Arkansas

Preliminary Notice Deadlines

Arkansas

Arkansas

Arkansas

Arkansas

Arkansas

For those who didn't contract directly with the prime, must deliver a bond claim to the prime contractor and the surety no later than 90 days of the last date of furnishing labor or materials to the project (good practice for those who didn't contract with prime as well).

Arkansas

Enforcement lawsuit must be filed within 1 year from the earlier of either: (a) the prime contractor receives final payment, or (b) the prime contractor ceases work under the contract.

Arkansas

Arkansas

For those who didn't contract directly with the prime, must deliver a bond claim to the prime contractor and the surety no later than 90 days of the last date of furnishing labor or materials to the project (good practice for those who didn't contract with prime as well).

Arkansas

Enforcement lawsuit must be filed within 1 year from the earlier of either: (a) the prime contractor receives final payment, or (b) the prime contractor ceases work under the contract.

The Arkansas public payment bond laws apply to all public works construction projects within the state that exceed $50K. The only exception to these laws are public works contracts executed by the Arkansas Department of Transportation.

In Arkansas, parties who furnish labor and/or materials to the general contractor or any subcontractor are protected, presumably, this means any tier. Suppliers to suppliers are not covered.

Note, however, that Arkansas case law holds that contractors are not allowed to contract with unlicensed subcontractors if the subcontractor’s labor or material exceeds $20,000 in value. It is unclear whether this means an unlicensed subcontractor providing more than $20,000 in labor and/or materials is without rights, however.

Under new Arkansas public bond claim laws, any claimant who didn’t contract directly with the principal contractor must send a bond claim to the principal contractor and the surety who posted the payment bond no later than 90 days after the last date of furnishing labor and/or materials to the project.

The only information that is required by statute under Ark. Code §18-44-508, is:

• The amount claimed, and

• The name of the party to whom the labor and/or materials were furnished to.

However, we recommend providing as much information as possible to streamline the claim process. Such as; the general contractor’s name & address, surety information, project description, and a brief description of labor and/or materials provided to the project.

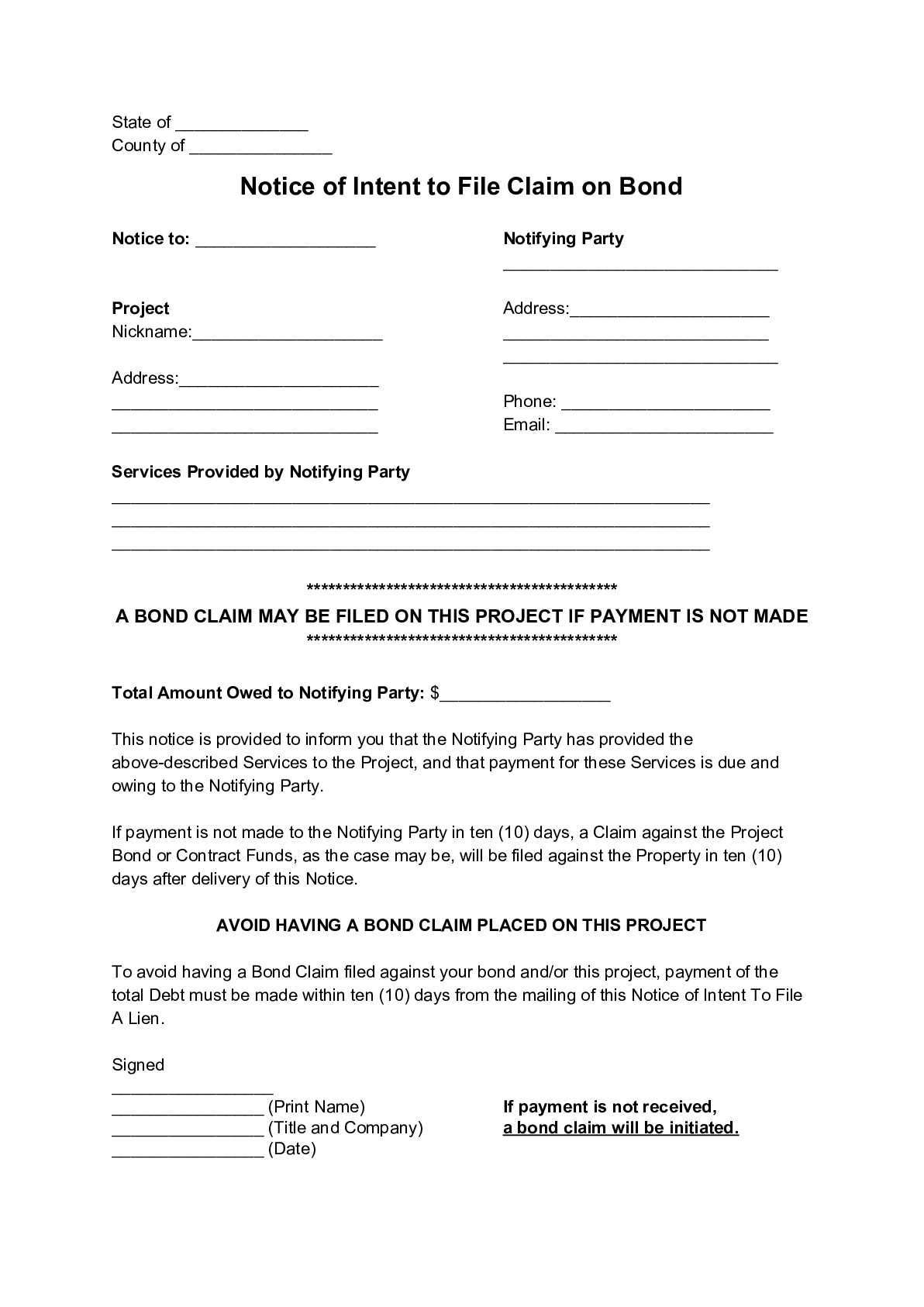

→ Download a free Arkansas Bond Claim form here

The bond claim must be sent to the principal contractor as well as the surety who provided the payment bond.

The Arkansas bond claim must be sent by any method that provides written, third-party verification of delivery. Thus, registered or certified mail will be sufficient.

The deadline to initiate an enforcement action is one (1) year from whichever of the following two occurs first:

• Final payment is made on the original contract; or

• The principal contractor on the payment bond ceases to work.

I did a job as a subcontractor for a buddy/contractor and haven’t been paid in full and I’m not sure if he gave the owners...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Arkansas, and are not paid, you can file a “lien” against the project pursuant to Arkansas’ Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Arkansas’ Little Miller Act is governed by Arkansas Code, Title 18, Chapter 44, Subchapter 5, Bonds, and Title 22, Public Property, Chapter 9, Public Works, Sub-chapter 4, Contractor’s Bonds, and is reproduced below. Updated as of July 2021.

(a) As used in this subchapter:

(1) “Construction contract” means a contract for the construction, erection, alteration, demolition, or repair of a building, structure, or improvement;

(2) “Public construction contract” means a contract for the construction, erection, alteration, demolition, or repair of a public building, public structure, or public improvement, including without limitation a:

(A) Levee;

(B) Sewer;

(C) Drain;

(D) Road;

(E) Street;

(F) Highway; or

(G) Bridge; and

(3) “Real estate construction contract” means a contract for the construction, erection, alteration, demolition, or repair of a building, structure, or improvement located on a privately owner real estate.

(b) Liability imposed under this subchapter of any surety furnishing a payment bond or performance bond is an integral party of the bond whether or not the liability is explicitly set our or assumed in the bond.

(c) The purpose of this subchapter is to provide a uniform bonding procedure for payment bonds and performance bonds issued under contract for the construction, erection, alteration, demolition, or repair of any building, structure, or improvement.

This subchapter shall not apply to any contract executed by the Arkansas Department of Transportation.

(a) A public construction contract in a sum exceeding fifty thousand dollars ($50,000), shall not be entered into by the State of Arkansas or any subdivision of the state, by any county, municipality, school district, or other local taxing unit, or by any agency of the state, a subdivision of the state, a county, a municipality, a school district, or any other local taxing unit, unless the contractor furnishes to the party letting the contract a payment bond in a sum equal to the amount of the public construction contract.

(b) A payment bond required under subsection (a) of this section shall cover all claims for labor and materials necessary or used for the public construction contract, including without limitation a claim for the:

(1) Wages of construction workers under the public construction contract;

(2) Wages or salaries of supervisory and administrative personnel under the public construction contract;

(3) Use of temporary facilities;

(4) Purchase or rental of any machinery, equipment, or have tools not customarily owned by construction workers;

(5) Purchase of building permits;

(6) Payment of construction testing fees;

(7) Purchase of fuel oil and gasoline;

(8) Payment of premiums for bonds and liability and workers’ compensation insurance;

(9) Taxes or payments due to the state or any political subdivision of the state origins from the wages earned by construction workers under the public construction contract or in connection with the public construction contract; and

(10) Wages earned by workers on a public construction contract covered by the payment bond.

(a) A construction contract in any sum exceeding twenty thousand dollars ($20,000) shall not be entered into by any church, religious organization, charitable institution, or by any agency of the church, religious organization, or charitable institution, unless the contractor furnishes to the party letting the construction contract a payment bond in a sum equal to the amount of the contract.

(b) If the bond is not furnished as required by this subsection, any person performing labor or furnishing material, except the principal contractor, shall have the right to assert and enforce a lien upon the property for the unpaid amount of the claim under § 18-44-101 et seq.

(a) A real estate construction contract between private parties may require the contractor to furnish to the party letting the real estate construction contract a:

(1) Payment bond in the sum equal to the amount of the real estate construction contract for the benefit of all persons and entities that can claim a lien under § 18-44-101 et seq.; and

(2) Performance bond in a sum equal to the amount of the real estate construction contract for the benefit of the real estate owner.

(b) If a payment bond is filed as provided under § 18-44-507 before a lien claim has been filed under § 18-44-101 et seq., then the real estate and improvements that otherwise would be subject to any lien under § 18-44-101 et seq. by reason of work or services provided or material or equipment supplied to the contractor providing the payment bond under the real estate construction contract shall not be subject to the lien.

(c) A civil action may be brought in the circuit court on a payment bond or performance bond furnished under this section as provided in § 18-44-508.

The payment bond or performance required or authorized in this subchapter shall be

(1) Executed by a solvent corporate surety company authorized to do business in the State of Arkansas; and

(2) Conditioned that the contractor shall:

(a) Perform his or her obligations under the construction contract, public construction contract, or real estate contract; and

(b) Pay all amounts owed for labor and materials furnished or performed under the construction contract, public construction contract, or real estate contract.

(a) The contractor shall file the payment bond with the circuit clerk of the county in which the construction work is to take place before the commencement of the construction work required under the construction contract, public construction contract, or real estate construction contract.

(b) If the contractor fails to file the payment bond as required by subsection (a) of this section, the person letting the construction contract, public construction contract, or real estate construction contract is not required to pay the contractor until the contractor:

(1) Files the payment bond; and

(2) Provides a file marked copy of the payment bond to the person letting the construction contract, public construction contract, or real estate construction contract.

(a) All persons, firms, associations, and corporations who have valid claims against the payment bond or performance bond may bring an action thereon against the corporate surety.

(b) An action shall not be brought on a payment bond after one (1) year from the date of whichever of the following occurs first, the date the:

(1) Final payment is made on the construction contract, public construction contract, or real estate contract; or

(2) The principal contractor on the payment bond ceases to work on the construction contract, public construction contract, or real estate construction contract.

(c) An action shall not be brought on a performance bond after two (2) years from whichever of the following occurs first, the date a principal contractor on the performance bond:

(1) Receives final payment under the construction contract, public construction contract, or real estate construction contract; or

(2) Ceases work on the construction contract, public construction contract, or real estate construction contract.

(d)

(1) Before bringing a civil action concerning a payment bond under this subchapter, a person having no contractual relationship with the contractor furnishing the bond, express or implied, shall give written notice to the contractor and his or her surety within ninety (90) days after the last date labor was performed or the last of the material or services for which the claim is based were furnished or supplied.

(2) Notice required by subdivision (d)(1) of this section shall:

(A) State the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed; and

(B) Be served:

(i) By any means that provides written third-party verification of delivery to the contractor’s residence or to any place the contractor maintains an office or conducts business; or

(ii) In any manner appropriate under the rules of civil procedure for the service of process in a civil action.

(e) A civil action under this subsection shall not be brought outside the State of Arkansas.

(a) All surety bonds required by the State of Arkansas or any subdivisions thereof by any county, municipality, school district, or other local taxing unit, or by any agency of any of the foregoing for the repair, alteration, construction, or improvement of any public works, including, but not limited to, buildings, levees, sewers, drains, roads, streets, highways, and bridges shall be liable on all claims for labor and materials entering into the construction, or necessary or incident to or used in the course of construction, of the public improvements.

(b) Claims for labor and materials shall include, but not be limited to, fuel oil, gasoline, camp equipment, food for workers, feed for animals, premiums for bonds and liability and workers’ compensation insurance, rentals on machinery, equipment, and draft animals, and taxes or payments due the State of Arkansas or any political subdivision thereof which shall have arisen on account of, or in connection with, wages earned by workers on the project covered by the bond.

The liability imposed by § 22-9-401 on any bond furnished by a public works contractor shall be deemed an integral part of the bond, whether or not the liability is explicitly set out or assumed therein.

(a)

(1) If required by the general contractor, each subcontractor must provide the general contractor with a payment and performance bond made by a surety company qualified under § 22-9-401 et seq., or a cash bond in a sum equal to the full amount of the subcontractor’s bid on a portion of a public works contract when:

(A) The subcontractor is the low responsible bidder for that portion of the contract;

(B) The state, pursuant to § 22-9-204, requires the general contractor to list the subcontractor in the general contractor’s bid; and

(C) The work value of the subcontractor’s bid is in excess of fifty thousand dollars ($50,000).

(2) If the general contractor requires the subcontractor to provide a bond, the subcontractor shall provide the bond to the general contractor within five (5) days after the award of the contract by the general contractor to the subcontractor.

(b) If the subcontractor fails to provide a payment and performance bond when required by the general contractor, the subcontractor shall lose the bid and shall pay to the general contractor a penalty equivalent to ten percent (10%) of the subcontractor’s bid or the difference between the low bid and the next responsible bid and the next responsible low bid, whichever is less, plus cost of recovery of the penalty, including attorney’s fees. The purpose of this section is to compensate the general contractor for the difference between the low bid and the next responsible low bid.

(c) The general contractor may enforce this section by a civil action in circuit court.

(d) The provisions of this section shall not apply to contracts awarded by the State Highway Commission for construction or maintenance of public highways, roads, or streets.

(a) It is unlawful for any contracting body referenced in § 22-9-401or any person acting on behalf of such contracting body to require a bidder or contractor to obtain or procure any surety bond from any particular insurance company or surety company, agent, or broker or to include surety bonds in an owner-controlled insurance program.

(b) Any person who violates the provisions of this section is guilty of a Class A misdemeanor.