California

Preliminary Notice Deadlines

California

California

California

California

Must deliver a 20-day preliminary notice to the public entity commissioning work, the prime contractor and the surety (if known). This must be delivered within 20 days of first furnishing labor and/or materials to the project.

California

Must file a Stop Notice within the earlier of: (a) 30 days from the recording of a "Notice of Completion" for the project; or (b) If this notice is not recorded, within 90 days from the actual completion. Must file suit against the surety if claim remains unpaid, and suit must be brought no later than 6 months from the expiration of the Stop Notice period.

California

Must deliver a 20-day preliminary notice to the public entity commissioning work, the prime contractor and the surety (if known). This must be delivered within 20 days of first furnishing labor and/or materials to the project.

California

Must file a Stop Notice within the earlier of: (a) 30 days from the recording of a "Notice of Completion" for the project; or (b) If this notice is not recorded, within 90 days from the actual completion. Must file suit against the surety if claim remains unpaid, and suit must be brought no later than 6 months from the expiration of the Stop Notice period.

On public projects in California, there are two potential types of protection: a bond claim against a contractor’s bond, and a stop notice claim against the contract funds.

California law makes no distinction between the parties who are allowed to file a bond claim or stop notice, and the claims may potentially be asserted in the same document. The parties entitled to protection are licensed subcontractors (any project tier), material suppliers, contractors performing site improvement work, and fringe benefit trust funds.

Parties not provided protection are general contractors, and suppliers to suppliers.

The time in which claim against the payment bond must be received is dependent on multiple factors. If the claimant did not directly contract with the general contractor, and did not give the 20-day preliminary notice, the bond claim must be given within 15 days after the recordation of the notice of completion. If no notice of completion was filed, the time period is extended to 75 days after the completion of the entire project.

A stop notice must be received within 30 days from the date of the filing of a notice of completion or cessation. If no such notice was filed, the stop notice must be received within 90 days after the completion or cessation of the project.

A claim against the payment bond must be provided to the surety and to the general contractor. The claim must be provided by certified or registered mail, (or by personal service). The statute is unclear as to the result if the mail is refused – best practice would likely be to have the claim served by personal service if the service by mail is refused by the general contractor (or the surety).

A stop notice against the contract funds must be filed with the director of the department that entered into the contract (if the project was a state project), or filed with the controller, auditor, or other disbursing officer, (or with the commissioners or managers) of the managing body that awarded the contract (for any non-state public project). It is also best practice to give notice to the general contractor, as well.

An action to enforce a claim on the contractor’s bond must be initiated after all material and/or labor is furnished by the claimant, but within 6 months after the time in which a stop notice may be given.

An action to enforce a stop notice must be initiated more than 10 days after the stop notice is served, but within 90 days after the time in which a stop notice may be filed (120 days after the notice of completion is filed, or 180 days after the completion of the work if notice of completion is not filed.).

A claim against the payment bond must include: 1) the value of labor and/or materials furnished or to be furnished to the project; 2) the name of the party who hired the claimant to furnish the labor and/or materials; 3) a description of the labor and/or materials furnished; 4) name of the claimant.

A stop notice must include: 1) the claimant’s name and address; 2) a general description of the work to be provided; 3) value of the labor and/or materials already furnished and the value of the total labor and/or materials agreed to be furnished; 4) the name of the party who hired the claimant to provide labor and/or materials; 5) verification by claimant or claimant’s agent.

California statutorily mandates that all parties on a construction project use certain legislatively designed construction lien waiver forms. This state is one of only 11 states that requires this. If a contractor or owner asks you to use a lien waiver form that does not conform to the statutory form, the waiver will be invalid, and the contractor could get in legal trouble. See this article: The 11 States with Statutory Lien Waiver Forms. Also, California state law prohibits contractors and suppliers from waiving their right to file a mechanics lien in contract. You can learn more about the prohibition of such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

No, suppliers to suppliers likely cannot file a bond claim in California.

Stop Notice: The stop notice must filed with the public entity who let the contract. It may be advisable to serve the stop notice on the disbursing officer of the public entity (for a non-state public project), or the director of the department (on a state project). California makes no specific requirement as to how the stop notice must be provided to the public entity for filing.

Bond Claim: A California bond claim must be served via registered or certified mail, or personal service.

Bay Area GC kicked off public works job and needs to get paid (retention, unpaid scope work completed, and change orders). Is there an alternative...

Can a bond company just pay someone without giving any notice to the principal?A plantiff (General Contractor), sues another GC (GC 2).. then adds whoever he can find that can be associated with that person including every bond...

What court should I file my lawsuitI filed a complaint with the CSLB. The CSLB issued an order of correction to my former contractor totaling almost $12,000. The contractor has not...

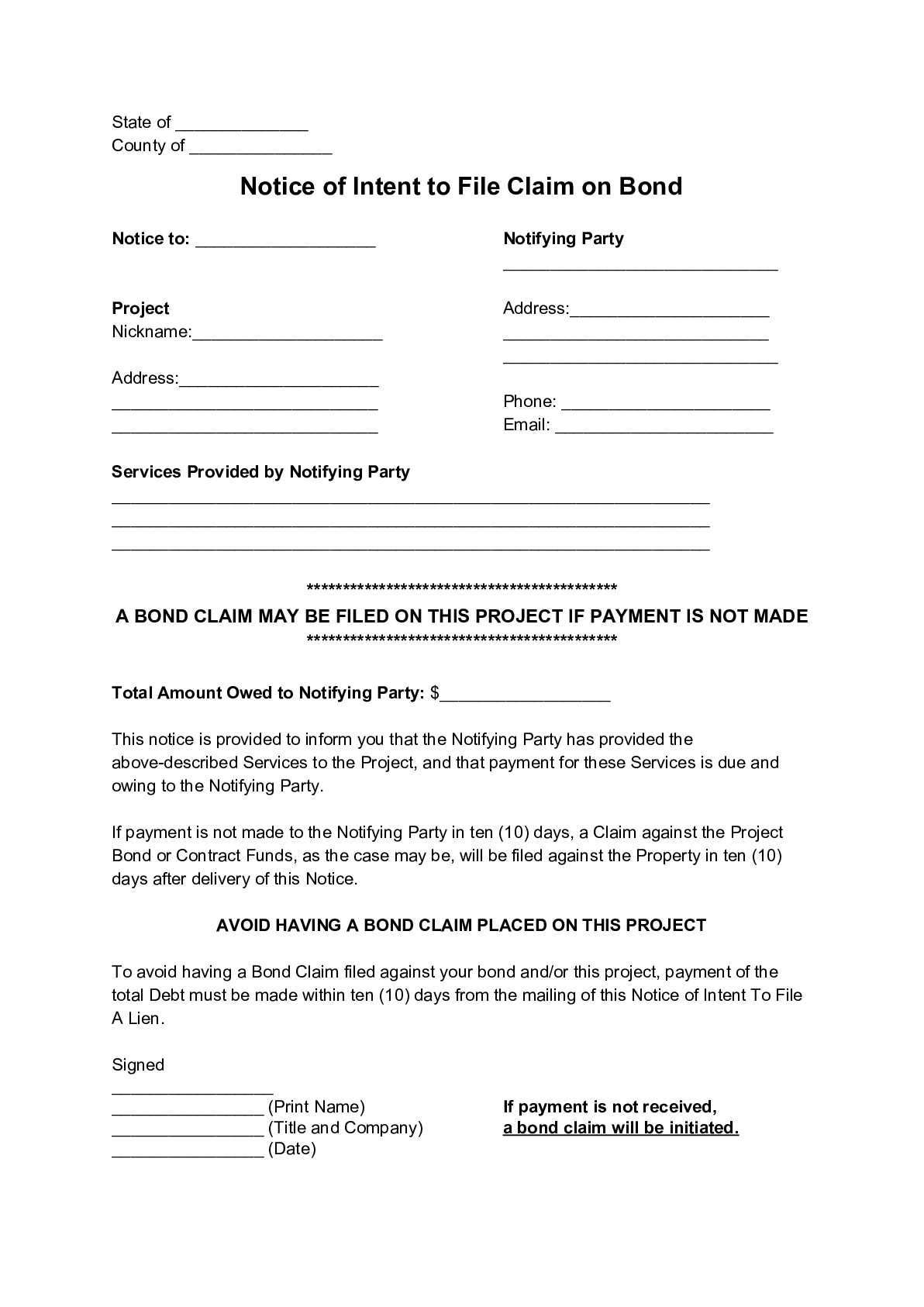

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in California, and are not paid, you can file a “lien” against the project pursuant to California’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

The provisions of the California statutes that permit the filing of stop payment notice and /or bond claim against a state, county, municipal or other public work can be found at California Civil Code 8000 through 9566 et. seq. Relevant sections of the California Mechanics Lien Law is provided below, and has been updated as of July 2023.

§ 8000. Generally

Unless the provision or context otherwise requires, the definitions in this article govern the construction of this part.

§ 8002. Admitted surety insurer

“Admitted surety insurer” has the meaning provided in Section 995.120 of the Code of Civil Procedure.

§ 8004. Claimant

“Claimant” means a person that has a right under this part to record a claim of lien, give a stop payment notice, or assert a claim against a payment bond, or do any combination of the foregoing.

§ 8006. Construction lender

“Construction lender” means either of the following:

(a) A mortgagee or beneficiary under a deed of trust lending funds with which the cost of all or part of a work of improvement is to be paid, or the assignee or successor in interest of the mortgagee or beneficiary.

(b) An escrow holder or other person holding funds provided by an owner, lender, or another person as a fund for with which the cost of all or part of a work of improvement is to be paid.

§ 8008. Contract

“Contract” means an agreement that provides for all or part of a work of improvement.

§ 8010. Contract price

“Contract price” means the price agreed to in a direct contract for a work of improvement.

§ 8012. Contractor

“Contractor” includes a direct contractor, subcontractor, or both. This section does not apply to Sections 8018 and 8046.

§ 8014. Design professional

“Design professional” means a person licensed as an architect pursuant to Chapter 3 (commencing with Section 5500) of Division 3 of the Business and Professions Code, licensed as a landscape architect pursuant to Chapter 3.5 (commencing with Section 5615) of Division 3 of the Business and Professions Code, registered as a professional engineer pursuant to Chapter 7 (commencing with Section 6700) of Division 3 of the Business and Professions Code, or licensed as a land surveyor pursuant to Chapter 15 (commencing with Section 8700) of Division 3 of the Business and Professions Code.

§ 8016. Direct contract

“Direct contract” means a contract between an owner and a direct contractor that provides for all or part of a work of improvement.

§ 8018. Direct contractor

“Direct contractor” means a contractor that has a direct contractual relationship with an owner. A reference in another statute to a “prime contractor” in connection with the provisions in this part means a “direct contractor.”

§ 8020. Funds

For the purposes of Title 3 (commencing with Section 9000), “funds” means warrant, check, money, or bonds (if bonds are to be issued in payment of the public works contract).

§ 8022. Labor, service, equipment or material

“Labor, service, equipment, or material” includes, but is not limited to, labor, skills, services, material, supplies, equipment, appliances, power, and surveying, provided for a work of improvement.

§ 8024. Laborer

(a) “Laborer” means a person who, acting as an employee, performs labor upon, or bestows skill or other necessary services on, a work of improvement.

(b) “Laborer” includes a person or entity to which a portion of a laborer’s compensation for a work of improvement, including, but not limited to, employer payments described in Section 1773.1 of the Labor Code and implementing regulations, is paid by agreement with that laborer or the collective bargaining agent of that laborer.

(c) A person or entity described in subdivision (b) that has standing under applicable law to maintain a direct legal action, in its own name or as an assignee, to collect any portion of compensation owed for a laborer for a work of improvement, shall have standing to enforce any rights or claims of the laborer under this part, to the extent of the compensation agreed to be paid to the person or entity for labor on that improvement. This subdivision is intended to give effect to the longstanding public policy of this state to protect the entire compensation of a laborer on a work of improvement, regardless of the form in which that compensation is to be paid.

§ 8026. Lien

“Lien” means a lien under Title 2 (commencing with Section 8160) and includes a lien of a design professional under Section 8302, a lien for a work of improvement under Section 8400, and a lien for a site improvement under Section 8402.

§ 8028. Material supplier

“Material supplier” means a person that provides material or supplies to be used or consumed in a work of improvement.

§ 8030. Payment bond

(a) For the purposes of Title 2 (commencing with Section 8160), “payment bond” means a bond given under Section 8600.

(b) For the purposes of Title 3 (commencing with Section 9000), “payment bond” means a bond required by Section 9550.

§ 8032. Person

“Person” means an individual, corporation, public entity, business trust, estate, trust, partnership, limited liability company, association, or other entity.

§ 8034. Preliminary notice

(a) For the purposes of Title 2 (commencing with Section 8160), “preliminary notice” means the notice provided for in Chapter 2 (commencing with Section 8200) of Title 2.

(b) For the purposes of Title 3 (commencing with Section 9000), “preliminary notice” means the notice provided for in Chapter 3 (commencing with Section 9300) of Title 3.

§ 8036. Public entity

“Public entity” means the state, Regents of the University of California, a county, city, district, public authority, public agency, and any other political subdivision or public corporation in the state.

§ 8038. Public works contract

“Public works contract” has the meaning provided in Section 1101 of the Public Contract Code.

§ 8040. Site

“Site” means the real property on which a work of improvement is situated or planned.

§ 8042. Site improvement

“Site improvement” means any of the following work on real property:

(a) Demolition or removal of improvements, trees, or other vegetation.

(b) Drilling test holes.

(c) Grading, filling, or otherwise improving the real property or a street, highway, or sidewalk in front of or adjoining the real property.

(d) Construction or installation of sewers or other public utilities.

(e) Construction of areas, vaults, cellars, or rooms under sidewalks.

(f) Any other work or improvements in preparation of the site for a work of improvement.

§ 8044. Stop payment notice

(a)

(1) For the purposes of Title 2 (commencing with Section 8160), “stop payment notice” means the notice given by a claimant under Chapter 5 (commencing with Section 8500) of Title 2.

(2) A stop payment notice given under Title 2 (commencing with Section 8160) may be bonded or unbonded. A “bonded stop payment notice” is a notice given with a bond under Section 8532. An “unbonded stop payment notice” is a notice not given with a bond under Section 8532.

(3) Except to the extent Title 2 (commencing with Section 8160) distinguishes between a bonded and an unbonded stop payment notice, a reference in that title to a stop payment notice includes both a bonded and an unbonded notice.

(b) For the purposes of Title 3 (commencing with Section 9000), “stop payment notice” means the notice given by a claimant under Chapter 4 (commencing with Section 9350) of Title 3.

(c) A reference in another statute to a “stop notice” in connection with the remedies provided in this part means a stop payment notice.

§ 8046. Subcontractor

“Subcontractor” means a contractor that does not have a direct contractual relationship with an owner. The term includes a contractor that has a contractual relationship with a direct contractor or with another subcontractor.

§ 8048. Work

“Work” means labor, service, equipment, or material provided to a work of improvement.

§ 8050. Work of improvement

(a) “Work of improvement” includes, but is not limited to:

(1) Construction, alteration, repair, demolition, or removal, in whole or in part, of, or addition to, a building, wharf, bridge, ditch, flume, aqueduct, well, tunnel, fence, machinery, railroad, or road.

(2) Seeding, sodding, or planting of real property for landscaping purposes.

(3) Filling, leveling, or grading of real property.

(b) Except as otherwise provided in this part, “work of improvement” means the entire structure or scheme of improvement as a whole, and includes site improvement.

§ 8052. Effective date of part; effectiveness of notice or action taken prior to effective date; restatement of previous provision

(a) This part is operative on July 1, 2012.

(b) Notwithstanding subdivision (a), the effectiveness of a notice given or other action taken on a work of improvement before July 1, 2012, is governed by the applicable law in effect before July 1, 2012, and not by this part.

(c) A provision of this part, insofar as it is substantially the same as a previously existing provision relating to the same subject matter, shall be construed as a restatement and continuation thereof and not as a new enactment.

§ 8054. Inapplicability of part

(a) This part does not apply to a transaction governed by the Oil and Gas Lien Act (Chapter 2.5 (commencing with Section 1203.50) of Title 4 of Part 3 of the Code of Civil Procedure).

(b) This part does not apply to or change improvement security under the Subdivision Map Act (Division 2 (commencing with Section 66410) of Title 7 of the Government Code).

(c) This part does not apply to a transaction governed by Sections 20457 to 20464, inclusive, of the Public Contract Code.

§ 8056. Rules of practice in proceedings under part

Except as otherwise provided in this part, Part 2 (commencing with Section 307) of the Code of Civil Procedure provides the rules of practice in proceedings under this part.

§ 8058. Day defined

For purposes of this part, “day” means a calendar day.

§ 8060. Filing or recording with county recorder

(a) If this part provides for filing a contract, plan, or other paper with the county recorder, the provision is satisfied by filing the paper in the office of the county recorder of the county in which the work of improvement or part of it is situated.

(b) If this part provides for recording a notice, claim of lien, release of lien, payment bond, or other paper, the provision is satisfied by filing the paper for record in the office of the county recorder of the county in which the work of improvement or part of it is situated.

(c) The county recorder shall number, index, and preserve a contract, plan, or other paper presented for filing under this part, and shall number, index, and transcribe into the official records, in the same manner as a conveyance of real property, a notice, claim of lien, payment bond, or other paper recorded under this part.

(d) The county recorder shall charge and collect the fees provided in Article 5 (commencing with Section 27360) of Chapter 6 of Part 3 of Division 2 of Title 3 of the Government Code for performing duties under this section.

§ 8062. Good faith act of owner

No act of an owner in good faith and in compliance with a provision of this part shall be construed to prevent a direct contractor’s performance of the contract, or exonerate a surety on a performance or payment bond.

§ 8064. Giving notice or executing document on behalf of co-owner

An owner may give a notice or execute or file a document under this part on behalf of a co-owner if the owner acts on the co-owner’s behalf and includes in the notice or document the name and address of the co-owner on whose behalf the owner acts.

§ 8066. Act done by or to person’s agent

An act that may be done by or to a person under this part may be done by or to the person’s agent to the extent the act is within the scope of the agent’s authority.

§ 8100. Writing required

Notice under this part shall be in writing. Writing includes printing and typewriting.

§ 8102. Information included

(a) Notice under this part shall, in addition to any other information required by statute for that type of notice, include all of the following information to the extent known to the person giving the notice:

(1) The name and address of the owner or reputed owner.

(2) The name and address of the direct contractor.

(3) The name and address of the construction lender, if any.

(4) A description of the site sufficient for identification, including the street address of the site, if any. If a sufficient legal description of the site is given, the effectiveness of the notice is not affected by the fact that the street address is erroneous or is omitted.

(5) The name, address, and relationship to the parties of the person giving the notice.

(6) If the person giving the notice is a claimant:

(A) A general statement of the work provided.

(B) The name of the person to or for whom the work is provided.

(C) A statement or estimate of the claimant’s demand, if any, after deducting all just credits and offsets.

(b) Notice is not invalid by reason of any variance from the requirements of this section if the notice is sufficient to substantially inform the person given notice of the information required by this section and other information required in the notice.

§ 8104. Notice of delinquency of payment of compensation to laborer

(a) A direct contractor or subcontractor on a work of improvement governed by this part that employs a laborer and fails to pay the full compensation due the laborer, including any employer payments described in Section 1773.1 of the Labor Code and implementing regulations, shall not later than the date the compensation became delinquent, give the laborer, the laborer’s bargaining representative, if any, the construction lender or reputed construction lender, if any, and the owner or reputed owner, notice that includes all of the following information, in addition to the information required by Section 8102:

(1) The name and address of the laborer, and of any person or entity described in subdivision (b) of Section 8024 to which employer payments are due.

(2) The total number of straight time and overtime hours worked by the laborer on each job.

(3) The amount then past due and owing.

(b) Failure to give the notice required by subdivision (a) constitutes grounds for disciplinary action under the Contractors’ State License Law, Chapter 9 (commencing with Section 7000) of Division 3 of the Business and Professions Code.

§ 8106. Means of giving notice

Except as otherwise provided by statute, notice under this part shall be given by any of the following means:

(a) Personal delivery.

(b) Mail in the manner provided in Section 8110.

(c) Leaving the notice and mailing a copy in the manner provided in Section 415.20 of the Code of Civil Procedure for service of summons and complaint in a civil action.

§ 8108. Place of giving notice

Except as otherwise provided by this part, notice under this part shall be given to the person to be notified at the person’s residence, the person’s place of business, or at any of the following addresses:

(a) If the person to be notified is an owner other than a public entity, the owner’s address shown on the direct contract, the building permit, or a construction trust deed.

(b) If the person to be notified is a public entity, the office of the public entity or another address specified by the public entity in the contract or elsewhere for service of notices, papers, and other documents.

(c) If the person to be notified is a construction lender, the construction lender’s address shown on the construction loan agreement or construction trust deed.

(d) If the person to be notified is a direct contractor or a subcontractor, the contractor’s address shown on the building permit, on the contractor’s contract, or on the records of the Contractors’ State License Board.

(e) If the person to be notified is a claimant, the claimant’s address shown on the claimant’s contract, preliminary notice, claim of lien, stop payment notice, or claim against a payment bond, or on the records of the Contractors’ State License Board.

(f) If the person to be notified is a surety on a bond, the surety’s address shown on the bond for service of notices, papers, and other documents, or on the records of the Department of Insurance.

§ 8110. Mail notice

Except as otherwise provided by this part, notice by mail under this part shall be given by registered or certified mail, express mail, or overnight delivery by an express service carrier.

§ 8114. Display of posted notice

A notice required by this part to be posted shall be displayed in a conspicuous location at the site.

§ 8116. When notice deemed complete and times given

Notice under this part is complete and deemed to have been given at the following times:

(a) If given by personal delivery, when delivered.

(b) If given by mail, when deposited in the mail or with an express service carrier in the manner provided in Section 1013 of the Code of Civil Procedure.

(c) If given by leaving the notice and mailing a copy in the manner provided in Section 415.20 of the Code of Civil Procedure for service of summons in a civil action, five days after mailing.

(d) If given by posting, when displayed.

(e) If given by recording, when recorded in the office of the county recorder.

§ 8118. Proof of notice declaration

(a) Proof that notice was given to a person in the manner required by this part shall be made by a proof of notice declaration that states all of the following:

(1) The type or description of the notice given.

(2) The date, place, and manner of notice, and facts showing that notice was given in the manner required by statute.

(3) The name and address of the person to which notice was given, and, if appropriate, the title or capacity in which the person was given notice.

(b) If the notice is given by mail, the declaration shall be accompanied by one of the following:

(1) Documentation provided by the United States Postal Service showing that payment was made to mail the notice using registered or certified mail, or express mail.

(2) Documentation provided by an express service carrier showing that payment was made to send the notice using an overnight delivery service.

(3) A return receipt, delivery confirmation, signature confirmation, tracking record, or other proof of delivery or attempted delivery provided by the United States Postal Service, or a photocopy of the record of delivery and receipt maintained by the United States Postal Service, showing the date of delivery and to whom delivered, or in the event of nondelivery, by the returned envelope itself.

(4) A tracking record or other documentation provided by an express service carrier showing delivery or attempted delivery of the notice.

§ 8119. Notice or service of process on association

(a) With respect to a work of improvement on a common area within a common interest development:

(1) The association is deemed to be an agent of the owners of separate interests in the common interest development for all notices and claims required by this part.

(2) If any provision of this part requires the delivery or service of a notice or claim to or on the owner of common area property, the notice or claim may be delivered to or served on the association.

(b) For the purposes of this section, the terms “association,” “common area,” “common interest development,” and “separate interest” have the meanings provided in Article 2 (commencing with Section 4075) of Chapter 1 of Part 5 and Article 2 (commencing with Section 6526) of Chapter 1 of Part 5.3.

§ 8120. Applicability of chapter

The provisions of this chapter apply to a work of improvement governed by this part.

§ 8122. Waiver or impairment of claimant’s rights prohibited

An owner, direct contractor, or subcontractor may not, by contract or otherwise, waive, affect, or impair any other claimant’s rights under this part, whether with or without notice, and any term of a contract that purports to do so is void and unenforceable unless and until the claimant executes and delivers a waiver and release under this article.

§ 8124. Release upon claimant’s waiver and release

A claimant’s waiver and release does not release the owner, construction lender, or surety on a payment bond from a lien or claim unless both of the following conditions are satisfied:

(a) The waiver and release is in substantially the form provided in this article and is signed by the claimant.

(b) If the release is a conditional release, there is evidence of payment to the claimant. Evidence of payment may be either of the following:

(1) The claimant’s endorsement on a single or joint payee check that has been paid by the financial institution on which it was drawn.

(2) Written acknowledgment of payment by the claimant.

§ 8126. Requirements for statement to waive, release, impair or adversely affect lien or claim

An oral or written statement purporting to waive, release, impair or otherwise adversely affect a lien or claim is void and unenforceable and does not create an estoppel or impairment of the lien or claim unless either of the following conditions is satisfied:

(a) The statement is pursuant to a waiver and release under this article.

(b) The claimant has actually received payment in full for the claim.

§ 8128. Reduction or release of stop payment notice

(a) A claimant may reduce the amount of, or release in its entirety, a stop payment notice. The reduction or release shall be in writing and may be given in a form other than a waiver and release form provided in this article.

(b) The writing shall identify whether it is a reduction of the amount of the stop payment notice, or a release of the notice in its entirety. If the writing is a reduction, it shall state the amount of the reduction, and the amount to remain withheld after the reduction.

(c) A claimant’s reduction or release of a stop payment notice has the following effect:

(1) The reduction or release releases the claimant’s right to enforce payment of the claim stated in the notice to the extent of the reduction or release.

(2) The reduction or release releases the person given the notice from the obligation to withhold funds pursuant to the notice to the extent of the reduction or release.

(3) The reduction or release does not preclude the claimant from giving a subsequent stop payment notice that is timely and proper.

(4) The reduction or release does not release any right of the claimant other than the right to enforce payment of the claim stated in the stop payment notice to the extent of the reduction or release.

§ 8130. Enforceability of accord and satisfaction

This article does not affect the enforceability of either an accord and satisfaction concerning a good faith dispute or an agreement made in settlement of an action pending in court if the accord and satisfaction or agreement and settlement make specific reference to the lien or claim.

§ 8132. Conditional waiver and release

If a claimant is required to execute a waiver and release in exchange for, or in order to induce payment of, a progress payment and the claimant is not, in fact, paid in exchange for the waiver and release or a single payee check or joint payee check is given in exchange for the waiver and release, the waiver and release shall be null, void, and unenforceable unless it is in substantially the following form:

CONDITIONAL WAIVER AND RELEASE ON PROGRESS PAYMENT

NOTICE: THIS DOCUMENT WAIVES THE CLAIMANT’S LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS EFFECTIVE ON RECEIPT OF PAYMENT. A PERSON SHOULD NOT RELY ON THIS DOCUMENT UNLESS SATISFIED THAT THE CLAIMANT HAS RECEIVED PAYMENT.

Identifying Information

Name of Claimant:

Name of Customer:

Job Location:

Owner:

Through Date:

Conditional Waiver and Release

This document waives and releases lien, stop payment notice, and payment bond rights the claimant has for labor and service provided, and equipment and material delivered, to the customer on this job through the Through Date of this document. Rights based upon labor or service provided, or equipment or material delivered, pursuant to a written change order that has been fully executed by the parties prior to the date that this document is signed by the claimant, are waived and released by this document, unless listed as an Exception below. This document is effective only on the claimant’s receipt of payment from the financial institution on which the following check is drawn:

Maker of Check:

Amount of Check: $

Check Payable to:

Exceptions

This document does not affect any of the following:

(1) Retentions.

(2) Extras for which the claimant has not received payment.

(3) The following progress payments for which the claimant has previously given a conditional waiver and release but has not received payment:

Date(s) of waiver and release:

Amount(s) of unpaid progress payment(s): $

(4) Contract rights, including (A) a right based on rescission, abandonment, or breach of contract, and (B) the right to recover compensation for work not compensated by the payment.

Signature

Claimant’s Signature:

Claimant’s Title:

Date of Signature:

§ 8134. Unconditional waiver and release

If the claimant is required to execute a waiver and release in exchange for, or in order to induce payment of, a progress payment and the claimant asserts in the waiver that the claimant has, in fact, been paid the progress payment, the waiver and release shall be null, void, and unenforceable unless it is in substantially the following form, with the text of the “Notice to Claimant” in at least as large a type as the largest type otherwise in the form:

UNCONDITIONAL WAIVER AND RELEASE ON PROGRESS PAYMENT

NOTICE TO CLAIMANT: THIS DOCUMENT WAIVES AND RELEASES LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS UNCONDITIONALLY AND STATES THAT YOU HAVE BEEN PAID FOR GIVING UP THOSE RIGHTS. THIS DOCUMENT IS ENFORCEABLE AGAINST YOU IF YOU SIGN IT, EVEN IF YOU HAVE NOT BEEN PAID. IF YOU HAVE NOT BEEN PAID, USE A CONDITIONAL WAIVER AND RELEASE FORM.

Identifying Information

Name of Claimant:

Name of Customer:

Job Location:

Owner:

Through Date:

Unconditional Waiver and Release

This document waives and releases lien, stop payment notice, and payment bond rights the claimant has for labor and service provided, and equipment and material delivered, to the customer on this job through the Through Date of this document. Rights based upon labor or service provided, or equipment or material delivered, pursuant to a written change order that has been fully executed by the parties prior to the date that this document is signed by the claimant, are waived and released by this document, unless listed as an Exception below. The claimant has received the following progress payment: $

Exceptions

This document does not affect any of the following:

(1) Retentions.

(2) Extras for which the claimant has not received payment.

(3) Contract rights, including (A) a right based on rescission, abandonment, or breach of contract, and (B) the right to recover compensation for work not compensated by the payment.

Signature

Claimant’s Signature:

Claimant’s Title:

Date of Signature:

§ 8136. Conditional waiver and release of final payment

If the claimant is required to execute a waiver and release in exchange for, or in order to induce payment of, a final payment and the claimant is not, in fact, paid in exchange for the waiver and release or a single payee check or joint payee check is given in exchange for the waiver and release, the waiver and release shall be null, void, and unenforceable unless it is in substantially the following form:

CONDITIONAL WAIVER AND RELEASE ON FINAL PAYMENT

NOTICE: THIS DOCUMENT WAIVES THE CLAIMANT’S LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS EFFECTIVE ON RECEIPT OF PAYMENT. A PERSON SHOULD NOT RELY ON THIS DOCUMENT UNLESS SATISFIED THAT THE CLAIMANT HAS RECEIVED PAYMENT.

Identifying Information

Name of Claimant:

Name of Customer:

Job Location:

Owner:

Conditional Waiver and Release

This document waives and releases lien, stop payment notice, and payment bond rights the claimant has for labor and service provided, and equipment and material delivered, to the customer on this job. Rights based upon labor or service provided, or equipment or material delivered, pursuant to a written change order that has been fully executed by the parties prior to the date that this document is signed by the claimant, are waived and released by this document, unless listed as an Exception below. This document is effective only on the claimant’s receipt of payment from the financial institution on which the following check is drawn:

Maker of Check:

Amount of Check: $

Check Payable to:

Exceptions

This document does not affect any of the following:

Disputed claims for extras in the amount of: $

Signature

Claimant’s Signature:

Claimant’s Title:

Date of Signature:

§ 8138. Unconditional waiver and release on final payment

If the claimant is required to execute a waiver and release in exchange for, or in order to induce payment of, a final payment and the claimant asserts in the waiver that the claimant has, in fact, been paid the final payment, the waiver and release shall be null, void, and unenforceable unless it is in substantially the following form, with the text of the “Notice to Claimant” in at least as large a type as the largest type otherwise in the form:

UNCONDITIONAL WAIVER AND RELEASE ON FINAL PAYMENT

NOTICE TO CLAIMANT: THIS DOCUMENT WAIVES AND RELEASES LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS UNCONDITIONALLY AND STATES THAT YOU HAVE BEEN PAID FOR GIVING UP THOSE RIGHTS. THIS DOCUMENT IS ENFORCEABLE AGAINST YOU IF YOU SIGN IT, EVEN IF YOU HAVE NOT BEEN PAID. IF YOU HAVE NOT BEEN PAID, USE A CONDITIONAL WAIVER AND RELEASE FORM.

Identifying Information

Name of Claimant:

Name of Customer:

Job Location:

Owner:

Unconditional Waiver and Release

This document waives and releases lien, stop payment notice, and payment bond rights the claimant has for all labor and service provided, and equipment and material delivered, to the customer on this job. Rights based upon labor or service provided, or equipment or material delivered, pursuant to a written change order that has been fully executed by the parties prior to the date that this document is signed by the claimant, are waived and released by this document, unless listed as an Exception below. The claimant has been paid in full.

Exceptions

This document does not affect the following:

Disputed claims for extras in the amount of: $

Signature

Claimant’s Signature:

Claimant’s Title:

Date of Signature:

§ 8150. Applicability of Bond and Undertaking Law

The Bond and Undertaking Law (Chapter 2 (commencing with Section 995.010) of Title 14 of Part 2 of the Code of Civil Procedure) applies to a bond given under this part, except to the extent this part prescribes a different rule or is inconsistent.

§ 8152. Surety not released from liability

None of the following releases a surety from liability on a bond given under this part:

(a) A change, alteration, or modification to a contract, plan, specification, or agreement for a work of improvement or for work provided for a work of improvement.

(b) A change or modification to the terms of payment or an extension of the time for payment for a work of improvement.

(c) A rescission or attempted rescission of a contract, agreement, or bond.

(d) A condition precedent or subsequent in the bond purporting to limit the right of recovery of a claimant otherwise entitled to recover pursuant to a contract, agreement, or bond.

(e) In the case of a bond given for the benefit of claimants, the fraud of a person other than the claimant seeking to recover on the bond.

§ 8154. Construction; not released by breach of obligee; conditions for recovery

(a) A bond given under this part shall be construed most strongly against the surety and in favor of all persons for whose benefit the bond is given.

(b) A surety is not released from liability to those for whose benefit the bond has been given by reason of a breach of the direct contract or on the part of any obligee named in the bond.

(c) Except as otherwise provided by statute, the sole conditions of recovery on the bond are that the claimant is a person described in Article 1 (commencing with Section 8400) of Chapter 4 of Title 2, or in Section 9100, and has not been paid the full amount of the claim.

This title applies to a work of improvement contracted for by a public entity.

(a) Except as provided in subdivision (b), any of the following persons that have not been paid in full may give a stop payment notice to the public entity or assert a claim against a payment bond:

(1) A person that provides work for a public works contract, if the work is authorized by a direct contractor, subcontractor, architect, project manager, or other person having charge of all or part of the public works contract.

(2) A laborer.

(3) A person described in Section 4107.7 of the Public Contract Code.

(b) A direct contractor may not give a stop payment notice or assert a claim against a payment bond under this title.

§ 9200. When completion occurs

For the purpose of this title, completion of a work of improvement occurs at the earliest of the following times:

(a) Acceptance of the work of improvement by the public entity.

(b) Cessation of labor on the work of improvement for a continuous period of 60 days. This subdivision does not apply to a contract awarded under the State Contract Act, Part 2 (commencing with Section 10100) of Division 2 of the Public Contract Code.

§ 9202. Notice of cessation

(a) A public entity may record a notice of cessation if there has been a continuous cessation of labor for at least 30 days prior to the recordation that continues through the date of the recordation.

(b) The notice shall be signed and verified by the public entity or its agent.

(c) The notice shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1, and shall also include all of the following information:

(1) The date on or about which the labor ceased.

(2) A statement that the cessation has continued until the recordation of the notice.

§ 9204. Notice of completion

(a) A public entity may record a notice of completion on or within 15 days after the date of completion of a work of improvement.

(b) The notice shall be signed and verified by the public entity or its agent.

(c) The notice shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1, and shall also include the date of completion. An erroneous statement of the date of completion does not affect the effectiveness of the notice if the true date of completion is 15 days or less before the date of recordation of the notice.

§ 9208. Recording notice of completion

A notice of completion in otherwise proper form, verified and containing the information required by this title shall be accepted by the recorder for recording and is deemed duly recorded without acknowledgment.

§ 9300. Person to whom notice is given

(a) Except as otherwise provided by statute, before giving a stop payment notice or asserting a claim against a payment bond, a claimant shall give preliminary notice to the following persons:

(1) The public entity.

(2) The direct contractor to which the claimant provides work.

(b) Notwithstanding subdivision (a):

(1) A laborer is not required to give preliminary notice.

(2) A claimant that has a direct contractual relationship with a direct contractor is not required to give preliminary notice.

(c) Compliance with this section is a necessary prerequisite to the validity of a stop payment notice under this title.

(d) Compliance with this section or with Section 9562 is a necessary prerequisite to the validity of a claim against a payment bond under this title.

§ 9302. Compliance

(a) Except as provided in subdivision (b), preliminary notice shall be given in compliance with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

(b) If the public works contract is for work constructed by the Department of Public Works or the Department of General Services of the state, preliminary notice to the public entity shall be given to the disbursing officer of the department constructing the work.

§ 9303. General description of work and estimate of price

The preliminary notice shall comply with the requirements of Section 8102, and shall also include:

(a) A general description of the work to be provided.

(b) An estimate of the total price of the work provided and to be provided.

§ 9304. Time for giving stop payment notice or asserting claim against payment bond

A claimant may give a stop payment notice or assert a claim against a payment bond only for work provided within 20 days before giving preliminary notice and at any time thereafter.

§ 9306. Failure of subcontractor to give notice grounds for discipline

If the contract of any subcontractor on a particular work of improvement provides for payment to the subcontractor of more than four hundred dollars ($400), the failure of that subcontractor, licensed under the Contractors’ State License Law (Chapter 9 (commencing with Section 7000) of Division 3 of the Business and Professions Code), to give the notice provided for in this chapter, constitutes grounds for disciplinary action under the Contractors’ State License Law.

§ 9350. Generally

The rights of all persons furnishing work pursuant to a public works contract, with respect to any fund for payment of construction costs, are governed exclusively by this chapter, and no person may assert any legal or equitable right with respect to that fund, other than a right created by direct written contract between the person and the person holding the fund, except pursuant to the provisions of this chapter.

§ 9352. Requirements

(a) A stop payment notice shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1, and shall be signed and verified by the claimant.

(b) The notice shall include a general description of work to be provided, and an estimate of the total amount in value of the work to be provided.

(c) The amount claimed in the notice may include only the amount due the claimant for work provided through the date of the notice.

§ 9354. Persons to whom notice given

(a) Except as provided in subdivision (b), a stop payment notice shall be given in compliance with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

(b) A stop payment notice shall be given to the public entity by giving the notice to the following person:

(1) In the case of a public works contract of the state, the director of the department that awarded the contract.

(2) In the case of a public works contract of a public entity other than the state, the office of the controller, auditor, or other public disbursing officer whose duty it is to make payment pursuant to the contract, or the commissioners, managers, trustees, officers, board of supervisors, board of trustees, common council, or other body by which the contract was awarded.

§ 9356. Time period for giving notice

A stop payment notice is not effective unless given before the expiration of whichever of the following time periods is applicable:

(a) If a notice of completion, acceptance, or cessation is recorded, 30 days after that recordation.

(b) If a notice of completion, acceptance, or cessation is not recorded, 90 days after cessation or completion.

§ 9358. Withholding fund upon receipt of notice

(a) The public entity shall, on receipt of a stop payment notice, withhold from the direct contractor sufficient funds due or to become due to the direct contractor to pay the claim stated in the stop payment notice and to provide for the public entity’s reasonable cost of any litigation pursuant to the stop payment notice.

(b) The public entity may satisfy its duty under this section by refusing to release funds held in escrow under Section 10263 or 22300 of the Public Contract Code.

§ 9360. Payments not prohibited by chapter

(a) This chapter does not prohibit payment of funds to a direct contractor or a direct contractor’s assignee if a stop payment notice is not received before the disbursing officer actually surrenders possession of the funds.

(b) This chapter does not prohibit payment of any amount due to a direct contractor or a direct contractor’s assignee in excess of the amount necessary to pay the total amount of all claims stated in stop payment notices received by the public entity at the time of payment plus any interest and court costs that might reasonably be anticipated in connection with the claims.

§ 9362. Notice of time within which action to enforce payment of claim must be commenced

(a) Not later than 10 days after each of the following events, the public entity shall give notice to a claimant that has given a stop payment notice of the time within which an action to enforce payment of the claim stated in the stop payment notice must be commenced:

(1) Completion of a public works contract, whether by acceptance or cessation.

(2) Recordation of a notice of cessation or completion.

(b) The notice shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

(c) A public entity need not give notice under this section unless the claimant has paid the public entity ten dollars ($10) at the time of giving the stop payment notice.

§ 9364. Release bond

(a) A public entity may, in its discretion, permit the direct contractor to give the public entity a release bond. The bond shall be executed by an admitted surety insurer, in an amount equal to 125 percent of the claim stated in the stop payment notice, conditioned for the payment of any amount the claimant recovers in an action on the claim, together with court costs if the claimant prevails.

(b) On receipt of a release bond, the public entity shall not withhold funds from the direct contractor pursuant to the stop payment notice.

(c) The surety on a release bond is jointly and severally liable to the claimant with the sureties on any payment bond given under Chapter 5 (commencing with Section 9550).

§ 9400. Grounds for obtaining release of funds under summary proceeding

A direct contractor may obtain release of funds withheld pursuant to a stop payment notice under the summary proceeding provided in this article on any of the following grounds:

(a) The claim on which the notice is based is not a type for which a stop payment notice is authorized under this chapter.

(b) The claimant is not a person authorized under Section 9100 to give a stop payment notice.

(c) The amount of the claim stated in the stop payment notice is excessive.

(d) There is no basis for the claim stated in the stop payment notice.

§ 9402. Affidavit served on public entity

The direct contractor shall serve on the public entity an affidavit, together with a copy of the affidavit, in compliance with the requirements of Chapter 2 (commencing with Section 8100) of Title 1, that includes all of the following information:

(a) An allegation of the grounds for release of the funds and a statement of the facts supporting the allegation.

(b) A demand for the release of all or the portion of the funds that are alleged to be withheld improperly or in an excessive amount.

(c) A statement of the address of the contractor within the state for the purpose of permitting service by mail on the contractor of any notice or document.

§ 9404. Service on claimant of affidavit with notice stating public entity will release funds withheld

The public entity shall serve on the claimant a copy of the direct contractor’s affidavit, together with a notice stating that the public entity will release the funds withheld, or the portion of the funds demanded, unless the claimant serves on the public entity a counteraffidavit on or before the time stated in the notice. The time stated in the notice shall be not less than 10 days nor more than 20 days after service on the claimant of the copy of the affidavit. The notice shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

§ 9406. Counteraffidavit served by claimant contesting contractor’s affidavit

(a) A claimant that contests the direct contractor’s affidavit shall serve on the public entity a counteraffidavit alleging the details of the claim and describing the specific basis on which the claimant contests or rebuts the allegations of the contractor’s affidavit. The counteraffidavit shall be served within the time stated in the public entity’s notice, together with proof of service of a copy of the counteraffidavit on the direct contractor. The service of the counteraffidavit on the public entity and the copy of the affidavit on the direct contractor shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

(b) If no counteraffidavit with proof of service is served on the public entity within the time stated in the public entity’s notice, the public entity shall immediately release the funds, or the portion of the funds demanded by the affidavit, without further notice to the claimant, and the public entity is not liable in any manner for their release.

(c) The public entity is not responsible for the validity of an affidavit or counteraffidavit under this article.

§ 9450. Funds insufficient to pay in full claims of persons

If funds withheld pursuant to a stop payment notice are insufficient to pay in full the claims of all persons who have given a stop payment notice, the funds shall be distributed among the claimants in the ratio that the claim of each bears to the aggregate of all claims for which a stop payment notice is given, without regard to the order in which the notices were given or enforcement actions were commenced.

§ 9452. Right of claimant to recover in action on payment bond

Nothing in this chapter impairs the right of a claimant to recover from the direct contractor or the contractor’s sureties in an action on a payment bond under Chapter 5 (commencing with Section 9550) any deficit that remains unpaid after the distribution under Section 9450.

§ 9454. False stop payment notice

A person that willfully gives a false stop payment notice to the public entity or that willfully includes in the notice work not provided for the public works contract for which the stop payment notice is given forfeits all right to participate in the distribution under Section 9450.

§ 9456. Priority of rights of claimant

(a) A stop payment notice takes priority over an assignment by a direct contractor of any amount due or to become due pursuant to a public works contract, including contract changes, whether made before or after the giving of a stop payment notice, and the assignment has no effect on the rights of the claimant.

(b) Any garnishment of an amount due or to become due pursuant to a public works contract by a creditor of a direct contractor under Article 8 (commencing with Section 708.710) of Chapter 6 of Division 2 of Title 9 of Part 2 of the Code of Civil Procedure and any statutory lien on that amount is subordinate to the rights of a claimant.

§ 9500. Compliance with conditions required to enforce payment

(a) A claimant may not enforce payment of the claim stated in a stop payment notice unless the claimant has complied with all of the following conditions:

(1) The claimant has given preliminary notice to the extent required by Chapter 3 (commencing with Section 9300).

(2) The claimant has given the stop payment notice within the time provided in Section 9356.

(b) The claim filing procedures of Part 3 (commencing with Section 900) of Division 3.6 of Title 1 of the Government Code do not apply to an action under this article.

§ 9502. Time for commencing action

(a) The claimant shall commence an action against the public entity and the direct contractor to enforce payment of the claim stated in a stop payment notice at any time after 10 days from the date the claimant gives the stop payment notice.

(b) The claimant shall commence an action against the public entity and the direct contractor to enforce payment of the claim stated in a stop payment notice not later than 90 days after expiration of the time within which a stop payment notice must be given.

(c) An action under this section may not be brought to trial or judgment entered before expiration of the time provided in subdivision (b).

(d) If a claimant does not commence an action to enforce payment of the claim stated in a stop payment notice within the time provided in subdivision (b), the notice ceases to be effective and the public entity shall release funds withheld pursuant to the notice.

§ 9504. Notice of commencement of action

Within five days after commencement of an action to enforce payment of the claim stated in a stop payment notice, the claimant shall give notice of commencement of the action to the public entity in the same manner that a stop payment notice is given.

§ 9506. More than one claimant giving stop payment notice

If more than one claimant has given a stop payment notice:

(a) Any number of claimants may join in the same enforcement action.

(b) If claimants commence separate actions, the court that first acquires jurisdiction may order the actions consolidated.

(c) On request of the public entity, the court shall require that all claimants be impleaded in one action and shall adjudicate the rights of all parties in the action.

§ 9508. Dismissal for want of prosecution

Notwithstanding Section 583.420 of the Code of Civil Procedure, if an action to enforce payment of the claim stated in a stop payment notice is not brought to trial within two years after commencement of the action, the court may in its discretion dismiss the action for want of prosecution.

§ 9510. Cessation of effectiveness of stop payment notice

A stop payment notice ceases to be effective, and the public entity shall release funds withheld, in either of the following circumstances:

(a) An action to enforce payment of the claim stated in the stop payment notice is dismissed, unless expressly stated to be without prejudice.

(b) Judgment in an action to enforce payment of the claim stated in the stop payment notice is against the claimant.

§ 9550. Generally

(a) A direct contractor that is awarded a public works contract involving an expenditure in excess of twenty-five thousand dollars ($25,000) shall, before commencement of work, give a payment bond to and approved by the officer or public entity by whom the contract was awarded.

(b) A public entity shall state in its call for bids that a payment bond is required for a public works contract involving an expenditure in excess of twenty-five thousand dollars ($25,000).

(c) A payment bond given and approved under this section will permit performance of and provide coverage for work pursuant to a public works contract that supplements the contract for which the bond is given, if the requirement of a new bond is waived by the public entity.

(d) For the purpose of this section, a design professional is not deemed a direct contractor and is not required to give a payment bond.

(e) This section does not apply to a public works contract with a “state entity” as defined in subdivision (d) of Section 7103 of the Public Contract Code.

§ 9552. Payment bond not given or approved

If a payment bond is not given and approved as required by Section 9550:

(a) Neither the public entity awarding the public works contract nor any officer of the public entity shall audit, allow, or pay a claim of the direct contractor pursuant to the contract.

(b) A claimant shall receive payment of a claim pursuant to a stop payment notice in the manner provided by Chapter 4 (commencing with Section 9350).

§ 9554. Amount; payment by surety; attorney’s fees; conditioned for payment in full of claims

(a) A payment bond shall be in an amount not less than 100 percent of the total amount payable pursuant to the public works contract. The bond shall be in the form of a bond and not a deposit in lieu of a bond. The bond shall be executed by an admitted surety insurer.

(b) The payment bond shall provide that if the direct contractor or a subcontractor fails to pay any of the following, the surety will pay the obligation and, if an action is brought to enforce the liability on the bond, a reasonable attorney’s fee, to be fixed by the court:

(1) A person authorized under Section 9100 to assert a claim against a payment bond.

(2) Amounts due under the Unemployment Insurance Code with respect to work or labor performed pursuant to the public works contract.

(3) Amounts required to be deducted, withheld, and paid over to the Employment Development Department from the wages of employees of the contractor and subcontractors under Section 13020 of the Unemployment Insurance Code with respect to the work and labor.

(c) The payment bond shall be conditioned for the payment in full of the claims of all claimants and by its terms inure to the benefit of any person authorized under Section 9100 to assert a claim against a payment bond so as to give a right of action to that person or that person’s assigns in an action to enforce the liability on the bond.

(d) The direct contractor may require that a subcontractor give a bond to indemnify the direct contractor for any loss sustained by the direct contractor because of any default of the subcontractor under this section.

§ 9558. Time claimant may commence action to enforce

A claimant may commence an action to enforce the liability on the bond at any time after the claimant ceases to provide work, but not later than six months after the period in which a stop payment notice may be given under Section 9356.

§ 9560. Preliminary notice required

(a) In order to enforce a claim against a payment bond, a claimant shall give the preliminary notice provided in Chapter 3 (commencing with Section 9300).

(b) If preliminary notice was not given as provided in Chapter 3 (commencing with Section 9300), a claimant may enforce a claim by giving written notice to the surety and the bond principal within 15 days after recordation of a notice of completion. If no notice of completion has been recorded, the time for giving written notice to the surety and the bond principal is extended to 75 days after completion of the work of improvement.

(c) Commencing July 1, 2012, and except as provided in subdivision (b), if the preliminary notice was required to be given by a person who has no direct contractual relationship with the contractor, and who has not given notice as provided in Chapter 3 (commencing with Section 9300), that person may enforce a claim by giving written notice to the surety and the bond principal, as provided in Section 9562, within 15 days after recordation of a notice of completion. If no notice of completion has been recorded, the time for giving written notice to the surety and the bond principal is extended to 75 days after completion of the work of improvement.

(d) Subdivision (c) shall not apply in either of the following circumstances:

(1) All progress payments, except for those disputed in good faith, have been made to a subcontractor who has a direct contractual relationship with the general contractor to whom the claimant has provided materials or services.

(2) The subcontractor who has a direct contractual relationship with the general contractor to whom the claimant has provided materials or services has been terminated from the project pursuant to the contract, and all progress payments, except those disputed in good faith, have been made as of the termination date.

(e) Pursuant to Section 9300, this section shall not apply to a laborer, as defined under Section 8024.

(f) This section shall become operative on July 1, 2012.

§ 9562. Notice to principal and surety

Notice to the principal and surety under Section 9560 shall comply with the requirements of Chapter 2 (commencing with Section 8100) of Title 1.

§ 9564. Action to enforce liability

(a) A claimant may maintain an action to enforce the liability of a surety on a payment bond whether or not the claimant has given the public entity a stop payment notice.

(b) A claimant may maintain an action to enforce the liability on the bond separately from and without commencement of an action against the public entity by whom the contract was awarded or against any officer of the public entity.

(c) In an action to enforce the liability on the bond, the court shall award the prevailing party a reasonable attorney’s fee.

§ 9566. Claimant required to have provided work to direct contractor

(a) A claimant does not have a right to recover on a payment bond unless the claimant provided work to the direct contractor either directly or through one or more subcontractors pursuant to a public works contract.

(b) Nothing in this section affects the stop payment notice rights of, and relative priorities among, design professionals.