Maryland

Preliminary Notice Deadlines

Maryland

Maryland

Maryland

Maryland

Maryland

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (although not required, it's good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from final acceptance of the project.

Maryland

A lawsuit to enforce a bond claim must be initiated no later than one year from final acceptance of the project.

Maryland

Maryland

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (although not required, it's good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year from final acceptance of the project.

Maryland

A lawsuit to enforce a bond claim must be initiated no later than one year from final acceptance of the project.

Maryland’s Little Miller Act applies to all State public works projects valued at $100K or more, and any other projects by a public entity within the state where the contract price is valued at $50K or more.

Bond Claims

In Maryland, all parties supplying labor or materials to the prime contractor, subcontractor, or sub-subcontractor on a public project may bring suit on a payment bond.

Contract Funds on State Jobs

Furthermore, subcontractors who aren’t paid may make a claim against the contract funds on state projects.

Bond Claims

All claimants who didn’t contract directly with the prime contractor must serve written notice within 90 days after the last date the claimant furnished labor and/or materials to the project.

1st-tier subcontractors are not required to serve this notice, and can file a lawsuit directly against the bond. However, it is recommended to send a notice in the same manner as listed above to initiate the process, and potentially avoid the need for a lawsuit.

Contract Funds on State Jobs

A claim must be served at least 10 days after the general contractor has received payment from the state if the claimant remains unpaid at that time,

Bond Claims

Maryland bond claims should contain the following information:

• Claimant’s information;

• Hiring party’s name;

• Project description; &

• Amount claimed.

Contract Funds on State Jobs

A claim against contract funds should contain the following information:

• Claimant’s information;

• General contractor’s name;

• Project description;

• Amount in dispute, with an itemized description; &

• Explanation of the dispute (if known).

Bond Claim

Bond claims are only required to be served on the general contractor, however, it may be a good idea to send a copy to the hiring party and the surety as well.

Note that to obtain a copy of the bond, the claimant must send final notice to the Comptroller or other officer in charge of the office in which the bond is required to be filed.

Contract Funds on State Jobs

Claims on contract funds are only required to be served on the state procurement officer who commissioned the project. It may be a good idea to send a copy to the general contractor as well.

Bond Claims

The claim must be sent to the general contractor by certified mail to the contractor’s residence or where the contractor has an office or does business. Verification of receipt is generally good practice, as the consequences of the general’s refusal of the mailing is unclear.

• Note: A recent Maryland District Court did hold that an emailed bond claim was sufficient, however, it’s best practice to strictly comply with the statutory requirements

Contract Funds on State Jobs

There is no specified method of delivery for claims on contract funds, however it is recommended to send certified mail in order to have proof of mailing.

Bond Claims

A lawsuit to enforce a bond claim must be initiated at least 90 days after the last date the claimant provided labor and/or materials to the project, but no later than 1 year after the date of final acceptance of the project.

Contract Funds on State Jobs

There is no specific deadline for a claimant to file a lawsuit to enforce the procurement officer’s decision.

I am being retaliated against by a group of nefarious individuals who place 'unwitting small business owners in a spider's web of unfairly weighted contracts...

Can I file bankruptcy for a mechanics lien?My contractor has put a mechanics lien on my house.

Claim against bondI need to file a Claim against a bond on a School Project in Maryland. I cannot seem to find the Maryland Little Milller Act...

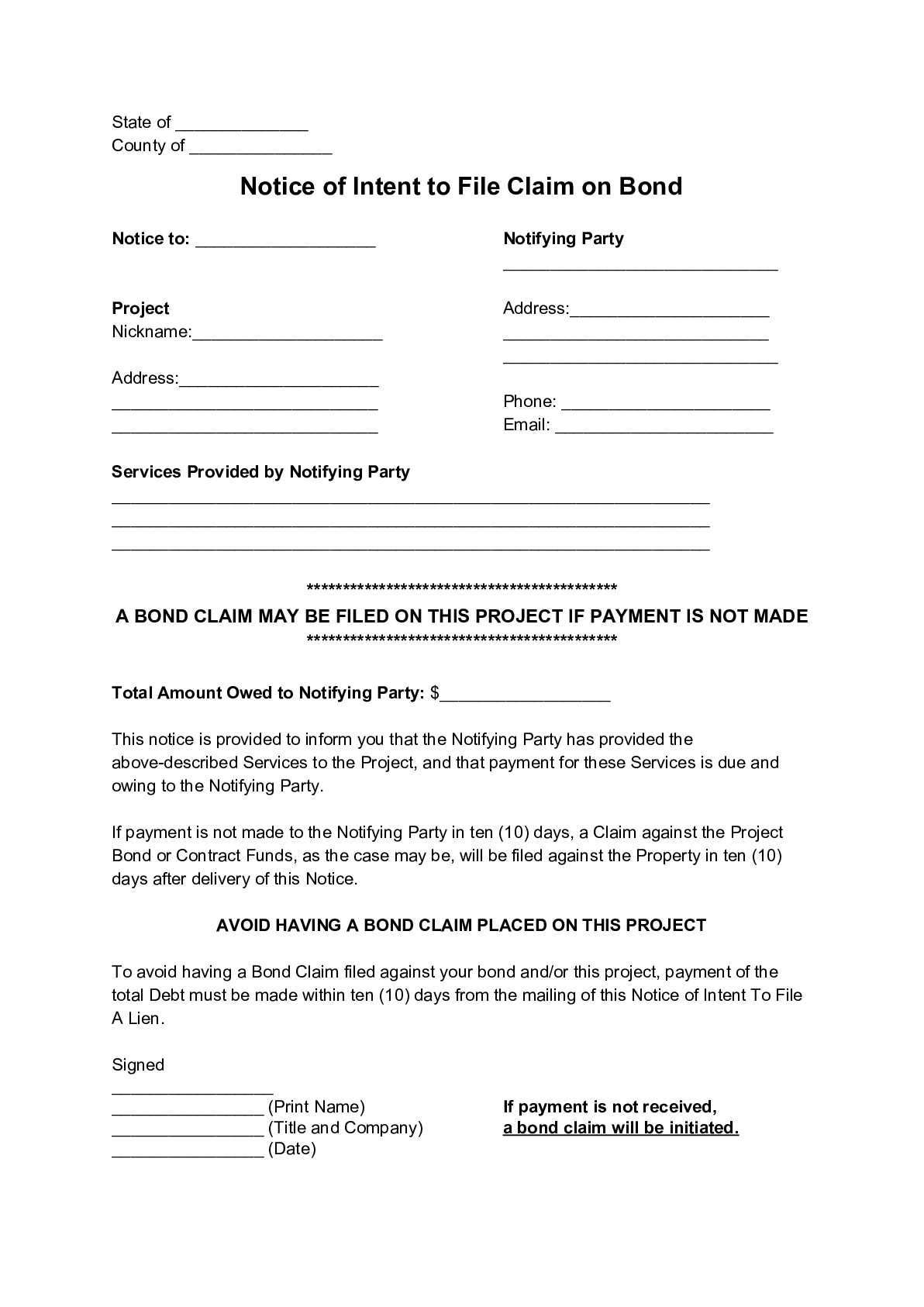

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Maryland, and are not paid, you can file a “lien” against the project pursuant toMaryland ‘s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Maryland’s Little Miller Act is found in the Maryland Code, State Finance and Procurement §§17-101 et. seq., which is reproduced below. Updated as of September 2021.

(a) In this subtitle the following words have the meanings indicated.

(b) “Payment security” means security to guarantee payment for labor and materials, including leased equipment, under a contract for construction.

(c) “Performance security” means security to guarantee the performance of a contract for construction.

(d) “Public body” means:

(1) the State;

(2) a county, municipal corporation, or other political subdivision;

(3) a public instrumentality; or

(4) any governmental unit authorized to award a contract.

(e)

(1) “Supplier” means a person who supplies labor or materials.

(2) “Supplier” includes a lessor of equipment to the extent of the fair rental value of the equipment.

(a) This subtitle does not limit the authority of a public body to require performance security in addition to, or in cases other than, those specified under §§ 17-103, 17-104, 17-106, and 17-107 of this subtitle.

(b) This subtitle applies only to security for a construction contract.

(c)

(1) By ordinance, Baltimore City may provide for a program to satisfy the bonding requirements under §§ 17-103, 17-104, 17-106, and 17-107 of this subtitle with respect to any construction contract:

(i) that does not exceed $200,000; and

(ii) for which State money is not used.

(2) The program shall provide for payment security of at least 50% of the total amount payable under the contract.

(a)

(1) Before a public body awards a construction contract exceeding $100,000, the contractor shall provide payment security and performance security that meet the requirements of § 17-104 of this subtitle.

(2) The security shall be:

(i) for performance security, in an amount that the public body considers adequate for its protection; and

(ii) for payment security, at least 50% of the total amount payable under the contract.

(b) A public body, other than the State or a unit of the State government, may require payment security or performance security for a construction contract if:

(1) the contract exceeds $50,000 but does not exceed $100,000; and

(2) the amount of the security does not exceed 50% of the contract amount.

(a) Payment security or performance security required under this subtitle shall be:

(1) a bond executed by a surety company authorized to do business in the State;

(2) cash in an amount equivalent to a bond; or

(3) other security that is satisfactory to the public body awarding the contract.

(b)

(1) Subject to paragraphs (2) and (3) of this subsection, performance security may include the granting of a mortgage or deed of trust on real property located within the State if such security is satisfactory to the public body awarding the contract.

(2) The face amount of a mortgage or deed of trust on real property granted as security under this subsection may not exceed 75% of the contractor’s equity interest in the property.

(3) A mortgage or deed of trust accepted under this subsection shall be recorded by an official designated by the public body accepting the mortgage or deed of trust in the land records of the county where the real property is situated in accordance with § 3-103 of the Real Property Article.

(a) Security under this subtitle:

(1) if required by the State or a unit of the State government, shall be payable to “the State of Maryland”; or

(2) if required by any other public body, shall be payable to that public body.

(b) The form of payment security or performance security shall be approved:

(1) for the State or a unit of the State government, by the Attorney General; and

(2) for any other public body, by its attorney.

(c) The contractor shall file the security or evidence of a trust account established as security:

(1) if payable to the State under this section, in the Office of the Comptroller; or

(2) if payable to any other public body, in the appropriate office of that public body.

Before a contractor receives a progress or final payment under a contract covered by payment security, the contractor shall certify in writing that, in accordance with contractual arrangements, suppliers:

(1) have been paid from the proceeds of previous progress payments; and

(2) will be paid in a timely manner from the proceeds of the progress or final payment currently due.

A contractor who provides payment security under this subtitle in connection with a construction contract awarded by a public body need not execute a waiver of a mechanics’ lien to the public body.

(a) Subject to subsection (b) of this section, a supplier may sue on payment security if the supplier:

(1) supplied labor or materials in the prosecution of work provided for in a contract subject to this subtitle; and

(2) has not been paid in full for the labor or materials within 90 days after the day that the person last supplied labor or materials for which the claim is made.

(b)

(1) A supplier who has a direct contractual relationship with a subcontractor or sub-subcontractor of a contractor who has provided payment security but no contractual relationship with the contractor may sue on the security if the supplier gives written notice to the contractor within 90 days after the labor or materials for which the claim is made were last supplied in prosecution of work covered by the security.

(2) A notice under this subsection:

(i) shall state with substantial accuracy the amount claimed and the person to whom the labor or material was supplied; and

(ii) shall be sent by certified mail to the contractor at the contractor’s residence or a place where the contractor has an office or does business.

(c)

(1) On request by a person who submits an affidavit verifying that the person has supplied labor or materials but has not been paid or is being sued under this section, the Comptroller or the officer in charge of the office where the payment security or evidence of security is required to be filed shall issue:

(i) a certified copy of the payment bond; or

(ii) for other security, a certified statement of the security.

(2) The person requesting certification shall pay a reasonable fee, set by the Comptroller or other officer required to issue the certification, to cover the costs of preparation.

(3) A certification under this section is prima facie evidence of the contents, execution, and delivery of payment security.

(d)

(1) An executory contract between a supplier and a contractor or subcontractor that is related to a construction contract may not waive or require the supplier to waive the right to sue on payment security under this section.

(2) A provision in an executory contract between a supplier and a contractor or subcontractor that is related to a construction contract and that conditions payment to the supplier on receipt of payment by the person from a public body or other third party, may not abrogate or waive the right of the supplier to sue on payment security under this subtitle.

(3) A provision of a contract made in violation of this subsection is void as against the public policy of the State.

(a) An action on a payment bond required by this subtitle shall be filed in the appropriate court of the county where:

(1) the contract was executed and performed; or

(2) the contractor has its principal place of business.

(b) An action on a payment bond required by this subtitle shall be filed within 1 year after the public body finally accepts the work performed under the contract.

(c) An obligee named in a bond or a trustee for any other security is not liable for any costs in connection with an action on a payment bond required by this subtitle.

(a) Subsections (b)(1) and (2), (c), and (d) of this section do not apply to an entity that is required to comply with the provisions of § 13-225 of this article.

(b)

(1) If a contractor has furnished 100% payment security and 100% performance security in accordance with this subtitle under a contract for construction awarded by a public body, the percentage specified in the contract for retainage may not exceed 5% of the total amount of the contract.

(2) In addition to retainage, a public body may withhold from payments otherwise due a contractor any amount that the public body reasonably believes necessary to protect the public body’s interest.

(3) Except as provided in paragraph (4) of this subsection, within 120 days after satisfactory completion of a contract for construction, a public body shall release any retainage due to the contractor.

(4) If there is a dispute or contract claim between the contractor and the public body concerning the satisfactory completion of a contract for construction, the public body shall release the retainage to the contractor within 120 days after the resolution of the dispute or contract claim.

(c)

(1) A contractor may not retain a percentage of payments due a subcontractor that exceeds the percentage of payments retained by the public body.

(2) Paragraph (1) of this subsection may not be construed to prohibit a contractor from withholding any amount in addition to retainage if the contractor determines that a subcontractor’s performance under the subcontract provides reasonable grounds for withholding the additional amount.

(d)

(1) A subcontractor may not retain a percentage of payments due a lower tier subcontractor that exceeds the percentage of payments retained from the subcontractor.

(2) Paragraph (1) of this subsection may not be construed to prohibit a subcontractor from withholding any amount in addition to retainage if the subcontractor determines that a lower tier subcontractor’s performance under the subcontract provides reasonable grounds for withholding the additional amount.

(e) This section may not be construed to limit the application of the remaining provisions of this subtitle.

This subtitle may be cited as the “Maryland Little Miller Act”.

(a) In this section, “undisputed amount” means an amount owed by a contractor to a subcontractor for which there is no good faith dispute, including any retainage withheld.

(b) It is the policy of the State that, for work under a State procurement contract for construction:

(1) a contractor shall promptly pay to a subcontractor any undisputed amount to which the subcontractor is entitled; and

(2) a subcontractor shall promptly pay to a lower tier subcontractor any undisputed amount to which the lower tier subcontractor is entitled.

(c)

(1) A contractor shall pay a subcontractor an undisputed amount to which the subcontractor is entitled within 10 days of receiving a progress or final payment from the State.

(2) If a contractor withholds payment from a subcontractor, within the time period in which payment normally would be made, the contractor shall:

(i) notify the subcontractor in writing and state the reason why payment is being withheld; and

(ii) provide a copy of the notice to the procurement officer.

(d)

(1) If a subcontractor does not receive a payment within the required time period, the subcontractor may give written notice of the nonpayment to the procurement officer.

(2) The notice shall:

(i) indicate the name of the contractor, the project under which the dispute exists, and the amount in dispute;

(ii) provide an itemized description on which the amount is based; and

(iii) if known, provide an explanation for any dispute concerning payment by the contractor.

(e)

(1) Within 2 business days of receipt of written notice from a subcontractor, a representative of the unit designated by the procurement officer shall verbally contact the contractor to ascertain whether the amount withheld is an undisputed amount.

(2) If the representative of the unit decides that a part or all of the amount withheld is an undisputed amount, the representative of the unit shall instruct the contractor to pay the subcontractor the undisputed amount within 3 business days.

(3) The representative of the unit shall verbally communicate to the subcontractor the results of discussions with the contractor.

(4) If the contractor is instructed to pay the subcontractor and the subcontractor is not paid within the time instructed under paragraph (2) of this subsection, the subcontractor may report the nonpayment in writing to the procurement officer.

(f)

(1) If the subcontractor notifies the procurement officer under subsection (e)(4) of this section that payment has not been made, the representative of the unit shall schedule a meeting to discuss the dispute with the unit’s project manager, the contractor, and the subcontractor:

(i) at a time and location designated by the representative of the unit; but

(ii) not later than 10 days after receiving notice from the subcontractor under subsection (e)(4) of this section.

(2) The purpose of the meeting is to establish why the contractor has not paid the subcontractor in the required time period.

(3) The representative of the unit shall require the parties to provide at the meeting any information that the representative believes necessary to evaluate the dispute.

(4) If the representative of the unit determines that the contractor is delinquent in payment of an undisputed amount to the subcontractor, further progress payments to the contractor may be withheld until the subcontractor is paid.

(5) If payment is not paid to the subcontractor within 7 days after the representative of the unit determines that the contractor is delinquent in paying the subcontractor under this subsection, the representative shall schedule a second meeting to address the dispute:

(i) at a time and location designated by the representative of the unit; but

(ii) not later than 5 days after the close of the 7-day period.

(6) If, at the completion of the second meeting, the representative of the unit determines that the contractor continues to be delinquent in payments owed to the subcontractor, the representative:

(i) shall order that further payments to the contractor not be processed until payment to the subcontractor is verified;

(ii) may order that work under the contract be suspended based on the failure of the contractor to meet obligations under the contract; and

(iii) subject to paragraph (7) of this subsection, may require that the contractor pay a penalty to the subcontractor, in an amount not exceeding $100 per day, from the date that payment was required under subsection (e)(2) of this section.

(7) A penalty may not be imposed under paragraph (6)(iii) of this subsection for any period that the representative of the unit determines the subcontractor was not diligent in reporting nonpayment to the procurement officer.

(g)

(1) A contractor or a subcontractor may appeal a decision under subsection (f)(6) of this section to the procurement officer.

(2) The contractor shall comply with the procurement officer’s decision.

(h) An act, failure to act, or decision of a procurement officer or a representative of a unit concerning a payment dispute between a contractor and subcontractor or between subcontractors under this section may not:

(1) affect the rights of the contracting parties under any other provision of law;

(2) be used as evidence on the merits of a dispute between the unit and the contractor or the contractor and subcontractor in any other proceeding; or

(3) result in liability against or prejudice the rights of the unit.

(i) A decision of a procurement officer or a representative of the unit designated by the procurement officer under this section is not subject to judicial review or the provisions of Part III of this subtitle.

(j)

(1) A unit shall include in each State procurement contract for construction a provision:

(i) governing prompt payment to subcontractors; and

(ii) requiring inclusion of a similar provision in each subcontract at any tier.

(2) The contract provision shall establish procedures and remedies for the resolution of payment disputes similar to the process and remedies prescribed in subsections (c) through (g) of this section.