Connecticut

Connecticut Notice of Intent Overview

Connecticut

Notice of Intent Requirement

Connecticut

Notice of Intent Deadline

Connecticut

Notice of Intent Requirement

Connecticut

Notice of Intent Deadline

There aren’t many states which require a Notice of Intent to Lien before filing a lien claim, but Connecticut is one of them. All Connecticut mechanics lien claimants hired by someone other than the owner must send a Notice of Intent to Lien in order to preserve lien rights. And, failure to send the notice will generally be fatal to lien claims. You can read the requirements for yourself at § 49-35 of the state’s lien statute.

Recall that, even if the document isn’t required for your specific situation, a Notice of Intent to Lien can be a powerful payment recovery tool. So, even for GC’s, it’s often a good idea to pursue recovery that way before a lien filing becomes necessary. And, sending the document to the owner, GC, lender, or any other higher-tiered party might lead to payment even if they aren’t required to receive it.

Certainly, the notice requirements can be a little intimidating at first blush. And, using an online platform to assist with these notice requirements can reduce a lot of headaches and stress.

Below are some frequently asked questions on the Connecticut Notice of Intent to Lien requirements.

Connecticut Notice of Intent FAQs

For Subcontractors, Suppliers, and Others

Is a Connecticut Notice of Intent to Lien required?

Any subcontractor, supplier, or equipment lessor who didn’t contract directly with the property owner must send a Notice of Intent to Lien prior to filing a Connecticut mechanics lien.

When must a Connecticut Notice of Intent to Lien be sent?

A Connecticut Notice of Intent to Lien must be sent anytime after first furnishing labor and/or materials to the project but within 90 days of the claimant’s last date of furnishing labor and/or materials to the project – and that deadline is strict.

Note that the deadline to file a lien in Connecticut is also 90 days from the last date of furnishing, and given the serving this notice can be tricky in CT, best practice is to start the process safely before that deadline.

• See: How should the Connecticut Notice of Intent to Lien be served?

Who needs to receive a Connecticut Notice of Intent to Lien?

The property owner must always receive a Notice of Intent to Lien in Connecticut. Keep in mind, that if there is more than one property owner, all owners must be served to be valid.

In most circumstances, the general contractor should be served a Notice of Intent to Lien as well. This is only required if the general contractor filed an affidavit within 15 days of commencement of the work listing their business name, address, and project property description.

Practically, though, it’s probably a good idea to send a Notice of Intent to Lien to both the owner and the GC on every project. And, if there are other higher-tiered parties who should be aware of the debt, it may be a good idea to send a copy to them as well.

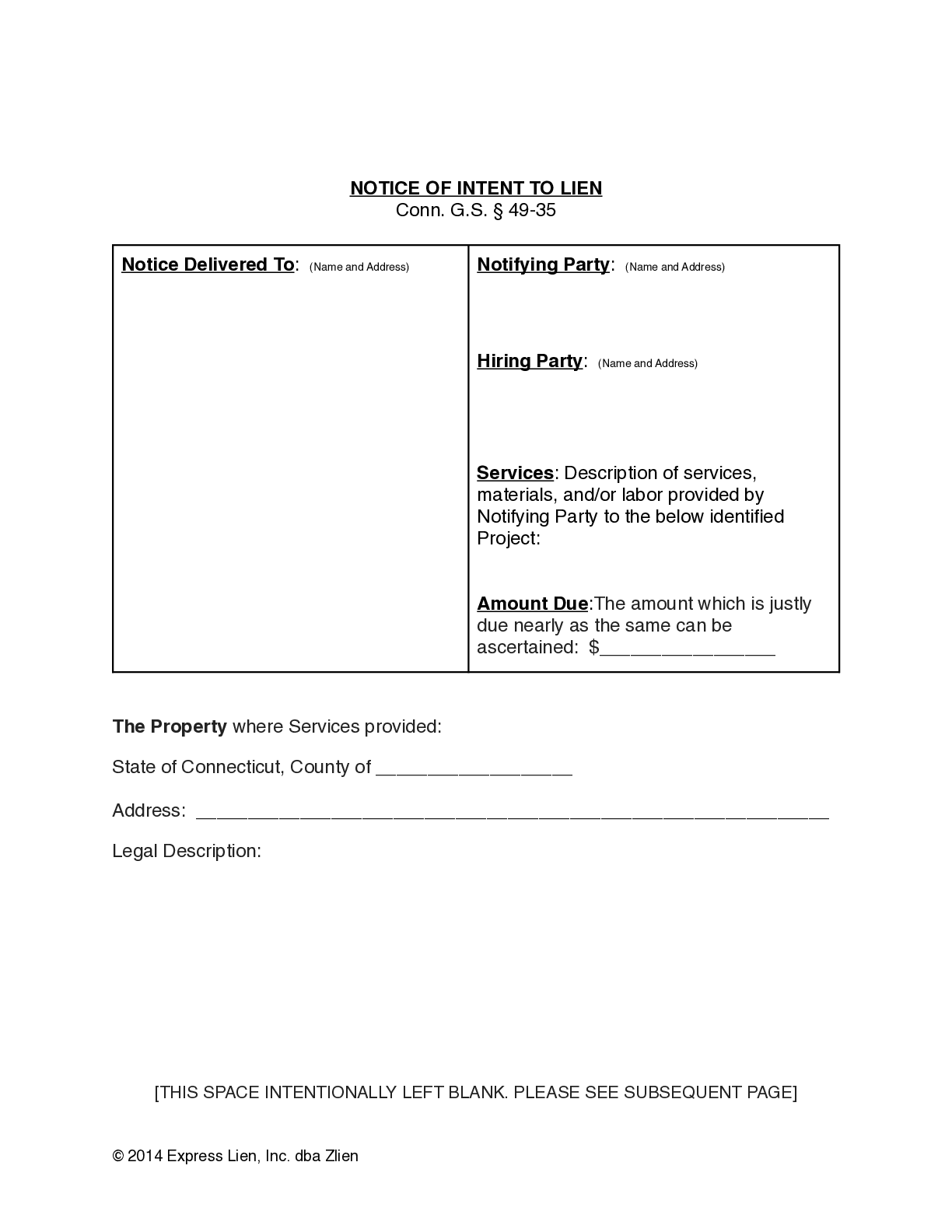

What information should be included on a Connecticut NOI?

Connecticut’s lien statute doesn’t provide a lot of insight into what, exactly, should be on the notice. It really only calls for the notice to state that the claimant “has furnished or commenced to furnish materials, or rendered or commenced to render services, and intends to claim a lien therefor on the building, lot or plot of land…” So, a statement of the work that’s been done and language indicating that a lien will soon be filed must appear on the notice.

Of course, it’s probably a good idea to include some other information as well, and the following might be worth putting on a Connecticut Notice of Intent to Lien:

• Name of the owner

• Location of the project property

• Name of your customer

• First and last furnishing dates

• A deadline for making payment

→ Download a free Connecticut Notice of Intent to Lien form here

How should the Connecticut Notice of Intent to Lien be sent?

If the owner or contractor resides in the county where the work was performed, then a Notice of Intent to Lien should generally be given by personal service in Connecticut.

To be specific, the statute calls for the notice to be served “by any indifferent person, state marshal or other proper officers, by leaving with such owner or original contractor or at such owner’s or the original contractor’s usual place of abode a true and attested copy thereof.“

If the owner or contractor does not reside in that town, but if they have a local agent, then notice can instead be personally served on that agent.

Further, if the owner or contractor doesn’t reside there, and if there isn’t a local agent present, then notice can be made to the owner or contractor by mailing an attested copy of the notice via registered or certified mail.

Finally, if personal service and mail service aren’t possible, then service by publication (i.e. publishing the notice in the newspaper) might work, but it’s not best to rely on this.

Is a Connecticut Notice of Intent to Lien considered served when sent or when received?

As you may have gleaned from the question above, service is typically considered complete when actually received by the owner and/or general contractor.

If service/delivery fails, then publication in accordance with Conn. Gen. Stat. §1-2 should be acceptable.

What if a Connecticut Notice of Intent to Lien is sent late?

Failure to send a Notice of Intent to Lien within the required timeframe will be fatal to a Connecticut mechanics lien claim.

For Public Projects

Does Connecticut require Notices of Intent on public projects?

It’s not quite a Notice of Intent to Lien, but Connecticut claimants who intend to look to the project’s payment bond for payment must send notice to be entitled to late payment interest.

Need More Help with a Connecticut Notice of Intent? We're Here

Recent Q&As about NOIs in Connecticut in our Expert Center

Does a GC hired by a Lessee need to file a Notice of Intent prior to filing a lienI am a GC who entered into a contract to construct a restaurant for a company leasing space in a building. No direct contract with...

I have a contract for a project on a property in Connecticut with a Milwaukee Wisconsin based company 63 days ago.Sent invoice for work completed 63 days ago. How much time do I have to provide a notice of intent lien? How much time do...

Can i file a lien on a company who subcontracted me to do the work on a property?I was subcontracted to provide $27,000 worth of emergency disinfection services to a large commercial property. I was hired by a general contractor who had...

How to file a lien in Connecticut

Free Connecticut Notice of Intent Forms

Compliant with Connecticut statutes and applicable for jobs in any Connecticut county.

Connecticut Notice of Intent to Lien Form | Free Downloadable Template

Fill out the form to download your free Connecticut Notice of Intent to Lien Form. You can fill out the form with a PDF editor,...

Connecticut Notice of Intent Statutes

Connecticut’s mechanics lien statute can be found in Connecticut General Statutes §49-33 et seq. And, the rules and requirements specifically related to the Notice of Intent to Lien process can be found at §49-35 Notice of Intent. Liens of subcontractors and materialmen, and it is reproduced below. Updated as of May 2021.

Connecticut Notice of Intent Statute

§ 49-35. Notice of Intent. Liens of Subcontractors and Materialmen

(a) No person other than the original contractor for the construction, raising, removal or repairing of the building, or the development of any lot, or the site development or subdivision of any plot of land or a subcontractor whose contract with the original contractor is in writing and has been assented to in writing by the other party to the original contract, is entitled to claim any such mechanic’s lien, unless, after commencing, and not later than ninety days after ceasing, to furnish materials or render services for such construction, raising, removal or repairing, such person gives written notice to the owner of the building, lot or plot of land and to the original contractor that he or she has furnished or commenced to furnish materials, or rendered or commenced to render services, and intends to claim a lien therefor on the building, lot or plot of land; provided an original contractor shall not be entitled to such notice, unless, not later than fifteen days after commencing the construction, raising, removal or repairing of the building, or the development of any lot, or the site development or subdivision of any plot of land, such original contractor lodges with the town clerk of the town in which the building, lot or plot of land is situated an affidavit in writing, which shall be recorded by the town clerk with deeds of land, (1) stating the name under which such original contractor conducts business, (2) stating the original contractor’s business address, and (3) describing the building, lot or plot of land. The right of any person to claim a lien under this section shall not be affected by the failure of such affidavit to conform to the requirements of this section. The notice shall be served upon the owner or original contractor, if such owner or original contractor resides in the same town in which the building is being erected, raised, removed or repaired or the lot is being improved, or the plot of land is being improved or subdivided, by any indifferent person, state marshal or other proper officer, by leaving with such owner or original contractor or at such owner’s or the original contractor’s usual place of abode a true and attested copy thereof. If the owner or original contractor does not reside in such town, but has a known agent therein, the notice may be so served upon the agent, otherwise it may be served by any indifferent person, state marshal or other proper officer, by mailing a true and attested copy of the notice by registered or certified mail to the owner or original contractor at the place where such owner or the original contractor resides. If such copy is returned unclaimed, notice to such owner or original contractor shall be given by publication in accordance with the provisions of section 1-2. When there are two or more owners, or two or more original contractors, the notice shall be so served on each owner and on each original contractor. The notice, with the return of the person who served it endorsed thereon, shall be returned to the original maker of the notice not later than thirty days after the filing of the certificate pursuant to section 49-34.

(b) No subcontractor, without a written contract complying with the provisions of this section, and no person who furnishes material or renders services by virtue of a contract with the original contractor or with any subcontractor, may be required to obtain an agreement with, or the consent of, the owner of the land, as provided in section 49-33, to enable him to claim a lien under this section.