Organization is key when it comes to recording financial transactions and creating financial statements. A chart of accounts provides the structure to organize a construction company’s financial transactions. It’s a key component of a company’s financial recording and reporting system.

Creating a chart of accounts for construction isn’t easy, but it doesn’t have to be stressful either. If you’re starting out with a new accounting software package, most will provide a basic structure for you. From there you just need to add the accounts your construction business needs. But first, it helps to get an understanding of what a chart of accounts is, what it does, and what it looks like.

What is a chart of accounts?

A chart of accounts (COA) is a listing of all the financial accounts in a company’s general ledger (GL). They are grouped into categories that correspond to the structure of construction company’s financial statements. These GL accounts are used to categorize every financial transaction a company makes.

The chart itself consists of a list of numbered accounts, with their name and a short description of what’s included in that account.

There is a generally accepted numbering structure for the accounts, so everyone’s accounts appear in roughly the same order. Account numbers can be three or four digits long and may include added numbers signifying divisions, depending on how the company is organized.

Chart of accounts setup

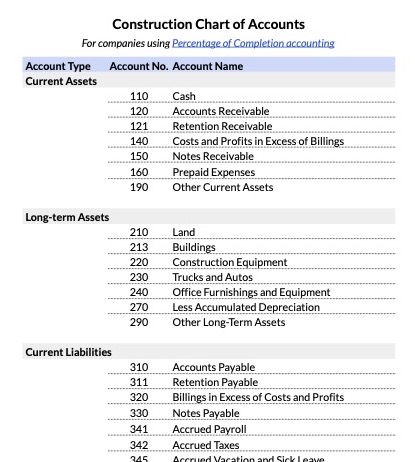

Here is a sample list of account numbers to show the standard setup and numbering:

- 1000 – 1999 Assets

- 2000 – 2999 Liabilities

- 3000 – 3999 Equity

- 4000 – 4999 Income or Revenue

- 5000 – 5999 Job Costs/Cost of Goods Sold

- 6000 – 6999 Overhead Costs or Expenses

- 7000 – 7999 Other Income

- 8000 – 8999 Other Expense

The actual numbering system is up to you, and largely depends on the number of accounts you need to track. While large companies often use numbering in the thousands, smaller companies can do just fine with accounts numbered in the hundreds.

The accounts in the list provide the structure for the company’s financial statements and are tailored to provide the information needed on those reports. Common reports for construction include the balance sheet, income statement, and work in progress report.

Using QuickBooks? Learn how to set up a Chart of Accounts for contractors.

How a chart of accounts works in construction

The chart of accounts for a construction company is used to organize financial transactions in order to build financial statements.

As transactions are entered into the accounting software, they are posted to the appropriate accounts in a double-entry system. Financial statements provide a summary of these transaction amounts for a given time period.

The accounts are grouped into categories that are based on the type of work the company performs and how income is recognized. For example, material suppliers and equipment rental companies are going to have very different charts of accounts than a contractor. Each company develops its own COA, based on its requirements, so no two companies are exactly alike.

Once the overall structure of the chart is established, it shouldn’t change often. Accounts can be added as needed throughout the year, but any major changes are reserved for the start of a new fiscal year to avoid confusion.

If you’re looking to revamp your chart of accounts, consult with your accountant about the best time to do it. They’ll have some advice and best practices, so you don’t lose transactions or end up creating incorrect financial statements.

Why construction businesses need a chart of accounts

A well-organized chart of accounts standardizes the accounting process and provides the structure for financial statements. If recurring transactions go to one account this month and another account next month, there’s no consistency and no one can have an accurate picture of how much is being spent.

By providing an organized structure and posting similar transactions consistently to the same accounts, you’ll have more accurate financial statements that allow you to make accurate business decisions for your company.

Your account structure should be clearly defined so that employees aren’t guessing where to post transactions when they come in.

It’s possible to have too many or too few accounts. The best bet is to start with a fairly standard chart, add accounts you know you want to track that are specific for your company, and then wait a couple of months and reevaluate. If there are expenses that aren’t getting categorized correctly, look at redefining or renaming accounts to make them clearer.

The more accurate your categorization of transactions is, the better your financial statements will be. You’ll have confidence that all the reports are capturing true costs if your structure provides enough detail to see where the money goes.

How to create a chart of accounts for a construction company

Before you start creating your own COA, there are some key items that’ll help shape your account structure — whether you are a supplier or contractor, how you recognize income, and whether you track indirect expenses.

Material suppliers and contractors require two different COA structures. For suppliers, the account structure is much simpler than a contractor. You recognize income when you sell your materials, and you generally aren’t tracking the progress of projects.

Contractors have more complex income streams and generally are recognizing their income based on completion of work.

Download a sample chart of accounts for construction

Get a free chart of accounts for construction, including versions for both percentage of completion and completed contract methods of accounting.

Recognizing income

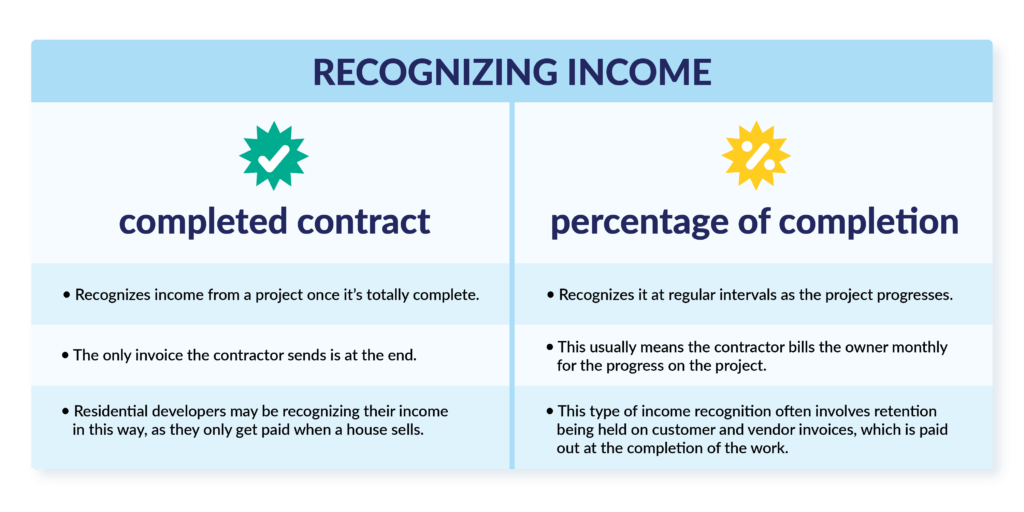

If you’re a contractor, there are two fundamental ways to recognize income — completed contract or percentage of completion.

The first recognizes income from a project once it’s totally complete. The only invoice the contractor sends is at the end. Residential developers may be recognizing their income in this way, as they only get paid when a house sells.

The second way of recognizing income — percentage of completion — recognizes it at regular intervals as the project progresses. This usually means the contractor bills the owner monthly for the progress on the project. This type of income recognition often involves retention being held on customer and vendor invoices, which is paid out at the completion of the work.

Tracking indirect expenses

Indirect expenses are expenses that provide support to the construction of projects. Examples include vehicle expenses for your workers, cell phones, uniforms, etc.

Some companies track these as administrative expenses and others track them as indirect job expenses — they are expenses that go towards a job but aren’t specific to any one entity. If you want to track these expenses separately, you’ll need a category for them.

Once you’ve figured out what type of company you are (supplier or contractor), how you recognize your income, and whether you want to track indirect expenses, you can begin to put together your COA. It’s easiest to start with one that is similar to the structure you need, and then add and remove accounts as needed to fit your situation.

Basic account categories

While every chart is different, there are some basic categories that most companies will want to include.

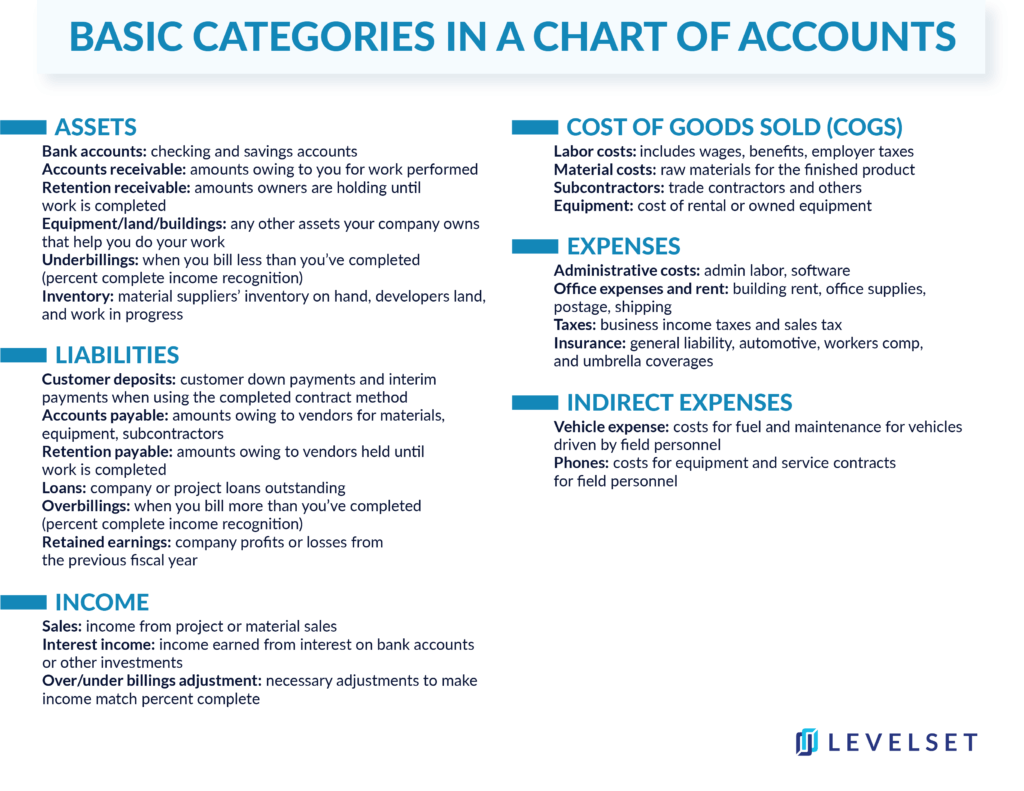

Assets

- Bank accounts: checking and savings accounts

- Accounts receivable: amounts owing to you for work performed

- Retention receivable: amounts owners are holding until work is completed

- Equipment/land/buildings: any other assets your company owns that help you do your work

- Underbillings: when you bill less than you’ve completed (percent complete income recognition)

- Inventory: material suppliers’ inventory on hand, developers land and work in progress

Liabilities

- Customer deposits: customer down payments and interim payments when using the completed contract method

- Accounts payable: amounts owing to vendors for materials, equipment, subcontractors

- Retention payable: amounts owing to vendors held until work is completed

- Loans: company or project loans outstanding

- Overbillings: when you bill more than you’ve completed (percent complete income recognition)

- Retained earnings: company profits or losses from the previous fiscal year

Income

- Sales: income from project or material sales

- Interest income: income earned from interest on bank accounts or other investments

- Over/under billings adjustment: necessary adjustments to make income match percent complete

Cost of Goods Sold (COGS)

- Labor costs: includes wages, benefits, employer taxes

- Material costs: raw materials for the finished product

- Subcontractors: trade contractors and others

- Equipment: cost of rental or owned equipment

Learn how to calculate cost of goods sold in construction

Expenses

- Administrative costs: admin labor, software

- Office expenses and rent: building rent, office supplies, postage, shipping

- Taxes: business income taxes and sales tax

- Insurance: general liability, automotive, workers comp, and umbrella coverages

Indirect expenses

- Vehicle expense: costs for fuel and maintenance for vehicles driven by field personnel

- Phones: costs for equipment and service contracts for field personnel

Accounts for Accrual Accounting Methods

Accounts for Percentage of Completion Method

Percentage of completion requires two additions to the chart of accounts:

- Costs and profits in excess of billings (under billings)

- Billings in excess of cost and profits (over billings)

Accounts for Completed Contract Method

The completed contract method is mostly used by owner-builders and spec developers because the sale price is not known until the project is complete.. Using this method, revenues and expenses are recorded when the sale is closed.

If your company is using the completed contract method, you will need to add several accounts to the chart of accounts. Here are some examples:

Short-term assets

- Construction work in progress

- Finished units or homes

- Funds due on construction and development loans

Long-term assets

These may also include accounts for long-term assets, like:

- Land and lots

- Finished units

- Model homes

- Model furnishings for assets not expected to be sold within a year

Other accounts

Liability accounts include warranty reserves to account for any future warranty claims.

Construction cost accounts include land and design fees.

And finally, accounts for general overhead expenses like marketing, model homes and sales office, closing costs, and bad debts.

Using software to manage your chart of accounts

The more complicated your COA, the harder it can be to keep track of all the accounts and transactions. Most accounting software packages have chart templates you can use as a starting place, depending on the type of company you operate.

Many businesses use Microsoft Excel or Intuit Quickbooks for accounting, but other popular software options for construction contractors include:

- FreshBooks

- ComputerEase

- Sage 100 Contractor

- CoConstruct (for home builders and remodelers)

Read More: 5 Quickbooks Tips for Contractors

You’ll want to personalize both the accounts list and the numbering system, so they fit your company and how you want to present your financial statements. And remember, it’s a good idea to meet with your accountant before implementing a new account structure.

Get the low-down on construction accounting, including more information on chart of accounts, common construction accounting reports, and more with Levelset’s Ultimate Guide to Construction Accounting.