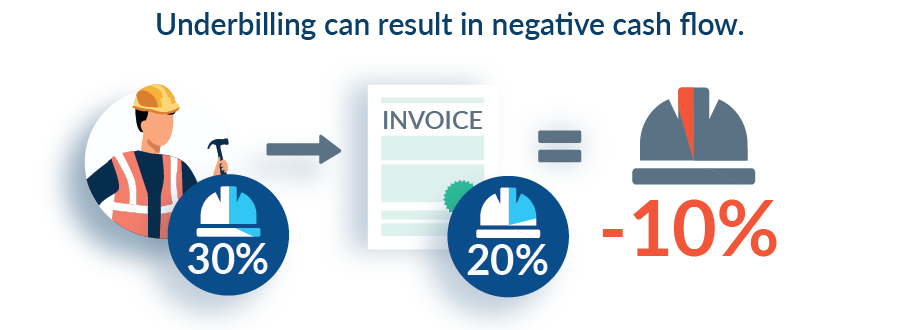

Underbilling in the construction industry describes the practice of not fully billing for all of the labor, materials, and services delivered in a billing cycle. Underbilling can lead to significant cash flow problems for contractors on their projects and jobs. A discussion of underbilling in the construction industry continues below.

What Is Underbilling?

Video Summary of Underbilling

How Underbilling Can Hurt Your Cash Flow

From a project cash flow perspective, underbilling is usually not good. Simply put, a contractor who is underbilling customers has cash going out the door (in the form of project costs) but does not have the corresponding revenue coming in, leading to a period of diminished, neutral, or, if the underbilling is significant enough, negative cash flow for however long the underbilling lasts.

One of the biggest and most common reasons why construction companies run into systemic underbilling problems on their projects is due to slow billing practices. If a contractor is supposed to get his progress bills to his customer on the 1st of every month, but doesn’t get around to it until the 10th, that’s a quintessential example of underbilling (and very poor A/R management!).

Underbilling caused by slow billing practices should only have a negative impact on cash flow that’s temporary. In theory, when the company finally “catches up” on their project billing, they should “become whole” on the project from a cash flow standpoint (if you ignore the time value of money).

How Bad Project Management Contributes to Underbilling

However, companies that have slow billing procedures, or sloppy A/R management, are far more likely to make other mistakes as well. And certain types of underbilling situations don’t “even out” in the end; rather, they turn into unrecoverable losses. Some of the bad practices that lead to these more destructive forms of underbilling include:

- Inability to correctly estimate jobs; underestimating project costs

- Unrecognized overbilling at the beginning of a project leading to underbillings towards the end

- Weak project management control

- Unapproved change orders

The first 2 bullet points are pretty straightforward and can be best illustrated by our old friends from the overbilling article, ACME Company. In the sample project above, what if ACME had, unbeknownst to them, underestimated their project costs by $10,000? So, the whole time they think it’s going to cost them $50,000 to complete the project, but when they get to the end, the project ends up costing $60,000. Each month along the way, ACME is sending their customer a bill for what they think is 20% of the project. But they were actually overbilling the customer by a few percentage points, so when they get to the 5th and final month, they’re not 80% complete on the project, they’re actually only about two-thirds complete. They’ve only got one final bill remaining for $12,000 that they can send, but finishing the project is going to take another $20,000 in cash to cover all of the project costs.

Due to their poor estimating, ACME is going to just break even on this project, spending $60,000 in costs to complete a contract worth the same. But from a cash flow standpoint, that 5th month is an absolute killer, because ACME has to spend $20,000 to finish the project, but only has $12,000 in revenue coming in resulting in net negative cash flow of $8,000 for the period. Yikes!

Unbillable Work and Unapproved Change Orders

Generally speaking, “weak project management control” is a company incurring costs on a project for unbillable work. An example of this is using stored materials on a project from the company’s existing inventory, then not including those materials in their invoicing. Another common example would be pulling labor off of one project and putting it on another without updating the original project cost estimates to capture the additional labor cost. In both of these examples, the actual costs on the project will be higher for the company due to utilizing resources on the project that they can’t bill for.

And last but certainly not least, we have that giant construction industry bugaboo, change orders. While a thorough discussion of change orders would require more space than we have here, unapproved change orders lead to permanent, unrecoverable underbillings when a customer refuses to pay (for the work included in the unapproved change order). The contractor spent the money to complete the change order, but because it never was approved, their customer has decided not to pay for that work. Those uncompensated costs can be a financial killer for any construction company.

Can Underbilling Ever Help You Financially?

Underbilling is almost never a good thing. The only situation on a jobsite where underbilling is favorable is when a company beats their cost estimates on the project. If a company spends $45,000 to complete a project that they thought was going to cost $50,000, then each progress billing (until the final bill) is technically underbilled, even though it’s really not. It’s just an example of a well-run company doing a great job of cost control and squeezing more profit out of less costs. It’s a worthy goal to aim for, but calling it “underbilling” would be misleading.

Conclusion — Underbilling Almost Never a Good Thing

Unlike it’s friendlier sibling ‘overbilling,’ underbilling on construction projects is almost never a good thing. The construction industry operates on such razor-thin profit margins that even a temporary hit to cash flow – caused by underbilling due to late payment practices – can have enough of a negative financial impact to do real damage. However, both under- and overbilling on a project indicate that a construction company lacks financial control and accounting effectiveness. And in the construction industry, that can be deadly.

Helpful Resources Available

- Bad debt is a like a “silent killer” for the construction industry — the threat is always there. Even worse, bad debt is very, very expensive. If you want to get an idea for just how much, download our Bad Debt Calculator (Excel template). Enter in a few actual numbers from your business and you can calculate how much a bad debt will cost you.

- Credit management is an essential function for many businesses in the construction industry -particularly for material suppliers. If you’d like some pointers on this important topic, download our Ultimate Guide to Construction Credit eBook.

More Articles on Construction Accounting

- What Is Overbilling?

- What Is a Schedule of Values?

- What Is a Work in Progress Schedule?

- Top 3 Causes of Hidden Losses in Construction