Massachusetts

Preliminary Notice Deadlines

Massachusetts

Massachusetts

Massachusetts

Massachusetts

Massachusetts

All tiers must bring lawsuit to enforce claim against bond within 1 year of last furnishing labor and/or materials. Those without direct contract with the prime contractor must file a Notice of Claim within 65 days from last furnishing labor and/or materials

Massachusetts

None, unless furnishing specially fabricated materials. If so, notice must be delivered to the prime contractor within 20 days of receiving the order for the specially fabricated materials.

Massachusetts

All tiers must bring lawsuit to enforce claim against bond within 1 year of last furnishing labor and/or materials. Those without direct contract with the prime contractor must file a Notice of Claim within 65 days from last furnishing labor and/or materials.

The Massachusetts public payment bond claim laws cover all construction projects commissioned by the Commonwealth, a county, city, town, district, or other public entity where the total contract value is at least $25,000 or more.

In Massachusetts, any party who furnishes labor and/or materials to the general contractor or 1st tier subcontractor is explicitly covered, as are trustees of employee benefit trusts. It is unclear if subcontractors on or below the 3rd tier have the right to make a claim against the payment bond. Suppliers to suppliers are not protected.

• Dive deeper: Massachusetts Court Rules Subcontractors Can’t Waive Bond Claim Rights

Claimants who did not contract directly with the general contractor are required to send a notice of a claim against the payment bond no later than 65 days after the claimant’s last date of furnishing labor and or materials to the project.

First-tier subcontractors, i.e. those hired by the GC, are not required to send this notice, although it may be a good idea to send one anyway to get the payment issue the proper attention.

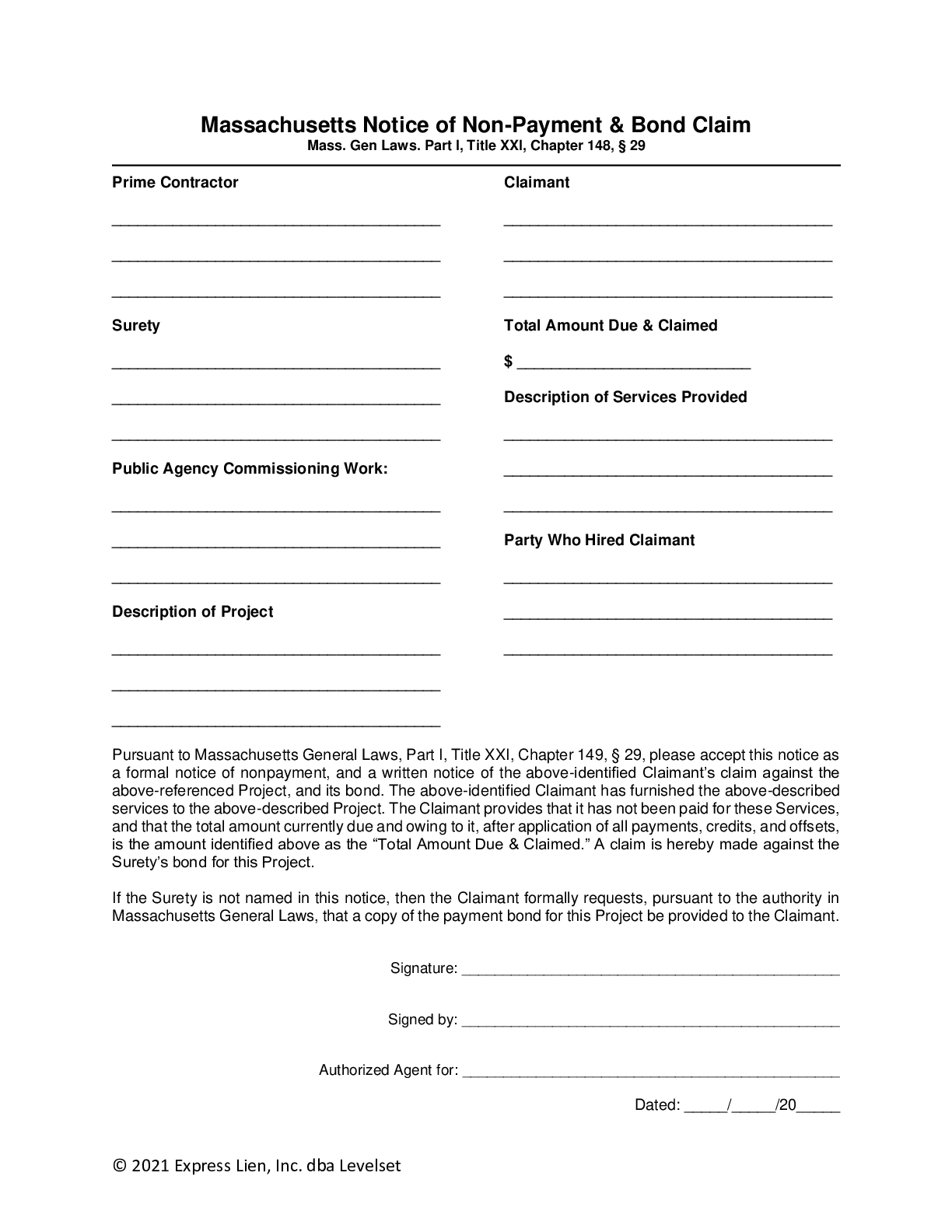

A Massachusetts bond claim is governed by Mass. Gen. Laws ch. 149 §29, and should include the following information:

• Public entity’s name & address

• Claimant’s name & address

• Hiring party’s name & address

• Surety’s name & address (if known)

• Property description

• Description of labor and/or materials furnished

• Amount claimed

→ Download a free Massachusetts public payment bond claim form here

In Massachusetts, only the general contractor is required to receive the claim, however, it may be advisable to send a copy of the claim to the public entity, and the surety (if known).

• See: Tip- Send Your Bond Claim to the Surety to Ensure Maximum Attention

A Massachusetts public payment bond claim must be sent by registered or certified mail, postage prepaid in an envelope addressed to the contractor principal to any place at which the contractor maintains an office or business; or in any manner in which civil process may be served.

A lawsuit to enforce a claim against a payment bond must be initiated no later than 1 year after the last date the claimant furnished labor and/or materials to the project.

Can a design professional working for a contractor on a design build project file a bond claim if it has not been paid?

Bonding and suggestions for receivablesI am on a private job in ma for subcontract work that I was not paid for 220k of work completed. The total project worth...

Can I file a bond claim if the subcontractor ignores my mechanics lien? Little Miller ActSirs : With the Aid of your firm I placed a lein for $19, 332 on a Sub contractor working under a large GC for...

This Massachusetts bond claim form should be filed when a party is unpaid on a public construction project. Mechanics liens are not available on state,...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Maryland, and are not paid, you can file a “lien” against the project pursuant to Massachusetts’ Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Massachusetts’ Little Miller Act is found in Massachusetts’ General Laws Part I, Title XXI, Chapter 149, Section 29 and is reproduced below. Updated as of September 2021.

Officers or agents contracting in behalf of the commonwealth or in behalf of any county, city, town, district or other political subdivision of the commonwealth or other public instrumentality for the construction, reconstruction, alteration, remodeling, repair or demolition of public buildings or other public works when the amount of the contract is more than $25,00, shall obtain security by bond in an amount not less than one half of the total contract price, for payment by the contractor and subcontractors for labor performed or furnished and materials used or employed therein, including lumber so employed which is not incorporated therein and is not wholly or necessarily consumed or made so worthless as to lose its identity, but only to the extent of its purchase price less its fair salvage value, and including also any material specially fabricated at the order of the contractor or subcontractor for use as a component part of said public building or other public work so as to be unsuitable for use elsewhere, even though such material has not been delivered and incorporated into the public building or public work, but only to the extent of its purchase price less its fair salvage value and only to the extent that such specially fabricated material is in conformity with the contract, plans and specifications or any changes therein duly made; for payment of transportation charges for materials used or employed therein which are consigned to the contractor or to a subcontractor who has a direct contractual relationship with the contractor; for payment by such contractor and subcontractors of any sums due for the rental or hire of vehicles, steam shovels, rollers propelled by steam or other power, concrete mixers, tools and other appliances and equipment employed in such construction, reconstruction, alteration, remodeling, repair or demolition; for payment of transportation charges directly related to such rental or hire; and for payment by such contractor and subcontractors of any sums due trustees or other persons authorized to collect such payments from the contractor or subcontractors, based upon the labor performed or furnished as aforesaid, for health and welfare plans, supplementary unemployment benefit plans and other fringe benefits which are payable in cash and provided for in collective bargaining agreements between organized labor and the contractor or subcontractors; provided, that any such trustees or other persons authorized to collect such payments for health and welfare plans, supplementary unemployment benefit plans and other fringe benefits shall, subject to the following provisions, be entitled to the benefit of the security only in an amount based upon labor performed or furnished as aforesaid for a maximum of two hundred and forty consecutive calendar days.

In order to obtain the benefit of such bond for any amount claimed due and unpaid at any time, any claimant having a contractual relationship with the contractor principal furnishing the bond, who has not been paid in full for any amount claimed due for the labor, materials, equipment, appliances or transportation included in the paragraph (1) coverage within sixty-five days after the due date for same, shall have the right to enforce any such claim (a) by filing a petition in equity within one year after the day on which such claimant last performed the labor or furnished the labor, materials, equipment, appliances or transportation included in the claim and (b) by prosecuting the claim thereafter by trial in the superior court to final adjudication and execution for the sums justly due the claimant as provided in this section.

Any claimant having a contractual relationship with a subcontractor performing labor or both performing labor and furnishing materials pursuant to a contract with the general contractor but no contractual relationship with the contractor principal furnishing the bond shall have the right to enforce any such claim as provided in subparagraphs (a) and (b) of paragraph (2) only if such claimant gives written notice to the contractor principal within sixty-five days after the day on which the claimant last performed the labor or furnished the labor, materials, equipment, appliances or transportation included in the paragraphs (1) coverage, stating with substantial accuracy the amount claimed, the name of the party for whom such labor was performed or such labor, materials, equipment, appliances or transportation were furnished; provided, that any such claimant shall have the right to enforce any part of a claim covering specially fabricated material included in the paragraph (1) coverage only if such claimant has given the contractor principal written notice of the placement of the order and the amount thereof not later than twenty days after receiving the final approval in writing for the use of the material. The notices provided for in this paragraph (3) shall be served by mailing the same by registered or certified mail postage prepaid in an envelope addressed to the contractor principal at any place at which the contractor principal maintains an office or conducts his business, or at the contractor principal’s residence, or in any manner in which civil process may be served.

Upon motion of any party, the court shall advance for speedy trial a petition to enforce a claim pursuant to this section. Sections fifty-nine and fifty-nine B of chapter two hundred thirty-one shall apply to petitions to enforce claims pursuant to this section. The court shall enter an interlocutory decree upon which execution shall issue for any part of a claim found due pursuant to said sections fifty-nine or fifty-nine B and shall, upon motion of any party, advance for speedy trial the petition to enforce the remainder of the claim. Any party aggrieved by such interlocutory decree shall have the right to appeal therefrom as from a final decree. The court shall not consolidate for trial the petition of any claimant under this section with the petition of one or more other claimants on the same bond, unless the court finds that a substantial portion of the evidence of the same events during the course of construction (other than the fact that the claims sought to be consolidated arise under the same general contract) is applicable to the petitions sought to be consolidated, and that such consolidation will prevent unnecessary duplication of evidence.

The court shall not dismiss any petition on the ground that it was filed before the sixty-fifth day after the day the claimant last performed the labor or furnished the labor, materials, equipment, appliances or transportation included in the claim, nor shall the court dismiss any petition on the ground that a claim involves more than one contract with the same party and that the one year period has elapsed as to any one contract; provided, that the court shall not enter a decree upon any claim or part thereof prior to the seventieth day after the day the claimant last performed the labor or furnished the labor, materials, equipment, appliances or transportation included in the claim.

A decree in favor of any claimant under this section shall include reasonable legal fees based upon the time spent and the results accomplished as approved by the court and such legal fees shall not in any event be less than published rate of any recommended fee schedule of a state-wide bar association or of a bar association in which the office of counsel for claimant is located, whichever is higher.

Any person employing persons on any public works hereinbefore referred to shall post conspicuously, at such place or places as will provide reasonable opportunity for all employees to read the same, a correct copy of this section. The attorney general shall enforce this paragraph.