Delaware Payment Terms Overview

- Private Jobs

- Public Jobs

- Top Links

Pay When Paid (Maybe?) Enforceable as Timing Clause

Pay when paid clauses were enforceable in Delaware prior to the passage of a statutory ban on pay-if-paid contracts. Accordingly, it is now unclear whether pay when paid clauses will be interpreted as a "pay if paid" clause subject to the ban, or if they can be enforced as a timing mechanism. In any event, a pay when paid clause would not be allowed to serve as a condition precedent to completely bar payment.

Pay If Paid Not Valid

With respect to private projects in Delaware, pay if paid clauses are unenforceable by statute.

Trust Fund Statute Exists

Delaware’s construction trust fund statute is strong, and applies to all parties (other than the owner) who both receive funds and also owe payment down the payment chain. There are no specific requirements regarding keeping trust funds in separate accounts or avoiding commingling of funds, provided the payments subject to the trust requirements end up in the right place.

The penalties for violation of the trust fund provisions in Delaware are strong.

Retainage Unregulated

Delaware has no specific statutes governing retainage on private projects. Accordingly, retainage is governed by the contract between the parties.

Payment Due to Subs/Suppliers in 15 Days

For Subs & Suppliers, payment is required to be made within 15 days of receipt of payment from above , unless otherwise agreed by contract. Payment to GCs is required within 30 days from invoice or end of the billing cycle.

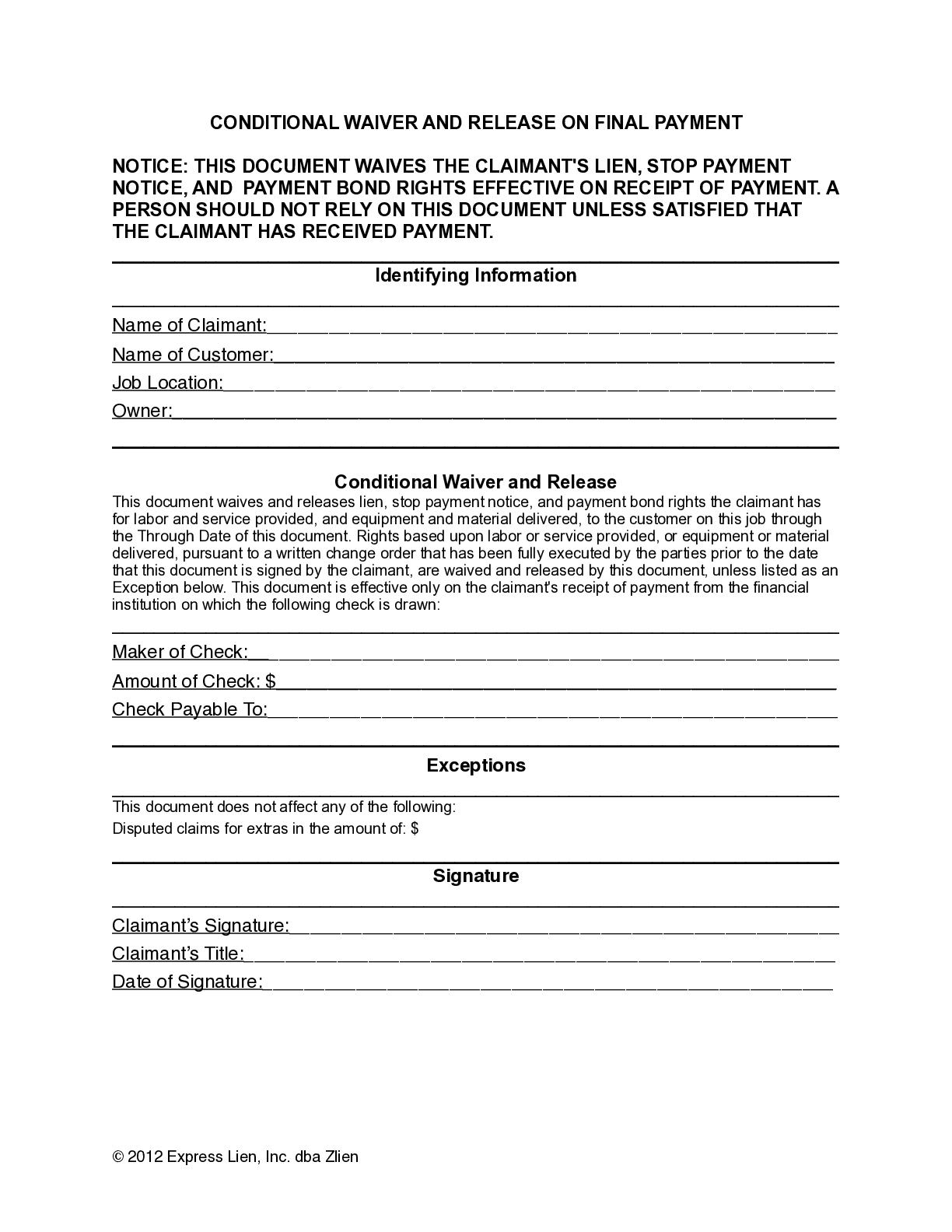

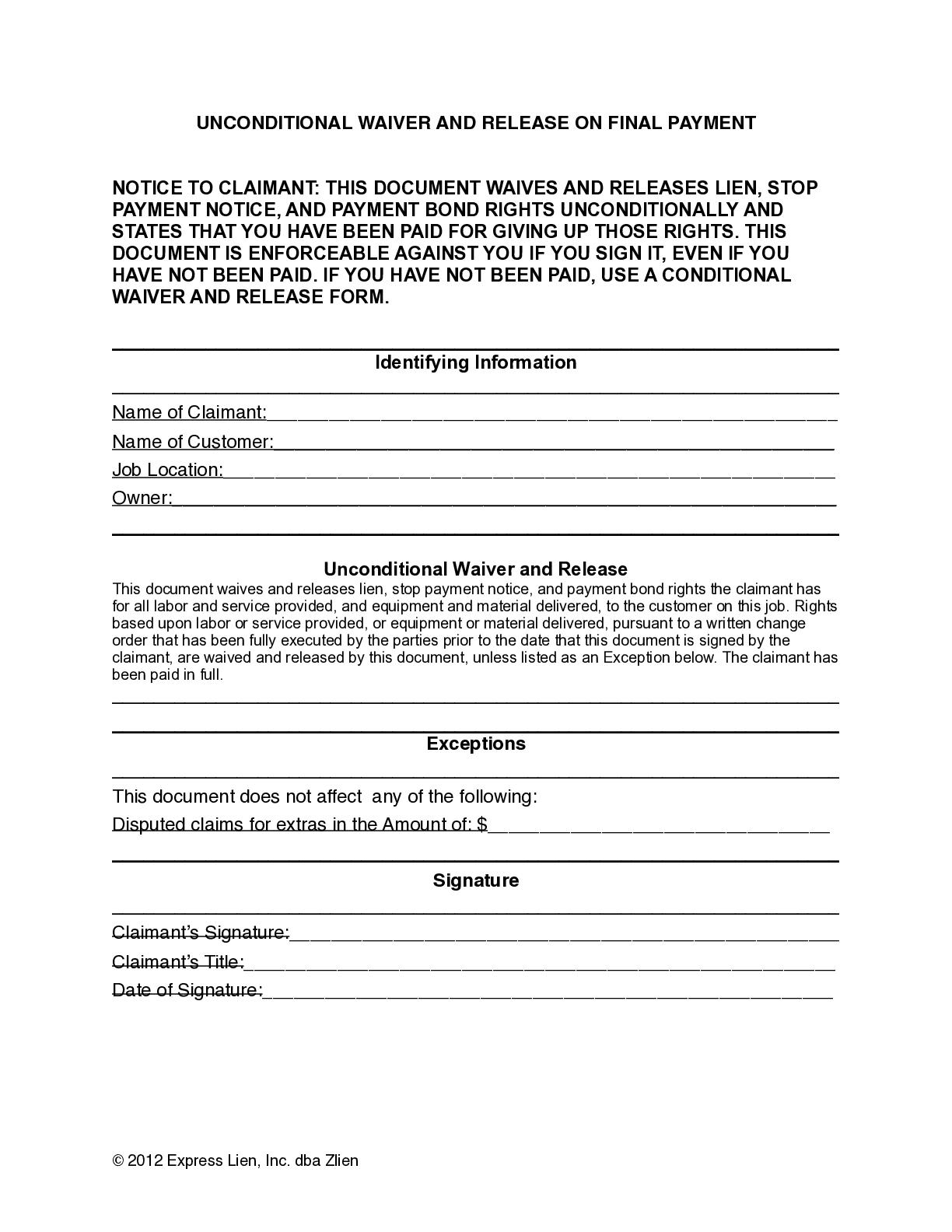

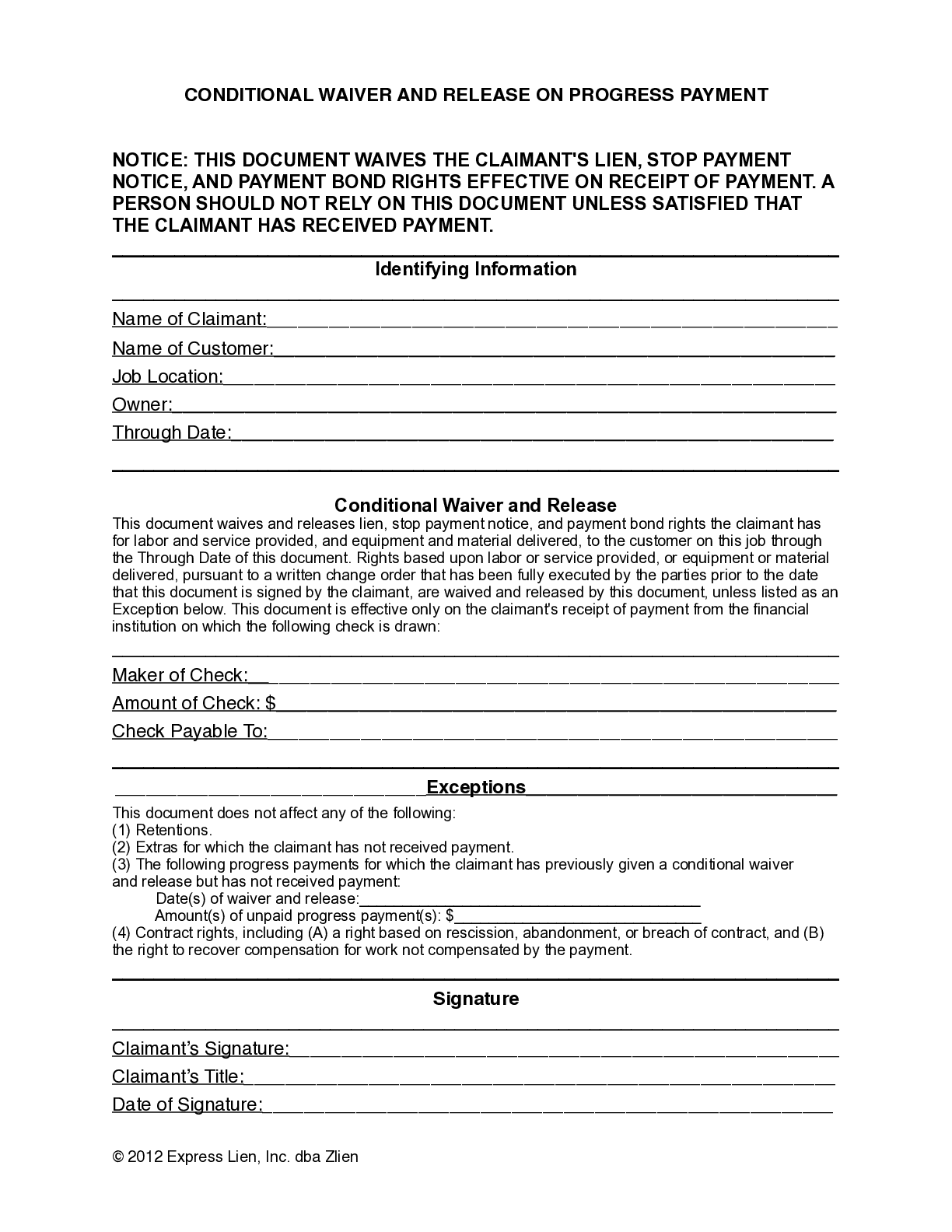

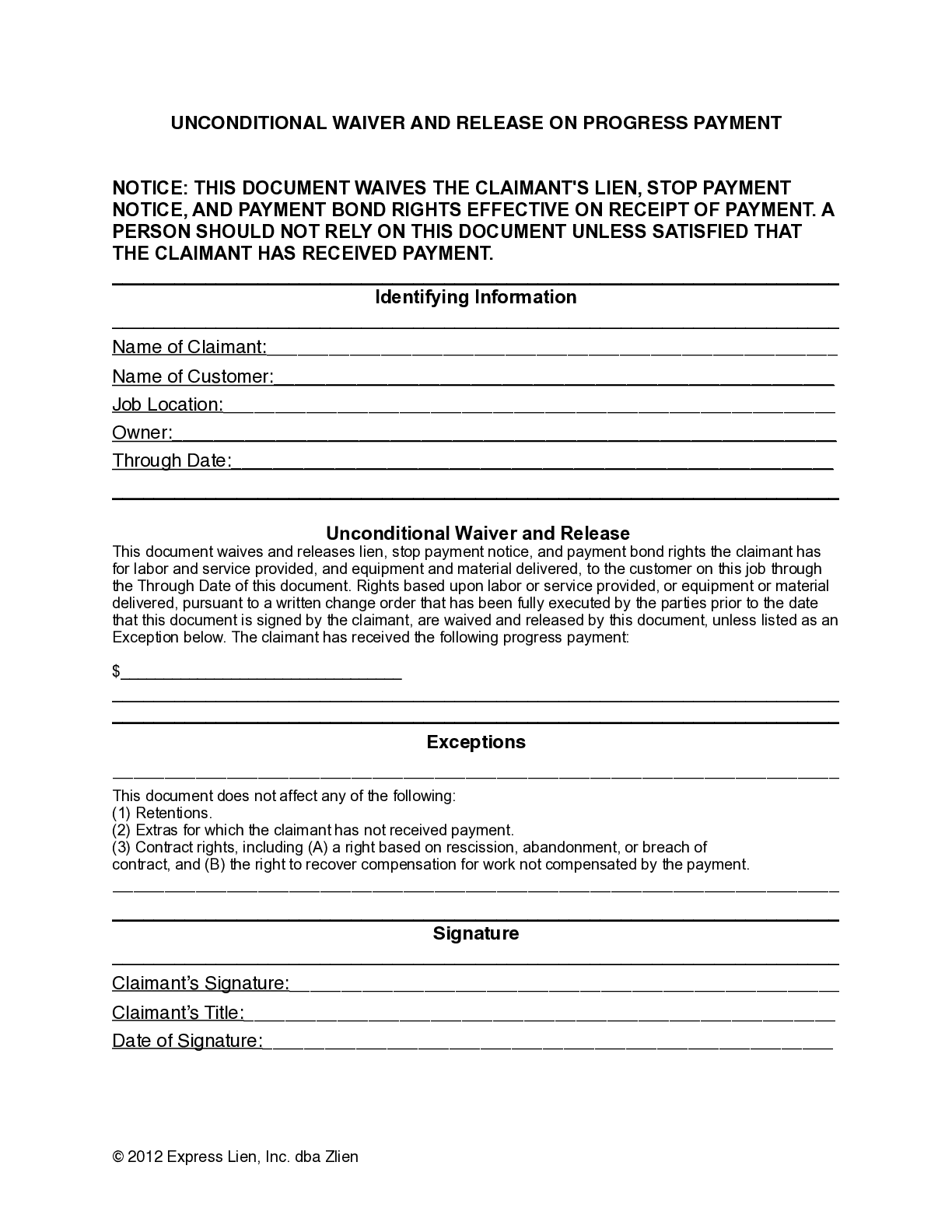

Lien Waiver Form Not Regulated

Delaware does mandate the use of a particular lien waiver form by statute, so parties are free to use and form with any words they want. However, Delaware does regulate the timing of lien waivers, and waivers are not allowed in contract or otherwise prior to payment.

Pay When Paid (Maybe?) Enforceable as Timing Clause

It is not particularly clear with respect to public projects, but, similarly to private projects, it is likely that any pay when paid clause would only be enforceable as a timing mechanism, if at all.

Pay If Paid Validity Unclear

While Del. Code Ann. tit. 6, § 3507(e) completely disallows pay if paid provisions, sub-part (f) of that statute states that it doesn't apply to public projects. Accordingly, it is unclear how such a clause will be treated on public projects.

Trust Fund Statute Exists

Delaware’s construction trust fund statute is strong, and applies to all parties (other than the owner) who both receive funds and also owe payment down the payment chain. There are no specific requirements regarding keeping trust funds in separate accounts or avoiding commingling of funds, provided the payments subject to the trust requirements end up in the right place.

The penalties for violation of the trust fund provisions in Delaware are strong.

Retainage Limited to 5%

In Delaware, retainage cannot exceed 5% of the value of work completed by a contractor.

Payment Due to Subs/Suppliers in 21 Days

For Subs & Suppliers, payment is required to be made within 21 days of receipt of payment from above , unless otherwise agreed by contract.

Payment to GCs is more complicated: Progress payments due according to contract if the contract is to be completed in less than 90 days, but for longer contracts, progress payments are due monthly within 21 days of the date on which the progress work has been certified and approved. Final/retainage payment due within 60 days of acceptance of the work.

Construction is a highly regulated industry in the United States, and that regulation continues through the payment terms. In every state legislation related to payment timing, retainage, lien rights or other security instruments, how to treat funds prior to payment, and more all must be balanced with construction participants’ freedom of contract.

In Delaware there are many strict rules and regulations that limit freedom of contract, with respect to construction payment terms. Delaware exercises significant regulatory control over construction payment terms on both private and public projects.

This means that owners, property developers, contractors, and suppliers must be careful to consider the rules and regulations set forth by Delaware statutory law prior to drafting and signing construction contracts, so they don’t risk the contract being invalidated. In Delaware, the time for payment (both general payment timing provisions and contingent payment provisions), retainage amount, lien waiver timing, and how construction funds must be treated prior to payment are all subject to rules and regulations set forth by state law.

Delaware has passed legislation that specifically disallows pay if paid provisions to be enforceable to shift the risk of nonpayment on a project to parties lower on the payment chain. Accordingly, construction participants in Delaware should be very careful about using standard construction contract templates, as many (AIA contract documents) contain these prohibited contingent payment provisions. In the absence of a sufficient sever ability clause, including statutorily disallowed provisions in a contract may be sufficient to invalidate the entire agreement.

Delaware is also strict in protecting the ability to file a lien to secure the amount due for work on a construction project. While lien waivers forms are unregulated in Delaware, and parties may use any form with any wording they want, lien rights may not be waived in contract or even at any point prior to payment. This is very strong protection to retain lien rights, as the earliest a participant may waive lien rights is pursuant to payment. This doesn’t meant that lien waivers do not need to be examined carefully, however. Since the form is not regulated by statute, a lien waiver can say basically whatever the drafting party wants it to. This means care should be taken to ensure that a lien waiver in Delaware doesn’t act to waive more than lien rights, or, at least, more than was intended to be waived.

There are some key laws that regulate the construction payment process in Delaware, which include:

- Lien Rights Laws

- Preliminary Notices

- Lien Waivers

- Mechanic Liens

- Bond Claims

- Retainage Laws

- Prompt Payment Laws

Another interesting aspect of Delware’s regulation of construction payment terms is the regulation of how construction funds must be treated prior to payment. Delaware has a construction trust fund statute to give further protection to construction parties against the misappropriation of funds meant to pay for the improvement to property. Delaware’s construction trust fund statute applies to all parties (other than the owner) who both receive funds and also owe payment down the payment chain. There are no specific requirements regarding keeping trust funds in separate accounts or avoiding commingling of funds, provided the payments subject to the trust requirements end up in the right place – but it’s very important to make sure that the funds do end up in the right place.

The penalties for violation of the trust fund provisions in Delaware are strong. A violator can be liable for interest, and if the payment was not subject to a good-faith dispute for reasonable cause, attorneys’ fees may also be awarded. Parties who violate the trust fund provisions in Delaware can be subject to criminal fines and even imprisonment.

In any event, it’s important for everyone on a construction project to treat one another fairly. But, when it comes to signing construction contracts in Connecticut, exchanging payment applications and other payment paperwork, and eventually the provision and receipt of payment itself . . . it’s important to know the rules of the game. This page provides a resource to you to really understand those rules.