Credit departments and credit managers love their key performance indicators (KPIs). One of the most telling KPIs for credit professionals is days sales outstanding, or DSO. Calculating your DSO on a regular basis and tracking trends can give you insight into your customers’ payment habits, as well as help predict future cash flow.

What is days sales outstanding (DSO)?

Days sales outstanding is a measurement of how long it takes your customers to pay their invoices. Also called “days receivable” or “average collection period,” it’s measured over a period of time — usually monthly, quarterly, and annually. Companies use this measurement to discover how long they are holding debt on their books.

DSO is a good indicator of a company’s cash flow. The longer you have to wait for payment, the more likely you’ll be to run out of money. A lower DSO means that you’re getting paid quickly, so you have cash on hand to pay your bills.

Construction has one of the highest DSOs of all US industries. In 2018, the average DSO for construction companies was 83 days. That means it took nearly three months to collect on the average account.

Learn more – Managing Cash Flow in Construction: Problems & Solutions

How to calculate DSO

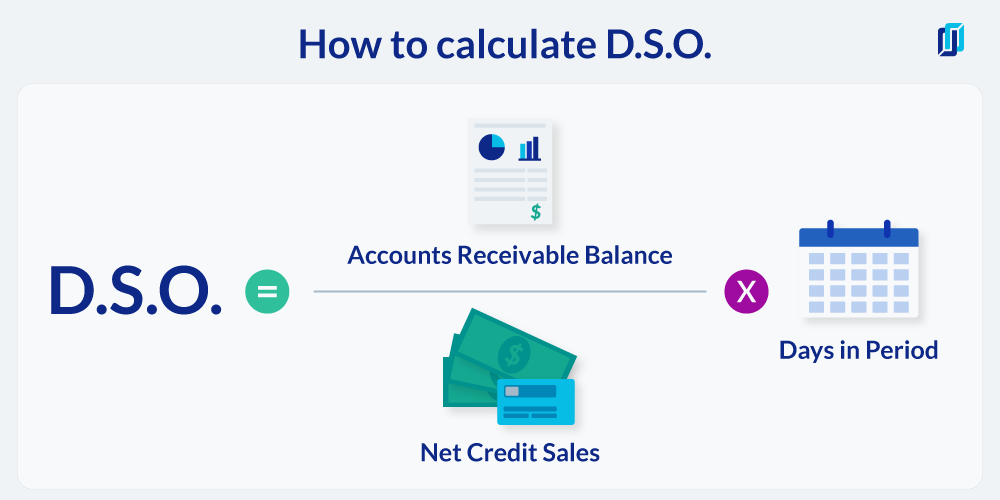

DSO is calculated by dividing the accounts receivable balance by the net credit sales during the period and multiplying that answer by the number of days in the period. The period of time may be a month, quarter, or year.

DSO formula:

DSO = (Accounts receivable balance ÷ net credit sales) x days in period

A high DSO means that you are waiting a long time for customers to pay their bills. A lower DSO means that you are getting paid quickly. Generally, a DSO under 45 is considered low. This means your invoices are getting paid within 45 days of the date of sale.

DSO only looks at purchases made on credit, so cash sales aren’t included in the calculation. Cash sales have a DSO of zero and will reduce the final answer if included in the measurement. So, if you include cash sales in your calculation, make sure you do it consistently.

DSO is also affected by sales volume, as an increase in sales lowers the DSO value.

If you’re interested in finding out how late your customer’s late payments are, consider using delinquent DSO, or average days delinquent (ADD) in conjunction with your DSO calculations. Delinquent DSO and average days delinquent let you know how late your late payments are for a particular moment in time.

DSO vs. Best DSO

Your DSO includes all accounts, whether on time or delinquent. As a result, this measure will give you an accurate picture of the average time it takes to collect. You can also look only at your on-time accounts to get your Best DSO, which will tell you the best possible days sales outstanding you can expect if everyone paid you on time.

To measure Best DSO, you simply replace “accounts receivable balance” with “current receivables” in the calculation.

Best DSO formula:

Best DSO = (Current receivables ÷ net credit sales) x days in period

Example DSO calculation

Let’s say ABC Contractor has an accounts receivable balance of $1.2 million at the end of May. They made $1.5 million in credit sales during the month.

To calculate the DSO, divide the AR balance ($1.2 million) by total credit sales ($1.5 million) and multiply that answer by the number of days in the month (31).

$1.2 million ÷ $1.5 million x 31 = 24.8

This means ABC Contractor collected payments an average of 25 days after invoicing during the month of May.

Now if we change the ending accounts receivable balance to $1.4 million, let’s see how the DSO changes.

$1.4 million ÷ $1.5 million x 31 days = 28.9

It now takes an average of 29 days to collect on invoices. By changing the AR balance, the DSO increased by four days.

DSO Calculators

Enter the figures in each calculator below to view your DSO or Best DSO.

Why you need to know your DSO

Calculating and tracking your DSO over time helps you spot trends in your customer’s payment practices. Generally, higher DSO numbers lead to cash flow problems, because you’re having to wait longer for payment.

If you notice your DSO increasing over several months, you should start planning for how you’ll fund your company’s operations in the future with less cash flow. Seasonal companies may find that their DSO is affected by the up-and-down nature of their income. If your income is seasonal, you can take the seasonal nature of your income into consideration and use this information to plan accordingly.

Reviewing your company’s DSO can also help you measure the success of your company’s collections efforts. If you see your DSO rising for several months, look at your collection efforts and come up with ideas to improve payment rates.

All companies should have a credit policy and collection processes established to give credit managers and employees in the credit department direction on how to proceed with delinquent accounts. These policies and processes help standardize a company’s collection procedures and usually improve collections.

DSO can also help the company identify customers who aren’t credit worthy. By calculating a specific customer’s DSO, credit managers can identify which customers are always slow to pay, and then implement strategies to improve their payment time or move that customer to a cash basis only. These processes should be spelled out in the company’s credit policy, so the customer knows what to expect if they aren’t making payments on time.

Thea Dudley teaches credit & collections

Join the free certificate course to learn the foundations of credit & collections in construction with 30-year industry veteran Thea Dudley.

Measure twice, cut once

Contractors and material suppliers should calculate and measure their collection efforts on a regular basis. If you don’t know how well you’re doing, there’s no way to know if you need to improve or if you’re doing well.

KPIs like DSO and average days delinquent (ADD) provide concrete measurements that stakeholders can use to measure performance and act on the results. Measuring results improves performance and allows credit managers and company stakeholders to respond to potential problems before they affect a business’ operations.