Kentucky

Preliminary Notice Deadlines

Kentucky

Kentucky

Kentucky

Kentucky

Kentucky

Within 60 days of the last day of the month in which materials were provided, the bond claim verified statement must be recorded. Thereafter, the claimant generally has 15 years to file a lawsuit to enforce the claim, although beware, as bonding companies can shorten this period through the bond, and frequently do.

Kentucky

Kentucky

Within 60 days of the last day of the month in which materials were provided, the bond claim verified statement must be recorded. Thereafter, the claimant generally has 15 years to file a lawsuit to enforce the claim, although beware, as bonding companies can shorten this period through the bond, and frequently do.

Kentucky provides two forms of payment protection on public projects, a claim against the payment bond and a lien on contract funds. Parties who furnish labor and/or materials to a general contractor or first-tier subcontractor may file either type of claim in the event of nonpayment. This includes equipment lessors, however, it does not include suppliers to suppliers.

Bond claim

No specific statutory provisions, so claimants must obtain a copy of the payment bond to determine any requirement provided therein.

• Always Get a Copy of the Payment Bond on Public Projects

Lien on contract funds

A lien on contract funds must be filed within 60 days of the last day of the month the claimant furnished labor and/or materials to the project, or within 60 days of the date of substantial completion; whichever is later.

Bond claim

No specific statutory provisions, so claimants must obtain a copy of the payment bond to determine any requirement provided therein.

Lien on contract funds

The statutory requirements for liens on contract funds in Kentucky can be found under KRS §376.230, and should include the following information:

• Claimant’s name & address;

• Hiring party’s name & address;

• Amount claimed;

• Last date of furnishing labor and/or materials; &

• Name of improvement.

Bond claim

No specific statutory provisions, so claimants must obtain a copy of the payment bond to determine any requirement provided therein.

Lien on contract funds

Where a lien on contract funds claim needs to be filed, depends on the entity who commissioned the project.

• If the project involves a public highway or some other property owned by a state, city, or county government entity, then the notice must be filed in the county where the seat of the government contracting entity is located.

• If the project is on public property owned by some other entity, then the notice must be filed in the clerk’s office of each county where the claimant performed the work.

• List of Kentucky county clerk’s offices

An attested copy of the notice on either type of project must then be delivered to the claimant’s hiring party. After which, a copy must also be provided to the public entity along with proof of mailing to the contractor or sub.

Bond claim

No statutory provisions – so the claimant must obtain a copy of the bond to determine the requirements provided therein. Best practice may be to send the claim to all necessary parties via certified mail, return receipt requested.

Lien on contract funds

Claims that must be sent to the contract administrator on public-owned public works must be sent by registered or certified mail, return receipt requested. Claims filed with the county clerk in the county in which the labor and/or materials were furnished must be actually filed and recorded by that office. However, the statutes only require sending the claim – there is no requirement of actual receipt.

Bond claim

An action to enforce a bond claim must be filed within 15 years, however, bonding companies may shorten this period, and they frequently do.

Lien on contract funds

Contractors are given 30 days to protest claims filed. If they protest, the lien claimant must institute a suit for the enforcement of the lien and serve summons within 30 days after written notice of the protest is mailed to claimant. If the claimant fails to initiate suit and serve summons within the 30-day period the claim is extinguished. If no protest is filed, no suit is required.

If, however, the entity does not release funds and the contractor does not protest, then an enforcement action must be initiated within 6 months from the date of filing the claim.

We supply solids removal equipment to Contractors and Subcontractors for large municipal and private water projects. Our Agreements include startup and commissioning services as part...

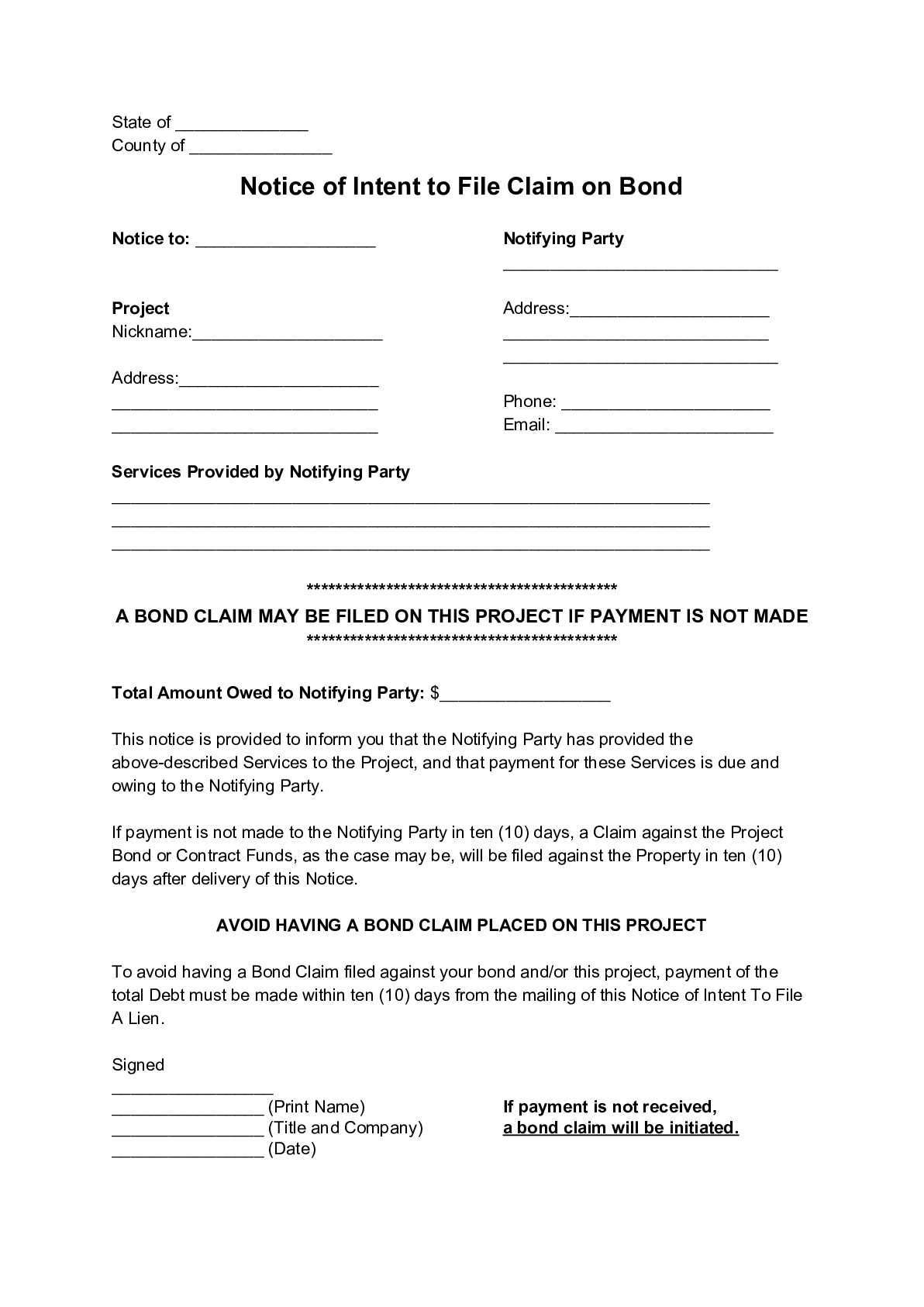

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Kentucky and are not paid, you can file a “lien” against the project pursuant to Kentucky’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Kentucky’s Little Miller Act is found in Kentucky Revised Statutes, Title VI Chapter 45A and Title XXVII Chapter 341, and the statutes regulating liens on contract funds are found under KRS §§376.210 – 376.260, and are reproduced below. Updated as of August 2021.

(1) As used in this section, “agency contract administrator” means the state agency employee responsible for the administration of a contract.

(2) When a construction contract is awarded in an amount in excess of forty thousand dollars ($40,000), the following bonds shall be furnished to the Commonwealth, and shall be binding on the parties upon the award of the contract:

(a) A performance bond satisfactory to the Commonwealth executed by a surety company authorized to do business in this Commonwealth, or otherwise supplied, satisfactory to the Commonwealth, in an amount equal to one hundred percent (100%) of the contract price as it may be increased; and

(b) A payment bond satisfactory to the Commonwealth executed by a surety company authorized to do business in the Commonwealth, or otherwise supplied, satisfactory to the Commonwealth, for the protection of all persons supplying labor and material to the contractor or his subcontractors, for the performance of the work provided for in the contract. The bond shall be in an amount equal to one hundred percent (100%) of the original contract price.

(3) When any contract in an amount in excess of forty thousand dollars ($40,000) for commodities, supplies, equipment, or services of any kind, or when a contract for construction services costing forty thousand dollars ($40,000) or less is proposed for presentation to vendors or contractors, the agency contract administrator shall evaluate whether a performance bond should be required in the procurement document, and make his recommendation to the purchasing agency. The agency contract administrator shall note the reason that a performance bond is or is not recommended and his notation shall be a part of the permanent record relating to the contract. If a performance bond is required, the requirement shall be included in the invitation to bid, request for proposal, or other procurement document. The agency contract administrator shall make audits of the performance of contracts upon completion of one-third (1/3) of the contract and upon completion of two-thirds (2/3) of the contract. For contracts taking longer than one (1) year to complete, audits of performance shall be conducted at least annually. Before a vendor is released from a performance bond, the agency contract administrator shall review the audits of performance, make a final performance review, and promptly determine whether, in his or her opinion, the vendor has fully complied with the terms of the contract. The opinion of the agency contract administrator shall be made in writing or electronically, set forth the reasons for his or her opinion regarding compliance or noncompliance, and be signed by the agency contract administrator. This opinion may have an electronic signature. The using agency head shall, after consideration of the performance audits, the final performance review, and the opinion of the agency contract administrator regarding compliance or noncompliance, determine whether to recommend to the purchasing agency that the performance bond be released or whether a claim should be made against the performance bond. This determination of the using agency head shall be in writing, signed by the using agency head, and forwarded to the purchasing agency. This determination may have an electronic signature and be transmitted electronically. If the recommendation of the using agency is not followed by the purchasing agency, the purchasing agency shall place a statement in the file explaining why it is not followed.

(4) Nothing in this section shall be construed to limit the authority of the Commonwealth to require a performance bond or other security in addition to those bonds, or in circumstances other than specified in subsection (2) or (3) of this section.

(1) The secretary of the Finance and Administration Cabinet shall promulgate by regulation the form of the bonds required by KRS 45A.180 to 45A.200.

(2) The purchasing agency shall furnish a certified copy of a bond to any person who requests a copy and pays a reasonable fee for the copy. The copy shall be prima facie evidence of the contents, execution, and delivery of the original.

(1) For purposes of KRS 45A.225 to 45A.290, court means the court of this Commonwealth which would have original jurisdiction over the action if it were between private citizens of this Commonwealth; and in the event of an appeal from such a court, the court which would have jurisdiction over such an appeal if the action were between private citizens of this Commonwealth.

(2) KRS 45A.225 to 45A.290 apply only to each contract solicited or entered into after January 1, 1979.

This section shall apply to a claim or controversy arising under contracts between the Commonwealth and its contractors. If such a claim or controversy is not resolved by mutual agreement, the secretary of the Finance and Administration Cabinet, or his designee, shall promptly issue a decision in writing. A copy of that decision shall be mailed or otherwise furnished to the contractor. The decision shall be final and conclusive unless fraudulent, or unless the contractor sues pursuant to KRS 45A.245. If the secretary of the Finance and Administration Cabinet does not issue a written decision within one hundred and twenty (120) days after written request for a final decision, or within such longer period as might be established by the parties to the contract in writing, then the contractor may proceed as if an adverse decision had been received.

(1) Any claim arising from a construction contract executed and administered by the Transportation Cabinet pursuant to the provisions of KRS Chapters 175, 176, 177 and 180 shall be commenced in Franklin Circuit Court within one (1) year from the time the Commonwealth has determined final pay quantities and issues a final pay estimate to the contracting party, notifying him of its final determination, or from the receipt of a final adverse decision from the Commonwealth, whichever occurs later.

(2) Any other claim shall be commenced in Franklin Circuit Court within one (1) year from the date of completion specified in the contract.

No person, firm, or corporation shall be permitted more than one (1) money recovery upon a claim for the enforcement of or for breach of contract with the Commonwealth.

(1) When a construction contract is awarded in an amount in excess of one hundred thousand dollars ($100,000), the following bonds shall be furnished to the local public agency, and shall become binding on the parties upon the award of the contract:

(a) A performance bond satisfactory to the local public agency executed by a surety company authorized to do business in this Commonwealth, or otherwise supplied, satisfactory to the local public agency, in an amount equal to one hundred percent (100%) of the contract price as it may be increased; and

(b) A payment bond satisfactory to the local public agency, executed by a surety company authorized to do business in this Commonwealth, or otherwise supplied, satisfactory to the local public agency, for the protection of all persons supplying labor and material to the contractor or his subcontractors for the performance of the work provided for in the contract. The bond shall be in an amount equal to one hundred percent (100%) of the original contract price.

(2) Nothing in this section shall be construed to limit the authority of the local public agency to require a performance bond or other security in addition to those bonds, or in circumstances other than specified in subsection (1) of this section, including, but not limited to, bonds for the payment of taxes and unemployment insurance premiums.

(1) The local public agency may promulgate by regulation the form of the bonds required by KRS 45A.430 and 45A.435, or it may adopt the form established by the state under KRS 45A.180 to 45A.200.

(2) The local public agency shall furnish a certified copy of a bond to any person who requests such and pays the reasonable fee for that copy. The copy shall be prima facie evidence of the contents, execution, and delivery of the original.

(1) Before any contract, exceeding two thousand dollars ($2,000) in amount, is awarded to any person for the construction, alteration, or repair of any public building or public work of the Commonwealth of Kentucky, or any subdivision, county or municipality thereof, such person shall furnish to the contracting agency, county or municipality a payment bond with satisfactory surety, which shall become binding upon the award of the contract to such person, to assure the payment of all contributions under this chapter incurred by such person incident to his performance of such contract.

(2) Nothing in this section shall be construed to limit the authority of any contracting agency, county or municipality to require such other bonds or security as might be elsewhere authorized or deemed desirable.

(1) Any person, firm, or corporation who performs labor or furnishes materials or supplies for the construction, maintenance, or improvement of any canal, railroad, bridge, public highway, or other public improvement in this state by contract, express or implied, with the owner thereof or by subcontract thereunder shall have a lien thereon, and upon all the property and the franchises of the owner, except property owned by the state, a subdivision or agency thereof, or by any city, county, urban-county, or charter county government. If the property improved is owned by the state or by any subdivision or agency thereof, or by any city, county, urban-county, or charter county government, the person furnishing the labor, materials, or supplies shall have a lien on the funds due the contractor from the owner of the property improved. Except as provided in KRS 376.195, the lien shall be for the full contract price of the labor, materials, and supplies furnished, and shall be superior to all other liens thereafter created.

(2) Any person undertaking or expecting to furnish labor, materials, or supplies as provided in this section may acquire the lien herein provided by filing in the clerk’s office of each county in which he has undertaken to furnish labor, materials, or supplies, except as provided in subsection (3), a statement in writing that he has undertaken and expects to furnish labor, materials, or supplies and the price at which they are to be furnished, and the lien for labor, material, or supplies furnished thereafter shall relate back and take effect from the date of the filing of the statement. In all cases of original construction the liens shall be prior to all liens theretofore or thereafter created on the part so constructed and on no other part.

(3) In all cases where the labor, materials, or supplies are furnished for the improvement of any public highway or other public property owned by the state or by any city, county, urban-county, or charter county government, the statement shall be filed in the county clerk’s office of the county in which is located the seat of government of the owner of the property improved, and the lien shall attach only to any unpaid balance due the contractor for the improvement from the time a copy of the statement, attested by the county clerk, is delivered to the owner or the owner’s authorized agent with whom the contract for improving the public highway or other public property was made.

(1) Any contractor or other person contracting with the public authority for the furnishing of any improvements or services for which a lien is created by KRS 376.210 or any person in privity with the contractor or other person may, at any time before a judgment is rendered enforcing the lien, execute before the county clerk in the county in which the lien was filed a bond for double the amount of the lien claimed.

(2) The bond executed under subsection (1) of this section shall be subject to the following conditions:

(a) The bond shall be approved by the clerk only if the bond is secured by:

1. Cash;

2. A letter of credit from a bank; or

3. Surety insurance as defined by KRS 304.5-060 that is issued by a licensed insurer; and

(b) The bond shall require that the obligor satisfy any judgment that may be rendered in favor of the person asserting the lien.

(3) The bond shall be preserved by the clerk, and upon its execution, the lien provided by KRS 376.210 shall be discharged.

(4) The person asserting the lien may make the obligors on the bond parties to any action to enforce his claim, and any judgment received may be against any of the obligors on the bond.

(1) The liens provided for in KRS 376.210 shall not be for a greater amount in the aggregate than the contract price of the original contractor, and should the aggregate amount of liens exceed the price agreed upon between the original contractor and the owner there shall be a pro rata distribution of the original contract price among the lien-holders.

(2) On claims for labor, materials or supplies furnished for the improvement of any bridge, public highway or other public property owned by the state or by any county or city, the provisions of this section for a pro rata distribution of the original contract price among lien-holders shall not apply to liens on the unpaid balance due the contractors, except as provided in KRS 376.240.

(3) If any person files a statement asserting a lien against any contractor on any fund due the contractor, for an amount in excess of the amount actually due, the person filing the lien shall be liable to any person damaged thereby to the extent of such damage, including reasonable court costs and attorney’s fees incurred by the injured parties. Any such claim for damages may be asserted and prosecuted in the county in which the lien statement was filed.

(1) The lien provided for in KRS 376.210 shall be dissolved unless the person who furnishes the labor, materials, or supplies shall, whichever is later, within sixty (60) days after the last day of the month in which any labor, materials, or supplies were furnished, or by the date of substantial completion, file in the county clerk’s office of each county in which labor, materials, or supplies were furnished, except as hereinafter provided, a statement in writing verified by affidavit of the claimant or his or her authorized agent or attorney, setting forth the amount due for which the lien is claimed, the date on which labor, materials, or supplies were last furnished and the name of the canal, railroad, bridge, public highway, or other public improvement upon which it is claimed.

(2) In all cases where a lien is claimed for labor, materials, or supplies furnished for the improvement of any bridge, public highway, or other public property owned by the state or by any county, charter county, urban-county, consolidated local government, or city, the statement of lien shall be filed only in the county clerk’s office of the county in which the seat of government of the owner of the property is located.

(3) The county clerk, upon the filing of the statement, shall make an abstract and entry thereof as now provided by law in case of mechanics’ liens in the same book used for that purpose, and shall make proper index thereof. The clerk shall be paid by the party filing the claim, and for attesting any copy of the lien statement. If he or she is required to make the copy, he or she may make an additional charge as provided by law. The clerk’s fees shall be determined pursuant to KRS 64.012. All of these charges may be recovered by the lien claimant as costs from the party and out of the fund against which the claim is filed.