Illinois

Preliminary Notice Deadlines

Illinois

Illinois

Illinois

Illinois

Illinois

A bond claim must be filed within 180 days after the date of last furnishing labor and/or materials to the project. A copy of the claim must also be sent to the general contractor within 10 days of filing. There is no deadline to file a lien on contract funds. However, it will only be effective as to funds that have not yet been paid by the public entity to the general contractor.

Illinois

A lawsuit to enforce a bond claim must be initiated within 1 year from the date of last furnishing labor and/or materials to the project; unless a longer period is provided in the bond. A lien on contract funds must be enforced within 90 days after service of the notice of claim.

Illinois

Illinois

A bond claim must be filed within 180 days after the date of last furnishing labor and/or materials to the project. A copy of the claim must also be sent to the general contractor within 10 days of filing. There is no deadline to file a lien on contract funds. However, it will only be effective as to funds that have not yet been paid by the public entity to the general contractor.

Illinois

A lawsuit to enforce a bond claim must be initiated within 1 year from the date of last furnishing labor and/or materials to the project; unless a longer period is provided in the bond. A lien on contract funds must be enforced within 90 days after service of the notice of claim.

In Illinois, there are two types of protection available to parties unpaid on public projects: a bond claim, or a lien on contract funds. For both claims, parties entitled to protection include subcontractors, and suppliers of labor and/or materials to the general contractor or a first tier sub. It is not entirely clear, but more remote parties may be covered as well. When a supplier can be considered a first-tier sub, a supplier to that supplier is likely able to make a bond claim.

• For more on the difference between the two, see the answer to this Illinois subcontractor’s question: In the state of IL which supersedes a public claim or a bond claim for collecting payment? What’s the difference between the two and which claims get paid first?

The bond claim provisions apply to public works projects valued at $50,000 or more.

Liens on contract funds applies to all public works projects within the state.

• Note: material suppliers may claim a lien on contract funds even if the materials were not incorporated into the project if the materials were delivered to either: (a) the owner/owner’s agent to be used in the building/improvement, or (b) to the place where the building or improvement is being constructed or other designated place, pursuant to the contract, for the purpose of being used in the building/improvement.

Bond Claims

A bond claim notice must be received by the contracting public entity within 180 days after the last date of furnishing labor and/or materials to the project. Also, a copy of the verified notice must be sent to the general contractor within 10 days of filing the notice with the public entity.

Lien on Contract Funds

A Notice of Lien on Contract Funds must be sent prior to payments sufficient to cover the claim are made by the contracting public entity to the general contractor.

Bond claims

An Illinois bond claim must be a verified statement containing the following information:

• Claimant’s name and address; including a business address within the state of Illinois

If the claimant does not have a business address in the state, the claimant must state their principal place of business, and if the claimant is a partnership, the claim must state the names of the partners and their residences.

• General contractor’s name & address

• Hiring party’s name & address

• Description of the property sufficient for identification

• Description of the contract; including the labor and materials provided

• Total amount due and unpaid

Lien on Contract Funds

A Notice of Lien on Contract Funds must be a sworn statement containing the following information:

• Identification of the claimant’s contract

• Description of the labor and/or materials provided

• Total amount due and unpaid

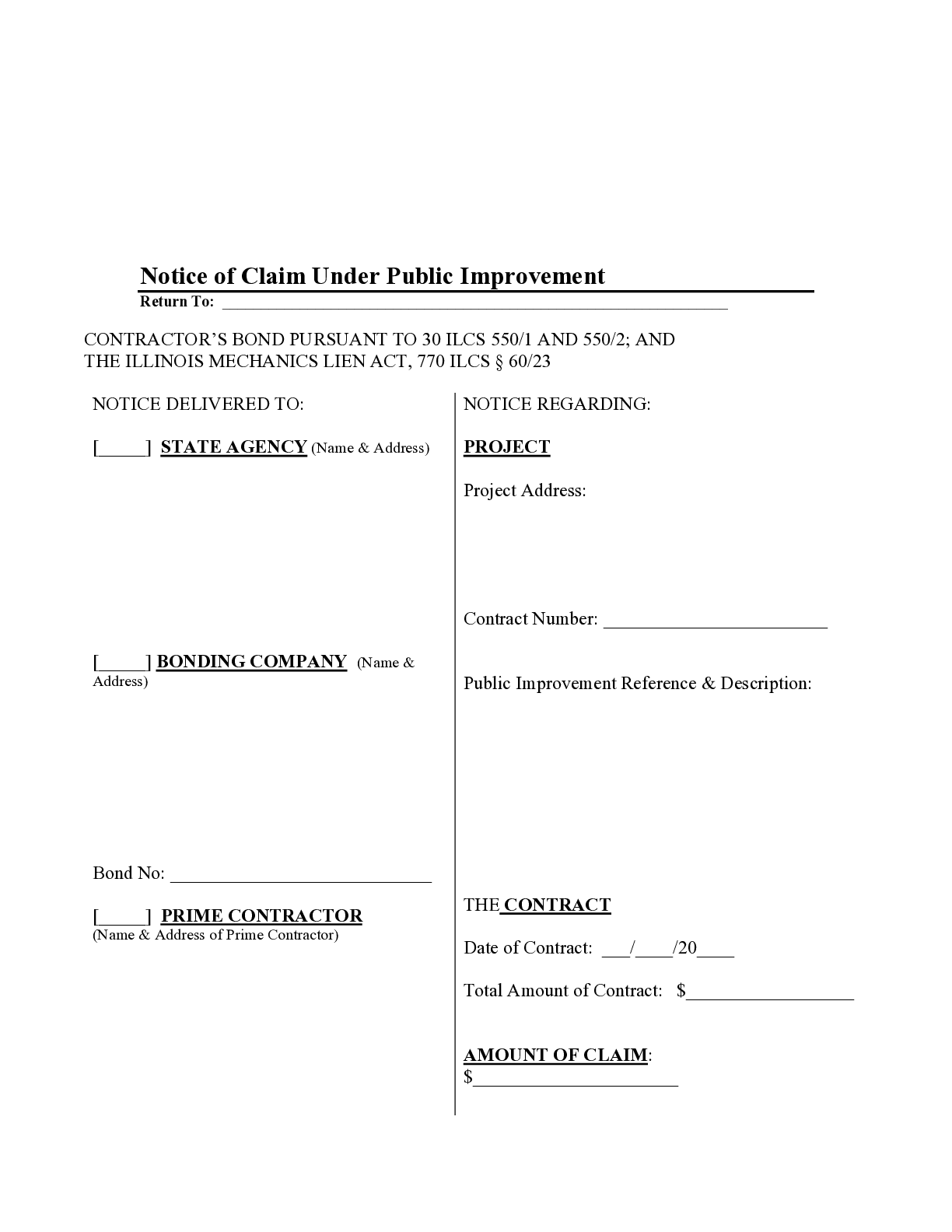

→ Download a free Illinois Public Notice of Bond Claim & Claim of Lien on Contract Funds form here

Bond Claim

A bond claim in Illinois must be given to the officer, board, bureau, or department of the contracting entity if a State project; or the Clerk or Secretary of the political subdivision for all other public works projects. The claim must also be served on the general contractor. Also, although not required, it’s a good idea to send the notice to the surety company as well.

• For more on this, see: Should I send Notice of Bond Claim?

Lien on Contract Funds

A Notice of Lien on Contract Funds must be given to the clerk or secretary of the contracting county, township, school district, city, municipality or municipal corporation, or, if the contract is with the State of Illinois, with the Director (or other official) of the public entity responsible for letting the contract. The claim must also be given to the general contractor.

Bond Claim

The bond claim is required to be “filed” with the public entity and the general contractor by either personal service or by US Mail, postage prepaid, certified or restricted delivery return receipt requested limited to the addressee only.

Lien on Contract Funds

The claim must be delivered by personal service, or sent by registered or certified mail, return receipt requested, with delivery limited to the addressee only.

Bond Claims

A bond claim is considered “filed” on the date personal service occurred, or when deposited in the mail in the appropriate manner.

Lien on Contract Funds

The claim is considered served when the claim is either received or refused by the Director, official, clerk, or secretary; as applicable.

Bond Claim

In Illinois, suit must be initiated in the appropriate circuit court no later than 1 year after the last date of the claimant’s furnishing labor and/or materials to the project.

However, this is a minimum time frame. If the language of the bond itself provides for a longer time period in which suit may be initiated, that time period will control.

Lien on Contract Funds

A lawsuit to enforce a claim of lien against contract funds must be initiated within 90 days after serving the notice of the claim. Additionally, a copy of the complaint must be delivered to the contracting public entity within 10 days of filing the action.

If a suit is commenced and is subsequently dismissed, the claim of lien will terminate 30 days after the order dismissing the suit, unless the claimant files either a motion for reinstatement, a motion to reconsider, or a notice of appeal within that 30 day time period.

Illinois does not have statutory lien or bond waiver forms, and therefore, you can use any waiver forms. Since these waivers are unregulated, be careful when reviewing and signing lien waivers. In regards to a bond claim, a waiver under the Mechanics Lien Act is not a waiver of bond rights unless specifically stated in the waiver.

• See this article: Should You Sign That Lien Waiver?.

Illinois state law is unclear or silent about whether contractors and suppliers can waive their lien rights before any work on the project begins. Accordingly, you want to proceed with caution on this subject.

• You can learn more about such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

We 're a Manufacturer supplier, and supplied material to a DBE company that supplied material to a sub-contractor. The DBE company had filed for Bankruptcy...

Time Frame for a Prime to submit a subcontractor's invoiceI have a question regarding the Prime's delay in submitting a subcontractor's invoices to a vendor for payment. My business provided work for a Prime...

What other recourse do we have after time lapseWe are material suppliers in MO, supplying material to a Bonded job in Illinois. I know we normally have 90 days to file against a...

When unpaid for labor, material, or services furnished to a construction project or work of improvement in Illinois that is commissioned by the state, county,...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Illinois, and are not paid, you can file a “lien” against the project pursuant to Illinois’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Illinois also offers the ability to place a “lien on public contract funds” as well.

Illinois’s Little Miller Act (Public Construction Bond Act) is found in 30 ILCS 550/0.01 – 550/3, and the provisions for a “lien against public funds” is found in 770 ILCS 60/23; and are reproduced below. Updated as of 2020.

This Act may be cited as the Public Construction Bond Act.

Except as otherwise provided by this Act, all officials, boards, commissions, or agents of this State, or of any political subdivision thereof, in making contracts for public work of any kind costing over $50,000 to be performed for the State, or of any political subdivision thereof, shall require every contractor for the work to furnish, supply and deliver a bond to the State, or to the political subdivision thereof entering into the contract, as the case may be, with good and sufficient sureties. The surety on the bond shall be a company that is licensed by the Department of Insurance authorizing it to execute surety bonds and the company shall have a financial strength rating of at least A- as rated by A.M. Best Company, Inc., Moody’s Investors Service, Standard & Poor’s Corporation, or a similar rating agency. The amount of the bond shall be fixed by the officials, boards, commissions, commissioners or agents, and the bond, among other conditions, shall be conditioned for the completion of the contract, for the payment of material used in the work and for all labor performed in the work, whether by subcontractor or otherwise.

If the contract is for emergency repairs as provided in the Illinois Procurement Code, proof of payment for all labor, materials, apparatus, fixtures, and machinery may be furnished in lieu of the bond required by this Section.

Each such bond is deemed to contain the following provisions whether such provisions are inserted in such bond or not:

“The principal and sureties on this bond agree that all the undertakings, covenants, terms, conditions and agreements of the contract or contracts entered into between the principal and the State or any political subdivision thereof will be performed and fulfilled and to pay all persons, firms and corporations having contracts with the principal or with subcontractors, all just claims due them under the provisions of such contracts for labor performed or materials furnished in the performance of the contract on account of which this bond is given, when such claims are not satisfied out of the contract price of the contract on account of which this bond is given, after final settlement between the officer, board, commission or agent of the State or of any political subdivision thereof and the principal has been made.”

Each bond securing contracts between the Capital Development Board or any board of a public institution of higher education and a contractor shall contain the following provisions, whether the provisions are inserted in the bond or not:

“Upon the default of the principal with respect to undertakings, covenants, terms, conditions, and agreements, the termination of the contractor’s right to proceed with the work, and written notice of that default and termination by the State or any political subdivision to the surety (“Notice”), the surety shall promptly remedy the default by taking one of the following actions:

(1) The surety shall complete the work pursuant to a written takeover agreement, using a completing contractor jointly selected by the surety and the State or any political subdivision; or

(2) The surety shall pay a sum of money to the obligee, up to the penal sum of the bond, that represents the reasonable cost to complete the work that exceeds the unpaid balance of the contract sum.

The surety shall respond to the Notice within 15 working days of receipt indicating the course of action that it intends to take or advising that it requires more time to investigate the default and select a course of action. If the surety requires more than 15 working days to investigate the default and select a course of action or if the surety elects to complete the work with a completing contractor that is not prepared to commence performance within 15 working days after receipt of Notice, and if the State or any political subdivision determines it is in the best interest of the State to maintain the progress of the work, the State or any political subdivision may continue to work until the completing contractor is prepared to commence performance. Unless otherwise agreed to by the procuring agency, in no case may the surety take longer than 30 working days to advise the State or political subdivision on the course of action it intends to take. The surety shall be liable for reasonable costs incurred by the State or any political subdivision to maintain the progress to the extent the costs exceed the unpaid balance of the contract sum, subject to the penal sum of the bond.”

The surety bond required by this Section may be acquired from the company, agent or broker of the contractor’s choice. The bond and sureties shall be subject to the right of reasonable approval or disapproval, including suspension, by the State or political subdivision thereof concerned. In the case of State construction contracts, a contractor shall not be required to post a cash bond or letter of credit in addition to or as a substitute for the surety bond required by this Section.

When other than motor fuel tax funds, federal‑aid funds, or other funds received from the State are used, a political subdivision may allow the contractor to provide a non‑diminishing irrevocable bank letter of credit, in lieu of the bond required by this Section, on contracts under $100,000 to comply with the requirements of this Section. Any such bank letter of credit shall contain all provisions required for bonds by this Section.

For the purposes of this Section, the terms “material”, “labor”, “apparatus”, “fixtures”, and “machinery” include those rented items that are on the construction site and those rented tools that are used or consumed on the construction site in the performance of the contract on account of which the bond is given.

This Act applies to any public private agreement entered into under the Public Private Agreements for the Illiana Expressway Act or the Public-Private Agreements for the South Suburban Airport Act.

This Act applies to any public-private agreement entered into under the Public-Private Partnerships for Transportation Act.

Every person furnishing material, apparatus, fixtures, machinery, or performing labor, either as an individual or as a sub-contractor, hereinafter referred to as Claimant, for any contractor, with the State, or a political subdivision thereof where bond or letter of credit shall be executed as provided in this Act, shall have the right to sue on such bond or letter of credit in the name of the State, or the political subdivision thereof entering into such contract, as the case may be, for his use and benefit, and in such suit the plaintiff shall file a copy of such bond or letter of credit, certified by the party or parties in whose charge such bond or letter of credit shall be, which copy shall, unless execution thereof be denied under oath, be prima facie evidence of the execution and delivery of the original; provided, however, that this Act shall not be taken to in any way make the State, or the political subdivision thereof entering into such contract, as the case may be, liable to such sub-contractor, materialman or laborer to any greater extent than it was liable under the law as it stood before the adoption of this Act.

Provided, however, that any Claimant having a claim for labor, material, apparatus, fixtures, and machinery furnished to the State shall have no such right of action unless it shall have filed a verified notice of said claim with the officer, board, bureau or department awarding the contract, within 180 days after the date of the last item of work or the furnishing of the last item of materials, apparatus, fixtures, and machinery, and shall have furnished a copy of such verified notice to the contractor within 10 days of the filing of the notice with the agency awarding the contract.

When any Claimant has a claim for labor, material, apparatus, fixtures, and machinery furnished to a political subdivision, the Claimant shall have no right of action unless it shall have filed a verified notice of that claim with the Clerk or Secretary of the political subdivision within 180 days after the date of the last item of work or furnishing of the last item of materials, apparatus, fixtures, and machinery, and shall have filed a copy of that verified notice upon the contractor in a like manner as provided herein within 10 days after the filing of the notice with the Clerk or Secretary.

The Claimant may file said verified notice by using personal service or by depositing the verified notice in the United States Mail, postage prepaid, certified or restricted delivery return receipt requested limited to addressee only. The verified notice shall be deemed filed on the date personal service occurs or the date when the verified notice is mailed in the form and manner provided in this Section.

The claim shall be verified and shall contain (1) the name and address of the claimant; the business address of the Claimant within this State and if the Claimant shall be a foreign corporation having no place of business within the State, the notice shall state the principal place of business of said corporation and in the case of a partnership, the notice shall state the names and residences of each of the partners; (2) the name of the contractor for the government; (3) the name of the person, firm or corporation by whom the Claimant was employed or to whom he or it furnished materials, apparatus, fixtures, or machinery; (4) a brief description of the public improvement; (5) a description of the Claimant’s contract as it pertains to the public improvement, describing the work done by the Claimant and stating the total amount due and unpaid as of the date of verified notice.

No defect in the notice herein provided for shall deprive the Claimant of his right of action under this article unless it shall affirmatively appear that such defect has prejudiced the rights of an interested party asserting the same.

Provided, further, that no action shall be brought later than one year after the date of the furnishing of the last item of work, materials, apparatus, fixtures, or machinery by the Claimant. Such action shall be brought only in the circuit court of this State in the judicial circuit in which the contract is to be performed.

The remedy provided in this Section is in addition to and independent of any other rights and remedies provided at law or in equity. A waiver of rights under the Mechanics Lien Act shall not constitute a waiver of rights under this Section unless specifically stated in the waiver.

For the purposes of this Section, the terms “material”, “labor”, “apparatus”, “fixtures”, and “machinery” include those rented items that are on the construction site and those rented tools that are used or consumed on the construction site in the performance of the contract on account of which the bond is given.

(a) A county or municipality may not require a cash bond, irrevocable letter of credit, surety bond, or letter of commitment issued by a bank, savings and loan association, surety, or insurance company from a builder or developer to guarantee completion of a project improvement when the builder or developer has filed with the county or municipal clerk a current, irrevocable letter of credit, surety bond, or letter of commitment issued by a bank, savings and loan association, surety, or insurance company, deemed good and sufficient by the county or municipality accepting such security, in an amount equal to or greater than 110% of the amount of the bid on each project improvement. A builder or developer has the option to utilize a cash bond, irrevocable letter of credit, surety bond, or letter of commitment, issued by a bank, savings and loan association, surety, or insurance company, deemed good and sufficient by the county or municipality, to satisfy any cash bond requirement established by a county or municipality. Except for a municipality or county with a population of 1,000,000 or more, the county or municipality must approve and deem a surety or insurance company good and sufficient for the purposes set forth in this Section if the surety or insurance company is authorized by the Illinois Department of Insurance to sell and issue sureties in the State of Illinois.

(b) If a county or municipality receives a cash bond, irrevocable letter of credit, or surety bond from a builder or developer to guarantee completion of a project improvement, the county or municipality shall (i) register the bond under the address of the project and the construction permit number and (ii) give the builder or developer a receipt for the bond. The county or municipality shall establish and maintain a separate account for all cash bonds received from builders and developers to guarantee completion of a project improvement.

(c) The county or municipality shall refund a cash bond to a builder or developer, or release the irrevocable letter of credit or surety bond, within 60 days after the builder or developer notifies the county or municipality in writing of the completion of the project improvement for which the bond was required. For these purposes, “completion” means that the county or municipality has determined that the project improvement for which the bond was required is complete or a licensed engineer or licensed architect has certified to the builder or developer and the county or municipality that the project improvement has been completed to the applicable codes and ordinances. The county or municipality shall pay interest to the builder or developer, beginning 60 days after the builder or developer notifies the county or municipality in writing of the completion of the project improvement, on any bond not refunded to a builder or developer, at the rate of 1% per month.

(d) A home rule county or municipality may not require or maintain cash bonds, irrevocable letters of credit, surety bonds, or letters of commitment issued by a bank, savings and loan association, surety, or insurance company from builders or developers in a manner inconsistent with this Section. This Section supercedes and controls over other provisions of the Counties Code or Illinois Municipal Code as they apply to and guarantee completion of a project improvement that is required by the county or municipality, regardless of whether the project improvement is a condition of annexation agreements. This Section is a denial and limitation under subsection (i) of Section 6 of Article VII of the Illinois Constitution on the concurrent exercise by a home rule county or municipality of powers and functions exercised by the State.

(a) For the purpose of this Section “contractor” includes any sub-contractor; “State” includes any department, board or commission thereof, or other person financing and constructing any public improvements for the benefit of the State or any department, board or commission thereof; and “director” includes any chairman or president of any State department, board or commission, or the president or chief executive officer or such other person financing and constructing a public improvement for the benefit of the State.

(a-5) For the purpose of this Section, “unit of local government” includes any unit of local government as defined in the Illinois Constitution of 1970, and any entity, other than the State, organized for the purpose of conducting public business pursuant to the Intergovernmental Cooperation Act or the General Not For Profit Corporation Act of 1986, or where a not-for-profit corporation is owned, operated, or controlled by one or more units of local government for the purpose of conducting public business.

(b) Any person who shall furnish labor, services, material, fixtures, apparatus or machinery, forms or form work to any contractor having a contract for public improvement for any county, township, school district, city, municipality, municipal corporation, or any other unit of local government in this State, shall have a lien for the value thereof on the money, bonds, or warrants due or to become due the contractor having a contract with such county, township, school district, municipality, municipal corporation, or any other unit of local government in this State under such contract. The lien shall attach only to that portion of the money, bonds, or warrants against which no voucher or other evidence of indebtedness has been issued and delivered to the contractor by or on behalf of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government as the case may be at the time of the notice.

(1) No person shall have a lien as provided in this subsection (b) unless such person shall, before payment or delivery thereof is made to such contractor, notify the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government by written notice of the claim for lien containing a sworn statement identifying the claimant’s contract, describing the work done by the claimant, and stating the total amount due and unpaid as of the date of the notice for the work and furnish a copy of said notice at once to said contractor. The person claiming such lien may cause notification and written notice thereof to be given either by sending the written notice (by registered or certified mail, return receipt requested, with delivery limited to addressee only) to, or by delivering the written notice to the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government; and the copy of the written notice which the person claiming the lien is to furnish to the contractor may be sent to, or delivered to such contractor in like manner. The notice shall be effective when received or refused by the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government.

(2) Provided further, that where such person has not so notified the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government of his claim for a lien, upon written demand of the contractor with service by certified mail (return receipt requested) and with a copy filed with the clerk or secretary, as the case may be, that person shall, within 30 days, notify the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government of his claim for a lien by either sending or delivering written notice in like manner as above provided for causing notification and written notice of a claim for lien to be given to such clerk or secretary, as the case may be, or the lien shall be forfeited.

(3) No official shall withhold from the contractor money, bonds, warrants, or funds on the basis of a lien forfeited as provided herein.

(4) The person so claiming a lien shall, within 90 days after serving such notice commence proceedings by complaint for an accounting, making the contractor having a contract with the county, township, school district, city, municipality, municipal corporation, or any other unit of local government and the contractor to whom such labor, services, material, fixtures, apparatus or machinery, forms or form work was furnished, parties defendant, and shall within 10 days after filing the complaint notify the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government of the commencement of such suit by delivering to him or them a copy of the complaint filed.

(5) Failure to commence proceedings by complaint for accounting within 90 days after serving notice of lien shall terminate the lien and no subsequent notice of lien may be given for the same claim nor may that claim be asserted in any proceedings pursuant to this Act, provided, however, that failure to file the complaint after notice of the claim for lien shall not preclude a subsequent notice or action for an amount or amounts becoming due to the lien claimant on a date after the prior notice or notices.

(6) It shall be the duty of any such clerk or secretary, as the case may be, upon receipt of the first notice herein provided for to cause to be withheld a sufficient amount to pay such claim for the period limited for the filing of suit plus the period for notice to the clerk or secretary of the suit, unless otherwise notified by the person claiming the lien. Upon the expiration of this period the money, bonds or warrants so withheld shall be released for payment to the contractor unless the person claiming the lien shall have instituted proceedings and delivered to the clerk or secretary, as the case may be, of the county, township, school district, city, municipality, municipal corporation, or any other unit of local government a copy of the complaint as herein provided, in which case, the amount claimed shall be withheld until the final adjudication of the suit is had. Provided, that the clerk or secretary, as the case may be, to whom a copy of the complaint is delivered as herein provided may pay over to the clerk of the court in which such suit is pending a sum sufficient to pay the amount claimed to abide the result of such suit and be distributed by the clerk according to the judgment rendered or other court order. Any payment so made to such claimant or to the clerk of the court shall be a credit on the contract price to be paid to such contractor.

(c) Any person who shall furnish labor, services, material, fixtures, apparatus or machinery, forms or form work to any contractor having a contract for public improvement for the State, may have a lien for the value thereof on the money, bonds or warrants due or about to become due the contractor having a contract with the State under the contract. The lien shall attach to only that portion of the money, bonds or warrants against which no voucher has been issued and delivered by the State.

(1) No person or party shall have a lien as provided in this subsection (c) unless such person shall, before payment or delivery thereof is made to the contractor, notify the Director or other official, whose duty it is to let such contract, written notice of a claim for lien containing a sworn statement identifying the claimant’s contract, describing the work done by the claimant and stating the total amount due and unpaid as of the date of the notice for the work. The claimant shall furnish a copy of said notice at once to the contractor. The person claiming such lien may cause such written notice with sworn statement of the claim to be given either by sending such notice (by registered or certified mail, return receipt requested, with delivery limited to addressee only) to, or by delivering such notice to the Director or other official of the State whose duty it is to let such contract; and the copy of such notice which the person claiming the lien is to furnish to the contractor may be sent to, or delivered to such contractor in like manner. The notice shall be effective when received or refused by the Director or other official whose duty it is to let the contract.

(2) Provided, that where such person has not so notified the Director or other official of the State, whose duty it is to let such contract, of his claim for a lien, upon written demand of the contractor, with service by certified mail (return receipt requested) and with a copy filed with such Director or other official of the State, that person shall, within 30 days, notify the Director or other official of the State, whose duty it is to let such contract, of his claim for a lien by either sending or delivering written notice in like manner as above provided for giving written notice with sworn statement of claim to such Director or official, or the lien shall be forfeited.

(3) No public official shall withhold from the contractor money, bonds, warrants or funds on the basis of a lien forfeited as provided herein.

(4) The person so claiming a lien shall, within 90 days after serving such notice, commence proceedings by complaint for an accounting, making the contractor having a contract with the State and the contractor to whom such labor, services, material, fixtures, apparatus or machinery, forms or form work was furnished, parties defendant, and shall, within 10 days after filing the suit notify the Director of the commencement of such suit by delivering to him a copy of the complaint filed; provided, if money appropriated by the General Assembly is to be used in connection with the construction of such public improvement, that suit shall be commenced and a copy of the complaint delivered to the Director not less than 15 days before the date when the appropriation from which such money is to be paid, will lapse.

(5) Failure to commence proceedings by complaint for accounting within 90 days after serving notice of lien pursuant to this subsection shall terminate the lien and no subsequent notice of lien may be given for the same claim nor may that claim be asserted in any proceedings pursuant to this Act, provided, however, that failure to file suit after notice of a claim for lien shall not preclude a subsequent notice or action for an amount or amounts becoming due to the lien claimant on a date after the prior notice or notices.

(6) It shall be the duty of the Director, upon receipt of the written notice with sworn statement as herein provided, to withhold payment of a sum sufficient to pay the amount of such claim, for the period limited for the filing of suit plus the period for the notice to the Director, unless otherwise notified by the person claiming the lien. Upon the expiration of this period the money, bonds, or warrants so withheld shall be released for payment to the contractor unless the person claiming the lien shall have instituted proceedings and delivered to the Director a copy of the complaint as herein provided, in which case, the amount claimed shall be withheld until the final adjudication of the suit is had. Provided, the Director or other official may pay over to the clerk of the court in which such suit is pending, a sum sufficient to pay the amount claimed to abide the result of such suit and be distributed by the clerk according to the judgment rendered or other court order. Any payment so made to such claimant or to the clerk of the court shall be a credit on the contract price to be paid to such contractor.

(d) Any officer of the State, county, township, school district, city, municipality, municipal corporation, or any other unit of local government violating the duty hereby imposed upon him shall be liable on his official bond to the claimant giving notice as provided in this Section for the damages resulting from such violation, which may be recovered in a civil action in the circuit court. There shall be no preference between the persons giving such notice, but all shall be paid pro rata in proportion to the amount due under their respective contracts.

(e) In the event a suit to enforce a claim based on a notice of claim for lien is commenced in accordance with this Section, and the suit is subsequently dismissed, the lien for the work claimed under the notice of claim for lien shall terminate 30 days after the effective date of the order dismissing the suit unless the lien claimant shall file a motion to reinstate the suit, a motion to reconsider, or a notice of appeal within the 30-day period. Notwithstanding the foregoing, nothing contained in this Section shall prevent a public body from paying a lien claim in less than 30 days after dismissal.

(f) Unless the contract with the State, county, township, school district, city, municipality, municipal corporation, or any other unit of local government otherwise provides, no lien for material shall be defeated because of lack of proof that the material after the delivery thereof, actually entered into the construction of the building or improvement, even if it be shown that the material was not actually used in the construction of the building or improvement so long as it is shown that the material was delivered either (i) to the owner or its agent for that building or improvement, to be used in that building or improvement or (ii) pursuant to the contract, at the place where the building or improvement was being constructed or some other designated place, for the purpose of being used in construction or for the purpose of being employed in the process of construction as a means for assisting in the erection of the building or improvement in what is commonly termed forms or form work where concrete, cement, or like material is used, in whole or in part.