Louisiana

Preliminary Notice Deadlines

Louisiana

Louisiana

Louisiana

Louisiana

Louisiana

The "Sworn Statement of Claim- must be filed within 45 days from the acceptance of the project, or filling of a notice of default.

Louisiana

Enforcement lawsuit must be filed within 1 year from acceptance of the work or filing of a notice of default.

Louisiana

Louisiana

The "Sworn Statement of Claim- must be filed within 45 days from the acceptance of the project, or filling of a notice of default.

Louisiana

Enforcement lawsuit must be filed within 1 year from acceptance of the work or filing of a notice of default.

In Louisiana, parties that can make a claim against the payment bond are subcontractors, equipment lessors, material suppliers (including those that deliver and/or transport materials to the job site), and design professionals such as registered/certified engineers, and licensed architects.

In addition to these parties, this who provide oil, gas, or electricity to machinery used to improve the property can also make a bond claim. Suppliers to suppliers likely cannot make a claim against the bond.

Note, that a pay-if-paid clauses are not a defense for a surety when it comes to LA bond claims

Claimants must file and record their bond claim after the maturity of the claim but within 45 days after the (a) notice of acceptance of the work has been filed or the (b) filing of a notice of default of the contractor or subcontractor.

Keep in mind, that once the public entity receives a notice of claim, they are required to withhold that amount from the prime contractor, so the earlier the better.

Also, material suppliers who are required to send a monthly Notice of Nonpayment must give notice before their claim is made.

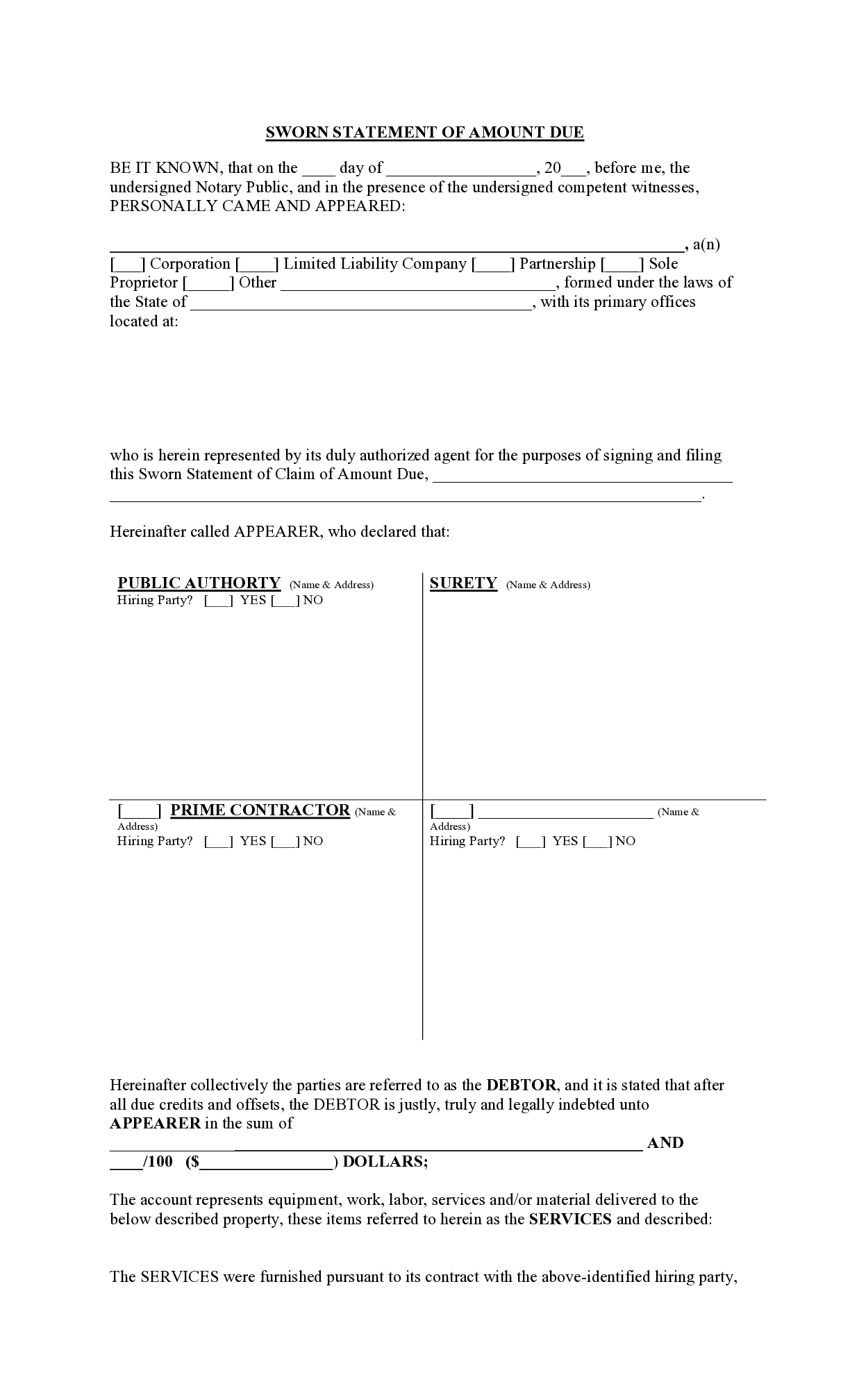

Download a free Louisiana Sworn Statement of Amount Due (Public Bond Claim) form here.

A Louisiana bond claim (Sworn Statement) must include the following information:

The claim must be given to the governing authority contracting for the improvement (public entity), and filed in the parish Recorder of Mortgages for the parish in which the work is done. Furthermore, if the claimant does not have a direct contract with the general contractor, the claim must also be given to the general. Failure to provide the sworn statement to a required party/office is fatal to bond claim rights.

Also, in order to preserve a right to 10% of attorney’s fees, the claimant must make an amicable demand for payment on the principal and the surety after the claim has been filed.

• For more on this, see: LA Bond Claims, Does the Surety Need to Know?

The claim must be sent to the the public entity, and recorded in the office of the Recorder of Mortgages in the parish in which the labor and/or materials were furnished.

• A full list of parish Recorder of Mortgages offices can be found here

When sending the notice to public entity and prime contractor, the notice must be sent by registered or certified mail. Keep in mind that actual delivery is required, so if the notice comes back returned or undelivered, then personal delivery is recommended to secure your bond claim rights.

There are a lot of questions on this page about who can make a Louisiana bond claim, when it must be made, what types of rules apply, and more. But you may be wondering something more practical; how do you actually make a Louisiana bond claim?

• For a full breakdown of the process, see: How to Make a Louisiana Bond Claim?

A lawsuit to enforce a claim against a payment bond must be initiated within one year from the recording of the notice of acceptance of the work, or the notice of the contractor’s default. The lawsuit may not be filed until at least 45 days of completion of the project. After the expiration of 45 days, the public entity should file the lawsuit asserting all the claims they received notice for.

If the entity fails to do so, then the claimant may initiate the action. If so, you should consult with a Louisiana-based construction attorney to help guide you through the process.

i'm a material supplier to a project in saint johns NB canada, i have a payment bond which i like to be checked if evyerhting is correct and if i'm secured of payment. could i forward the bond to anyone who can help me with it, and what would the required notices be and how do i sent them whilst...

How long do I have to file a lien on a project?We are working on the New Orleans airport project and our scope ended 30 days ago. The overall project is still going on. The project has large bond

Bond Claim Overview - deadlines for filing claim; does State or bond language have precedence, are pre-notices needed, and claim filing requirementsI am interested in filing a bond claim in the State of Louisiana. We are a first-tier subcontractor and the project is near completion. I would like to use Zlien, but believe I may need to hire an attorney. I am so confused on when, how and to whom a bond claim is filed specifically: 1. We finally...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a claimant...

A Public Statement of Claim should be filed on public or government projects when labor has been performed or materials provided, and you have not been...

When you perform work on a state construction project in Louisiana, and are not paid, you can file a “lien” against the project pursuant to Louisiana’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a payment bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Louisiana ‘s Little Miller Act is a bit segregated, whereby normal “Public Contracts” are governed by Louisiana. Revised Stautes § 38:2181 – 2247, and “Roads, Bridges and Ferries” are governed by La. R.S. § 48:250 – 256.12. Both titles are reproduced below. Updated as of 2020.

A. A suit to annul a public contract on the ground of fraud, illegality, or violation of the contract, may be instituted against a contractor either in the parish of the domicile of the contractor or in the parish where the real or personal property involved is located, or in the parish, or any one of the parishes wherein the work under the contract is to be performed.

B. A suit arising under any public contract regarding the construction, alteration, or repair of any public works or for the purchase of materials or supplies, may be instituted either in the parish in which the public entity is located or in any other parish where, by law, such action may be instituted.

C. Any other provisions of the law to the contrary notwithstanding, the parties to a public contract may stipulate in the contract that the venue of any possible litigation arising under such contract shall be in the parish in which the public entity is located.

D. A suit to enjoin the award of a competitively bid public contract shall be instituted in the parish in which the public entity is located.

Any action against the contractor on the contract or on the bond, or against the contractor or the surety or both on the bond furnished by the contractor, all in connection with the construction, alteration, or repair of any public works let by the state or any of its agencies, boards or subdivisions shall prescribe 5 years from the substantial completion, as defined in R.S. 38:2241.1, or acceptance of such work, whichever occurs first, or of notice of default of the contractor unless otherwise limited in this Chapter.

Any action by the contractor on the contract or on the bond, or by the contractor or the surety or both on the bond furnished by the contractor, against the state, or any of its agencies, boards or subdivisions, all in connection with the construction, alteration, or repair of any public works let by the state or any of its agencies, boards, or subdivisions, shall prescribe five years from the completion, the substantial completion, as defined in R.S. 38:2241.1, or acceptance of such work, whichever occurs first, or of notice of default of the contractor or other termination of the contract, unless otherwise limited in this Chapter. Any action which would be extinguished by the provisions of this Section may be brought within one year of the effective day of this Section.

A. As used in this Chapter unless the context clearly indicates otherwise, the following terms shall mean:

(1) “Alternate” means an item on the bid form that may either increase or decrease the quantity of work or change the type of work within the scope of the project, material, or equipment specified in the bidding documents, or both.

(2) “Bidding documents” means the bid notice, plans and specifications, bid form, bidding instructions, addenda, special provisions, and all other written instruments prepared by or on behalf of a public entity for use by prospective bidders on a public contract.

(3)

(a) “Change order” means any contract modification that includes an alteration, deviation, addition, or omission as to a preexisting public work contract, which authorizes an adjustment in the contract price, contract time, or an addition, deletion, or revision of work.

(b) “Change order outside the scope of the contract” means a change order which alters the nature of the thing to be constructed or which is not an integral part of the project objective.

(c) “Change order within the scope of the contract” means a change order which does not alter the nature of the thing to be constructed and which is an integral part of the project objective.

(4) “Contractor” means any person or other legal entity who enters into a public contract.

(5)

(a) “Emergency” means an unforeseen mischance bringing with it destruction or injury of life or property or the imminent threat of such destruction or injury or as the result of an order from any judicial body to take any immediate action which requires construction or repairs absent compliance with the formalities of this Part, where the mischance or court order will not admit of the delay incident to advertising as provided in this Part. In regard to a municipally owned public utility, an emergency shall be deemed to exist and the public entity may negotiate as provided by R.S. 38:2212(P) for the purchase of fuel for the generation of its electric power where the public entity has first advertised for bids as provided by this Part but has failed to receive more than one bid.

(b) An “extreme public emergency” means a catastrophic event which causes the loss of ability to obtain a quorum of the members necessary to certify the emergency prior to making the expenditure to acquire materials or supplies or to make repairs necessary for the protection of life, property, or continued function of the public entity.

(6) “Licensed design professional” means the architect, landscape architect, or engineer who shall have the primary responsibility for the total design services performed in connection with a public works project. Such professional shall be licensed as appropriate and shall be registered under the laws of the state of Louisiana.

(7)

(a) “Louisiana resident contractor” for the purposes of this Part, includes any person, partnership, association, corporation, or other legal entity and is defined as one that either:

(i) Is an individual who has been a resident of Louisiana for two years or more immediately prior to bidding on work,

(ii) Is any partnership, association, corporation, or other legal entity whose majority interest is owned by and controlled by residents of Louisiana, or

(iii) For two years prior to bidding has maintained a valid Louisiana contractor’s license and has operated a permanent facility in the state of Louisiana and has not had a change in ownership or control throughout those two years.

(b) For the purposes of Item (7)(a)(ii) of this Paragraph, ownership percentages shall be determined on the basis of:

(i) In the case of corporations, all common and preferred stock, whether voting or nonvoting, and all bonds, debentures, warrants, or other instruments convertible into common and/or preferred stock.

(ii) In the case of partnerships, capital accounts together with any and all other capital advances, loans, bonds, debentures, whether or not convertible into capital accounts.

(8) “Negotiate” means the process of making purchases and entering into contracts without formal advertising and public bidding with the intention of obtaining the best price and terms possible under the circumstances.

(9) “Probable construction costs” means the estimate for the cost of the project as designed that is determined by the public entity or the designer.

(10) “Public contract” or “contract” means any contract awarded by any public entity for the making of any public works or for the purchase of any materials or supplies.

(11) “Public entity” means and includes the state of Louisiana, or any agency, board, commission, department, or public corporation of the state, created by the constitution or statute or pursuant thereto, or any political subdivision of the state, including but not limited to any political subdivision as defined in Article VI Section 44 of the Constitution of Louisiana, and any public housing authority, public school board, or any public officer whether or not an officer of a public corporation or political subdivision. “Public entity” shall not include a public body or officer where the particular transaction of the public body or officer is governed by the provisions of the model procurement code.

(12) “Public work” means the erection, construction, alteration, improvement, or repair of any public facility or immovable property owned, used, or leased by a public entity.

(13) “Written” or “in writing” means the product of any method of forming characters on paper, other materials, or viewable screen, which can be read, retrieved, and reproduced, including information that is electronically transmitted and stored.

B. Unless clearly indicated otherwise, compliance with this Part required of any public entity shall be done by the governing authority of such public entity if it has a governing authority.

A.

(1) When any bid is accepted for the construction or doing of any public works, a written contract shall be entered into by the successful bidder and the public entity letting the contract, and the party to whom the contract is awarded shall furnish good and solvent bond in an amount not less than one-half of the amount of the contract, for the faithful performance of his duties.

(2) Repealed by Acts 2001, No. 138, §1, eff. July 1, 2001.

B. When any bid is accepted for the purchase of materials or supplies, the public entity purchasing the materials or supplies may require that a written contract be entered into between the successful bidder and the public entity and further, the public entity may require that the successful bidder shall furnish good and solvent bond in an amount not less than one-half of the amount of the contract, for the faithful performance of his duties. Any such requirements shall be incorporated in the specifications and advertisement.

C.

(1) On public contracts of two hundred thousand dollars or less, small businesses, as defined by the Department of Economic Development, shall only be required to furnish one-half the amount of bond, as called for in the bid, as provided in Subsections A and B, and by meeting the qualifications specified in Subsection D hereof.

(2)

(a) For purposes of this Subsection, “responsible bidder” shall mean a contractor or subcontractor who has an established business and who has demonstrated the capability to provide goods and services in accordance with the terms of the contract, plan, and specifications without excessive delays, extensions, cost overruns, or changes for which the contractor or subcontractor was held to be responsible, and who does not have a documented record of past projects resulting in arbitration or litigation in which such contractor or subcontractor was found to be at fault.

(b) A responsible bidder shall have a negotiable net worth, or shall be underwritten by an entity with a negotiable net worth, which is equal to or exceeds in value the total cost amount of the public contract as provided in the bid submitted by such bidder. All property comprising the negotiable net worth shall be pledged and otherwise unencumbered throughout the duration of the contract period.

D. In order to qualify for the one-half bond requirements set forth in Paragraph (C)(1) hereof, a bidder shall have the following characteristics:

(1) Qualifies as a small business, as certified by the Department of Economic Development.

(2) Is a responsible bidder in accordance with Paragraph (C)(2) hereof.

(3) Has been certified by the director of the Department of Economic Development to be in compliance with the criteria set forth by the Department of Economic Development.

(4) Has been operating as the same business for a continuous period of at least three years.

(5) Has been denied guaranteed bond by the Small Business Administration or denied a performance bond by an established security firm as required under the provisions of Subsections A(1) and B of this Section, for reasons other than the applicant has a previous history of performance default.

E. In the event the responsible bidder, though meeting the requirements of Subsection D of this Section, is unable to secure the performance bond required under Paragraph C(1) of this Section, the responsible bidder shall pay a fee equal to the cost of a Small Business Administration guaranteed bond, as provided for under the provisions of Paragraph C(1) of this Section. All such fees shall be paid into the state treasury by the commissioner of administration and shall be credited to the Bond Security and Redemption Fund.

F. The provisions of Subsections C, D, and E of this Section shall be administered by the Department of Economic Development which shall promulgate all rules and regulations necessary for their effectuation.

G. It is hereby declared that any provision contained in a public contract, other than a contract of insurance, providing for a hold harmless or indemnity agreement, or both,

(1) From the contractor to the public body for damages arising out of injuries or property damage to third parties caused by the negligence of the public body, its employees, or agents, or,

(2) From the contractor to any architect, landscape architect, engineer, or land surveyor engaged by the public body for such damages caused by the negligence of such architect, landscape architect, engineer, or land surveyor is contrary to the public policy of the state, and any and all such provisions in any and all contracts are null and void.

H. Any provision contained in a public contract which purports to waive, release, or extinguish the rights of a contractor to recover cost of damages, or obtain equitable adjustment, for delays in performing such contract, if such delay is caused in whole, or in part, by acts or omissions within the control of the contracting public entity or persons acting on behalf thereof, is against public policy and is void or unenforceable. When a contract contains a provision which is void and unenforceable under this Subsection, that provision shall be severed from the other provisions of the contract and the fact that the provision is void and unenforceable shall not affect the other provisions of the contract.

I.

(1) On public contracts of fifty thousand dollars or less, a performance bond as required by this Section may be waived by the public entity for a contractor or subcontractor who:

(a) Meets the definition and requirements of a “responsible bidder” as set forth in Paragraph C(2) of this Section.

(b) Has been operating as the same business for a continuous period of at least three years.

(c) Has been denied a performance bond by an established security firm, for reasons other than that the applicant has a previous history of performance default.

(d) Provides an irrevocable letter of credit, property bond, or other authorized form of security that is acceptable to the public entity and is in an amount of not less than the amount of the contract, for the faithful performance of his duties.

(2) The public entity may adopt rules and regulations in accordance with law to effectuate the provisions of this Subsection.

J. The provisions of this Section shall not be subject to waiver by contract.

K. The performance bond described by this Section shall inure solely to the benefit of the obligee named therein and his successors or assigns, and no other person shall have any right of action based thereon.

L.

(1) There shall be no provision contained in a contract for public works which requires a contractor to reimburse a design professional for additional costs incurred by any design professional for inspections of the contracted project which occur outside of normal working hours.

(2) Notwithstanding the provisions of Paragraph (1) of this Subsection, in any parish or municipality with a population in excess of four hundred twenty-five thousand, the parish or municipality may require a contractor to pay for the additional costs incurred by a parish or municipality with respect to inspections of the contracted project provided the additional costs for inspections are above the budgeted amount for the contracted project, and further provided that the specifications or bidding documents include the average hourly rate to be charged for inspection and specify a reasonable budget for such inspections.

M. Any term, provision, or condition of any contract for public works which is contrary to or in violation of the provisions of the Public Bid Law, Chapter 10 of this Title, is against public policy and shall be invalid and unenforceable. When a contract contains a provision which is invalid and unenforceable under this Subsection, that provision shall be severed from the other provisions of the contract and the fact that the provision is void and unenforceable shall not affect the other provisions of the contract.

In all public building, construction or other contracts which do not provide the right to independent arbitration with both parties having equal authority in selection of the arbitrator or arbitrators, the right of each party to such contract to judicial review of and redress for any action, determination or interpretation made under or with respect to such contract shall not be denied. In any such judicial action, no prior nonjudicial decision, determination or interpretation shall have any binding or conclusive or presumptive effect, nor shall there be any limitation upon the evidence which may be introduced in such action except the limitations arising out of the application of the rules of evidence applicable in courts of this state. The provisions of this Section may not be waived.

A. The public entity advertising for bids for work shall require the bidders to attach a certified check, cashier’s check, or bid bond for not more than five percent of the contract price of work to be done, as an evidence of good faith of the bidder. The public entity advertising for bids for work may require the bidders to attach a certified check, cashier’s check, or bid bond for not more than five percent of the estimated price of supplies or materials, as evidence of good faith of the bidder.

B. Repealed by Acts 2001, No. 138, §1, eff. July 1, 2001.

C. If bid bond is used, it shall be written by a surety or insurance company currently on the U.S. Department of the Treasury Financial Management Service list of approved bonding companies which is published annually in the Federal Register, or by a Louisiana domiciled insurance company with at least an A- rating in the latest printing of the A.M. Best’s Key Rating Guide to write individual bonds up to ten percent of policyholders’ surplus as shown in the A.M. Best’s Key Rating Guide or by an insurance company in good standing licensed to write bid bonds which is either domiciled in Louisiana or owned by Louisiana residents.

A.

(1)

(a) Any surety bond written for a public works project shall be written by a surety or insurance company currently on the U.S. Department of the Treasury Financial Management Service list of approved bonding companies which is published annually in the Federal Register, or by a Louisiana domiciled insurance company with at least an A- rating in the latest printing of the A.M. Best’s Key Rating Guide to write individual bonds up to ten percent of policyholders’ surplus as shown in the A.M. Best’s Key Rating Guide, or by an insurance company that is either domiciled in Louisiana or owned by Louisiana residents and is licensed to write surety bonds.

(b) For any public works project, no surety or insurance company shall write a bond which is in excess of the amount indicated as approved by the U.S. Department of the Treasury Financial Management Service list or by a Louisiana domiciled insurance company with an A- rating by A.M. Best up to a limit of ten percent of policyholders’ surplus as shown by A.M. Best; companies authorized by this Paragraph who are not on the treasury list shall not write a bond when the penalty exceeds fifteen percent of its capital and surplus, such capital and surplus being the amount by which the company’s assets exceed its liabilities as reflected by the most recent financial statements filed by the company with the Department of Insurance.

(c) In addition, any surety bond written for a public works project shall be written by a surety or insurance company that is currently licensed to do business in the state of Louisiana.

(2) Notwithstanding Paragraph (1) of this Subsection, a surety bond for the faithful performance of a contractor on a public works project, the primary purpose of which is asbestos abatement, shall be deemed sufficient and acceptable under this Section if the surety thereon is an insurance company which is admitted to do business in Louisiana, provided all of the following conditions are met:

(a) The applicability of this Paragraph to the public entity for all such contracts has been specifically authorized:

(i) By the municipality or parish, through the adoption of an ordinance, after public hearing thereon, and with the written approval of the ordinance by its chief executive officer.

(ii) By any other public entity, through the adoption of a resolution, after public hearing thereon, together with the approval of the governing authority of the municipality as to public works projects located within the municipality, or the approval of the governing authority of the parish as to public works projects not located within a municipality, by resolution, after public hearing thereon, and with written approval of the chief executive officer of the municipality or parish.

(b) The contract is bid, let, and entered into on or prior to July 1, 1990.

(3) Notwithstanding any provision of law to the contrary, particularly the provisions of R.S. 33:4085, all contracts with the New Orleans Sewerage and Water Board for the purchase of goods and services, professional and nonprofessional, involving an amount less than one hundred thousand dollars shall not be subject to requirements for performance or surety bond. Any company or individual who defaults on performance of such a contract without bond and any individual or company having more than a fifty percent ownership interest in the defaulting company shall be prohibited from bidding on future contracts with the New Orleans Sewerage and Water Board for five years from the date of such default. Any company in which a defaulting company or individual has more than a fifty percent ownership interest shall also be prohibited from bidding on future contracts with the board for five years from the date of default.

B. No officer or employee of a public entity, or any person acting or purporting to act on behalf of any such officer or employee, shall with respect to any public building or construction contract or any other public contract, which is about to be, or which has been competitively bid, require the bidder to make application to or to procure any of the surety bonds or insurance specified by law or in connection with such contracts, from a particular surety or insurance company, or through a particular agent or broker in any particular locality.

A.

(1) Whenever a public entity enters into a contract in excess of five thousand dollars for the construction, alteration, or repair of any public works, the official representative of the public entity shall reduce the contract to writing and have it signed by the parties. When an emergency as provided in R.S. 38:2212(D) is deemed to exist for the construction, alteration, or repair of any public works and the contract for such emergency work is less than fifty thousand dollars, there shall be no requirement to reduce the contract to writing.

(2) For each contract in excess of twenty-five thousand dollars per project, the public entity shall require of the contractor a bond with good, solvent, and sufficient surety in a sum of not less than fifty percent of the contract price for the payment by the contractor or subcontractor to claimants as defined in R.S. 38:2242. The bond furnished shall be a statutory bond and no modification, omissions, additions in or to the terms of the contract, in the plans or specifications, or in the manner and mode of payment shall in any manner diminish, enlarge, or otherwise modify the obligations of the bond. The bond shall be executed by the contractor with surety or sureties approved by the public entity and shall be recorded with the contract in the office of the recorder of mortgages in the parish where the work is to be done not later than thirty days after the work has begun.

B. All requirements and obligations of this Section, except the requirement to furnish a bond, shall be applicable to any contractor or subcontractor for whom bond requirements are waived under the provisions of R.S. 38:2216(C) or (D).

C. The payment provisions of all bonds furnished for public work contracts described in this Part, regardless of form or content, shall be construed as and deemed statutory bond provisions. Any such bond which fails to contain any of the requirements set forth in this Part shall be deemed to incorporate all of the requirements set forth in this Section. Language in any such bond containing any obligations beyond the requirements set forth in this Part shall be deemed surplusage and read out of such bond. Sureties and contractors executing payment bonds for public works contracts under this Part shall be immune from liability for or payment of any claims not required by this Part.

D. A bond issued pursuant to this Section shall not create, nor shall such bond be construed to create, any cause of action in favor of the public entity, or any third party, for personal injury or property damages sustained by any third party during the effective period of the bond. Nothing contained herein shall in any way limit the liability on the bond for the performance of the work pursuant to the contract in question; however, to the extent that the public contract in question should contain any provisions for a hold harmless or indemnity agreement, or both, by the contractor, in favor of the public entity, for personal injury or property damages sustained by third parties, the hold harmless or indemnity agreement, or both, shall not be deemed or construed to be secured by the bond, conditioned upon the concurrence of the contractor and the surety.

E. Any provisions of a bond issued pursuant to this Section which are contrary to Subsection D hereof are hereby declared to be contrary to the public policy of the state of Louisiana and are null and void.

F. The provisions of this Section shall not be subject to waiver by contract.

A. If a statement of claim or privilege is filed, any interested party may deposit with the recorder of mortgages either a bond of a lawful surety company authorized to do business in the state or cash, certified funds, or a federally insured certificate of deposit to guarantee payment of the obligation secured by the privilege or that portion as may be lawfully due together with interest, costs, and attorney’s fees to which the claimant may be entitled up to a total amount of one hundred twenty-five percent of the principal amount of the claim as asserted in the statement of claim or privilege. A surety shall not have the benefit of division or discussion.

B. If the recorder of mortgages finds the amount of the cash, certified funds, or certificate of deposit or the terms and amount of a bond deposited with him to be in conformity with this Section, he shall note his approval on the bond and make note of either the bond or of the cash, certified funds, or certificate of deposit in the margin of the statement of claim or privilege as it is recorded in the mortgage records and cancel the statement of claim or privilege from his records by making an appropriate notation in the margin of the recorded statement. The bond shall not be recorded but shall be retained by the recorder of mortgages as a part of his records.

C. Any party who files a bond or other security to guarantee payment of an obligation secured by a privilege in accordance with the provisions of Subsection A of this Section shall give notice to the public entity, the claimant, and the contractor by certified mail.

A. If no objections are made by any claimant to the solvency or sufficiency of the bond required of the contractor by this Part, the public entity shall, ten days after the service of judicial notice of the concursus proceeding on each claimant having recorded claims, obtain a certificate to that effect from the clerk of court. The certificate shall relieve the public entity of any personal liability and the recorder of mortgages shall cancel all of the recorded claims.

B. If any objections are made by the claimants they shall be tried summarily. Whenever it is found that the surety is not solvent or sufficient to cover the amount of the bond or that the public entity has failed to exact the bond or record the bond within the time allowed, the public entity shall be in default and shall be liable to the same extent as the surety would have been. The surety on the bond shall be limited to the defenses which the principal has on the bond.

All proceedings brought under this Part shall be tried summarily and referred to a commissioner, as provided by law, who shall report his findings to the court at the earliest date possible.

A. After amicable demand for payment has been made on the principal and surety and thirty days have elapsed without payment being made, any claimant recovering the full amount of his timely and properly recorded or sworn claim, whether by concursus proceeding or separate suit, shall be allowed ten percent attorney’s fees which shall be taxed in the judgment on the amount recovered.

B. If the trial court finds that such an action was brought by any claimant without just cause or in bad faith, the trial judge shall award the principal or surety a reasonable amount as attorney’s fees for defending such action.

Nothing in this Part shall be construed to deprive any claimant, as defined in this Part and who has complied with the notice and recordation requirements of R.S. 38:2242(B), of his right of action on the bond furnished pursuant to this Part, provided that said action must be brought against the surety or the contractor or both within one year from the registry of acceptance of the work or of notice of default of the contractor; except that before any claimant having a direct contractual relationship with a subcontractor but no contractual relationship with the contractor shall have a right of action against the contractor or the surety on the bond furnished by the contractor, he shall in addition to the notice and recordation required in R.S. 38:2242(B) give written notice to said contractor within forty-five days from the recordation of the notice of acceptance by the owner of the work or notice by the owner of default, stating with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor or service was done or performed. Such notice shall be served by mailing the same by registered or certified mail, postage prepaid, in an envelope addressed to the contractor at any place he maintains an office in the state of Louisiana.

A. All projects for the construction or maintenance of, or improvements to, highways or other public facilities under the control of or advertised and let by the Department of Transportation and Development shall, except as otherwise provided in this Part, be undertaken only under contract.

B. Every contract exceeding the contract limit, as defined herein, for construction, maintenance, or improvement of a department facility under the provisions of this Part shall be made in the name of the department and shall be signed by the secretary of the Department of Transportation and Development or his duly appointed designee and by the contracting party. The contract limit for this Part is hereby defined to equal five hundred thousand dollars. No such contract shall be entered into nor shall any such work be authorized which will create a liability on the part of the state in excess of the funds available or which will be available for the project.

C. Every contract for the construction of or improvements to highways shall include a warranty by the contractor as to the quality of materials and workmanship for a duration of three years. The Department of Transportation and Development shall implement the purposes of this Subsection and shall submit a report on its implementation of the warranty requirements to the Joint Legislative Committee on Transportation, Highways and Public Works no later than July 1, 1998.

D. There shall be established by the Department of Transportation and Development a cash management plan which shall to the greatest extent possible effectively and efficiently utilize the funds appropriated or otherwise made available to the department to assure the timely construction of projects. The department shall submit a report on its implementation of the cash management plan to the House and Senate Committees on Transportation, Highways and Public Works and to the Joint Legislative Committee on the Budget no later than July 1, 1998.

Any action against a contractor on a contract or on the bond furnished by the contractor, or against a contractor or the surety or both on the bond furnished by the contractor, all in connection with the construction or maintenance of any public works let by the department shall prescribe five years from recordation of the acceptance of such work, or of notice of default of the contractor, whichever occurs first.

Any action arising out of or related to a department contract or on the bond furnished by a contractor shall prescribe five years from recordation of the acceptance of such contract or of notice of default of the contractor or other termination of the contract, whichever occurs first. Any action which would be extinguished by the provisions of this Section may be brought within one year of July 14, 1997.

A. The department shall promptly pay all obligations arising under public contracts within thirty days of the date the obligations become due and payable under the contract. All progressive stage payments and final payments shall be paid when they, respectively, become due and payable under the contract.

B.

(1) If the department fails to make any final payments after recordation of formal final acceptance and within forty-five days following receipt of a clear lien certificate by the department, the retainage or other payments known by the department to be due and payable shall be released, but the contractor and the contractor’s surety shall remain liable for any overpayment by the department to the contractor, stipulated damages for delay in completion or work necessary to repair latent defects, or in performance of warranty work under the contract.

(2) If the department fails to make any final payment within one hundred days after its receipt of the clear lien certificate, the department shall be liable for legal interest on the balance due on the contract.

(3) If the department fails to make final payment as provided or neglects to promptly ascertain the final estimated quantities under the contract in bad faith, then the contractor shall be entitled to attorney fees if a mandamus to perform such acts is necessary for the contractor to receive all monies due and owed the contractor under the contract.

C. The provisions of this Section shall not be subject to waiver by contract.

The legislature hereby declares null and void and unenforceable as against public policy any provision in a department contract which requires either of the following:

(1) That a suit or arbitration proceeding must be brought in a forum or jurisdiction outside of this state, instead of being pursued in accordance with the laws of this state governing such actions.

(2) That the agreement must be interpreted according to the laws of another jurisdiction.

A. Every bid submitted for projects in excess of fifty thousand dollars shall be accompanied by a bid bond guaranteed by a surety company qualified to do business in this state. The bid bond submitted shall be for five percent of the official bid amount.

B.

(1) The bid bond shall be forfeited to the department or other named obligee if the bidder fails to make the required bond, fails to execute the contract, or fails to comply with any provision necessary for execution of the contract.

(2) Should the forfeited bid bond in any manner be limited or not payable on demand, the bidder will be disqualified from bidding or approval as a subcontractor on any department advertised project for a period of one year following nonpayment.

C. The bid bonds of unsuccessful bidders shall not be returned by the department.

D. Bid bonds shall be written by a surety or insurance company currently on the U.S. Department of Treasury Financial Management Service list of approved bonding companies which is published annually in the Federal Register, or by a Louisiana-domiciled insurance company with at least an A- rating in the latest printing of the A. M. Best’s Key Rating Guide.

A. The department shall establish specific bidding requirements, in accordance with the provisions of this Part, provisions of the Federal Highway Administration, if applicable, and other provisions as necessary and will include these requirements in the project specifications and bid package issued to prospective bidders. Bids of prospective bidders shall conform to these requirements. Bids not submitted in accordance with this Subpart or such other specified requirements are irregular and must be rejected by the department.

B.

(1) For all construction, maintenance, or improvement projects for department facilities or other public facility projects, advertised and let by the department, the department or the contracting agency may reject any and all bids for just cause but otherwise shall, with the concurrence of all funding sources, award the contract to the lowest responsible bidder within forty-five calendar days after receipt of bids or twenty calendar days after receipt by the department of concurrence in award from all project funding agencies, whichever occurs last, unless the department and the successful bidder mutually agree to extend the deadline. However, in cases where concurrence in award is required, the department shall award the contract no later than sixty calendar days after receipt of bids unless the department and the successful bidder mutually agree to extend the deadline.

(2) Should the successful low bidder not agree to extend the time period for award beyond the above described period the bid guaranty will be returned to the bidder and the department may, at its discretion, award to the next low bidder or may readvertise the project.

(3) If the department delays the award of the project in bad faith beyond the period specified herein for award such that the low bidder cannot perform at the prices bid and the project is awarded to a higher bidder, the unsuccessful low bidder shall receive the costs of preparation of his bid on the project from the department.

(4) If the contract is to be financed by bonds which are required to be sold after receipt of bids on the construction contract, or if the contract is to be financed in whole or in part by federal or other funds which will not be available at the time construction bids are received, or if the contract requires a poll of the legislature prior to the release of funds for the contract, the time limitation for the award of a contract herein stipulated in this Section may be modified and, if modified, shall be reflected in the specifications for the construction project and in the official advertisement for bids required in accordance with R.S. 48:252.

(5) For the purposes of this Section “just cause” means but is not limited to the following circumstances:

(a) The department’s unavailability of funds sufficient for the construction of the proposed public work or the unavailability of funding participation in the project by anticipated funding sources.

(b) The failure of any bidder to submit a bid within an established threshold of the preconstruction estimate for the project by the department’s engineers.

(c) A substantial change by the department prior to the award in the scope or design of the proposed public work.

(d) A determination by the department not to build the proposed public work within twelve months of the date for the public opening and presentation of bids.

(e) The disqualification or rejection by the department of all bidders.

(f) The discovery by the department prior to the award of the project of an error, defect, or ambiguity in the bidding documents that may have affected the integrity of the competitive bidding process or may lead to a potential advantage or disadvantage to one or more of the bidders.

(6) If two or more responsive bids from responsible bidders are received for exactly the same price and no preference or other method exists to determine the lowest bidder, the chief engineer shall notify the tied bidders of a time and place where the lowest bidder on the project will be chosen by flipping a coin or by lots, as appropriate in the determination of the chief engineer. The department may readvertise the projects in its discretion.

(7) Repealed by Acts 2007, No. 386, §2, eff. July 1, 2007.

C. Bids containing patently obvious mechanical, clerical, or mathematical errors may be withdrawn by the contractor if clear and convincing sworn, written evidence of such errors is furnished to the department within seventy-two hours of the bid opening, excluding Saturdays, Sundays, or other legal holidays. If the department determines that the error is a patently obvious mechanical, clerical, or mathematical error, it shall accept the withdrawal request and return the bid security to the contractor. A contractor who withdraws a bid under the provisions of this Section shall not be allowed to resubmit a bid on the project. If the bid withdrawn is the lowest bid, the next lowest bid may be accepted. If all bids are rejected, any contractor who had withdrawn a bid prior to rejection of all bids shall not be eligible to bid on the project unless the re-advertisement and opening of bids is at least one hundred eighty days after the date the bid was withdrawn.

D.

(1) When the bid is accepted for the construction, maintenance, or improvement to a department facility, or public works project, a written contract shall be entered into by the successful bidder and the department or contracting agency, and, on projects exceeding fifty thousand dollars, the party to whom the contract is awarded shall furnish good and solvent bond in an amount equal to the contract bid cost for the faithful performance of his duties.

(2) Any surety bond written for a department project shall be written by a surety or insurance company currently on the U.S. Department of Treasury Financial Management Service list of approved bonding companies which is published annually in the Federal Register, or by a Louisiana-domiciled insurance company with at least an A- rating in the latest printing of the A.M. Best’s Key Rating Guide.

(3) For any project advertised and let by the department, no surety or insurance company shall write a bond which is in excess of the amount indicated as approved for them by the United States Department of the Treasury Financial Management Service list of approved bonding companies as published annually in the Federal Register. For any project advertised and let by the department, a Louisiana-domiciled insurance company not on the U.S. Department of Treasury Financial Management Service list of approved bonding companies shall not write bonds exceeding ten percent of policyholder’s surplus as shown in the A.M. Best’s Key Rating Guide.

(4) In addition, any surety bond written for a project advertised and let by the department shall be written by a surety or insurance company that is licensed to do business in the state of Louisiana.

(5) The performance bond described by this Section shall inure solely to the benefit of the department and its successors or assigns, and no other person shall have any right of action based thereon.

E. The secretary shall reject any bid submitted by any firm, corporation, individual, or legal entity on any state funded project who, at the time or submission of bid, is prohibited from bidding or working on any federally funded project by the Federal Highway Administration.

F.

(1) The contractor shall return the signed contracts along with good and solvent bond to the department or the contracting agency within fifteen calendar days following the transmittal of contracts for execution. After return of the surety bond and signed contracts from the contractor, the department or the contracting agency shall execute the contract documents within twenty calendar days.

(2) The department or contracting agency shall issue a work order to the successful contractor within sixty calendar days following execution of the contract. However, upon mutual written consent by all parties, the notice to proceed may be extended beyond the sixty days. Should the contractor not wish to extend the period from contract execution to work order beyond sixty days, the contractor may demand contract cancellation.

(3) Should the contract be canceled at the request of the contractor, the department may at its discretion award the contract to the next higher bidder if the next higher bidder so agrees, or the department, at its discretion, may readvertise and relet the contract. Should the contract be canceled at the request of the contractor, the contractor shall be compensated for the cost of procuring the bond or bonds required for the contract

(4) If the contractor demands cancellation, but the department does not cancel the contract, the contractor shall be entitled to an escalation of his bid prices for the period between the lapse of the sixty-day period and the actual work order to the extent that the contractor can prove such escalation during that period, but in no event shall such escalation exceed the rate of inflation reflected by the United States Bureau of Labor Statistics Wholesale Price Index for the relevant period.

Within thirty days after default by a contractor on a public works project, the department shall notify the surety company with whom the contractor acquired a performance bond. Such notification shall be in writing by certified mail or overnight delivery. Within thirty days of receipt of such notification, the surety company shall present to the department either a plan assuming performance on the contract and procuring, or tendering completion of the project, the bond penal sum, or provide the public entity in writing with a reasonable response for the contractor’s alleged default. If no plan is presented by the surety company and the public entity completes the project, the surety company shall then be responsible for payment to the public entity of the costs of completion of the project and stipulated damages assessed by the public entity up to the total amount of the bond purchased by the contractor. In addition, if the surety company has not timely completed the project and a court of competent jurisdiction has determined that the surety company has in bad faith refused to take over the project as provided in this Section, the surety company shall be responsible for the payment of any stipulated damages for any delay in the completion of the project as specified in the original contract and any reasonable attorney fees and court costs incurred by the public entity in collection of the payments required by this Section.

A.

(1) Whenever the department enters into a contract in excess of fifty thousand dollars for the construction, maintenance, alteration, or repair of any public works, the department shall require of the contractor a bond with good, solvent, and sufficient surety in a sum not less than fifty percent of the contract price for the payment by the contractor or subcontractor to claimants as defined in R.S. 48:256.5.

(2) The bond furnished shall be a statutory bond and no modification, omissions, additions in or to the terms of the contract, in the plans or specifications, or in the manner and mode of payment shall in any manner diminish, enlarge, or otherwise modify the obligations of the bond. The bond shall be executed by the contractor with surety or sureties approved by the department and shall be recorded with the contract in the office of the recorder of mortgages in the parish where the work is to be done not later than thirty days after the work has begun

(3) The recorded portion of the contract shall state that the undersecretary is the official of the department to whom claims against the contractor or surety or both shall be made and shall state with particularity the address for delivery of claims to the department pursuant to R.S. 48:256.5.

B. The payment provisions of all bonds furnished for department contracts described in this Subpart, regardless of form or content, shall be construed as and deemed statutory bond provisions. Any such bond which fails to contain any of the requirements set forth in this Subpart shall be deemed to incorporate all of the requirements set forth in this Section. Language in any such bond containing any obligations beyond the requirements set forth in this Part shall be deemed surplusage and read out of such bond. Sureties and contractors executing payment bonds for department contracts under this Subpart shall be immune from liability for or payment of any claims not required by this Subpart.

C. A bond issued pursuant to this Section shall not create, nor shall such bond be construed to create, any cause of action in favor of the department, or any third party, for personal injury or property damages sustained by any third party during the effective period of the bond. Nothing contained herein shall in any way limit the liability on the bond for the performance of the work pursuant to the contract in question; however, to the extent that the department contract in question should contain any provisions for a hold harmless or indemnity agreement, or both, by the contractor, in favor of the public entity, for personal injury or property damages sustained by third parties, the hold harmless or indemnity agreement, or both, shall not be deemed or construed to be secured by the bond, conditioned upon the concurrence of the contractor and the surety.

D. Any provisions of a bond issued pursuant to this Section which are contrary to Subsection C of this Section are hereby declared to be contrary to the public policy of the state of Louisiana and are null and void.

E. The provisions of this Section shall not be subject to waiver by contract.

Whenever the department enters into a contract for the construction, maintenance, alteration, or repair of any public works, in accordance with the provisions of this Subpart, the undersecretary or his duly appointed designee of the department shall have recorded in the office of the recorder of mortgages, in the parish where the work has been done, a final acceptance of said work or a partial acceptance of any specified area thereof upon completion of all of the work. The final acceptance shall be executed by the secretary or his duly appointed designee within thirty days of completion of all of the work on the project. The recordation of a final acceptance in accordance with the provisions of this Section shall be effective for all purposes under this Chapter.

A. “Claimant”, as used in this Chapter, means any person to whom money is due pursuant to a contract with the owner or a contractor or subcontractor for doing work, performing labor, or furnishing materials or supplies for the construction, alteration, or repair of any public works, or for transporting and delivering such materials or supplies to the site of the job by a for-hire carrier, or for furnishing oil, gas, electricity, or other materials or supplies for use in machines used in the construction, alteration, or repair of any public works, including persons to whom money is due for the lease or rental of movable property, used at the site of the immovable and leased to the contractor or subcontractor by written contract, and including registered or certified surveyors or engineers, or licensed architects, or their professional subconsultants, employed by the contractor or subcontractor in connection with the building of any public work.

B. Any claimant shall, after the maturity of his claim and within forty-five days after the recordation of final acceptance of the work by the department or of notice of default of the contractor or subcontractor, record the original sworn statement of the amount due him in the office of the recorder of mortgages for the parish in which the work is done and file a certified copy of the recorded sworn statement of the amount due, showing the recordation data, with the undersecretary of the department.

C.

(1) To be entitled to assert the claim given by Subsection B of this Section, the lessor of movables shall deliver a copy of the lease to the department and the contractor, not more than ten days after the movables are first placed at the site of the immovable for use in the work.

(2) The claim or privilege granted the lessor of the movables by Subsection B of this Section is limited to and secures only the part of the rentals accruing during the time the movable is located at the site of the immovable for use in a work. A movable shall be deemed not located at the site of the immovable for use in a work after one or more of the following have occurred:

(a) The work is completed or abandoned.

(b) The notice of final acceptance of the work is filed.

(c) The lessee has abandoned the movable, or use of the movable in a work is completed or no longer necessary, and the owner or contractor gives written notice to the lessor of abandonment or completion of use.

D.

(1) The department shall withhold from progress payments and the final payment one hundred twenty-five percent of the amount claimed after receipt by the undersecretary of the department at the location specified in the recorded contract of a sworn statement of amount due from a claimant to the extent of payments due and owed the contractor after receipt of said claim.

(2) When the department makes final payment to the contractor without deducting such amounts as required in this Subsection of all outstanding claims so served on it or without obtaining a bond from the contractor to cover the total amount of all outstanding claims, the department shall become liable for the amount of these claims to the extent of its failure to withhold funds as required in this Subsection.

E. If an architect or engineer has not been employed by the contractor or subcontractor, he shall have no claim to or privilege on the funds due the contractor or subcontractor, nor shall such architect or engineer be within the coverage of the payment and performance bond required of the contractor by R.S. 38:2241.

A. If a statement of claim or privilege is filed, any interested party may deposit with the recorder of mortgages either a bond of a lawful surety company authorized to do business in the state or cash, certified funds, or a federally insured certificate of deposit to guarantee payment of the obligation secured by the privilege or that portion as may be lawfully due together with interest, costs, and attorney fees to which the claimant may be entitled up to a total amount of one hundred twenty-five percent of the principal amount of the claim as asserted in the statement of claim or privilege. A surety shall not have the benefit of division or discussion.

B. If the recorder of mortgages finds the amount of the cash, certified funds, or certificate of deposit or the terms and amount of a bond deposited with him to be in conformity with this Section, he shall note his approval on the bond and make note of either the bond or of the cash, certified funds, or certificate of deposit in the margin of the statement of claim or privilege as it is recorded in the mortgage records and cancel the statement of claim or privilege from his records by making an appropriate notation in the margin of the recorded statement. The bond shall not be recorded but shall be retained by the recorder of mortgages as a part of his records.

C. Any party who files a bond or other security to guarantee payment of an obligation secured by a privilege in accordance with the provisions of Subsection A of this Section shall give notice to the department, the claimant, and the contractor by certified mail, and shall file a certified copy of the cancellation of the statement of claim or privilege by the recorder of mortgages, showing the recordation data, with the undersecretary of the department by certified mail.

A. If no objections are made by any claimant to the solvency or sufficiency of the bond required of the contractor by this Part, the department shall, ten days after the service of judicial notice of the concursus proceeding on each claimant having recorded claims, obtain a certificate to that effect from the clerk of court. The certificate shall relieve the department of any personal liability and the recorder of mortgages shall cancel all of the recorded claims.

B. If any objections are made by the claimants they shall be tried summarily. Whenever it is found that the surety is not solvent or sufficient to cover the amount of the bond or that the department has failed to exact the bond or record the bond within the time allowed, the department shall be in default and shall be liable to the same extent as the surety would have been. The surety on the bond shall be limited to the defense which the principal has on the bond.

All proceedings brought under this Part shall be tried summarily, if a commissioner is available in the venue of the suit, the proceeding shall be referred to a commissioner, as provided by law, who shall report his findings to the court at the earliest date possible.

A. After amicable demand for payment has been made on the principal and surety and thirty days have elapsed without payment being made, any claimant recovering the full amount of his timely and properly recorded or sworn claim in a concursus proceeding pursuant to this Subpart shall be allowed reasonable attorney fees which shall be taxed in the judgment on the amount recovered.

B. If the trial court finds that such an action was brought by any claimant without just cause or in bad faith, the trial judge shall award the principal or surety a reasonable amount as attorney fees for defending such action.

Nothing in this Part shall be construed to deprive any claimant, as defined in this Part and who has complied with the notice and recordation requirements of R.S. 48:256.5(B), of his right of action on the bond furnished pursuant to this Part, provided that said action must be brought against the surety or the contractor or both within one year from the registry of acceptance of the work or of notice of default of the contractor; except that before any claimant having a direct contractual relationship with a subcontractor but no contractual relationship with the contractor shall have a right of action against the contractor or the surety on the bond furnished by the contractor, he shall in addition to the notice and recordation required in R.S. 48:256.5(B) give written notice to said contractor and surety within forty-five days from the recordation of the notice of final acceptance by the department of the work or notice by the department of default, stating with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor or service was done or performed. Such notice shall be served by mailing the same by registered or certified mail, postage prepaid, in envelopes addressed separately to the contractor and surety at any place each maintains an office in the state of Louisiana.