Financial statements do more than just report on a company’s finances. Businesses can use them to make better decisions. Analyzing trends and forecasting expenses into the future help construction businesses know when it’s time to expand or buy new equipment. An income statement is an important piece of any construction company’s financial analysis: not only does it show whether the business turned a profit, but it also summarizes business expenses, allowing management to spot trends and make key business decisions.

In this article, we take a look at income statements for construction companies, including the information it contains, and how to put one together. Let’s dig in.

What is an income statement?

An income statement summarizes a company’s income, expenses, and profit over a period of time. Also known as a profit and loss statement, the income statement is an essential tool in managing a construction business.

An income statement shows the total income the company received during the period and the expenses incurred during that same timeframe. The bottom line on the statement is the net income or profit for the period. Companies typically produce this statement on a monthly or annual basis.

The statement is part of the main financial statements companies create, along with a balance sheet and cash flow statement. The balance sheet shows a company’s assets and liabilities, the cash flow statement shows how cash came in and left, and the income statement shows a company’s profits.

Steven J. Peterson teaches Construction Financial Management

Join the free certificate course to learn the foundations of financial management and accounting in construction, taught by the man who wrote the textbook (literally).

What an income statement includes

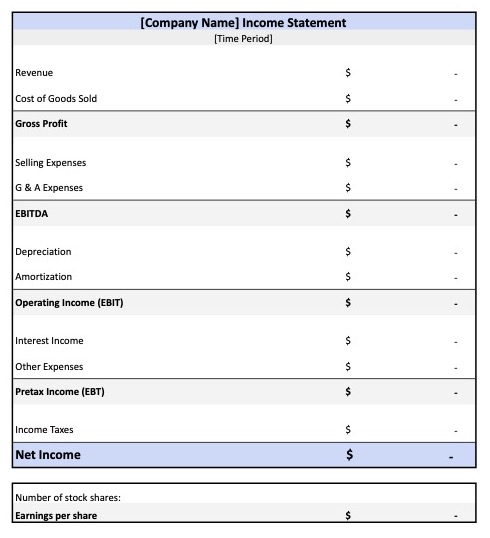

An income statement adds up the transactions for each of the general ledger accounts below. It should summarize the activity for a specific time period (usually a month or year). Comparing similar periods over time will provide a good understanding of the business’s financial trajectory.

Revenue

The recognized revenue for the sale of goods and services during the time period. It should include all revenue streams that the business is involved in. Note that for businesses using accrual accounting, revenue includes all invoices sent out during the period, and not just those that have been paid. There are also rules regarding when income can be recognized on long term contracts or projects.

Cost of goods sold

Cost of goods sold, or COGS, lists the direct costs associated with providing goods or services. This should include direct labor, materials, parts, equipment rental, and other expenses that go into construction.

Gross profit

This is calculated by subtracting the COGS from total revenue for the period.

Gross Profit = Total Revenue – Cost of Goods Sold

Selling expenses

Selling expenses include costs incurred for marketing, advertising, and promotion of the business. Includes all costs related to selling business goods and services.

General and administrative expenses (G&A)

General and administrative (G&A) expenses are indirect costs involved in running a business that are not directly related to the goods or services being sold. This includes salaries, rent, utilities, office expenses, insurance, travel, etc.

EBITDA

On the income statement, EBITDA stands for “earnings before interest, tax, depreciation, and amortization.” This is simply gross profit minus selling and G&A expenses.

EBITDA = Gross Profit – Selling Expenses – G&A Expenses

Depreciation and amortization expenses

Depreciation and amortization are expenses related to spreading out the costs of assets, like property, buildings, and equipment over time. These expenses are usually incurred at the direction of an accountant or CPA.

Operating income

Operating income, also known as “earnings before interest and taxes” (EBIT), is the total income from regular business operations. This figure is calculated by subtracting depreciation and amortization costs from the EBITDA.

Operating Income = Gross Profit – Selling Expenses – G&A – Depreciation – Amortization

Interest

On a profit & loss statement, a contractor’s interest is counted as income. But because this is received from investments or bank accounts rather than revenue you earned by doing construction work or supplying materials, it is not included in revenue.

Other expenses

Other expenses are miscellaneous costs that are not part of regular business activities. This can include construction accounting software, research and development, sale of investments, etc.

Pretax income

Pretax income, also known as EBT, or “earnings before tax,” is operating income minus interest and other expenses.

EBT = Operating Income – Interest Expenses – Other Expenses

Income taxes

Regardless of the time period you’re preparing the statement for, you will owe a percentage of that income in taxes. Income taxes are calculated based on your EBT, or pretax income.

Income Tax = EBT x [Your Company’s Income Tax Rate]

Net income (or net loss)

Net income is found at the bottom of the income statement, and represents your company’s profit for the period. In the case of a negative number, it’s the net loss (hence why it’s also known as a profit & loss statement). For privately owned construction companies, net income will likely be the final number on the statement.

Net Income = EBT – Income Taxes

Earnings per share

Typically, only public companies report earnings per share, and calculate it by dividing net income by the number of stock shares.

Earnings Per Share = Net Income / Number of Shares

How to prepare an income statement

You can prepare an income statement by adding up the transactions in each of the categories above for the period that you want to report on, then do the calculations for each of the subtotals. If preparing a report for the year to date, you can take amounts from your trial balance report to complete the income statement.

However, if the reporting period is just the current month or a quarter, you’ll need to run a report summarizing the transactions during the period or add them up in a spreadsheet.

If you use a construction accounting program, most programs will create an income statement for you at the touch of a button.

Download a free template

Get an income statement template with built-in formulas. Make a copy to use the template in Google Sheets or download as a Microsoft Excel file.

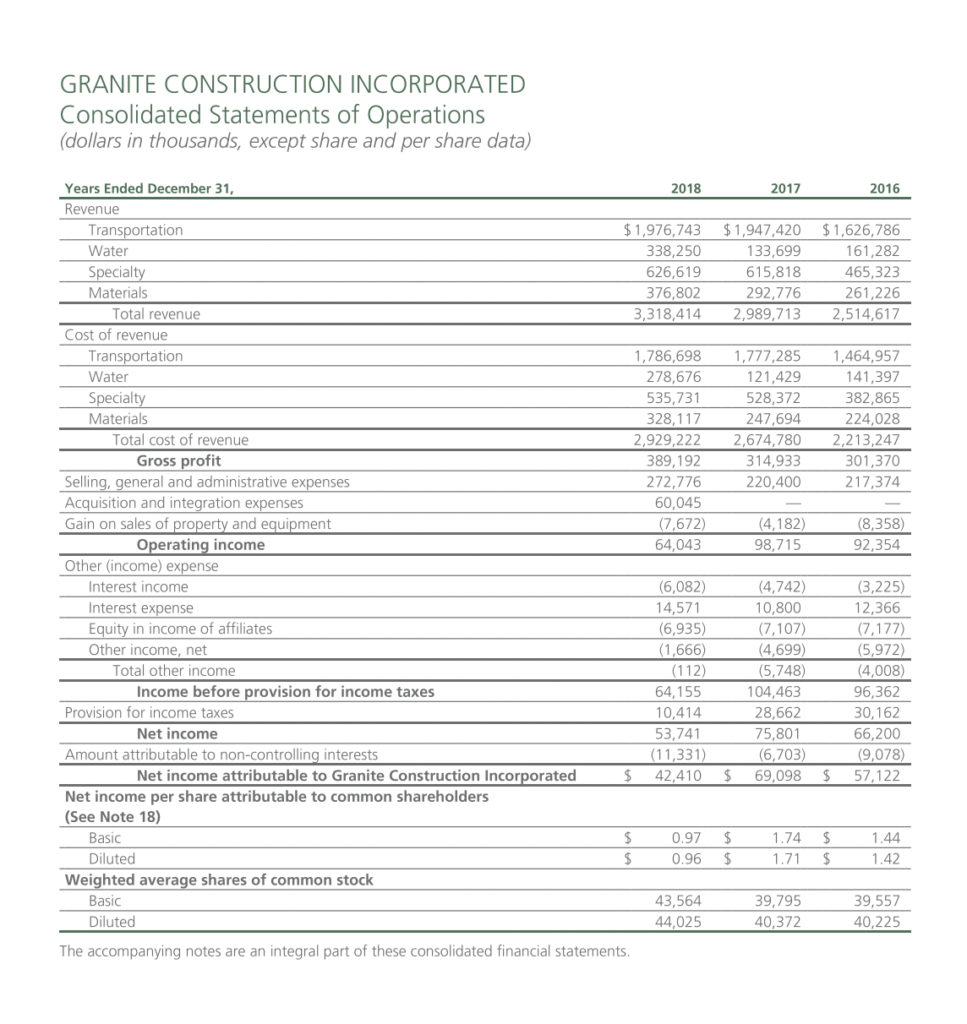

Income statement example for a construction company

Here’s an example of a P&L statement Granite Construction, a publicly traded contracting firm based in California. Because they are a public company, they list the earnings per share, as well as “net income attributable to non-controlling interests.”

The company’s 2018 net income was $42.4 million, which declined from $57.1 million in 2016 despite growing revenues. If you look closely, you will notice that the company’s cost of goods sold (listed here as cost of revenue) increased in those same years, eating into their profit margins.

Why income statements matter

Lenders and financing companies use income statements to assess the profitability of a construction business when they are requesting a loan or financing. Lenders will often look the income statement and other financials to get a good feeling for where the business stands financially. They may request income statements from past years to look for trends.

Surety companies providing construction bonds typically require an income statement from a contractor in order to qualify. The surety uses the income statement and other financial statements to assess the stability of the company and determine their bonding capacity.

The law requires public construction companies to provide income statements to their stockholders and certain regulatory bodies like the SEC. Many post their financial statements publicly on their website.

The amount of tax a company pays is based on pretax income. Businesses typically produce quarterly income statements, as they are required to pay estimated taxes on the income they’ve earned.

Companies can also use their income statement to compare with other companies in a similar industry. They can gauge their standing in regards to the competition and can make changes accordingly to improve their financial position.

Income is king

Financial statements are a key reporting tool for businesses when it comes to analyzing their profitability and customer buying trends. Reviewing them on a regular basis will ensure that data is accurate, and that management always knows where the business is financially.

Income statements are particularly important because they show the total profit for the business in a time period. And everyone knows that profit is the holy grail for all businesses.