Do lien waivers need to be notarized, or should they be notarized? In nearly every case, the answer is no. But, if you’re someone in charge of payments getting in and out of the door at a construction company, you likely encounter lien waiver documents that “require” notarization every day. Why is that?

Surprisingly, this is a pretty spicy topic in the world of construction payment. This blog article will explain what a notarized lien waiver is, why the controversy exists, and – despite the notary boondoggle – how you can make the exchange process faster and easier for your company.

What is a Notarized Lien Waiver?

Let’s start with the basics: What exactly is a notarized lien waiver (also sometimes called a lien release)? And, what’s so different between a notarized waiver document and one not notarized?

Any document in the world can be notarized. You can take a child’s drawing, sign it, and get the document “notarized.” That’s because notarization is simply the verification of a signature. Getting a document notarized doesn’t make it any more true, false, clear, or effective. It simply makes it easier to later prove the document was actually signed by the person who signed it.

In the world of construction payment disputes, this particular type of dispute is rarely encountered.

The difference between a notarized lien waiver and one that is not notarized, therefore, is very, very minimal.

Want to learn more about when you should notarize construction documents? Download our one-page guide about Notarizing Construction Documents.

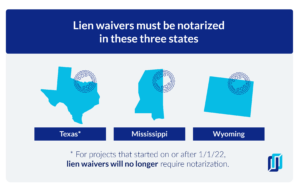

Only Three States Require Notarization

There are just 3 states where lien waivers must be notarized: Texas, Wyoming, and Mississippi.

And of these three states, only Texas’ law is explicitly clear on the matter.

The Texas lien waivers rule is explicit that lien waivers must be notarized to effectively release the owner from filed lien claims. This is all part of 2013 Texas legislation introducing strict waiver requirements and statutory forms. We write about the Texas notarization requirement more fully in Do Texas Lien Waivers Need to Be Notarized?.

- Note: Texas lien waivers will no longer require notarization for projects started on or after January 1, 2022.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

The notarization requirement in Mississippi and Wyoming is a bit vaguer.

Neither of the two statutes mentions notarization at all, but they do provide lien waiver forms, and those forms have a place for notarization. Like Texas, the Mississippi rules are also fairly new, as we explored in the 2014 article “Mississippi Lien Waivers – A New Approach.”

If a construction project is in one of these three states, the notarization may actually be required, and it’s certainly a best practice in these areas. Elsewhere, however, it’s a practice that gets in the way at best, and could be damaging at worst.

Notarization may Damage or Invalidate Lien Waivers in Some States

Interestingly, getting a lien waiver document notarized when notarization is not contemplated by the state’s statute could — in some cases — actually damage or invalidate the entire lien waiver.

While lien waiver forms are unregulated in most states, 12 states provide that the parties exchange a certain lien waiver form. These laws exist for public policy reasons. This means they are there to protect weaker parties against stronger parties. In some cases, the laws are very specific and strict on what can and cannot be on the form itself.

Georgia’s rule, for example, provides that a lien waiver is “not effective or enforceable unless…[i]t is pursuant to a waiver and release form” provided by the statute, and the Georgia form does not include a notary.

The same is true with the Florida rule, which provides that “A person may not require a lienor to furnish a lien waiver or release of lien that is different from the forms” provided in the statute, and again, the statutory forms do not include notarization. Read about this and other potential pitfalls in Common Florida Lien Waiver Mistakes & How to Avoid Them.

According to a strict reading of these laws, including notarization in the forms could materially change the forms and be requiring someone to furnish a lien waiver that is different than required in the statute, thereby invalidating it entirely.

Requiring a lien waiver to be notarized, in other words, may actually invalidate it!

The Lien Waiver Notarization Controversy

A Florida material supplier recently had an inter-office debate about whether lien waivers need to be notarized. It makes perfect sense that they would be questioning the practice. They likely sign a lot of lien releases, and including notarization on them all is a pain in the neck. They probably looked at their practice and wondered to themselves: why in the heck are we even doing this?

We see this all. the. time.

The Levelset platform processes tens of thousands of lien documents (including waivers) each month, and we work with companies of all shapes and sizes who struggle with the notarization requirement. In fact, even when companies clearly understand that notarization is not a requirement, they still notarize just to avoid the argument with the other party.

What the heck is going on here?

How to Make The Exchange Process Easier for your Company

So, how can you make this easier for your company? And yourself?

If you’re an office manager or accountant already managing a pile of tasks related to payment, one place to start is to eliminate, avoid, or reduce situations where you’re adding unnecessary steps to an already intensive process. It’s crystal clear that notarization is not required or even helpful to lien waivers. Accordingly, if you can avoid it, do.

Simply take the notarization step away from your own process and see if and where there is fallout, and then start to address the fall-out. It’s likely that you’ll experience less push-back than you might anticipate, and if you do experience push back, deal with it on a case-by-case basis.

And if you encounter too much trouble, send them over to this article.

Essential reading about Lien Waivers

Anyone in the construction industry involved with payments needs to read our Ultimate Guide to Lien Waivers article.