North Carolina Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

Not specified in state statutes

Subcontractors

For Subcontractors, payment due within 7 days after payment received from above.

Suppliers

For Suppliers, payment due within 7 days after payment received from above.

Interest & Fees

Interest at 1% month

Prime Contractors

For Prime (General) Contractors, progress payments are due pursuant ot the contract. Final/Retainage payment due within 45 days after the earlier of acceptance or occupancy.

Subcontractors

For Subcontractors, payment due within 7 days after receipt of payment from above.

Suppliers

For Suppliers, payment due within 7 days after receipt of payment from above.

Interest & Fees

Interest at 1% month, unless a lower rate is agreed to in the contract.

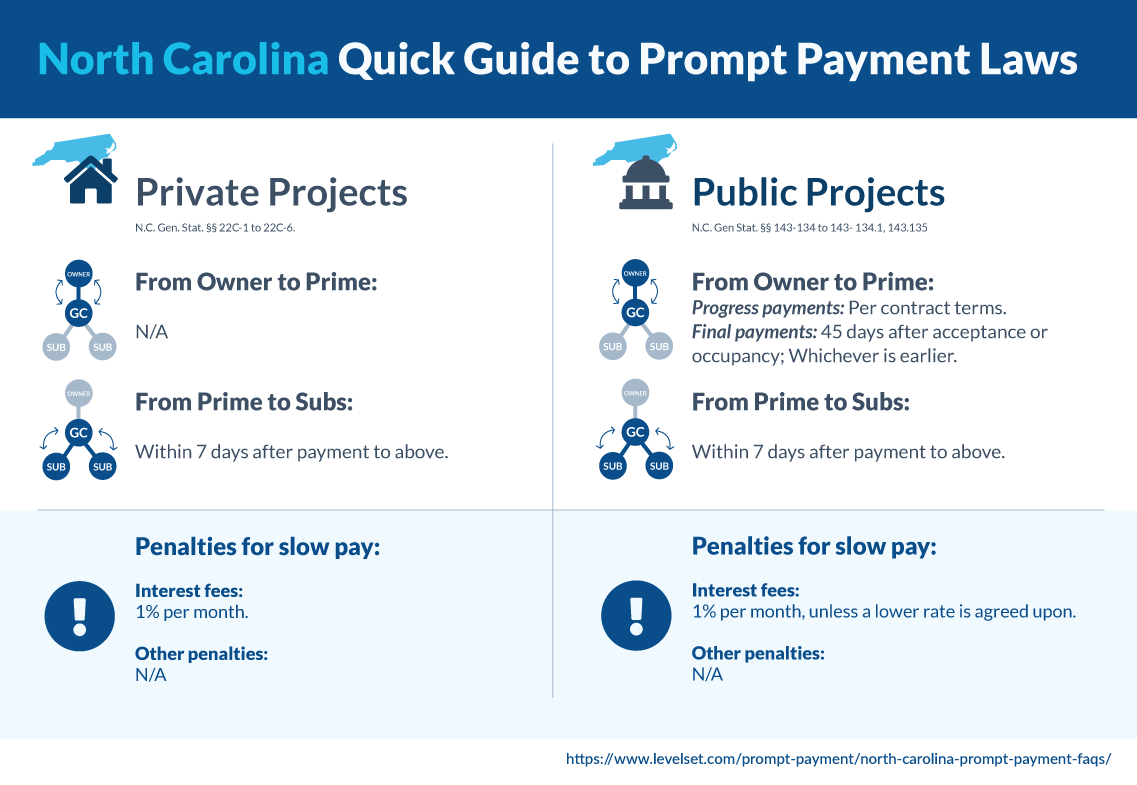

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Projects Covered by Prompt Payment in North Carolina

The state of North Carolina’s prompt payment provisions are split into two sections, covering both private and public projects. These statutes govern the timing of all payments on construction projects, and impose penalties for late payment in the form of interest.

Private Projects

Private construction projects within the state of North Carolina are governed by N.C. Gen. Stat. §§22C-1 et seq. These rules cover all private projects except residential projects of 12 or fewer units.

Payment Deadlines for Private Projects

Payments from the property owner to the prime contractor are not covered by the prompt payment provisions. Therefore, they will be governed by the terms of the contract between the parties. As for all other payments to subcontractors and suppliers, these must be made within 7 days of the higher-tiered party’s receipt of payment.

Penalties for Late Payment on Private Projects

The prompt payment provisions offer some circumstances where payment can be properly withheld. However, barring any of those reasons, if payment is late or otherwise wrongfully withheld, the unpaid balance will be subject to interest penalties at a rate of 1% per month, until the party is paid.

Public Projects

Payments on public works projects in North Carolina are regulated by N.C. Gen. Stat. §§143-134, 143-134.1, and 143-135. All public construction projects are subject to these rules, with the exception of those involving roads, bridges, and their approaches.

Payment Deadlines for Public Projects

Progress payments from the public entity to the prime contractor must be made according to the terms of the contract. As for final payments from the entity, these must be made within 45 days of either the acceptance of the project, or occupancy of the improvement; whichever is earlier. All other payments to subcontractors and suppliers must be made within 7 days of the higher-tiered party’s receipt of payment.

Penalties for Late Payment on Public Projects

Like private projects, there is a similar list of reasons when payments can be properly withheld. If none of these exist and payment is either late or wrongfully withheld, the unpaid balance will be subject to interest penalties accruing at a rate of 1% per month, unless a lower rate is agreed upon in the contract.