractor or a subcontractor in connection with the public improvement contract as the claim becomes due, the proper officer that represents the state or a county, school district, municipality or municipal corporation or a subdivision of the state, county, school district, municipality or municipal corporation may pay the amount of the claim to the person that provides the labor or services and charge the amount of the payment against funds due or to become due the contractor by reason of the contract.

(2) Every public improvement contract must contain a clause or condition that, if the contractor or a first-tier subcontractor fails, neglects or refuses to pay a person that provides labor or materials in connection with the public improvement contract within 30 days after receiving payment from the contracting agency or a contractor, the contractor or first-tier subcontractor owes the person the amount due plus interest charges that begin at the end of the 10-day period within which payment is due under ORS 279C. 580 (4) and that end upon final payment, unless payment is subject to a good faith dispute as defined in ORS 279C. 580. The rate of interest on the amount due is nine percent per annum. The amount of interest may not be waived.

(3) Every public improvement contract and every contract related to the public improvement contract must contain a clause or condition that, if the contractor or a subcontractor fails, neglects or refuses to pay a person that provides labor or materials in connection with the public improvement contract, the person may file a complaint with the Construction Contractors Board, unless payment is subject to a good faith dispute as defined in ORS 279C. 580.

(4) Paying a claim in the manner authorized in this section does not relieve the contractor or the contractor’s surety from obligation with respect to an unpaid claim.

(1) A person claiming to have supplied labor or materials for the performance of the work provided for in a public contract, including any person having a direct contractual relationship with the contractor furnishing the payment bond or a direct contractual relationship with any subcontractor, or an assignee of such person, or a person claiming moneys due the State Accident Insurance Fund Corporation, the Unemployment Compensation Trust Fund or the Department of Revenue in connection with the performance of the contract, has a right of action on the contractor’s payment bond as provided for in ORS 279C. 380 and 279C. 400 only if:

(a) The person or the assignee of the person has not been paid in full; and

(b) The person gives written notice of claim, as prescribed in ORS 279C. 605, to the contractor and the contracting agency.

(2) When, upon investigation, the Commissioner of the Bureau of Labor and Industries has received information indicating that one or more workers providing labor on a public works have not been paid in full at the prevailing rate of wage or overtime wages, the commissioner has a right of action first on the contractor’s public works bond required under ORS 279C. 836 and then, for any amount of a claim not satisfied by the public works bond, on the contractor’s payment bond, as provided in ORS 279C. 380 and 279C. 400. When an investigation indicates that a subcontractor’s workers have not been paid in full at the prevailing rate of wage or overtime wages, the commissioner has a right of action first on the subcontractor’s public works bond and then, for any amount of a claim not satisfied by the subcontractor’s public works bond, on the contractor’s payment bond. The commissioner’s right of action exists without necessity of an assignment and extends to workers on the project who are not identified when the written notice of claim is given, but for whom the commissioner has received information indicating that the workers have provided labor on the public works and have not been paid in full. The commissioner shall give written notice of the claim, as prescribed in ORS 279C. 605, to the contracting agency, the Construction Contractors Board, the contractor and, if applicable, the subcontractor. The commissioner may not make a claim for the same unpaid wages against more than one bond under this section.

(1) The notice of claim required by ORS 279C. 600 must be sent by registered or certified mail or hand delivered no later than 180 days after the day the person last provided labor or furnished materials or 180 days after the worker listed in the notice of claim by the Commissioner of the Bureau of Labor and Industries last provided labor. The notice may be sent or delivered to the contractor or subcontractor at any place the contractor or subcontractor maintains an office or conducts business or at the residence of the contractor or subcontractor.

(2) Notwithstanding subsection (1) of this section, if the claim is for a required contribution to a fund of an employee benefit plan, the notice required by ORS 279C. 600 must be sent or delivered within 200 days after the employee last provided labor or materials.

(3) The notice must be in writing substantially as follows:

______________________________________________________________________________

To (here insert the name of the contractor or subcontractor and the name of the public body):

Notice hereby is given that the undersigned (here insert the name of the claimant) has a claim for (here insert a brief description of the labor or materials performed or furnished and the person by whom performed or furnished; if the claim is for other than labor or materials, insert a brief description of the claim) in the sum of (here insert the amount) dollars against the (here insert public works bond or payment bond, as applicable) taken from (here insert the name of the principal and, if known, the surety or sureties upon the public works bond or payment bond) for the work of (here insert a brief description of the work concerning which the public works bond or payment bond was taken). Such material or labor was supplied to (here insert the name of the contractor or subcontractor).

_____________________

(here to be signed)

______________________________________________________________________________

(4) When notice of claim is given by the commissioner and if the claim includes a worker who is then unidentified, the commissioner shall include in the notice a statement that the claim includes an unidentified worker for whom the commissioner has received information indicating that the worker has not been paid in full at the prevailing rate of wage required by ORS 279C. 840 or overtime wages required by ORS 279C. 540.

(5) The person making the claim or giving the notice shall sign the notice.

(1) The Commissioner of the Bureau of Labor and Industries or a person who has a right of action on the public works bond or the payment bond under ORS 279C. 600 and, where required, who has filed and served the notice or notices of claim, as required under ORS 279C. 600 and 279C. 605, or that person’s assignee, may institute an action on the contractor’s public works bond or payment bond in a circuit court of this state or the federal district court of the district.

(2) The action shall be on the relation of the commissioner, the claimant, or that person’s assignee, as the case may be, and shall be in the name of the contracting agency that let the contract or, when applicable, the public agency or agencies for whose benefit the contract was let. It may be prosecuted to final judgment and execution for the use and benefit of the commissioner or the claimant, or that person’s assignee, as the fact may appear.

(3) The action shall be instituted no later than two years after the person last provided labor or materials or two years after the worker listed in the commissioner’s notice of claim last provided labor.

All labor and material liens have preference and are superior to all other liens and claims of any kind or nature created by ORS 279C. 500 to 279C. 530 and 279C. 600 to 279C. 625.

A person providing medical, surgical or hospital care services or other needed care and attention, incident to sickness or injury, to the employees of a contractor or subcontractor on a public contract is deemed to have performed labor on the public contract for the purposes of ORS 279C. 600 to 279C. 625.

If the public improvement contract is one for which a payment bond as provided for in ORS 279C. 380 and 279C. 400 is required and the contractor fails to pay for labor or materials or to pay claims due the Industrial Accident Fund, the Unemployment Compensation Trust Fund or the Department of Revenue and the officers of the public body that authorized the contract fail or neglect to require the person entering into the contract to execute the payment bond:

(1) The State of Oregon and the officers authorizing the contract shall be jointly liable for the labor and materials used in the performance of any work under the contract, and for claims due the Industrial Accident Fund, the Unemployment Compensation Trust Fund and the Department of Revenue, if the contract was entered into with the State of Oregon.

(2) The public body and the officers authorizing the contract shall be jointly liable for the labor and materials used in the performance of any work under the contract and for claims due the Industrial Accident Fund, the Unemployment Compensation Trust Fund and the Department of Revenue, if the contract was entered into on behalf of a public body other than the state.