Florida Payment Terms Overview

- Private Jobs

- Public Jobs

- Top Links

Pay When Paid Likely Valid as Timing Clause

Arkansas doesn't address pay when paid in private construction, but does allow pay when paid clauses by statute for public works, so it is likely that it would be applied in a similar fashion to private construction. What is not clear is if a pay when paid clause can ever completely bar payment. Ark. Code Ann. § 22-9-205

Pay If Paid Valid

In Arkansas, pay if paid provisions are enforceable if it is clearly and unambiguously set forth in the contract that payment to contractor is condition precedent to payment to sub.

Trust Fund Statute Does Not Exist

Arkansas does not have a construction trust fund staute, but does have a related statute that makes contractors criminally liable if they are paid by the owner but fail to pay their subs. While the statute doesn’t rise to the level of creating a construction trust fund, it does provide some protection to subcontractors against nonpayment.

Retainage Unregulated on Private Projects

Arkansas has no specific statutes governing retainage on private projects. Accordingly, retainage is governed by the contract between the parties.

No Prompt Payment Statute

Arkansas has no specific statutes governing prompt payment (or any payment timing) on private projects. Accordingly, payment timing provisions are set forth and governed by the contract between the parties.

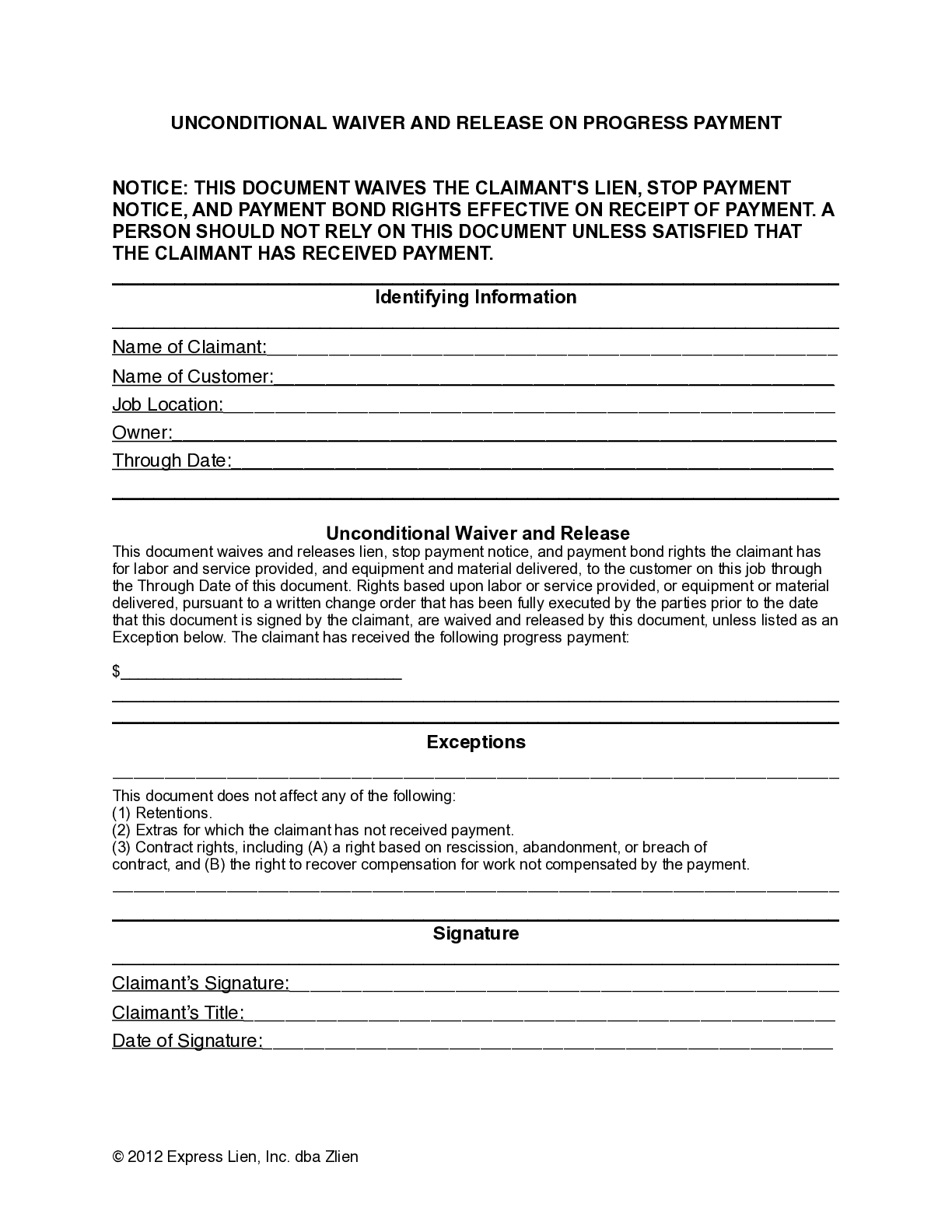

Lien Waivers Unregulated

Arkansas does not regulate the form, process, or timing for lien waivers. Accordingly, parties in Arkansas should exercise caution when executing lien waivers, and examine contract documents for prospective lien waivers.

Pay When Paid Valid

Arkansas allows pay when paid clauses by statute for public works. Ark. Code Ann. § 22-9-205

Pay If Paid Valid

In Arkansas, pay if paid provisions are enforceable if it is clearly and unambiguously set forth in the contract that payment to contractor is condition precedent to payment to sub.

Trust Fund Statute Does Not Exist

Arkansas does not have a construction trust fund staute, but does have a related statute that makes contractors criminally liable if they are paid by the owner but fail to pay their subs. While the statute doesn’t rise to the level of creating a construction trust fund, it does provide some protection to subcontractors against nonpayment.

Retainage 10%

Retainage rate is generally 10%. Upon 50% completion of the project, no additional withholding is allowed. Additionally, release of retained funds is required within 30 days from completion of the contract (or separate phase on contract).

Payment Due to GCs in 5 Days

With respect to payments to be made to GCs, progress payments are due within 5 days of properly prepared request for payment, and final payment is due within 90 days of request for payment.

Prompt payment requirements do not apply to payments to sub-tier parties, however. The timing for payments to sub-tiers is set forth by there contracts.

Construction payment is highly regulated all over the United States. Legislatures in all states have passed rules and regulations related to payment timing, what percentage of payment may be withheld, how lien rights or other security instruments play into the payment scheme, and more. But that’s not all, since all of these rules must be balanced with the ability of construction participants to draft their contracts how they want.

In Arkansas, parties are generally allowed to contract as they see fit with respect to private construction projects, but there are more rules and regulations that apply to public works projects.

Generally, construction pariticipants throughout the payment chain, from property developers and owners to sub-subcontractors and suppliers are allowed to draft and enter into construction contracts that control payment terms with very little oversight or limiting regulation from statute. Arkansas allows parties to control payment timing, retainage and even the risk of nonpayment (via pay if paid provisions) through contract. And, Arkansas even allows parties to prospectively give up certain rights to secure or recover payment that is due through “no lien” clauses or advance lien waivers.

All of this means that construction participants on private projects in Arkansas should be very careful and thorough in reviewing their contracts. Especially since pay if paid provisions are included in “standard” construction contracts, like AIA documents.

Additionally, lien waivers are generally unregulated in Arkansas, and not only may parties may use any form with any wording they want, Arkansas allows lien rights to be waived in contract prior to furnishing work. This means that a contract with a “no lien” clause can create a prohibition on using the mechanics lien remedy to secure payment is payment is slow or otherwise appears to not be forthcoming.

There are some key laws that regulate the construction payment process in Arkansas, which include:

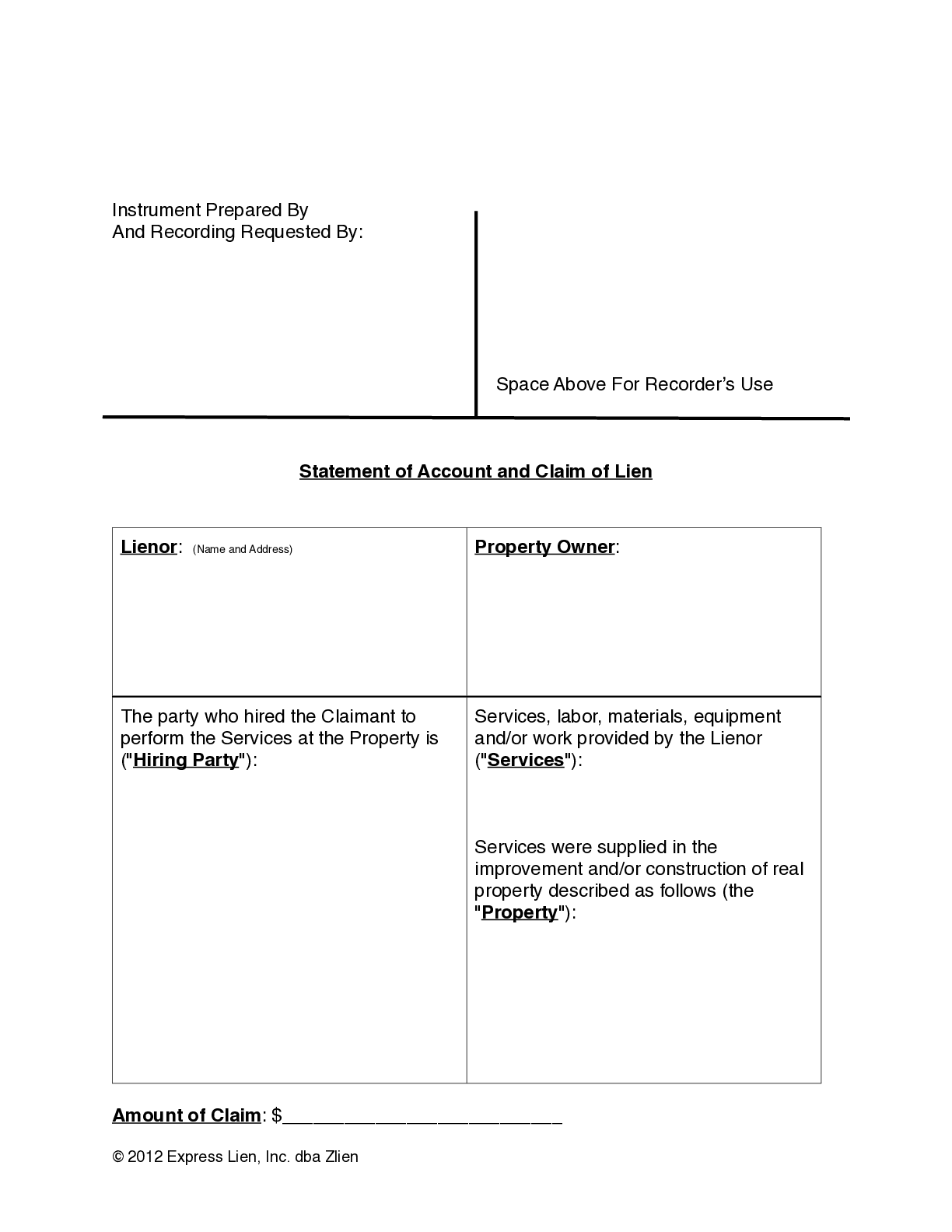

- Lien Rights Laws

- Preliminary Notices

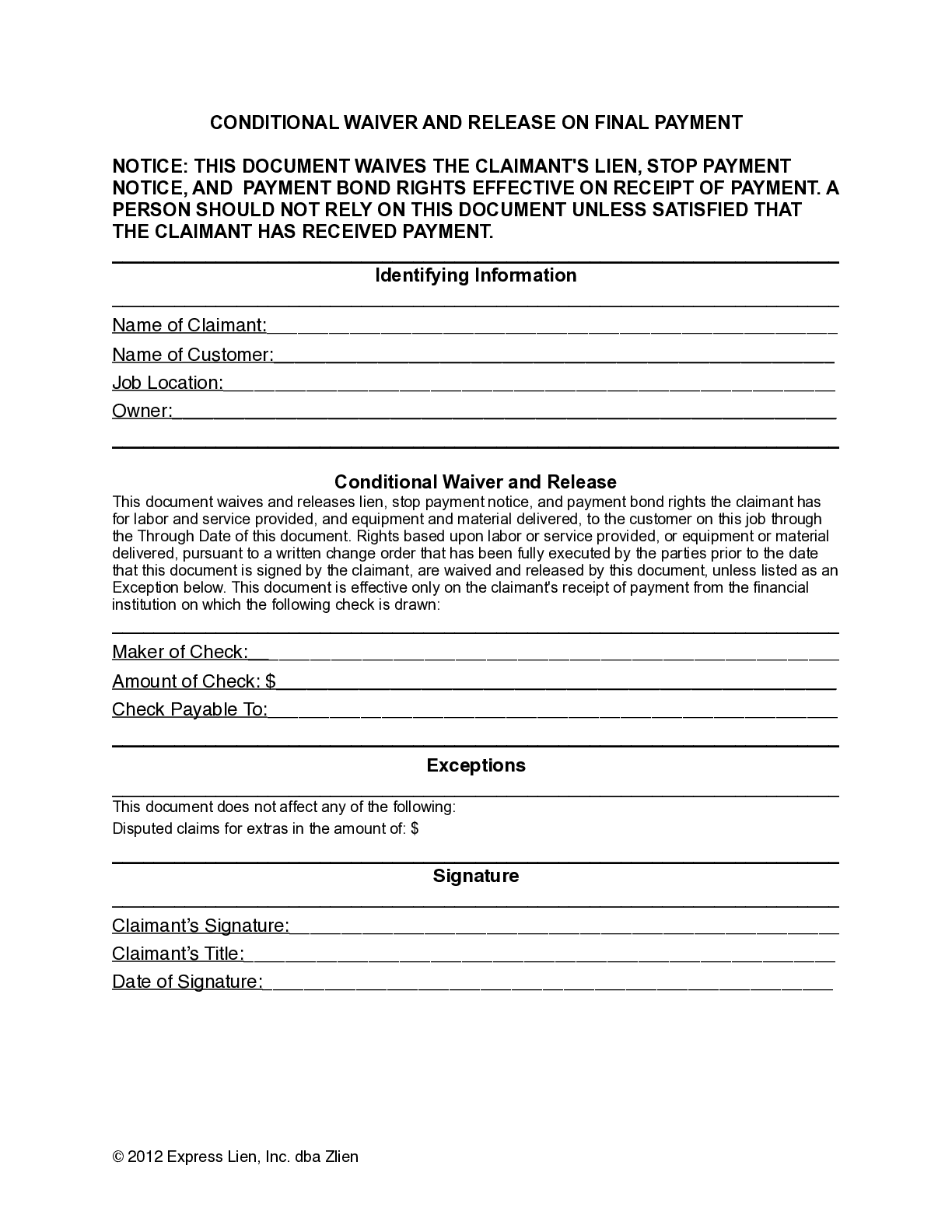

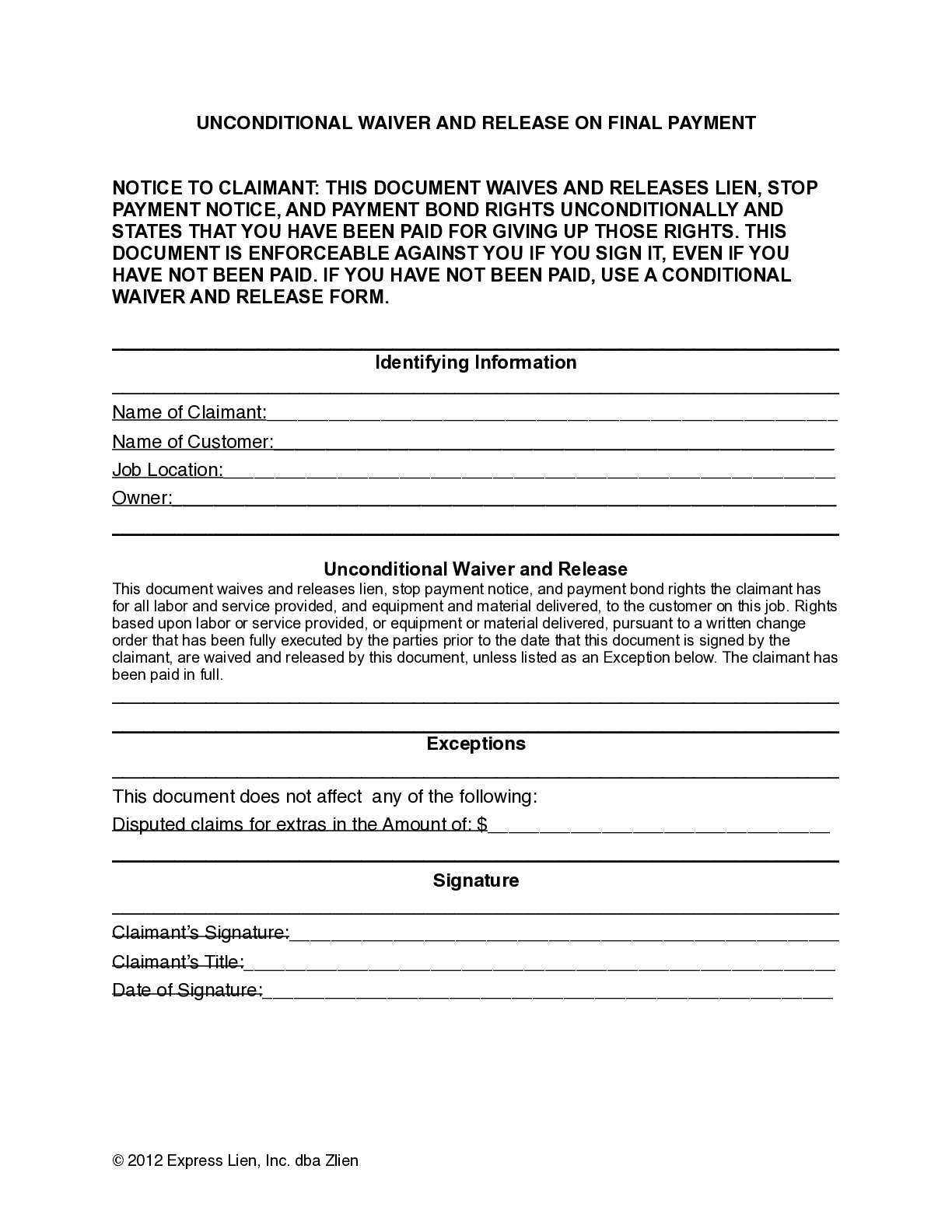

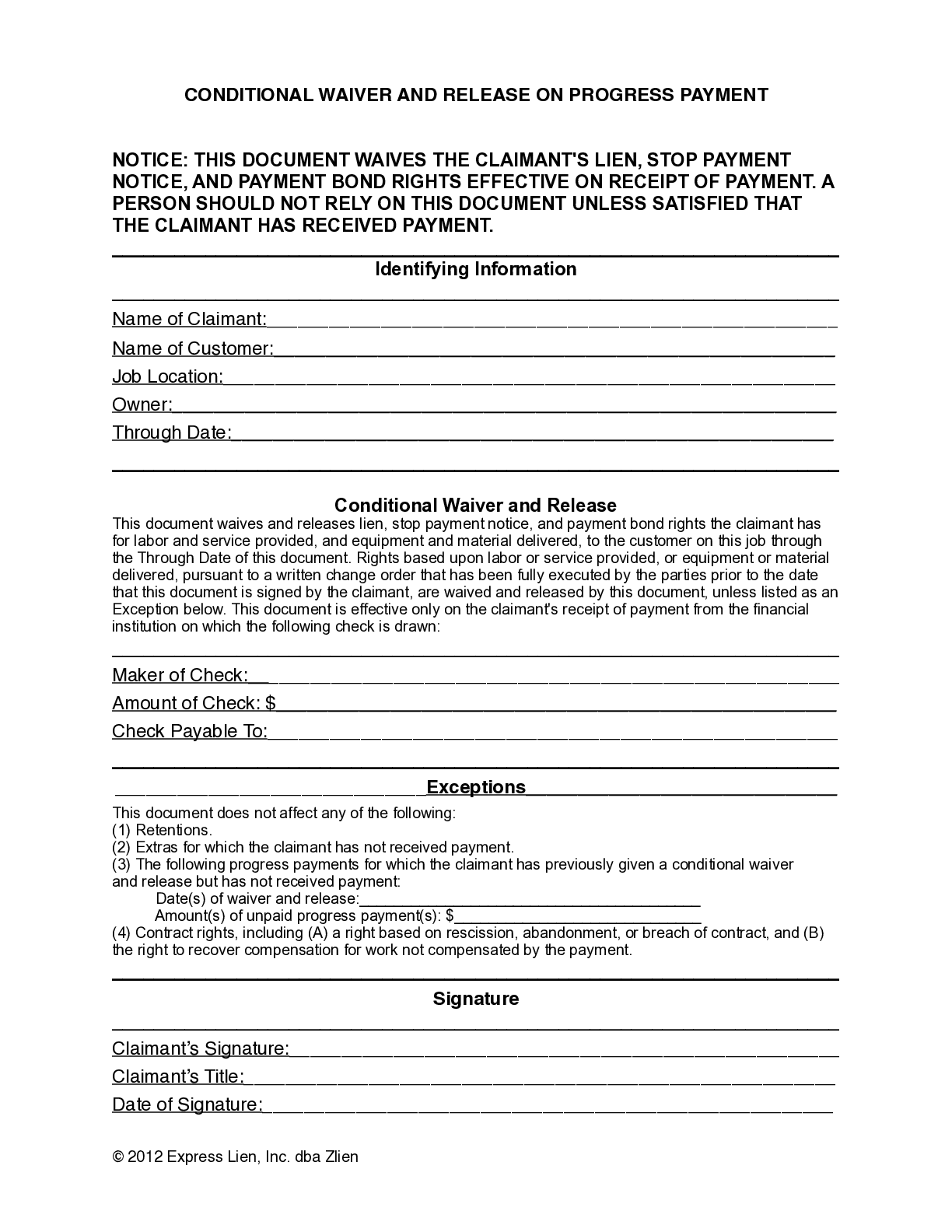

- Lien Waivers

- Mechanic Liens

- Bond Claims

- Retainage Laws

- Prompt Payment Laws

Public projects in Arkansas have a bit more statutory regulation governing the payment terms, but there are still many payment terms that can be controlled by contract. Retainage is limited in amount and limited in the time for which it can be held. And, there are prompt payment requirements with respect to payments made by public entities. Arkansas is rare, however, in that the prompt payment requirements apply only to payments to be made to GCs, while the timing of payments to sub-tier participants are controlled by contract.

It’s important for everyone on a construction project to treat one another fairly. But, when it comes to signing construction contracts in Arkansas, exchanging payment applications, deadline with payment paperwork, and eventually, making or receiving payment . . . it’s important to know the rules of the game. This page provides a resource to you to really understand those rules.