Lien waivers are a necessity on any given construction project. The reason they are so important is that they affect just about every participant on a construction project:

- Project lenders frequently require lien waivers to approve loan disbursements.

- Developers or homeowners require lien waivers to limit the possibility that they pay for the same work twice.

- General contractors must collect lien waivers on behalf of the owners and lenders, and also protect themselves.

- Subcontractors and suppliers must send out lien waivers to get their payments processed.

If you’re reading this, you’re likely in charge of getting lien waivers right, on a Texas construction project. Exchanging lien waivers is an indispensable step in the construction payment process. Close attention should be paid to lien waivers, as one mistake could invalidate the entire waiver and potentially delay payments.

Texas lien waiver overview

Each state handles lien waivers in their own way. However, at their most basic level, lien waivers function in the same way across the country. Lien waivers are documents, signed by potential lien claimants, that waive certain lien rights in exchange for payment of work performed. Getting lien waivers right often involves a little more work than one would imagine. In addition to this guide, you can find downloadable forms, Texas statutes, and frequently asked questions about Texas lien waivers here: Texas Lien Waivers FAQs

Texas doesn’t allow contract terms that waive lien rights

Texas, like most other states, explicitly prohibit the waiver of lien rights by contract. We here at Levelset call these “no lien clauses.” In §53.286 the statute states that “any contract, agreement, or understanding purporting to waive the right to file or enforce any lien or claim under this chapter is void.” For more information on “no-lien clauses” click here.

Lien waiver requirements do not apply to all projects

First, the waiver requirements are not enforced on any public (city, state, or federal) projects. In the private construction realm, there is another exception concerning residential projects. Texas Property Code §53.282(a)(3) provides another exception for lien waivers.

The exception is a statement in a written, original contract for construction, remodel or repair of a single-family house, townhouse or duplex agreed upon before labor or materials are furnished to the project. This is a strange exception, leaving contractors unsure of which laws apply to the residential project.

How to determine the right Texas lien waiver form

Texas is a lien waiver regulated state, meaning it is just one of 12 states that provide statutory lien waiver forms. In the other “non-regulated” states, there is often plenty of disputes over the language and additional rights that may be waived. Texas solves this problem by providing four specific statutory forms. Deciding which to use depends on what type of payment is being received and whether the payment has been transferred.

1. Is it a progress payment, or a final payment?

A progress payment, otherwise known as partial payment, is just one installment of an otherwise larger contract price. If the claimant is expecting future payments, then it is a progress payment. On the other hand, if this is the last payment on a project, and no future payments are expected to be forthcoming, then it will be considered a final payment.

2. Has the payment been actually made yet?

The other determining factor is whether the claimant has actually received payment. A check in hand, a credit card charge, or an ACH transfer might not suffice. These payments are always subject to bouncing, charge disputes, or transfer reversals. If the payment has been cashed or deposited into the claimant’s account, then an unconditional waiver should be used. In any other circumstance, always use conditional waivers.

| Final Or Partial Payment? | Payment Made Already or Not? | Lien Waiver Form Download |

| Final | Payment Already Made | Unconditional Final Lien Waiver |

| Final | Payment Not Made | Conditional Final Lien Waiver |

| Progress | Payment Already Made | Unconditional Progress Lien Waiver |

| Progress | Payment Not Made | Conditional Progress Lien Waiver |

Notably, the Texas Property Code actually prohibits requesting an unconditional lien waiver before payment has been made. More on that below…

Frequently Asked Questions About Texas Lien Waivers

This should give you a basic understanding of how lien waivers work in Texas. But, as with most things regulated by the state, there are minor issues and details that need to be complied with to ensure the enforceability of a Texas lien waiver.

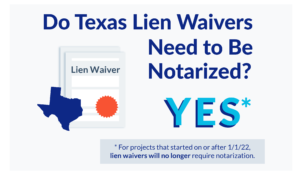

1. Does a Texas lien waiver need to be notarized?*

Yes, Texas lien waivers are required to be notarized. Only three states in the US require notarization of lien waivers; Texas, Mississippi, and Wyoming. Under §53.281(2)(b), a waiver is effective only if it is signed by the claimant or the claimant’s authorized agent and notarized. Failure to notarize a lien waiver in the state of Texas will result in the waiver being unenforceable. Do not forget to notarize Texas lien waivers!

* Note: For projects started on or after 1/1/22, Texas lien waivers will no longer require notarization.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

2. Do you need to exchange conditional AND unconditional waiver forms?

No, this would be an unnecessary step. Conditional lien waivers are conditioned on the transfer of payment. Once payment is transmitted, the lien waiver becomes valid and enforceable. A conditional waiver is all you need, and the Texas lien law is explicit about this.

According to §53.281 in the case of a conditional lien waiver and release, it is effective only if there exists evidence of payment to the claimant. Therefore, all you need is a conditional release and some sort of evidence of payment, to be effective.

3. Can unconditional waivers be exchanged before payment?

This question was recently addressed on the Levelset Expert Center: Question About an Unconditional Waiver. As stated there, the answer is no.

According to Tex. Prop. Code §53.281(b)(3) conditional waivers and releases are effective only if evidence of payment exists.

At § 53.283, the statute later states that a person may not require claimants to execute an unconditional waiver and release for the progress of final payment unless the claimant received payment for that amount. Reading these two provisions lead to the conclusion that one cannot waive their rights in advance.

4. How strict are the Texas lien waiver rules?

The Texas lien waiver rules are pretty strict, and one should assume that they will be strictly enforced. In fact, Tex. Prop. Code §53.281 et seq. provides that “any waiver or release of a lien or payment bond claim under this chapter is unenforceable unless the waiver or release is executed and delivered in accordance with this subchapter.” Many states provide some leeway for parties to determine how to waive lien rights. This is not the case in Texas. The rules are specific, lengthy, and must be strictly followed.

Need a Lien Waiver?

Create lien waivers in minutes for free. Send a signed waiver to your customer, or request a signature from vendors.

Your Free Lien WaiverFor a deep dive on lien waivers in general: